There are several components you need to understand for you to be a successful and profitable trader. One of the major components to trading is understanding different types of charts and what they illustrate or indicate. Different chart patterns reflect different components of these financial markets.

In this article, we will look at the Open High Low Close type of chart. We will discuss what components of different financial instruments that the chart shows and how to understand them. As a bonus, we have shared some tips on when to trade using the OHLC chart type.

Also Read: How to read a Stock Chart

Contents

- What is the OHLC chart?

- OHLC Bar Layout

- Interpreting an OHLC chart

- OHLC Charts vs Candlestick Charts

- Conclusion

- FAQs

What is the OHLC chart?

As the name suggests, the Open High Low Close is a bar chart that shows the open prices, high price, low price and close price of a specific underlying security over a given trading period. Usually, the default period for a OHLC chart is a day, however, it could be anything from a minute to a month to a year.

The open price is usually the point where price starts for the trading period. As an example, assume you are trading on Tesla stocks on a daily time frame. The opening price would be the price at the beginning of that day when the markets open. The high price, will be the maximum price achieved by the Tesla stocks as prices usually trade within a specific range each day.

The lowest value will be the minimum price achieved by the Tesla stock during the day trading range. The closing price on the other hand, will be the price of the underlying asset at the close of the trading period. From our example above, it would be the price of the Tesla stocks at the end of the day (market close).

Usually, the highest and lowest values are driven by the supply and demand for the underlying asset. The highest value will most likely be the price where the bulls refused to buy over and the bears to control of the market, while the lowest values will be the price bears refused to sell under hence allowing bulls to take over.

Below is an image of an OHLC price chart on the USD/JPY daily chart on trading view.

The highest and lowest prices are important to traders as the illustrate how volatile a market is. This in turn allows traders to determine what kind of trades to take and what trading strategies to use. OHLC charts are also useful to traders who wait for various chart patterns to speculate market direction.

OHLC Bar Layout

An OHLC chart will be made up of OHLC bars which indicate the open, high, low and close prices. An OHLC bar shows the open and close values on the vertical line or x axis and the high and low prices on alternate sides in a horizontal line. The open value will be on the horizontal axis on the left side, while the closing prices are on the right side of the horizontal axis.

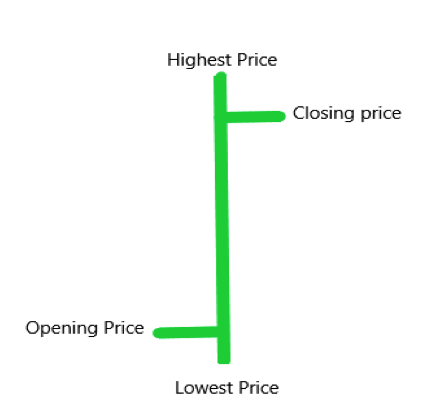

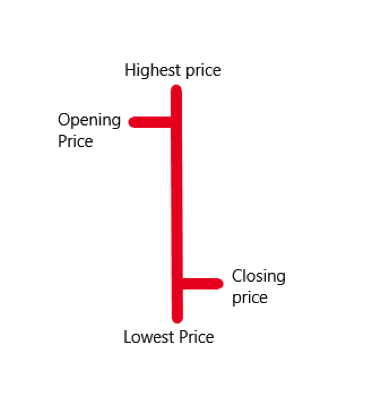

Below is an illustration of a bullish OHLC bar and a bearish OHLC bar.

A bullish OHLC bar is formed when the opening price is lower than the closing price while a bearish OHLC bar is formed when the open price is higher than the close price.

Interpreting an OHLC chart

OHLC charts are made up of OHLC bars. When the price of an asset is rising the bars formed will mostly be bullish characterized by lower open prices and higher closing prices. When the price of an asset is falling the bars formed will mostly be bearish bars characterized by higher open prices and lower close prices.

However, it is important to note that sometimes the lowest value could also be the opening price or closing price. Conversely, the highest value could also be the open price or close price.

OHLC Charts vs Candlestick Charts

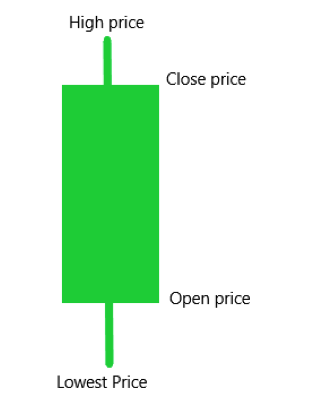

OHLC charts are often confused for candlestick charts as both the OHLC bars and candlesticks show the same information – the open, high, low and the close price. Typically, the only difference is the bar formation and candle stick formation. Below is an image of the candlestick chart in the USD/JPY daily chart.

In both the OHLC charts and candlestick charts the vertical lines represent the high and low values while the horizontal lines represent the open and close values. Typically, Japanese candlesticks have a wider bar compares to the OHLC bars. Below are illustrations of a bearish candle stick and a bullish candle stick.

Both the OHLC charts and candlestick charts can be used for technical analysis of open, high low and close values to various patterns and to evaluate what method or trading strategy to use.

Also Read: Candlestick Patterns Cheat Sheet

Conclusion

Simply put, the OHLC chart shows the highest price (maximum) and lowest price (minimum) for a specific asset on the vertical axis and the open and close values on the left and right sides respectively on a horizontal axis.

Traders watch out for these prices to determine and evaluate what trading strategies to use while trading a specific underlying security. This could be either a specific stock, currency pair or commodity.

FAQs

What is the OHLC strategy?

The OHLC strategy is an intraday trading strategy, where traders look out for stocks with an open high or open low. For example, if a stock opens low, a trader could choose to enter the market with a buy order (long position) with an expectation that the stock price will rise.

What is volume in OHLC?

The OHLC volume chart is a stack upper Japanese candlestick chart which displays a time-varying index of trading volumes and a lower column graph that reflects a given time period. The varying time index displays the opening, highest, lowest, and closing prices of a security over a given period.