GBP/USD Advances with Growing Rate Cut Expectations

The Pound Sterling surged toward 1.3150 against the US Dollar, fueled by increasing market bets on a 50 bps rate cut from the Federal Reserve at its upcoming meeting. Slower US PPI data for August has strengthened the belief that the Fed may opt for a more aggressive policy shift. Meanwhile, investors expect the Bank of England (BoE) to hold off on cutting interest rates next week.

On Friday, the Pound Sterling (GBP) showed robust performance against major currencies, benefiting from speculation that the Fed may reduce rates aggressively. Additionally, firm expectations that the BoE will take a more conservative approach to policy easing have further supported the Pound's rise.

Historically, when the Fed adopts an aggressive policy-normalization stance, it boosts the appeal of risky assets. S&P 500 futures gained nominally during the Asian session, signaling improved risk sentiment among investors.

The US Dollar Index (DXY) dropped further, nearing 101.00. The annual headline PPI for August came in at 1.7%, lower than the estimated 1.8% and July’s 2.1%. Core PPI, excluding food and energy, held steady at 2.4%, below market expectations of 2.5%. This soft inflation data has fueled speculation of a 50 bps rate cut, with probabilities rising from 14% to 43%.

BoE Likely to Hold Rates, CPI Data in Focus

According to a Reuters poll, the BoE is expected to maintain its interest rates at 5.0% in its next meeting, scheduled for Thursday. This follows a reduction from a 16-year high of 5.25% in August. The next critical event for the Pound Sterling will be the release of UK CPI data for August on Wednesday, with forecasts suggesting inflation will remain above 2% by year-end.

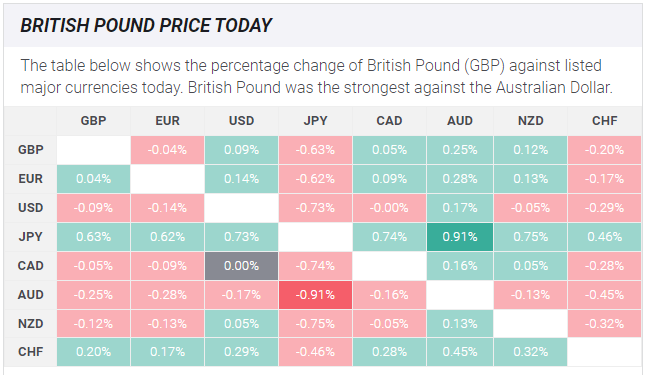

The table below displays the percentage change of the British Pound against major currencies. The GBP was strongest against the Australian Dollar.

The Pound Sterling continued its upward momentum, nearing 1.3150 against the US Dollar during Friday's London session. The GBP/USD pair advanced as the USD weakened significantly after disappointing US PPI data, heightening expectations for a significant Fed rate cut.

The Pound Sterling rebounded sharply to near 1.3150, finding strong buying interest near the trendline from the December 28, 2023 high of 1.2828. The pair saw a bullish breakout on August 21 and continues to benefit from the 20-day Exponential Moving Average (EMA) near 1.3080 as support.

The 14-day Relative Strength Index (RSI) remains in the 40.00-60.00 range, and a fresh bullish impulse is likely if the RSI breaks above 60.00. On the upside, resistance is expected near 1.3200 and the psychological 1.3500 level. On the downside, support is near 1.3000.