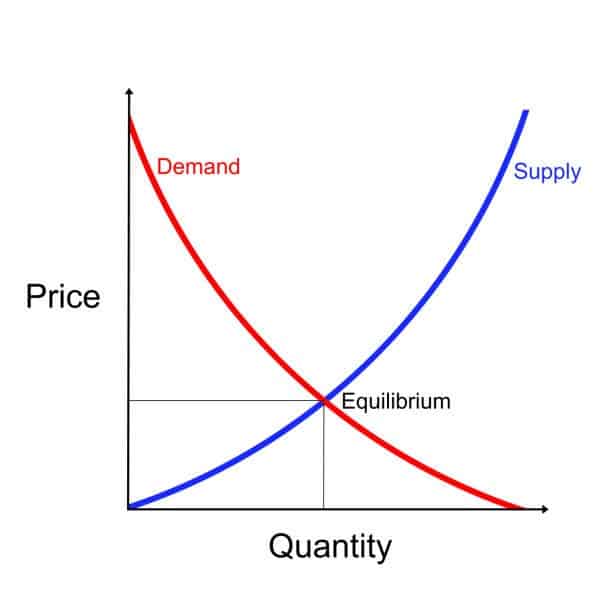

The marketplace is controlled by the flow of demand and supply- the gig is the higher the supply, the lower the price, and the higher the demand, the higher the price. Usually, there’s an increase in the demand for raincoats during continuous downfalls. Ice-creams are sold faster in summer, and there is less demand for non-essential items in times of war, crises, or a pandemic, leading to a price fall.

From the above instances, it's clear that the point where supply and demand meet, which influences price, are themselves affected by other underlining criteria- this is what this concept is concerned with.

This article seeks to give an insight into the concept- its importance to the investment of a company, and its style of functioning.

Contents

- WHAT’S PRICE DISCOVERY PROCESS?

- WHY IS PRICE DISCOVERY IMPORTANT TO TRADING?

- FACTORS THAT DETERMINE THE MARKET PRICE

- HOW PRICE DISCOVERY INVOLVES FINDING SOLUTIONS TO DAY TRADING

- CONCLUSION

- FAQ

WHAT’S PRICE DISCOVERY PROCESS?

Price discovery involves finding methods employed by traders to ascertain the proper price of a commodity through the interactions between sellers and buyers. The method is also referred to as the price discovery process or the price discovery mechanism.

Generally, the maintenance of a balance between the seller and the buyers is a significant indicator of the interactions of the market and consequently affects actions on what buyers would pay for an asset. The balance required is most identified on the market price line when resistance and support rates are presented on them.

Support rates are the location where the demand increases, and the price is pushed up. Resistance rates, on the other hand, are the point where the demand reduces allowing for a resultant fall in price. In both rates, there is a contemplation that the supply is the same.

These levels allow market players and traders to track whether buyers or the seller are controlling the market at any time. The significance of this knowledge is that market analysts can measure efficiently the volatility levels of the market price. The price discovery matters because it provides a purchase price, which offers significant risk reduction to sellers’ investments.

HOW PRICE DISCOVERY MECHANISM WORKS

In the easiest way possible, price discovery matters to buyers and sellers generally, it acts as a dynamic process to determine the equilibrium price following the interactions with the supply and demand of an asset, which helps to boost the process for finding the best liquidity for it. It assists traders to identify the proper price of an asset, which eventually is where supply and demand meet.

Nonetheless, despite market analysts’ efforts to identify the specific locations and shapes of the interaction of supply and demand curves, determining the appropriate sum to pay for an asset is often almost impossible. For instance, tons of research have been deployed to the cause of frequent changes in stock security prices.

WHY IS PRICE DISCOVERY IMPORTANT TO TRADING?

The price discovery works to assist sellers and buyers to progress from an opening price to a specific and effective price for a transaction. The process is dynamic and largely influences marketplace exchange and acts as the correct step for any exchange.

The observation of the change in transactions is the basic force that drives investment in the industry. The financial markets are constantly fluctuating, it, therefore, is vital to access the developments occurring in commodities, forex, stock, index, or others to avoid either of them from being over or underbought, to determine a proper price amongst sellers and buyers.

Through this process, buyers and sellers determine if assets are traded below or above the current value in the market. This information helps buyers and sellers actualize an effective spot price.

FACTORS THAT DETERMINE THE MARKET PRICE

Price discovery matter a lot to both local and foreign exchange and is determined by many factors, some of which are remote, while others are direct causing factors of the concept. Here are some of the evident factors influencing price recovery:

DEMAND AND SUPPLY

These are arguably the most significant factors influencing the exchange of an asset, which eventually allows sellers to determine a fair market value.

For example, if the supply is higher, the price is bound to fall because of the availability of the commodity- this puts the supplier on edge and at a loss because the resultant price discovery process would favor the buyers.

In markets where the demand and supply are equal, economists and investors agree that such a price location is at its equilibrium following the equal number of sellers and buyers in the market, allowing for a fair price to both players.

Volatility

The volatile nature of a market can influence the actions of the buyers and sellers, which can invariably influence the price of the asset. A buyer determines whether to begin or conclude a position in trade through the asset’s volatility.

Most traders patronize volatile transactions because they often offer greater chances of a large profit.

However, these volatile markets are also likely to incur great losses with expected bullish and bearish flux in the valuation of street market assets. For volatile markets, observing the fluctuations of prices and discovering the best price for a trade.

Available Information

The available information to buyers and sellers influences the rate at which either would buy or sell a commodity. Frequently, sellers agree to implore price discovery work and methods to influence price through information to the buyer.

For example, buyers might have certain knowledge or idea of a particular market and will be influenced by buying commodities based on this information.

HOW PRICE DISCOVERY INVOLVES FINDING SOLUTIONS TO DAY TRADING

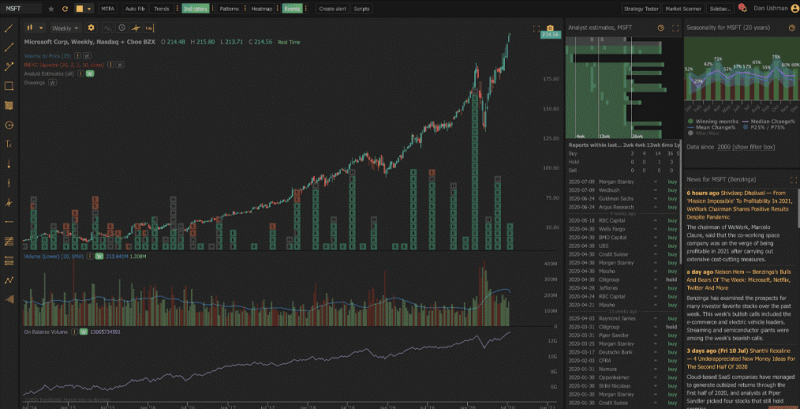

Day trading on the IPO open days for trading are the main concerns for day traders and price discovery.

The first hours of trading provide for volatile shares; this is caused by first-time trading in shares on the open market, meaning the absence of an actual level of support and resistance. Having to trade on these circumstances can be tougher than expected, the risk could cost a lot in the long run.

An ideal way to handle IPO trades is to allow the morning trades to cool off to create increased levels of support and resistance. This trick offers you something to trade off from and in turn, allows you to manage risks efficiently.

Traders must wait a while for IPOs prices to hold on several occasions before they break down and trade low for the remaining days. This technique lets prices establish some levels of price discovery to trade on and seize the advantage of the moves when the price breaks up or down. Such is exemplified in the chart below.

CONCLUSION

Price discovery has evolved over the years with increased concentration by traders on getting the best price possible for a transaction. Players are interested in the spot where the asset would be selling at a spot price.

This article provided all there is to know about the concept as well as how it best improves the trade across sectors.

FAQ

How does Price Discovery help the Securities Market?

Traders can gain knowledge of security with investment above or below the price value. This mechanism allows investors to sell shares by taking calls on contemplation to open a long or short position. With this, the fairness or otherwise of the price of a security would be known to the buyers and the sellers.

What Investments are the most liquid for a Company?

The ability of an asset to exchange for cash is its liquidity. The easier an asset is convertible to cash, the more liquid that asset becomes. Typically, cash is the most liquid asset, cash at the bank is also considered the most liquid because it can easily be retrieved through a transfer or an ATM withdrawal.

Is Price Determination and Price Discovery the Same?

No. Both concepts are related terms but are generally different. Price determination is used to determine the levels of the transaction's valuation, which its general level may be low or high. Price discovery starts with the market price level and offers a fair price for the transaction.

Can a Seller agree to use certain Methods for Price Discovery on a Transaction?

There are generally six methods, these are:

- Going-rate Pricing

- Perceived-value pricing

- Sealed-bid Pricing

- Break-even Analysis

- Target Return Pricing

- Mark-up Pricing