Range Market Review

Forex brokers play a pivotal role in the world of currency trading, acting as intermediaries between retail traders and the vast Forex market. Choosing the right Forex broker is crucial for traders at any level of experience. It can significantly impact your trading performance, risk management, and overall success in the Forex market. A reliable broker ensures access to competitive spreads, robust trading platforms, and superior customer support, among other essential services.

Range Market stands out in the crowded Forex brokerage landscape. Since its inception in 2002, Range Market has been catering to the needs of active traders and investors who leverage the prowess of MT4 signal providers. With offerings like high leverage, a diverse selection of accounts, and a broad array of currency pairs, Range Market positions itself as a go-to broker for those aiming to optimize their trading strategies.

In our comprehensive Range Market review, we delve into the specifics that set this broker apart. We cover everything from account types to deposit and withdrawal mechanisms, commission structures, and more. Our goal is to furnish you with a balanced mix of expert analysis and real user feedback. This ensures you have all the necessary facts at your fingertips to consider Range Market as your broker of choice. Stay tuned for a detailed exploration of what makes Range Market a standout choice in the Forex and CFD trading sphere.

What is Range Market?

Range Market is a well-established broker in the Forex and CFD trading industry, having opened its doors to traders worldwide in 2002. It has built a reputation for facilitating access to the global currency and contracts for difference markets, catering specifically to active traders and investors. These users often seek to mirror the strategies of leading MT4 signal providers, aiming to replicate their success.

One of the key features of Range Market is its offer of high leverage, alongside a varied selection of account types and currency pairs. This flexibility allows traders to tailor their trading experiences to their specific needs and goals. Additionally, the broker enhances the trading experience by providing free market analytics, supporting scalping, hedging, and algorithmic trading strategies. Such features are invaluable tools for traders looking to gain an edge in the competitive Forex and CFD markets.

Benefits of Trading with Range Market

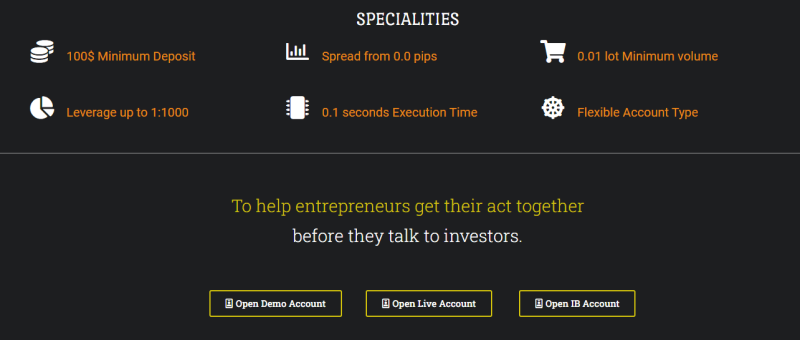

After trading with Range Market, I've found several benefits that stand out. Firstly, the broker offers high leverage, reaching up to 1:500, which allows for greater market exposure with a smaller initial investment. This feature is particularly beneficial for traders looking to maximize their trading strategies without needing substantial capital upfront.

Another advantage is the wide selection of account types, including cent and classic accounts, which caters to both beginners and experienced traders. The flexibility in choosing an account that best fits one's trading style and budget is a significant plus, making it easier to manage risk and tailor the trading experience to individual needs.

Additionally, Range Market's commitment to providing free market analytics is a valuable resource for making informed decisions. This support, combined with the allowance for scalping, hedging, and algorithmic trading, equips traders with the tools and freedom to explore various trading strategies effectively.

Range Market Regulation and Safety

Range Market operates under the regulatory oversight of the Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA). This registration assures traders of the broker's compliance with legal standards and its commitment to maintaining a secure and transparent trading environment. By aligning its operations with the laws of Saint Vincent and the Grenadines, Range Market establishes itself as a reliable choice for traders seeking a regulated broker with a broad range of trading options and services.

Range Market Pros and Cons

Pros

- Supports news trading, hedging, and automated trading

- Low spreads starting at 0.5 pips

- Unrestricted use of advisors and bots

- Affiliate program available

- Up to 1:500 leverage

- MetaTrader 4 platform

- Cent and classic accounts

Cons

- Limited CFD offerings

- Few payment system options

- No brokerage activity license

Range Market Customer Reviews

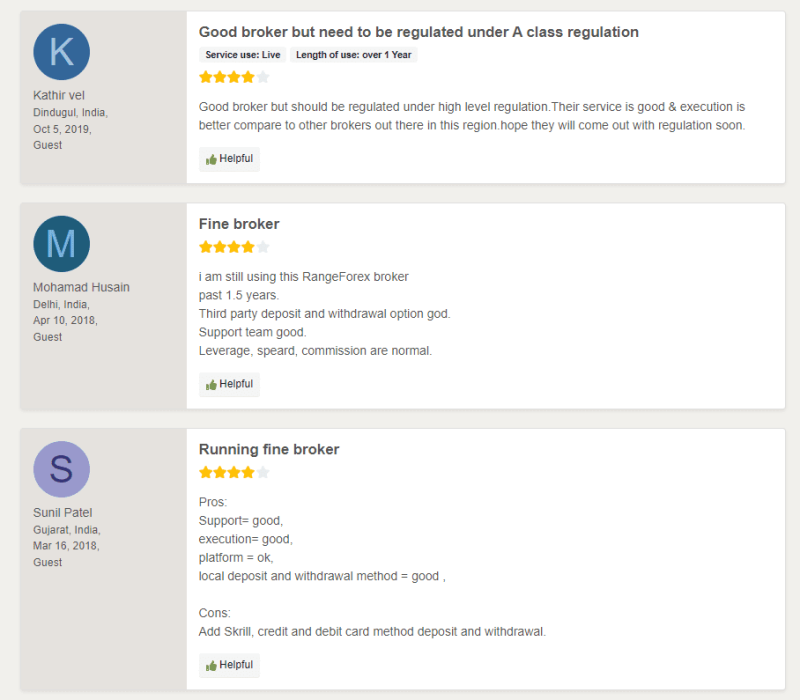

Customers generally view Range Market as a good broker, praising its service quality and execution speeds as superior to many competitors in the region.

Despite the positive feedback on customer support, leverage, spreads, and commission rates, a common theme among the reviews is the desire for higher-level regulatory oversight. Clients appreciate the availability of local deposit and withdrawal methods, but express a clear need for additional payment options, including Skrill and credit/debit card transactions.

The overall sentiment suggests satisfaction with the broker's performance over the past 1.5 years, highlighting its effective support team and third-party deposit and withdrawal facilities as significant advantages. However, the call for enhanced regulatory compliance and expanded payment methods indicates areas for potential improvement.

Range Market Spreads, Fees, and Commissions

I've noticed Range Market operates with a straightforward approach to spreads, fees, and commissions. In my experience, they only apply a trading commission in the form of spreads. Specifically, the Platinum account boasts the most competitive spreads, beginning at 0.5 pips. For those considering the Gold account, spreads start from 1.4 pips, and for the Silver and Palladium accounts, the starting point is 1.6 pips. It's worth mentioning that the Silver account is tailored as a micro account, meaning its commission is uniquely calculated in cents, making it an accessible option for smaller volume traders.

One of the perks I appreciate about Range Market is their no-fee policy on deposits and withdrawals, which is relatively rare in the Forex industry. They even cover Neteller system fees, which is a nice bonus. However, it's important to budget for a $25 fee when you're depositing or withdrawing via bank transfer. Another aspect to be mindful of is the $5 monthly fee charged for an inactive account—defined as one that hasn't seen any funds movement or trading activity for 90 days. This policy encourages active trading and account management, ensuring that traders stay engaged with their investments.

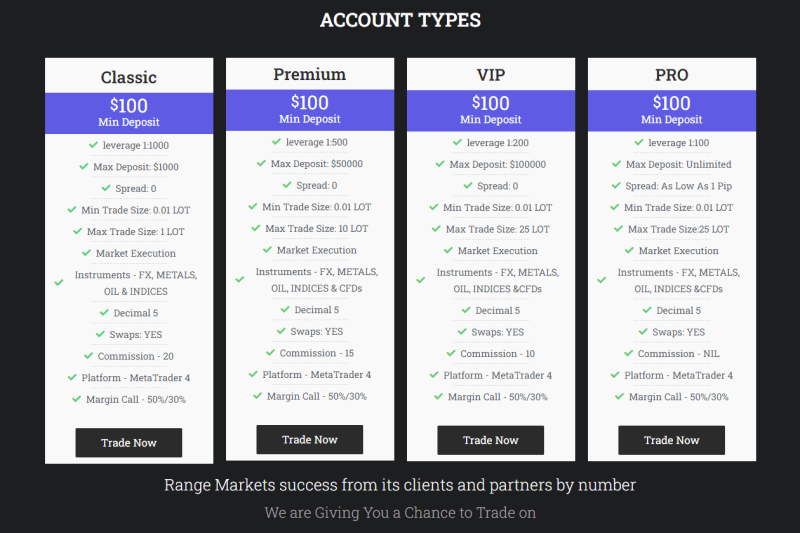

Account Types

Range Market offers a variety of account types to suit different trading strategies and levels of investment. Here's a straightforward breakdown:

Classic Account

- Minimum Deposit: $100

- Leverage: 1:1000

- Maximum Deposit: $1,000

- Spread: 0

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 1 LOT

Premium Account

- Minimum Deposit: $100

- Leverage: 1:500

- Maximum Deposit: $50,000

- Spread: 0

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 10 LOT

VIP Account

- Minimum Deposit: $100

- Leverage: 1:200

- Maximum Deposit: $100,000

- Spread: 0

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 25 LOT

PRO Account

- Minimum Deposit: $100

- Leverage: 1:100

- Maximum Deposit: Unlimited

- Spread: As low as 1 pip

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 25 LOT

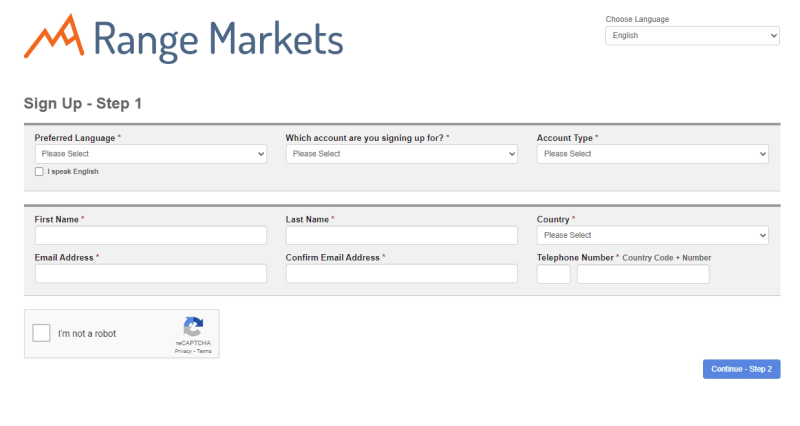

How to Open Your Account

- Go to the Range Market official website and click on the “Open Live Account” button.

- Fill out the form with your personal details, including email and password.

- Confirm your email address as part of the registration process.

- Create a strong password for account security.

- Answer a few basic questions related to Forex trading.

- If intending to deposit by bank transfer, add your bank account information.

- Set up a “Landing Account” to hold funds before your trading account is activated.

- Use your email and newly created password to access your user account.

Range Market Trading Platforms

Based on my experience, Range Market offers traders access to a single trading platform, MetaTrader 4 (MT4). This platform is renowned for its reliability, user-friendly interface, and comprehensive analytical tools. It caters to both novice and experienced traders, providing them with advanced charting tools, automated trading capabilities, and a wide range of technical indicators. MT4's popularity stems from its ability to support a variety of trading strategies, making it a preferred choice for those trading with Range Market.

What Can You Trade on Range Market

Based on my experience with Range Market, traders can explore a diverse selection of trading instruments. The platform offers a variety of currency pairs, allowing traders to engage in the vast Forex market. This includes major pairs, minors, and exotics, providing ample opportunities for currency trading.

In addition to Forex, Range Market also gives access to metals CFDs, including precious metals like gold and silver. This is ideal for traders looking to diversify their portfolio or hedge against currency risk.

Indices and oil are other tradable commodities on Range Market. Indices offer a way to trade on the performance of a group of stocks, representing various sectors of the economy. Trading oil CFDs allows traders to speculate on the price movements of one of the world's most vital commodities without the need to physically own it.

Range Market Customer Support

Based on my experience, Range Market's customer support can be accessed through multiple channels, ensuring that traders have the assistance they need. Email communication is straightforward, allowing for detailed queries and concerns to be addressed efficiently. Additionally, the option to request a callback via a form is a convenient service for those who prefer discussing their issues directly over a phone call.

However, while the Contact Us section mentions the availability of online chat support, I found no visible button for this service on the website or within the user account. This discrepancy might lead to some confusion for users expecting immediate live chat assistance. Despite this, the provided email and callback services contribute to a responsive and helpful customer support experience at Range Market.

Advantages and Disadvantages of Range Market Customer Support

Withdrawal Options and Fees

From my experience, Range Market ensures a swift withdrawal process, with requests typically handled by the finance department within 24 hours. Withdrawals can be directed to a bank account, card, or through the Neteller system, offering flexibility in how you receive your funds. The time it takes for the transfer to reach a bank account varies by country, with the entire process potentially taking up to 5 business days.

Importantly, Range Market stands out for not imposing fees on withdrawals and even covers the commissions charged by payment systems. This approach makes the process more cost-effective for traders. However, it's worth noting that the conditions for withdrawing profits are subject to change. Therefore, checking the latest information on their website before opening an account is advisable to ensure you're up to date with any new policies or requirements.

Range Market Vs Other Brokers

#1. Range Market vs AvaTrade

AvaTrade stands out for its extensive regulatory framework, operational since 2006, and offers a broad array of over 1,250 financial instruments across global markets. With a strong emphasis on security and a diverse range of trading platforms, AvaTrade caters to a wide audience, excluding US traders. Range Market, on the other hand, focuses on Forex and CFD trading with competitive spreads and leverages, and although it offers fewer instruments, it provides specialized services like high leverage and support for MT4 trading.

Verdict: For traders prioritizing a wide selection of instruments and regulatory security, AvaTrade is the superior choice. However, Range Market may appeal more to those focused on Forex and CFD trading with high leverage options.

#2. Range Market vs RoboForex

RoboForex, with its inception in 2009, prides itself on delivering excellent trading conditions supported by advanced technologies. It offers a vast selection of over 12,000 trading options across eight asset classes, along with multiple trading platforms including MetaTrader, cTrader, and RTrader. RoboForex's approach is tailored to accommodate traders of all levels with personalized terms. Range Market, while offering high leverage and a focus on Forex and CFDs, has a more streamlined approach, specializing in these markets with support for MT4 and competitive conditions.

Verdict: RoboForex is better for traders seeking a wide range of trading options and platform choices. Range Market is ideal for those who prefer a focused trading environment with specific strengths in Forex and CFD markets.

#3. Range Market vs Exness

Exness, established in 2008, is a Cyprus-based broker offering a vast monthly trading volume and a wide range of CFDs, including over 120 currency pairs, with unique features like unlimited leverage on small deposits. Its emphasis on low commissions, instant order execution, and a variety of account types cater to different trader needs, from beginners to experts. Range Market provides a more focused offering, with its strengths lying in competitive Forex and CFD trading conditions, high leverage, and a tailored selection of account types.

Verdict: Exness is the better option for traders looking for a wide variety of CFDs and innovative features like unlimited leverage. Range Market suits traders who prioritize specialized Forex and CFD trading with high leverage and dedicated support for MT4.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH RANGE MARKET

Conclusion: Range Market Review

In conclusion, Range Market offers solid options for traders focused on Forex and CFD markets, especially those who utilize MT4. Its strengths in leverage and account variety are notable; however, prospective clients should carefully consider the cons, including the regulatory aspect and support options, before committing. Balancing these factors will be key to determining if Range Market aligns with your trading needs and goals.

Also Read: IronFX Review 2023 – Expert Trader Insights

Range Market Review: FAQs

Is Range Market regulated?

No, Range Market does not currently hold a license for its brokerage activities, operating under the laws of Saint Vincent and the Grenadines instead.

What trading platforms does Range Market offer?

Range Market provides access exclusively to the MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools.

Can I trade cryptocurrencies with Range Market?

The information provided does not specify cryptocurrency trading. Range Market primarily offers Forex, metals CFDs, indices, and oil trading.

OPEN AN ACCOUNT NOW WITH RANGE MARKET AND GET YOUR BONUS