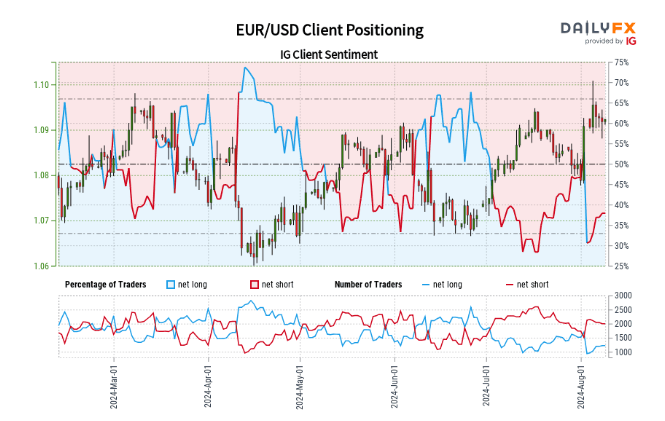

EUR/USD: Shifting Trader Sentiment

Recent analysis reveals a notable change in trader positions for EUR/USD. Currently, only 38.16% of traders are holding long positions, resulting in a short-to-long ratio of 1.62:1. Over the past week, there has been a decline in long positions and an increase in short positions. This evolving sentiment points towards the potential for EUR/USD price gains, though the overall trading bias remains uncertain.

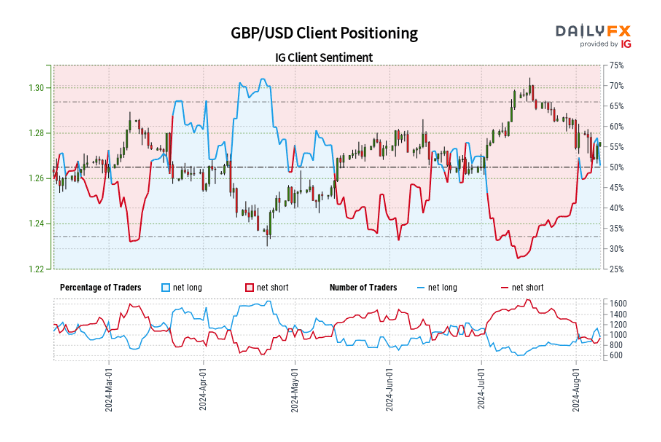

GBP/USD: Balanced, Yet Shifting Sentiment

The sentiment among GBP/USD traders is nearly even, with 50.26% of positions being net-long. Recent trends indicate a reduction in long positions accompanied by a rise in short positions. Although a net-long bias typically signals bearish pressure, the current shift in sentiment could be an indicator of a potential upward reversal for GBP/USD.

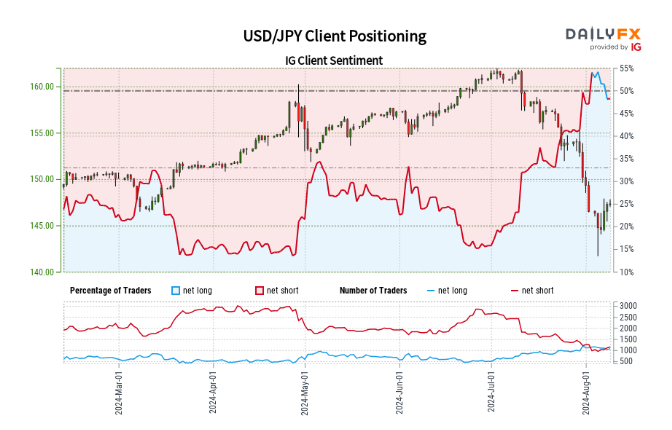

USD/JPY: Conflicted Sentiment

In the case of USD/JPY, retail traders are slightly net-short, with 48.06% holding long positions. Daily analysis shows increased activity on both sides, while weekly trends highlight a reduction in overall positions. This conflicted sentiment results in a mixed trading bias for USD/JPY, though the prevailing net-short position might suggest potential price increases.