Analytical software has spoiled modern traders with signals for appropriate investment decisions.

In the old days, brokers had to interpret market conditions by themselves. Predicting stock prices was a test of knowledge and innovation skills.

Not to mention that they also had to invent the technical indicators to speed up their work, something new age traders take for granted.

Before the internet, communication was done with the telegraph. The data on the tape had to be correctly read for successful stock trades. Edison created the first practical stock ticker, enabling fast distribution of data about the stock market.

The ticker tape machine was the only available technology for quoting stocks, and many traders had to know Morse code to understand the messages over telegraph lines. The term tape reading has its roots from this period. When brokers read the paper tapes for data and formulated strategies.

Also Read: Best Technical Indicators for Day Trading

Contents

- Old Fashion Technical Analysis

- How To Read Stock Price

- Advantage Of Tape Reading Over Chartist

- Identifying Support And Resistance Levels

- What’s The Role Of Time And Sales?

- Why Traders Use Time And Sales

- Pros And Cons of Tape Reading for Stock Prices

- Is It Still Useful For Trading Stocks?

- Don't Abandon a Profitable Position Too Soon

- Conclusion

- FAQs

Old Fashion Technical Analysis

With the new technology came new methods for market analysis. While the telegraph went out of fashion at the beginning of the 20 centuries. The techniques and terms used 150 years ago, such as ticker symbols and stock tickers, are still practiced by traders.

Tape reading is an important indicator when active trading. Trading platforms use hundreds of indicators. Yet, most brokers do not understand how they work because of modern automation provided by software platforms.

Tape reading is distinct to every circumstance, making it different from other indicators that have oversold or overbought levels.

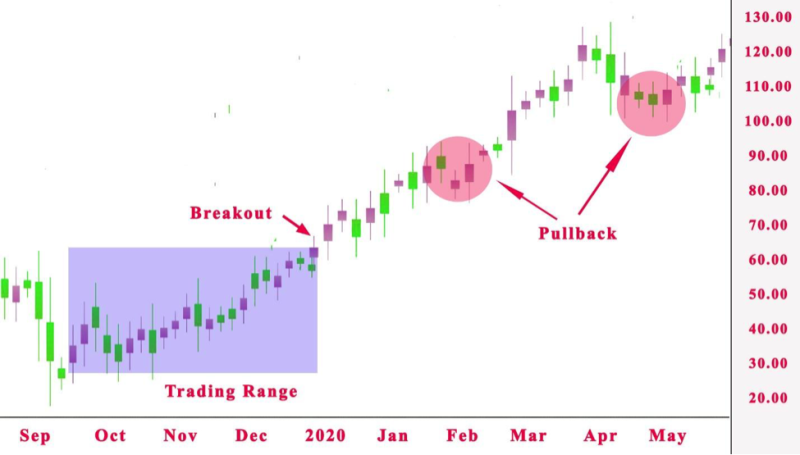

This is not about how a stock is performing, but how an asset is trading on a particular day and at a certain price level. The tape is most useful when verifying breakouts and supply versus demand at important price points.

How To Read Stock Price

With the progress of technology, modern tape reading started to incorporate limited orders .

The orders are non-executed trades, reposing on the order book, requiring a serious level of information on what’s happening in the background of the price action strategy.

If an investor notices a large buy resting order at a given price, it can advise him the price may locate support and bottom out.

In the opposite case, if he recognizes a big sell order reposing on the order book over the present price, it may propose the price can locate a resistance level and sell-off.

Few tips on how to read the tape:

- Use a size filter. Back in the 19-century communication progressed at a slower pace, today it's faster and can be supplemented with small orders. To prevent these, traders can filter the minimum and maximum orders.

- Day trading tape reading should be used in tandem with price action.

- Brokers only use the tape as a verification tool for entry and exits.

Advantage Of Tape Reading Over Chartist

Tape readers interpret intraday data in real-time, giving them huge leverage over inspecting a stock chart for market inputs.

Plus, they can refine pages of numbers into especially precise forecasting of short-term price movement.

The almost legendary trading skill offers other benefits, helping professional traders to estimate the market environment, and the intensity of market players, and can bring more potential for a longer-term market strategy.

The skill can be learned fast, but putting that knowledge into practice takes a lifetime to perfect. Because of the complexities of the market, many years of examination of how segments influence the entire picture.

Macro forces influence global markets to change over time, with quantitative easing influencing one cycle, while a housing bubble keeps markets stable in another cycle.

Yet most crucially, the market structure has developed dramatically over the years, making tape readers frequently review modern techniques.

Identifying Support And Resistance Levels

Investors search for big limit sell or buy orders in the order book for a given stock in several trading venues.

If there is the case that the prediction is that the stock will have resistance or support at the distinct levels.

When implementing the strategy, traders get an impression if it's useful to trade the given stock at the given price, measure the risk, and prepare a better plan for trading.

What’s The Role Of Time And Sales?

Time and sales are basically the information on the tape, is a history of every stock transaction during the trading day and usually incorporates trade size, price, and time of the trade.

Investors use the tape to locate changes in the markets by maturing an instinct to feel how the tape reacts when changes in the market happen.

Bid And Ask Prices

They are crucial for connecting time and sales information.

The bid is the most favorable price that traders are prepared to pay for stocks, and the offer is the most favorable price that investors are prepared to receive for stocks.

Usually, in trading platforms, orders on the bid have a red color, and the ones on the offer are green, while the ones that trade amid the bid and the offer are white.

The reason for that is when traders purchase at the offer, that’s a bullish indicator and an investor had to buy from the accord because there wasn’t liquidity possible at the bid price.

Why Traders Use Time And Sales

Because every transaction is recorded on the tape, nothing is hidden, especially if there is a large volume.

Traders benefit from the data by observing other brokers. And predict if the veteran investors will buy or sell and then do the opposite.

Supply and demand help traders make short -term moves to decide their positions.

Transaction Velocity

When predicting the market course, trades rely on speed to recognize momentum by observing the increase of prints in one direction.

If you’re observing the tape of for example Tesla stock, at a given moment there can be an order per second is realized.

But if unexpectedly few orders per second are realized on the bid, that can reveal a change in the market dynamics.

The speed is not proof enough to join the trade. If used in tandem with other indicators, it can serve as verification.

Rate of Volume

The majority of market orders are fractional. If a trend has made traders aggressive, it is because of the progress of software trading.

It’s crucial not to get too obsessed with analyzing the information.

There is much frequency in the modern market, and your interest needs to be directed to the lesser orders that truly influence markets.

If a trader spots a strand of small orders and unexpectedly a large order, you get intrigued and ask yourself, what are they doing?

Buying or selling, and other large orders to follow, what course will the market take.

Also Read: What Is a Buy Stop Order, and Why Is It Important for any Trader?

Pros And Cons of Tape Reading for Stock Prices

The best approach in estimating if a given analysis technique is appropriate for a trading strategy is to look at the advantages and disadvantages.

Pros

Excellent instrument for forecasting prices. With rudimentary knowledge of tape reading will give you the data to understand the intraday basics.

With more experience, traders can identify small spikes and mounting pricing pressure.

Enables day traders to sync exits. Inexperience day traders allow their ego to keep them in the trade for longer than it’s advisable and because of that they encounter problems with their trade.

Tape reading helps investors conquer this and make quality transaction moves by implementing small, but useful indicators about the attitude of market players.

Great for both newbies and veterans. Tape reading is hard, still, it can be learned fast and implemented with success.

Beginners should focus on investigating only individual assets that already have experience with and are ready to trade.

Investors perceive these instruments as useful in improving tape reading techniques.

Cons

Time & Sales are difficult to master. One disadvantage is that they can be difficult to follow.

Many platforms offer it as detached numerical tools that require focus and fast judgment.

There is no archival representation, this makes it difficult to receive a general review of the order book.

Requires laser-focus. Today most trades are done algorithmically and if you strive to be a solid tape reader, you must make decisions in a very dynamic environment.

Data is distributed at high frequency without being able to analyze it appropriately.

Inefficient as a stand-alone analysis tool. The key to transforming yourself into a quality tape reader is the capability to perceive the large volume of transactions, especially if observing few markets and at the same time.

The issue is that important data like the liquidity volumes only have a short use, stopping you from understanding how long the liquidity was present.

Tape reading can’t provide a total picture of the market circumstances.

Is It Still Useful For Trading Stocks?

Many investors claim that tape reading today is not reliable. They argue that the complex structure of today’s market is making it difficult to implement the toolset.

Still, proficient traders aim to manipulate the tape, influencing the price of their preferred instruments.

If these risks are not factored in, how can traders be confident they are trading in the best way?

The boom in this type of trading activity has made advanced tape readers even more precise at what they do.

Learning how to use it is not hard but requires a commitment to research the topic in detail. It will provide the knowledge that other traders are missing.

Don't Abandon A Profitable Position Too Soon

Rarely do you find a trader who has constant luck in the market? That doesn't mean that traders need to come to terms with failure. The skill to locate when to stay in the position is what determines success.

For example, you are prepared to sell a certain stock, and all of a sudden the stock’s price jumps, which is the opposite of your position. When you check the tape, you locate the cause for the rise and that can be due to just a few stocks being traded.

Veteran tape readers will recognize that a continual bullish price move needs a larger volume to survive. If the rise is for a short time you should remain in your position. With tape reading, traders can find small details that might have given them false impressions and made them close a position.

Conclusion

Tape reading is a useful skill for a short-term trader, who knows how to be patient when making investments in the market.

It can be used in foreign exchange trading to observe when the price breaks. As one of the older market tactics, some doubt it has a place in the modern trading arena.

Using a trading system that incorporates tape reading can reveal a sales window for the current price.

A successful trader can open a profitable position if he has a complete picture of the market environment that implements risk management tactics. Ticker tapes, as they were known in the past, are an important skill that provides the data to initiate buy and sell orders.

Mastering tape reading is time-consuming, but the rewards are large. The best traders have an integrated market view that enables them to predict when the market breaks.

The discipline has been disrupted with electronic trading, and while tape reading might not be able to produce the results it had in the past, traders can use it to verify their trading decisions.

FAQs

How Important Is Tape Reading?

Tape reading offers benefits in day trading because it gives investors real-time intraday data. This is useful for short-term price predictions.

If used with long-term trading strategies, tape reading can help improve proficiency.

How Do You Practice Reading Tape?

It takes years to master the practice of reading tape, but with study and observation, traders develop instincts to identify signals in each of the phases of market movement.

How Do You Read A Level 2 Tape?

Level 2 gives traders an advantage by revealing the sizes of the orders in the market makers book.