For the last few weeks, the stock market has been flashing some serious signs of strength, fueled by new trade deals emerging in response to President Donald Trump's tariff policies. May was particularly robust, with the S&P 500 climbing 5% and the Nasdaq Composite surging an impressive 8%. Among the biggest winners were artificial intelligence (AI) stocks, especially those within the elite “Magnificent Seven.” But even among these giants, Tesla (NASDAQ: TSLA) stood out, delivering a stunning 23% surge last month. This kind of parabolic move naturally begs the question: What's driving this sudden acceleration, and is now truly the time to jump in?

Tesla's Price Action: What's Driving the Surge?

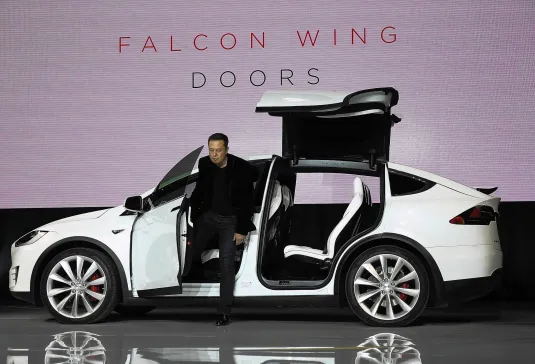

It’s often said that a company's share price should faithfully reflect the performance of its core business. However, when it comes to Tesla, its recent stock behavior isn't quite aligning with its operational reality. Right now, the company's underlying business isn't exactly in peak condition. Its electric vehicle (EV) segment, which serves as its primary source of revenue and profits, is notably decelerating. Adding to this complexity, rising competition from domestic manufacturers like Rivian and overseas rivals such as BYD is creating new hurdles on the customer acquisition front.

So, if the business fundamentals aren't the primary driver, what is? Throughout 2025, Tesla's stock price has instead been heavily influenced by the actions—and even the very presence—of its often-controversial CEO, Elon Musk. For much of 2025, Musk’s focus had been noticeably diverted away from Tesla due to his role as a special government employee for the Trump administration, specifically within the Department of Government Efficiency (DOGE). His time in Washington proved quite polarizing, and this diversion contributed to Tesla's mounting challenges with consumer demand. As recently as mid-April, the stock found itself down over 50% from its all-time high.

It's against this backdrop that Musk recently made a pivotal announcement: he's stepping away from DOGE and turning his full focus back to Tesla. The timing of this decision appears quite strategic. One of the biggest potential growth catalysts for Tesla's future is the highly anticipated introduction of its autonomous driving fleet, famously dubbed Robotaxi. This groundbreaking service is scheduled to launch on June 12 in Austin, Texas. With Musk’s attention seemingly back on Tesla and the Robotaxi launch just days away, investors are pouring back into the stock, fueling its recent impressive rally.

Is Now a Good Time to Buy Tesla Stock?

In tandem with Musk stepping away from his government duties, long-time Tesla bulls like Cathie Wood of Ark Invest and Dan Ives of Wedbush Securities have been making the rounds on financial news outlets, enthusiastically hyping the narrative that Tesla could be on the brink of a new wave of growth. Wood, for instance, has firmly doubled down on her ambitious $2,600 price target, while Ives recently raised his own forecast to a cool $500 per share. Both agree that significant upside could be in store for Tesla shareholders.

However, while the allure of investing in momentum stocks can be incredibly tempting, it's crucial for investors to zoom out and consider the bigger picture. As a vital reminder, Musk himself explicitly told investors that the initial Robotaxi launch this month will be modest. Moreover, he also alluded that Robotaxi isn't expected to become a major financial contributor to Tesla's business for another year or so.

Despite the current excitement, Tesla is presently trading at a forward price-to-earnings (P/E) multiple of 181. This is an extremely high valuation for any growth stock, let alone one that actually saw its revenue decline in the first quarter. Investors have clearly already priced the stock according to a heavily bullish narrative surrounding Musk's return to Tesla and the Robotaxi launch. However, far too much uncertainty remains regarding how quickly these catalysts will translate into tangible financial results. Considering this lofty valuation, it would be prudent to exercise caution. Chasing Tesla stock at these current levels might not be the wisest move.