Heard about Aerodrome Crypto or Aerodrome Finance? Want to know about something cool happening with Coinbase's new internet money project (called Base network or base blockchain)? Let's talk about Aerodrome (AERO).

Think of Aerodrome as a self-serve money exchange booth on a new, fast internet highway built by Coinbase. It’s a key platform in the world of decentralized finance (DeFi).

What is Aerodrome Finance, Really?

Imagine you want to swap one type of digital money (like Ether) for another (like a new token). Normally, you go to a big company like Coinbase or Binance.

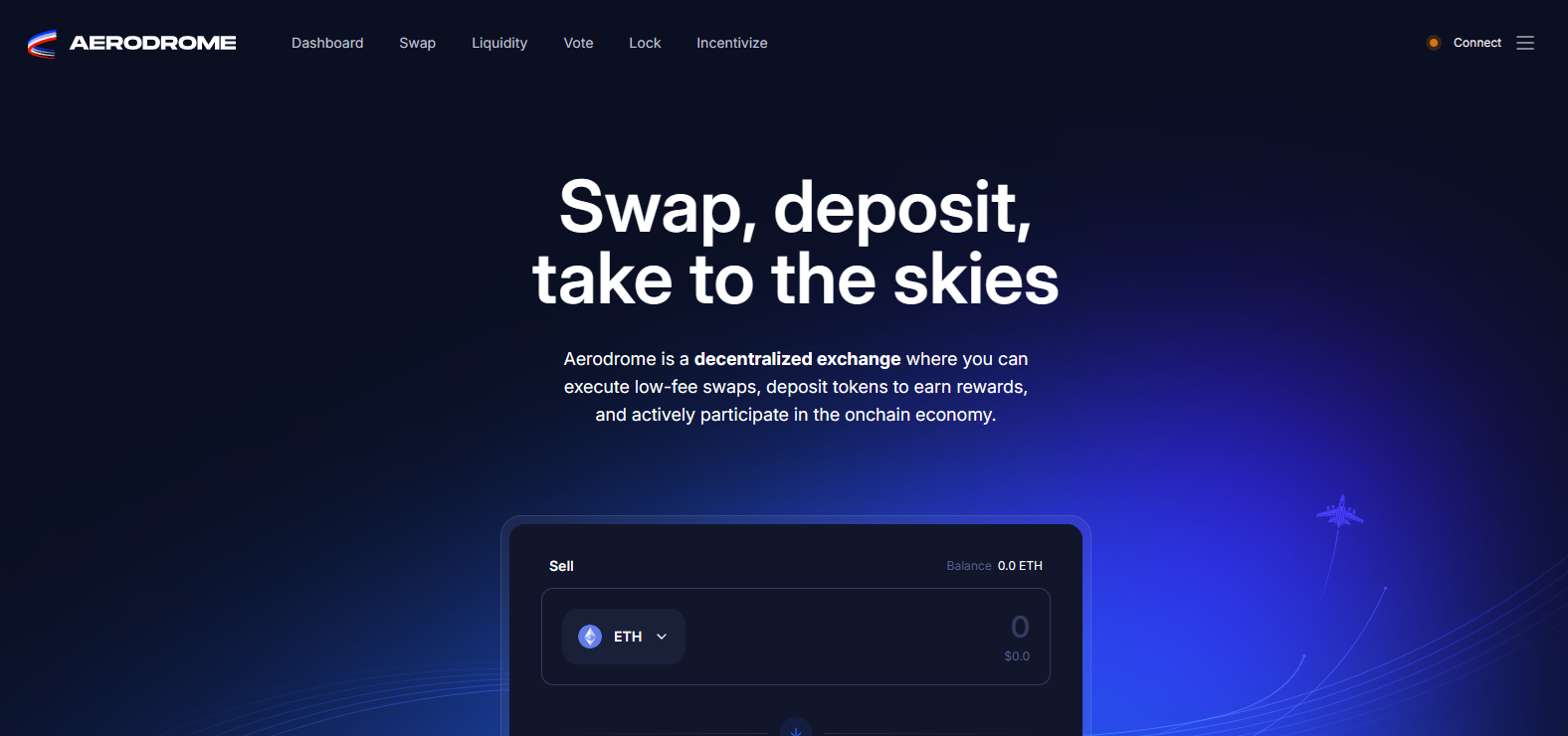

Aerodrome is different. It's a decentralized exchange (DEX). That means there's no single company in charge. Instead, it uses smart computer programs (called smart contracts) and liquidity pools – basically, pools of digital assets provided by everyday people like you.

It's also an automated market maker (AMM), or you could call it an advanced automated market maker. This sounds fancy, but it just means the computer program uses the money in the liquidity pools to automatically figure out the best price for your swap. You don't need someone else to agree to trade with you; you just trade with the pool! This helps facilitate efficient token swaps with minimal slippage, especially for common token swaps. It makes automated market making work smoothly.

Why Is It on “Base”?

Aerodrome chose to set up shop on the Base network. Think of Base as a special express lane built on the main Ethereum internet money highway.

Why use this express lane?

- Low Fees: Trading and using Aerodrome on Base means you pay low fees compared to the main Ethereum highway.

- It's Super Fast: Transactions happen almost instantly.

- Coinbase Backing: Coinbase helped create Base. While it's open to everyone, this connection adds a layer of trust and attention, making it a robust platform.

So, Aerodrome being on Base means you can trade and use it quickly and cheaply, enabling more efficient token swaps.

Meet AERO: The Platform's Reward Token

Every platform needs a way to keep things running smoothly and reward people who help out. For Aerodrome Finance, that's the AERO token. You might search to buy aerodrome finance or buy AERO tokens.

Think of AERO as the loyalty points or rewards you get for participating.

If you put your digital money into the liquidity pools (this is called providing “liquidity” – basically making sure there's money available for others to swap), you earn AERO tokens as a reward. This system is a robust liquidity incentive engine or powerful liquidity incentive engine. It provides liquidity incentives to attract liquidity and make sure the pools have money. This encourages liquidity providers to deposit their crypto assets, ensuring there's enough liquidity for seamless trading.

Get Your Voting Badge: How veAERO Works

This is a clever part of Aerodrome. You can take your AERO tokens and “lock them up” for a period of time (you choose how long, up to four years). This is part of the dual token system.

When you lock your AERO, you don't just get more AERO; you get a special item called veAERO (you actually receive veAERO NFTs). Think of veAERO as your VIP voting badge or a membership card that gives you special perks. This is called the vote lock governance model.

What does having this veAERO badge let you do?

- You Get a Vote: You get to help decide which liquidity pools on Aerodrome should give out the most AERO emissions (newly created AERO tokens) that week. This gives veAERO holders direct influence over where liquidity is incentivized on the platform. The longer you lock your AERO, the more voting power you receive for governance participation. This is about managing liquidity incentives through a decentralized approach.

- You Earn Trading Fees: People who use Aerodrome to swap money pay a tiny fee. veAERO holders get to share in ALL of the trading fees generated by the protocol! They receive trading fees. The more veAERO you have, the bigger your share of the fees. This happens in epoch based rewards.

- Bribes: Other projects can offer other incentives (like extra tokens, called “bribes”) to veAERO voters to encourage them to direct AERO emissions towards their specific liquidity pools. These incentives are extra rewards.

This vote-lock model creates a powerful system, aligning the incentives of liquidity providers, traders, and people involved in governance for the long-term health and growth of the protocol.

Simple Trading & Earning

Here's what you can easily do with Aerodrome:

- Trade Crypto Quickly: You can swap between different digital currencies fast. Just pick what you have and what you want, and the platform does the swap using the money pools.

- Earn by Adding Money to Pools (Be a Helper): You can put pairs of your digital money into shared pools. When people trade using the money in these pools, you earn rewards in AERO tokens and get a piece of the trading fees. You're helping make trading possible for others, and you get paid for it!

- Earn Extra by Voting (If You Get a veAERO Badge): If you choose to lock up your AERO tokens to get a special voting badge called veAERO, you gain power. You can vote on which money pools should give out the most AERO rewards that week. By voting, you earn a share of the trading fees from the pools you voted for. Sometimes, other projects even pay extra rewards (incentives) to get your vote for their pool!

The whole platform is built to be easy for you to use, with a clear look and smart tools working behind the scenes.

Aerodrome's Big Picture

Aerodrome wants to be the main “money exchange booth” or central liquidity hub on the Base network. By being the biggest and easiest place to trade and find liquidity, it helps all the other cool projects being built on Base. It's all about facilitating liquidity across the network.

Why People Are Talking About AERO

Aerodrome Finance (AERO) gained significant traction quickly after its launch on Base, attracting a large amount of Total Value Locked (TVL) – which is the total value of assets locked in the platform. Its strong connection to the growing Base network, its innovative approach similar to Velodrome Finance, and the potential for users to earn rewards through liquidity provision and governance participation have all contributed to the buzz around AERO.

You can look at Aerodrome Finance markets on different exchanges. People watch the price performance, trading volume, market cap (or market capitalization), and circulating supply of AERO tokens. Sometimes you see bullish sentiment (people are positive) or bearish sentiment (people are negative) based on market conditions. You can also see the all time high price that AERO reached. You might even buy aerodrome finance using a debit card on some platforms. Prices are tracked in real time.

Important Considerations

Like all crypto and DeFi projects, investing in or using Aerodrome Finance comes with risks. Even with smart contracts and a focus on security, things can go wrong. The price of AERO and other digital money can be very unpredictable.

Always do your own thorough research and understand the risks before participating.

Conclusion: A Key Player on a Growing Network

Aerodrome Finance (AERO) is a powerful and important DeFi platform on the Base network. Its innovative ways of managing liquidity and involving users through governance make it a key spot for trading on this growing blockchain.

For those looking to use DeFi on Base, or understand the main places to trade there, Aerodrome is definitely one to check out. It offers ways to trade, provide liquidity, and even participate in how the platform is run, all with the goal of creating an efficient and rewarding market.