Position in Rating | Overall Rating | Trading Terminals |

188th  | 2.7 Overall Rating |  |

Tier1FX Review

When it comes to Forex trading, choosing the right broker is one of the most crucial decisions you'll make. A good broker not only provides the necessary platform and tools for trading but also ensures that your funds are secure and your trades are executed fairly. With countless options in the market, it's essential to understand the importance of selecting a reliable and well-regulated Forex broker to enhance your trading success.

Tier1FX stands out in the crowded Forex broker market due to its emphasis on transparency, advanced trading technology, and client-centric services.

In this detailed review, I aim to provide an exhaustive evaluation of Tier1FX, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Tier1FX as your preferred brokerage service provider.

What is Tier1FX?

Tier1FX is a Forex broker based in Malta, regulated by the Malta Financial Services Authority (MFSA). The broker is known for its strict regulatory compliance and high-security measures, ensuring traders' funds are well-protected. With Tier1FX, you can trade over 60 currency pairs, as well as gold, silver, oil, indices CFDs, and cryptocurrencies, offering a broad spectrum of trading options.

One of the standout features of Tier1FX is its multiple trading platforms, including MetaTrader 4 (MT4), Fortex 6, and JForex, catering to different trading preferences. The broker also provides Direct Market Access (DMA) and Straight-Through Processing (STP) models, which means trades are executed directly in the market without any dealing desk intervention, enhancing transparency and fairness in trade execution.

Benefits of Trading with Tier1FX

After trading with Tier1FX, I found several notable benefits that stand out. The broker's regulation by the Malta Financial Services Authority (MFSA) provides a high level of security and compliance, ensuring that my funds are protected and that trading practices are transparent and fair. This regulatory oversight gave me confidence in the safety of my investments.

One major advantage is the competitive spreads offered by Tier1FX, with spreads on major currency pairs like EUR/USD often as low as 0.2 pips. This low-cost trading environment, combined with a straightforward commission structure, helps keep my trading expenses manageable. I also appreciated the transparency with no hidden fees, which made it easier to plan and manage my trading budget.

The availability of multiple trading platforms, including MetaTrader 4 (MT4) and JForex, caters to different trading preferences. Whether I was manually trading or using automated strategies, these platforms provided the tools and features needed for efficient trading. The support for algorithmic trading and the Direct Market Access (DMA) model ensured that my trades were executed quickly and fairly.

Additionally, the broker’s customer support is accessible and helpful, with multiple contact methods and reasonable response times. Knowing that support is available 24/5 reassured me that any issues could be promptly addressed.

Tier1FX Regulation and Safety

Tier1FX is regulated by the Malta Financial Services Authority (MFSA), ensuring it adheres to stringent financial and operational standards. This regulation under the MFSA means the broker must comply with rigorous safety and transparency requirements, which are critical for protecting traders' interests. When you trade with Tier1FX, you can feel confident that your funds are held in segregated accounts at top-tier banking institutions, separate from the broker's own funds. This setup provides a layer of security, ensuring that your money remains safe even if the broker faces financial difficulties.

The broker also adheres to the European Union’s Markets in Financial Instruments Directive (MiFID II), which mandates strict guidelines for brokers operating within the EU. This compliance ensures that Tier1FX maintains a high level of transparency and accountability, crucial for fostering trust with its clients. Moreover, Tier1FX participates in the Investor Compensation Scheme, which provides a safety net for retail investors, offering compensation of up to €20,000 if the broker becomes insolvent.

Tier1FX Pros and Cons

Pros

- Single live account for all trader levels

- Lower-than-average spreads, competitive commissions

- Transparent fees, no hidden charges

- No trading restrictions, supports scalping and algorithmic trading

- Moderate leverage for balanced risk and profit potential

Cons

- $1,000 minimum deposit

- No educational programs

- Not available for residents of certain countries

Tier1FX Customer Reviews

Customers generally find Tier1FX to be a well-regulated and reliable broker with quick and helpful support. Users appreciate the secure handling of funds and prompt deposits, along with the low spreads and competitive trading commissions. The broker's transparent fee structure and support for various trading strategies like scalping and algorithmic trading are highly valued. Although some users are waiting to assess the portfolio management and withdrawal processes fully, the overall satisfaction with the broker's quality and conditions is evident.

Tier1FX Spreads, Fees, and Commissions

When trading with Tier1FX, I found that the broker offers competitive spreads and transparent fees. The spreads on major currency pairs, like EUR/USD, are often as low as 0.2 pips, which is quite favorable compared to other brokers. Additionally, the commission structure is straightforward and competitive, with $2.75 per lot for forex trades. This helps keep overall trading costs low, which is a significant advantage for active traders.

One thing I appreciate about Tier1FX's fee structure is that there are no hidden charges. All commissions are disclosed upfront, and there are no additional fees sneaking up later. This transparency makes it easier to plan and manage trading expenses. For commodities, the commission is $3.25 per lot, and for CFDs, it is $0.30 per contract, which I found to be reasonable and competitive with other top brokers.

Moreover, the broker supports a variety of trading styles without imposing restrictions, which means scalping, algorithmic trading, and the use of advisors are all allowed. This flexibility, combined with moderate leverage options up to 1:100, enables traders to enhance their profit potential while managing risk effectively. The absence of inactivity fees is another plus, making Tier1FX a cost-effective choice for both active and occasional traders.

Account Types

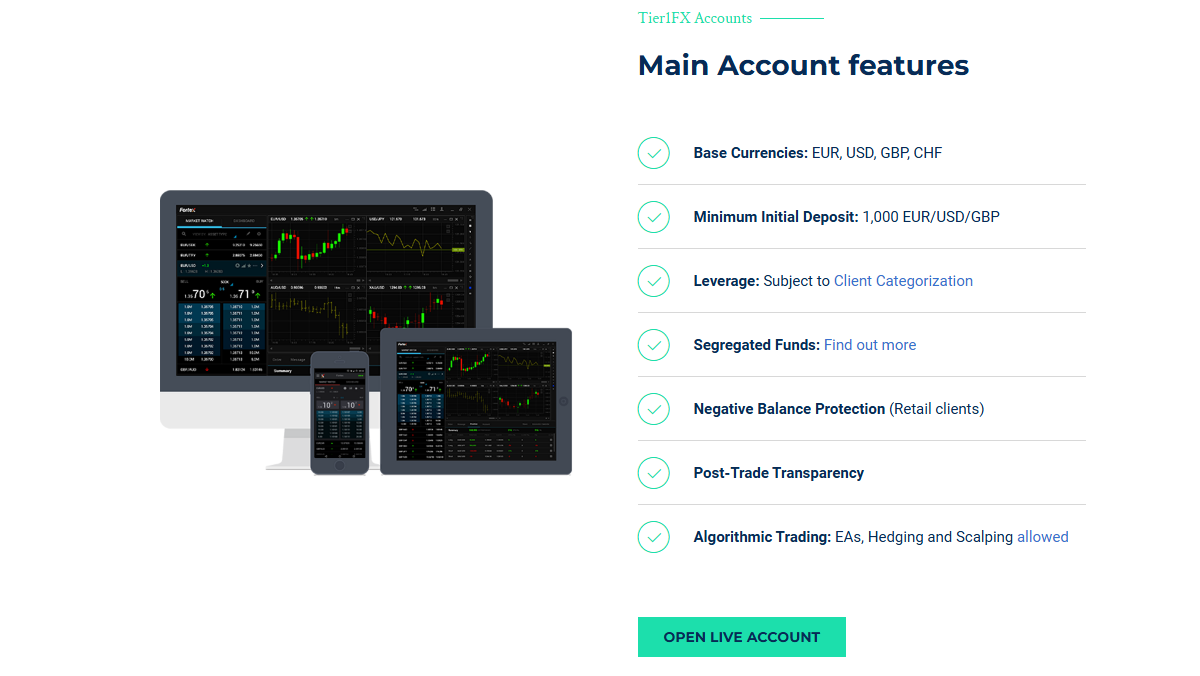

Tier1FX only offers one type of account aside from their demo account:

Standard Account

- Base Currencies: EUR, USD, GBP, CHF

- Minimum Initial Deposit: 1,000 EUR/USD/GBP

- Leverage: Up to 1:100 for retail clients, higher for professional clients

- Segregated Funds: Ensuring client funds are kept separate and secure

- Negative Balance Protection: Retail clients are protected from incurring negative balances

- Post-Trade Transparency: Full visibility into trade executions and costs

- Algorithmic Trading Support: Allows for the use of Expert Advisors (EAs), hedging, and scalping strategies

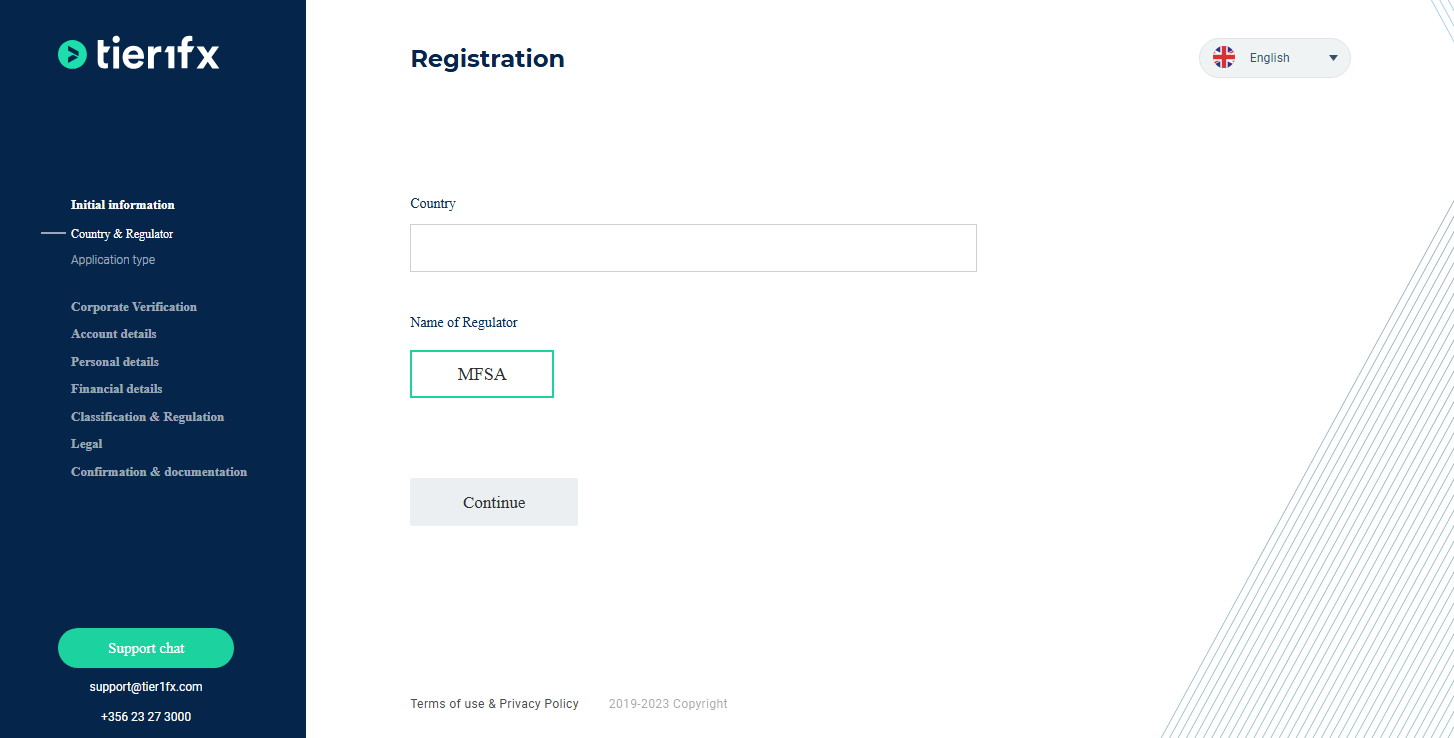

How to Open Your Account

- Visit the official Tier1FX website and select your preferred language from the top right corner.

- Click on “Open Live” and then select “Get Started” to begin the registration process.

- Choose your country and regulator from the provided options and click “Continue.”

- Fill in your account type, full name, phone number, email address, and create a password, then agree to the terms and click “Continue.”

- Check your email for a confirmation link, follow the link to proceed with the registration.

- Select your account's base currency, trading platform, and other preferences, clicking “Continue” after each selection.

- Provide personal information such as your gender, date of birth, address, and financial details as required.

- Complete the registration by sharing your bank account details, if available, and your trading experience. Click “Continue” after filling in each section.

Tier1FX Trading Platforms

From my experience with Tier1FX, I found their MetaTrader 4 (MT4) platform to be robust and highly reliable. This platform offers a wide range of tools and indicators, making it ideal for both beginners and advanced traders. The user-friendly interface and powerful charting capabilities have significantly improved my trading efficiency.

I also explored the JForex platform, which is tailored for those who prefer automated trading and advanced analytics. The platform supports algorithmic trading and provides access to a comprehensive set of technical analysis tools. Its seamless integration with various trading strategies has made it my go-to choice for more sophisticated trading needs.

For those looking into programmatic trading, Tier1FX’s FIX API is an excellent option. This feature allows for direct market access (DMA) and ensures low-latency execution, which is crucial for high-frequency trading strategies. Additionally, it provides the flexibility to create custom trading applications, catering to the needs of professional traders.

Tier1FX also offers the Fortex 6 platform, which is designed for institutional-level trading. This platform excels in providing deep liquidity and superior trade execution, making it a perfect fit for traders dealing with large volumes. Its advanced order types and execution algorithms have been a significant advantage in managing my trades effectively.

What Can You Trade on Tier1FX

From my experience with Tier1FX, I found their range of trading instruments to be quite comprehensive. You can trade over 60 forex currency pairs, which covers all the major, minor, and some exotic pairs. This provides a broad spectrum of opportunities to capitalize on various market conditions. The broker also supports trading in precious metals like gold and silver, offering a way to diversify your trading portfolio with commodities.

Tier1FX also includes cryptocurrencies in its lineup, allowing you to trade popular digital assets such as Bitcoin, Ethereum, and Litecoin. This is particularly advantageous for traders looking to explore the volatile yet potentially rewarding world of crypto trading. Additionally, the platform offers contracts for difference (CFDs) on several stock indices and commodities like oil, enabling you to speculate on the price movements of these assets without owning them physically.

For those interested in the stock market, Tier1FX provides access to major stock indices, giving you exposure to the performance of leading companies globally. While the broker does not offer individual stock trading, the inclusion of indices like the S&P 500 and Dow Jones can help diversify your investment strategies. Moreover, the spot commodities market on Tier1FX allows trading in resources such as crude oil and natural gas, catering to traders focusing on the energy sector.

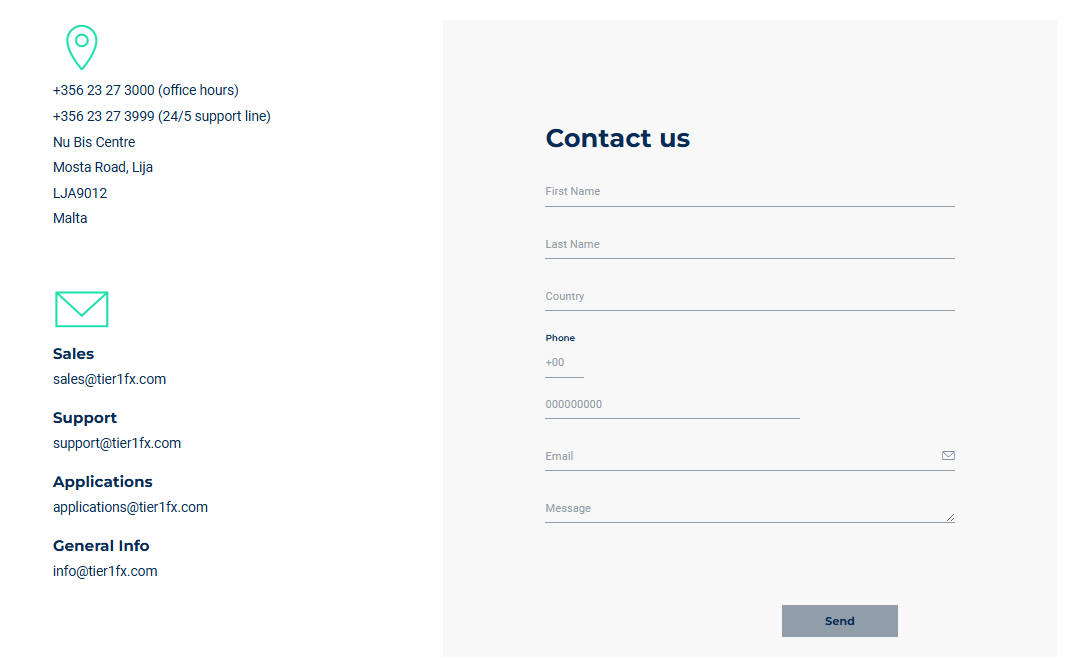

Tier1FX Customer Support

From my experience with Tier1FX, I found their customer support to be efficient and accessible. The support team is available 24 hours a day from Monday to Friday, ensuring that help is always on hand during trading hours. You can reach them via live chat, email, or phone, which offers flexibility depending on your preferred method of communication.

While using their services, I noticed that the average wait time for support is around 10 minutes, which is relatively fast but can be slightly longer compared to other brokers. However, the support representatives are friendly and knowledgeable, which helps resolve issues effectively despite the wait.

For those who prefer online communication, the live chat feature on their website is particularly convenient. It allows for real-time assistance with trading-related inquiries or technical issues. Additionally, the option to contact support through email at support@tier1fx.com or by phone ensures that all bases are covered for more complex queries.

Advantages and Disadvantages of Tier1FX Customer Support

Withdrawal Options and Fees

From my experience with Tier1FX, I found that their withdrawal options are somewhat limited but straightforward. You can withdraw funds using bank wire transfer or card payments, which covers the basic needs but might not be as flexible as some other brokers. The processing time for withdrawals is generally one business day, ensuring that you get your funds relatively quickly.

In terms of fees, Tier1FX does not charge for deposits, which is a plus. However, there is a fixed withdrawal fee of $20 or 15 EUR/GBP for bank wire transfers, which is important to consider if you plan to withdraw funds frequently. Additionally, it’s worth noting that card withdrawals are limited to the amount deposited, with any profits needing to be withdrawn via bank transfer.

While the withdrawal process is efficient, the high minimum deposit requirement of 1,000 EUR/USD/GBP could be a drawback for some traders. This requirement might deter beginners or those looking to start with a smaller investment. Overall, the reliable and timely processing of withdrawals is a positive aspect, despite the limited options and associated fees.

Tier1FX Vs Other Brokers

#1. Tier1FX vs AvaTrade

Tier1FX is a broker that focuses on providing a personalized service to professional and institutional traders, offering features such as direct market access (DMA) and a strong emphasis on security and transparency. AvaTrade, on the other hand, is a more retail-oriented broker with a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies, catering to a broad spectrum of traders with its user-friendly platforms and extensive educational resources.

Verdict: Tier1FX is better for professional traders seeking direct market access and a high level of service and security. AvaTrade, however, is preferable for beginner to intermediate traders looking for a diverse range of trading instruments and educational support.

#2. Tier1FX vs RoboForex

Tier1FX specializes in direct market access for forex trading, providing high levels of transparency and institutional-grade execution. RoboForex offers a broader range of trading services, including forex, stocks, indices, cryptocurrencies, and commodities, with various account types to suit different trading styles and automated trading options. RoboForex also stands out for its flexible leverage options and user-friendly trading platforms.

Verdict: Tier1FX is ideal for traders who prioritize direct market access and high execution quality. In contrast, RoboForex is better suited for those seeking a wide range of trading instruments and flexible account options.

#3. Tier1FX vs Exness

Tier1FX is recognized for its focus on providing high-quality execution and direct market access to professional traders, emphasizing security and regulatory compliance. Exness, meanwhile, offers a variety of account types, competitive spreads, and high leverage, making it attractive to both retail and professional traders. Exness is also known for its robust trading platforms and extensive range of tradable assets, including forex, cryptocurrencies, and commodities.

Verdict: Tier1FX is superior for professional traders who need direct market access and rigorous security standards. Exness is better for traders seeking flexible account options, competitive spreads, and a wide array of trading instruments.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Tier1FX Review

Tier1FX stands out for its emphasis on transparency, advanced trading technology, and strong regulatory compliance. It offers a robust trading experience with multiple platforms like MT4 and JForex, catering to both manual and automated traders. The broker's focus on security and direct market access (DMA) makes it a reliable choice for professional and institutional traders.

However, Tier1FX has a high minimum deposit requirement of $1,000, which may not be suitable for beginners or those with limited capital. Additionally, the lack of educational resources can be a drawback for new traders seeking guidance and skill development. Overall, while Tier1FX is an excellent option for experienced traders looking for high-quality execution and security, novice traders might find it less accommodating due to the entry cost and limited learning support.

Also Read: Baxia Markets Review 2024 – Expert Trader Insights

Tier1FX Review: FAQs

Is Tier1FX a regulated broker?

Yes, Tier1FX is regulated by the Malta Financial Services Authority (MFSA), ensuring compliance with stringent financial and operational standards.

What trading platforms does Tier1FX offer?

Tier1FX offers several trading platforms, including MetaTrader 4 (MT4), JForex, and Fortex 6, catering to different trading preferences and strategies.

What is the minimum deposit required to start trading with Tier1FX?

The minimum deposit required to start trading with Tier1FX is $1,000 or its equivalent in EUR/GBP.

OPEN AN ACCOUNT NOW WITH TIER1FX AND GET YOUR BONUS