Position in Rating | Overall Rating | Trading Terminals |

4th  | 4.0 Overall Rating |    |

TMGM Review

In this article, the review will tackle about a forex broker, which is TMGM or Trademax Global Markets. The forex broker has been around for a long time and offers a variety of trading tools, such as Forex, CFDs, and commodities. The Australian Securities and Investments Commission (ASIC) oversees the broker, which gives its customers peace of mind when they trade. Platform choices from TMGM, like MetaTrader 4 and IRESS, are good for both new and experienced traders.

Low spreads starting at 0.0 pips and leverage up to 1:500 make the broker a good choice for forex traders. Trademax Global offers different types of accounts to meet different trading styles. These include options that are based on spreads or commissions. The broker also offers advanced trading tools, such as economic calendars and trading signals, to help buyers make smart choices.

TMGM's customer service team is open 24 hours a day, seven days a week, so buyers can get help whenever they need it. The broker also provides learning tools, such as webinars and books, to help clients become better traders. There are many ways to pay, including bank transfers, credit cards, and famous e-wallets. This makes it easy for customers to deposit and withdraw money.

What is TMGM?

TMGM is a global brokerage company that lets people trade Forex, CFDs, and other types of financial instruments. It is controlled by groups such as the Australian Securities and Investments Commission (ASIC), which makes it a safe place for dealers. TMGM's platforms, like MetaTrader 4 and MetaTrader 5, are easy for both new and expert traders to use.

The broker is known for having low spreads and high leverage of up to 1:500, which make trading conditions very competitive. There are different account types at TMGM to meet the needs of different traders. For example, forex traders can choose between commission-based and spread-based dealing. Some of the useful trade tools that the broker offers are advanced charting and risk management.

Customers of TMGM can get help 24 hours a day, seven days a week, and can also find a lot of ways to learn. The broker accepts a number of payment methods, which makes it easy for users to enter and withdraw money. TMGM is a popular choice for traders who want both reliability and freedom because it has strict rules and a lot of trading options.

TMGM Regulation and Safety

The Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC) are two respected financial markets authority that keep an eye on TMGM. These governing groups make sure that TMGM follows strict rules to keep things open and keep client money safe. By following these rules, the broker helps give buyers a safe and reliable place to trade.

TMGM keeps client money in separate accounts at top-tier banks, which adds another level of security. In the event that the company's finances become unstable, this split of funds will keep clients' money safe. Plus, TMGM offers negative balance safety, which keeps traders from losing more than they put in.

TMGM protects its clients' personal and business information with SSL encryption and other high-tech security measures. The broker is regularly audited to make sure they are following business standard, financial markets authority and government rules. Because of these safety steps, TMGM is a good choice for traders who want to feel safe while trading.

TMGM Pros and Cons

Pros:

- Low spreads

- High leverage

- Regulation

- 24/5 support

Cons:

- Limited crypto

- No U.S. clients

- Inactivity fee

- Complex accounts

Benefits of Trading with TMGM

There are many perks to trading with TMGM, such as the ability to take advantage of competitive trading conditions like high leverage and low spreads. The broker offers many platforms, like MetaTrader 4 and MetaTrader 5, so both new and expert traders can find what they need. TMGM also lets you trade in different products, such as Forex, indices, and commodities.

TMGM keeps client money safe by keeping it in separate accounts at banks that they trust with financial markets authority. This adds an extra layer of safety, which makes it appealing to buyers who want to keep their funds safe. The broker also protects clients from losing more than they put in, so they can't lose more than their initial deposit.

Customer service is open 24 hours a day, seven days a week, and can help with any trading-related issues right away. TMGM also helps traders get better by giving them webinars and market views and other learning materials. TMGM wants to make buying as easy as possible by offering a variety of account types and payment methods.

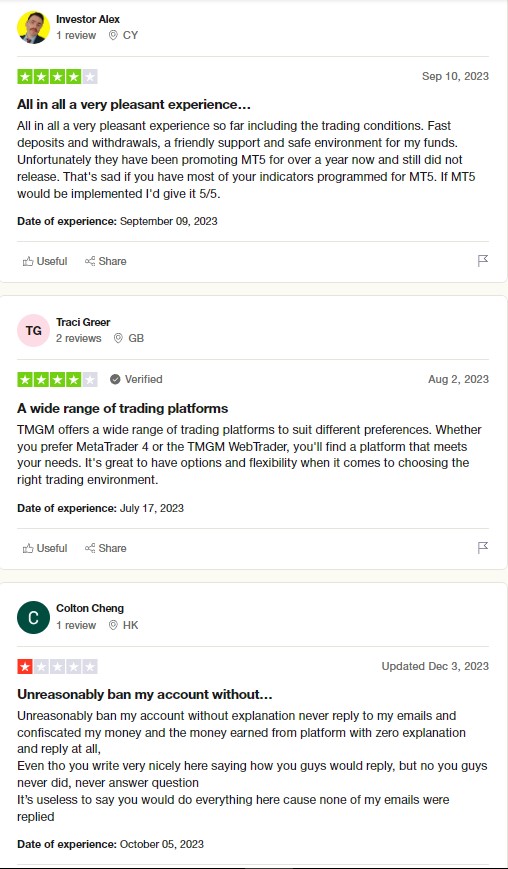

TMGM Customer Reviews

Customers have given TMGM mixed reviews, but many have said that the site is easy to use and has good trading conditions. Low spreads and fast execution speeds are things that traders like because they help them make the most of their trading methods. People also like that there are a lot of trading systems to choose from, like MetaTrader 4 and MetaTrader 5.

Some customers are happy with TMGM's customer service, which is offered 24 hours a day, seven days a week. Webinars and market research are some of the educational tools that the broker offers that traders of all levels will find useful. A lot of people also like the safety features, such as the ability to separate funds and the government's monitoring.

Some traders have said that the downsides are limited coin options and fees for not using an account for a while. Some people also don't like that the service isn't available for U.S. clients. Overall, TMGM is praised for being reliable and having a good trading setting, but there are still some things that could be done better.

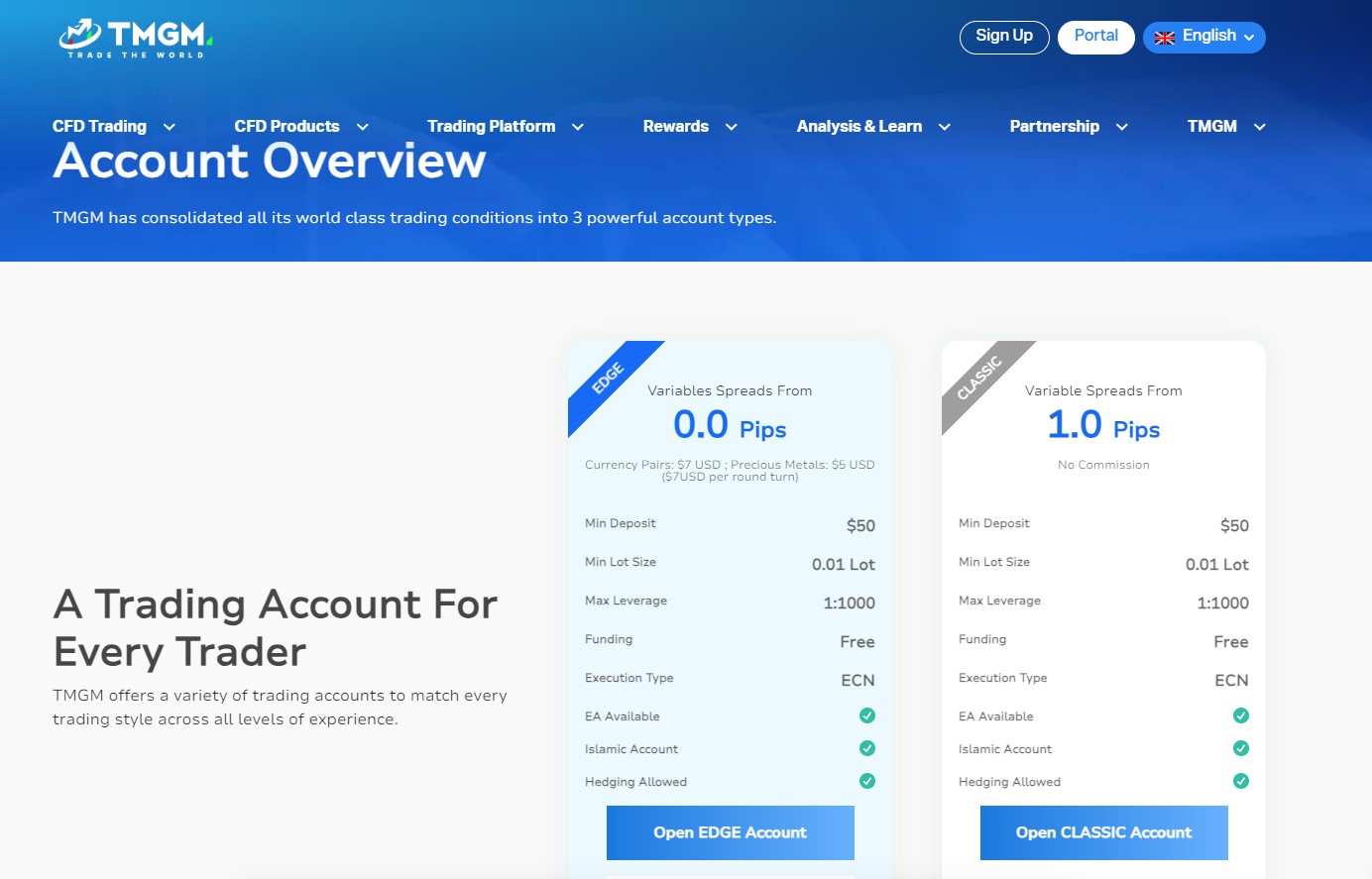

TMGM Spreads, Fees, and Commissions

TMGM has low spreads that can go as low as 0.0 pips based on the type of account and the state of the market. The broker's spreads are different for commission-based and spread-only accounts, so traders with different trading styles can use them. Because of these low spreads, TMGM is appealing to traders who want to keep trading costs as low as possible.

TMGM charges commissions on some account types, like the Edge account, in addition to spreads. The costs start at $7 per round turn. Traders should also think about other costs that might come up, like swap fees for leaving accounts open overnight. TMGM, on the other hand, doesn't charge deposit fees, which makes it easy to start an account.

One possible downside is the inactivity fee, which is charged to accounts that haven't been used for trade for several months. Even so, TMGM is still competitive with many other dealers thanks to its low spreads and clear fee structure. For the most part, whether new or experienced traders can apply their trading strategies in TMGM.

Account Types

TMGM offers a variety of account categories for new and experienced traders. Each account category offers low-cost spreads to powerful tools for pros with minimum deposit, customized to different trading styles. TMGM's account options, terminology, and advantages are below.

Classic Account: Next to demo accounts, a classic account with no commissions, ideal for beginners looking for a straightforward trading experience.

Edge Account: Edge account offers tighter spreads with a commission fee, suitable for experienced traders aiming to reduce trading costs.

Professional Account: Designed for advanced traders who meet specific criteria, offering higher leverage and more advanced trading instruments.

Demo Account: Demo accounts are allowing traders to familiarize themselves with the platform and test strategies without minimum deposit. Demo account is good for beginners and veterans.

Each type of account protects against negative balances and lets traders trade in different trading strategies using account manager. It is important to TMGM that their clients can pick the best account for their investing style and objectives.

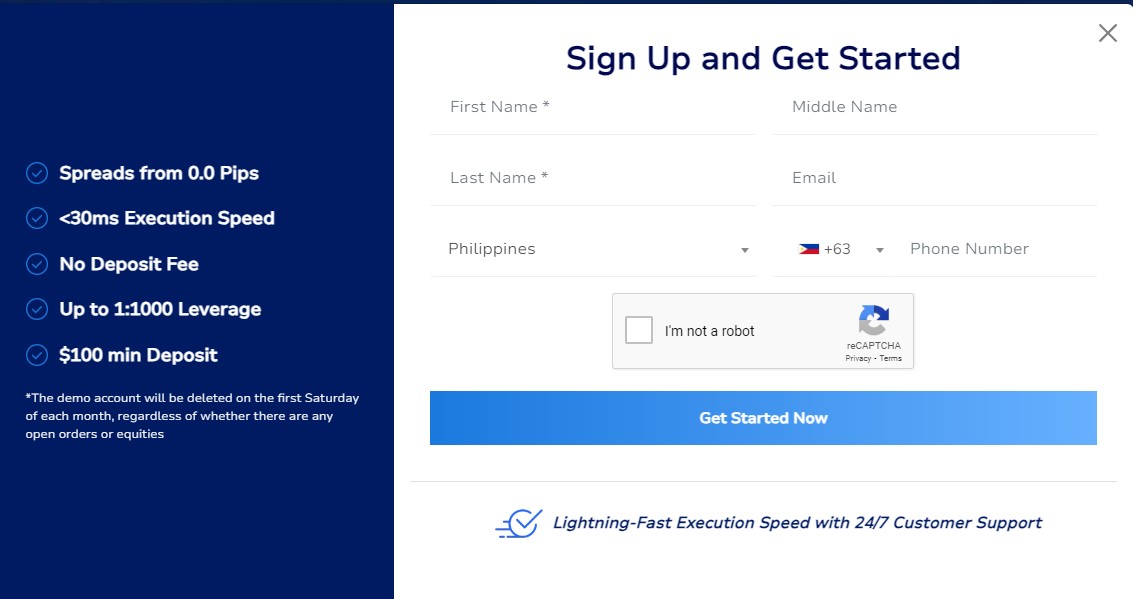

How to Open Your Account

TMGM trading account can be opened in a few easy steps. TMGM's onboarding process is simple for beginners and pros. Start applying trading ideas with TMGM by following the steps below.

Visit the TMGM Website: Go to the official TMGM website and click on the “Open Account” button.

Fill Out the Registration Form: Provide your personal information, including users name, email, phone number, and country of residence.

Verify Your Identity: Upload necessary documents, such as a government-issued ID and proof of address, to verify identity.

Choose Account Type: Select the account type that best suits every traders trading needs (Demo account, Classic, Edge, or Professional).

Fund Your Account: Deposit funds using the preferred payment method, such as bank transfer, credit card, or e-wallet with the required minimum deposit.

Start Trading: Once your account is verified and funded, the users can start trading on the TMGM platform.

Following the above described measures will help the users to be ready to seize TMGM's competitive trading conditions and running in no time.

TMGM Trading Platforms

To serve a range of traders, TMGM provides MetaTrader 4, MetaTrader 5, and IRESS among other trading platform. Both novice and professional traders will find MetaTrader 4 (MT4) perfect for its easy-to-use interface and thorough charting capabilities. MetaTrader 5 (MT5) gives more indicators and functions, hence increasing trading flexibility and depth.

For those inclined in advanced trading of stocks, options, and futures, another choice is the IRESS platform. It provides real-time data and direct market access (DMA), therefore empowering traders over their transactions. Professionals looking for a complex trading environment will find IRESS appropriate.

Using MT4 and MT5 mobile apps, TMGM also allows mobile trading—that is, trading on the move. These systems let traders remain always connected to the market anywhere. The great variety of trading platform guarantees Trademax Global Markets satisfies all trading styles and preferences.

What Can You Trade on TMGM

Among the several trading instruments TMGM offers are Forex, commodities, indices, and shares. With more than 50 currency pairs—including major, minor, and exotic pairs—forex trading is among the main offers. This range lets traders seize several market in Trademax Global Markets possibilities and degrees of volatility.

Apart from Forex, TMGM provides commodities including gold, silver, other precious metals and oil based CFDs. Without holding the actual assets, these commodities CFDs expose traders to worldwide markets. TMGM also offers trading on well-known indexes as the S&P 500, FTSE 100, and NASDAQ thereby enabling traders to profit on the success of important worldwide markets.

TMGM also encourages trading on shares, therefore providing access to particular stocks from important markets such Australia, Europe, and the United States. This lets traders diversify their portfolios and make investments in big businesses in several sectors. TMGM gives traders access to a range of instruments, so guaranteeing a range of trading prospects.

TMGM Customer Support

TMGM provides phone, email, and live chat customer assistance among other outlets. The customer service team is on call 24/5, so traders have help right during market hours. This accessibility guarantees quick answers to any inquiries or problems, therefore improving the trading experience.

Those looking for quick answers often choose the live chat tool. For hurried questions, it is handy and offers real-time help. For more specific questions, traders can also reach out by email; usually, they get answers one business day.

For those that would rather direct contact, phone support is provided. The bilingual support team of TMGM can serve merchants from all over. This all-encompassing assistance system guarantees clients have the tools they need to properly handle their trading accounts.

Advantages and Disadvantages of TMGM Customer Support

Withdrawal Options and Fees

Among the deposit and withdrawal options TMGM provides are credit/debit cards, bank account transfers, and e-wallets like Skrill and Neteller. These choices give traders flexibility so they may choose the most practical approach. Depending on the chosen approach, withdrawals are handled within 1–5 business days.

While e-wallet transactions are normally speedier, bank transfers typically take 3–5 business days to handle. For most withdrawals, TMGM does not charge fees; nevertheless third-party costs could apply. For most clients, this simplifies and reasonably costs the withdrawal process.

Another choice with an average processing time of 2-3 business days are credit and debit card withdrawals. TMGM seeks to give traders quick access to their money while also a hassle-free withdrawal experience. The several withdrawal strategies let to satisfy various trader preferences.

TMGM Vs Other Brokers

#1. TMGM vs AvaTrade

Both well-known brokers providing access to a broad spectrum of financial assets, including Forex, commodities, and CFDs, TMGM and AvaTrade are Attractive to traders looking for cost effectiveness, TMGM stands out for its tight spreads and up to 1:500 high leverage. Conversely, AvaTrade caters more to risk-averse traders with its fixed spreads and reduced leverage.

Regarding platforms, TMGM offers flexibility for various trading instruments by means of MetaTrader 4, MetaTrader 5, and IRESS. Providing a simple solution for newcomers, AvaTrade offers MetaTrader 4, MetaTrader 5, and its own platform, AvaTradeGO. Both advisers endorse mobile trading, therefore enabling consumers to trade wherever.

While AvaTrade also provides 24/5 help across like channels, TMGM customer support is available 24/5 via live chat, email, and phone. For inexperienced traders especially, AvaTrade is well-known for its wealth of instructional tools. For those seeking reliability and a beginner-friendly atmosphere, AvaTrade is best; TMGM is chosen overall for its competitive price and professional features.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. TMGM vs RoboForex

Just like other brokers, forex, indices, and commodities are several trading instruments available from TMGM and RoboForex. Attracting traders searching for reduced trading costs, TMGM is well-known for its competitive spreads and high leverage of up to 1:500. For traders looking for more risk and possible benefits, RoboForex presents a leverage of up to 1:2000.

RoboForex supports MetaTrader 4, MetaTrader 5, and cTrader; TMGM offers MetaTrader 4, MetaTrader 5, and IRESS. RoboForex also provides its own R Trader system, which gives other tools for developing strategies. Since both brokers offer mobile trading choices, traders may easily handle their positions anywhere.

Like RoboForex, TMGM customer assistance is available 24/5 by phone, email, and live chat. RoboForex is well-known for providing several account options, including cent accounts, which are appropriate for beginners making less investments. On the other hand, TMGM is a preferred option for traders giving safety first priority since it emphasizes offering safe and controlled trading circumstances.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. TMGM vs Exness

Popular traders of Forex, indices, and commodities, TMGM and Exness are both Approaching traders looking for competitive trading circumstances, TMGM offers leverage of up to 1:500. Exness provides greatly more leverage; for certain accounts, options provide unlimited leverage, so serving high-risk traders.

TMGM offers a selection of trading platforms to suit various tastes, so supporting MetaTrader 4, MetaTrader 5, and IRESS. Exness now provides MetaTrader 4 and MetaTrader 5 together with a proprietary web platform for even more simplicity. Since both firms advocate mobile trading, consumers will have simple access to handle trades anywhere.

Customer support by phone, email, live chat allows TMGM and Exness 24/5. For traders, Exness's quick deposit and withdrawal processing increases convenience. Conversely, TMGM stresses a more controlled and safe trading environment, which is perfect for traders giving safety and openness first priority.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: TMGM Review

TMGM has a broad product offering with competitive spreads, account types, and trading platforms. MetaTrader 4, MetaTrader 5, and IRESS are all accessible, giving traders of different tastes freedom. The broker's substantial leverage and minimal spreads attract financially responsible traders.

TMGM follows ASIC requirements to keep clients safe. Safety from segregated client funds boosts user confidence. The broker also offers negative balance protection to protect traders from losing more than they invested.

Customers can get help 24/7 by live chat, email, and phone. TMGM supports foreign exchange, commodities, and indices to help traders diversify their portfolios. TMGM is a trusted broker for traders of all levels due to its wide services, secure environment, and assistance.

TMGM Review: FAQs

Is TMGM regulated?

Yes, TMGM is regulated broker by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

What trading platforms does TMGM offer?

TMGM offers MetaTrader 4, MetaTrader 5, and IRESS platforms.

What assets can you trade on TMGM?

TMGM offers Forex, commodities, indices, and shares.

OPEN AN ACCOUNT NOW WITH TMGM AND GET YOUR BONUS