TopFX Review

TopFX is a different kind of broker because it provides institutional-grade liquidity and a wide range of trading instruments for both individual and expert traders.

This broker is well-known for its low-latency execution and competitive spreads, which makes it a popular choice for people who want to quickly enter the market. TopFX promises a safe trading environment by being regulated by CySEC and the FSA. This gives traders peace of mind.

TopFX offers a lot of different assets, such as forex, commodities, indices, and cryptocurrencies, so traders can spread out their holdings.

It has easy-to-use trading instruments and trading platforms like cTrader and MetaTrader 4 that can be used by people trading styles . The Forex broker also has great teaching materials and great customer service, which makes it a great choice for both new and experienced traders.

What is TopFX?

TopFX is a top multi-asset broker that helps both individual and business clients with dealing and liquidity.

Since it started in 2010, the broker has been a trusted name in the forex and CFD trading business thanks to its low spreads and quick execution. TopFX makes sure that all of its users can trade safely by being regulated by both CySEC and the FSA.

TopFX lets you trade more than 1,000 different types of assets, such as forex, commodities, stocks, indices, and cryptocurrencies.

The broker works with well-known trading systems like MetaTrader 4 and cTrader, giving traders access to advanced trading platforms, tools, and an easy-to-use interface. TopFX has great customer service and a lot of educational tools to help you learn how to trade better, no matter how experienced you are.

TopFX Regulation and Safety

TopFX is closely watched by regulators, which makes sure that its clients can trade safely and easily. The Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA) have given it licenses and keep an eye on it.

These governing groups make sure that industry standards are followed. This gives traders legal protection and peace of mind. With such strong governmental support, TopFX is dedicated to keeping client funds safe through separate accounts and other investor protection measures.

TopFX uses both strict rules and advanced security protocols to keep its trading platforms and customer info safe. The broker makes sure that all deals are encrypted and has strict rules about privacy to keep user data safe.

This focus on safety and control makes TopFX a good choice for traders who want to work with a broker that puts safety and trustworthiness first.

TopFX Pros and Cons

Pros

- Competitive spreads

- Fast execution

- Regulated broker

- Wide asset range

Cons

- Limited bonuses

- No MetaTrader 5

- High deposit for VIP accounts

- Few payment options

Benefits of Trading with TopFX

There are many benefits to trading with TopFX. One is that it has institutional-grade liquidity, which means that spreads are tight and trades are executed quickly.

Traders can easily diversify their portfolios because the broker gives them access to more than 1,000 trading products, such as forex, commodities, indices, and cryptocurrencies. TopFX makes sure that traders are safe by following industry standards and being regulated by CySEC and the FSA.

TopFX works with popular systems like MetaTrader 4 and cTrader, which are known for having easy-to-use interfaces and powerful trading tools. The broker also has customer service available 24 hours a day, seven days a week.

This helps both new and expert traders get around the markets quickly. In addition to teaching tools and different account types, TopFX offers a full trading experience that is made to fit the needs of all traders.

TopFX Customer Reviews

Users have mostly good things to say about TopFX. They like how quickly trades are executed and how low the spreads are, which makes it a good choice for both new and experienced traders.

A lot of customers also like how easy it is to use the broker's platforms, like MetaTrader 4 and cTrader, which have powerful tools for dealing. People who need help have also said that the helpful customer service team is one of the best things about the company.

But some traders have said that withdrawals took too long and that the broker should offer more deals. While some people like VIP accounts, others don't like the high deposit requirement or the limited payment choices.

Even with these worries,TopFX is still a popular broker because it is generally reliable and has good dealing conditions.

TopFX Spreads, Fees, and Commissions

TopFX has spreads that are reasonable, which makes it a good choice for traders who want to trade for less money. TopFX makes sure that traders can join and exit positions with little cost by offering spreads that start as low as 0.0 pips on some account types.

The broker also has an easy-to-understand fee system that makes any extra costs, like commissions on ECN accounts, clear, so traders know exactly what to expect.

TopFX charges a small fee for each lot sold with the ECN account. The Standard account, on the other hand, only charges for spreads. Traders can pick an account that fits their trading style and plan the best because of this.

TopFX offers a good experience and confidence to every traders who wants to make the most money out of trading without any risk and danger.

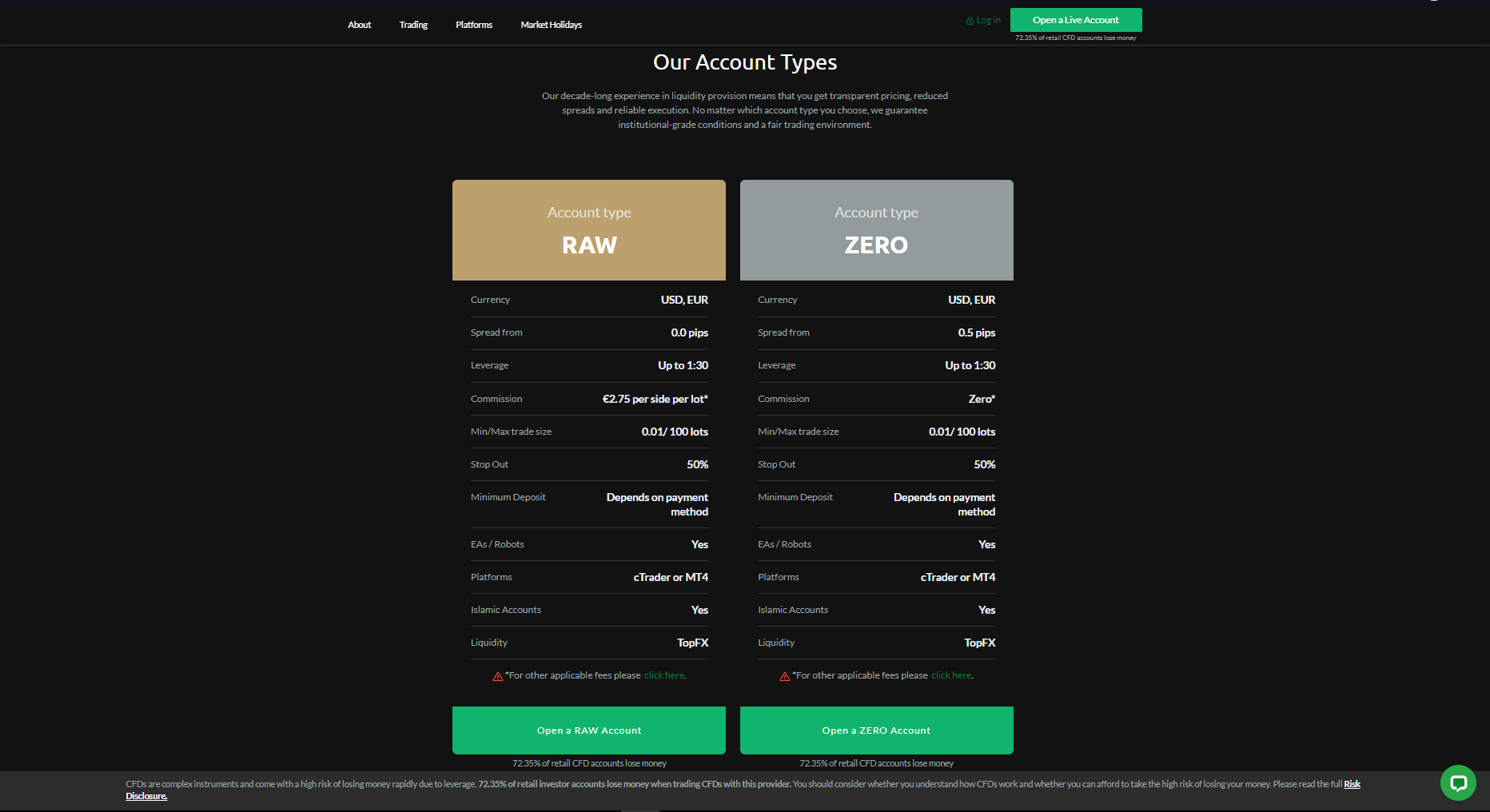

Account Types

The list below are the trading account and its benefits that TopFX review gathered. The users are free the identify which raw account or trading accounts are preferred and fitted in their lifestyle.

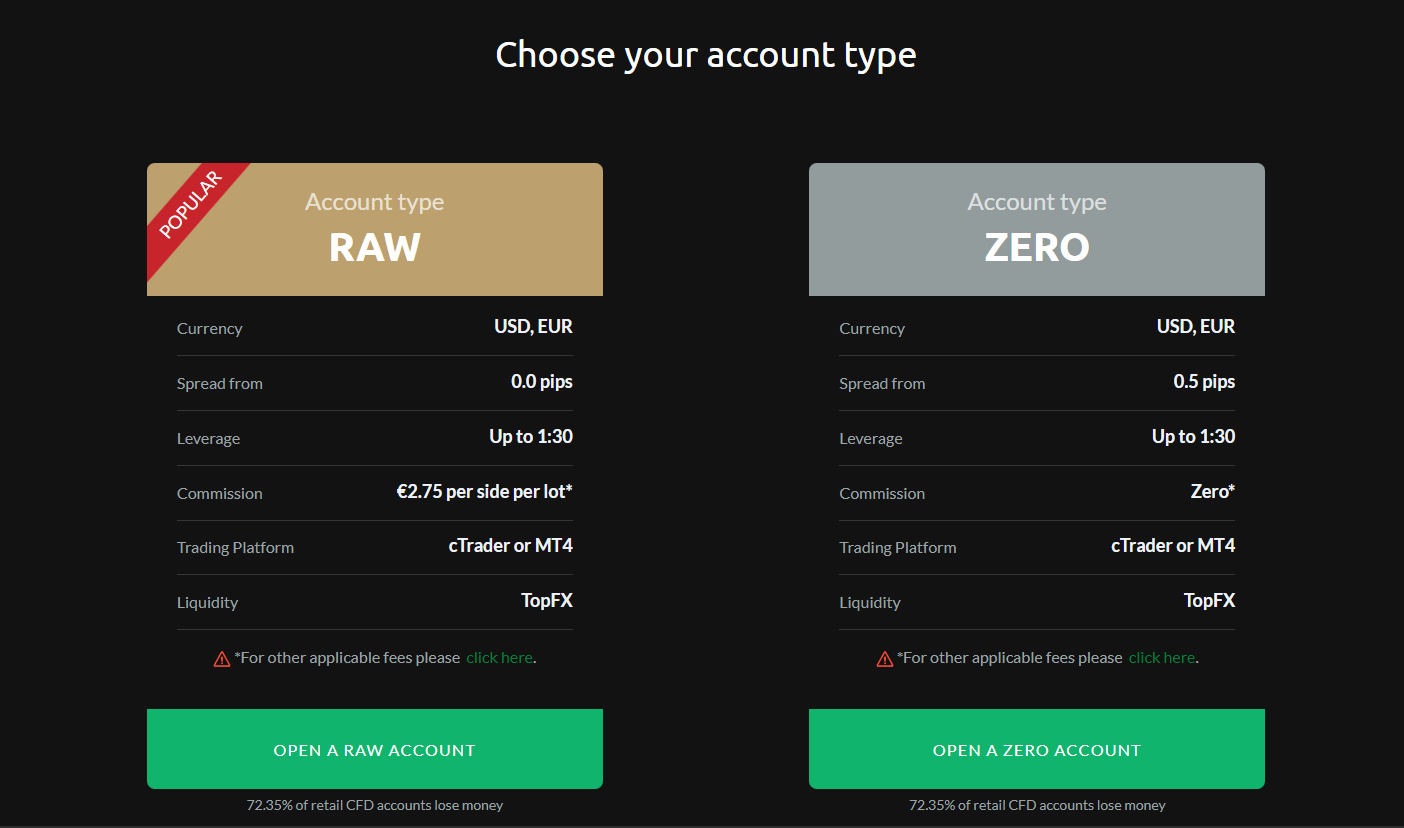

Raw Account: offers spreads from 0.0 pips and cheap commissions per lot for traders seeking precise market pricing. This raw account suits skilled traders who value tight spreads and transparency.

Zero Account: The Zero Account has zero commissions and somewhat larger spreads, making it ideal for minimal cost structures. The spread-only concept benefits traders without extra expenses.

Standard Account: The Standard Account offers competitive spreads without commissions for new traders. It simplifies trading and provides market access for beginners.

VIP Account: High-net-worth traders receive premium services and specialized account management with the VIP Account. This account is suitable for people seeking exclusive support and better trading conditions.

This trading account will determine what the customer preferred whether they are casual or professional traders. Zero account is the best starting account for the beginner traders and casual ones.

TopFX also offers demo account for those traders who wants to experience first and to gain assurance.

How to Open Your Account

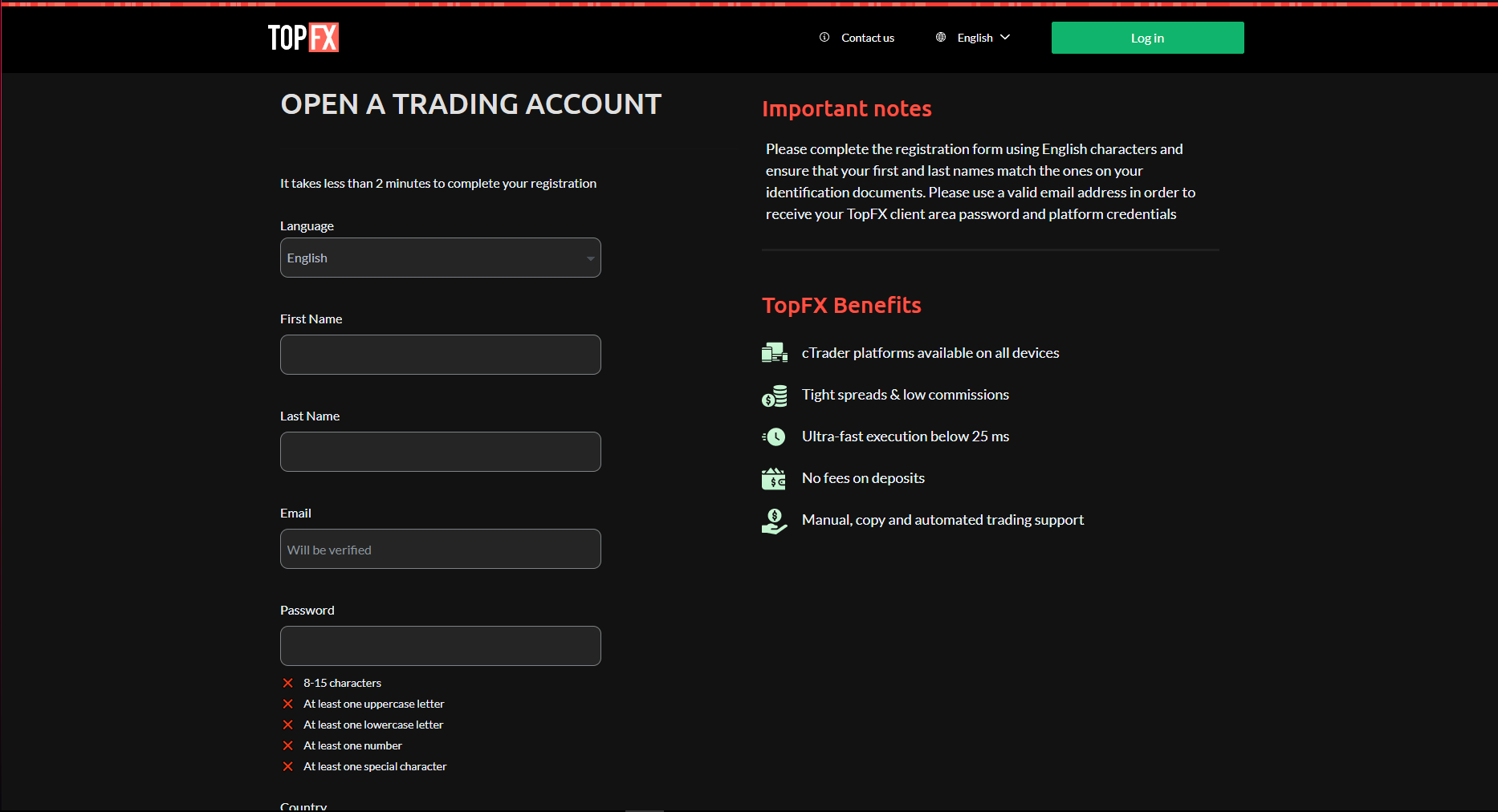

#1. TopFX website: Visit TopFX and click “Open Account” on the homepage.

#2. Fill Out Registration Form: Enter your name, email, phone number, and other information.

#3. Select Account Type: Choose Raw, Zero, Standard, or VIP for your trading needs.

#4. Check Your Identity: Upload passports and utility bills or bank statements for identity verification.

#5. After verification, deposit money into your new account using one of the payment methods.

#6. Start Trading: After financing your account, you can instantly use MetaTrader 4 or cTrader to trade.

TopFX Trading Platforms

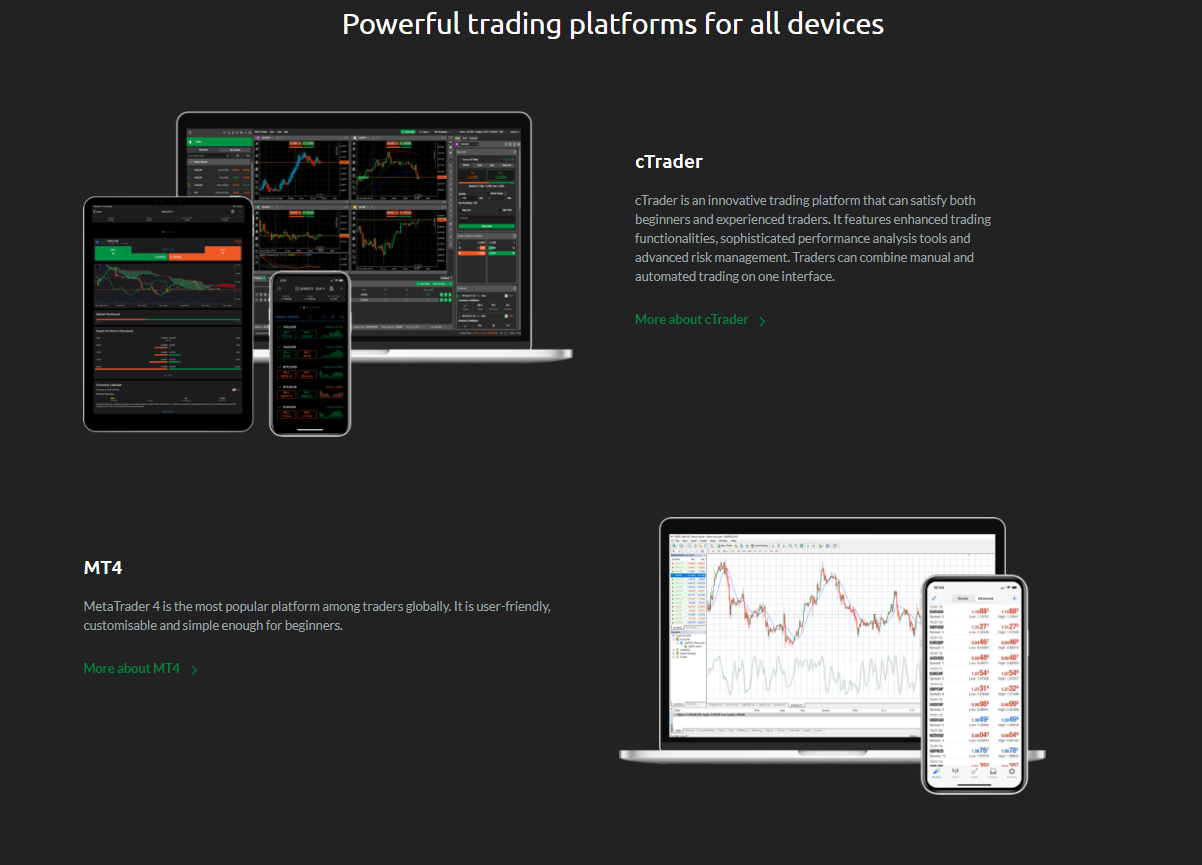

TopFX provides several trading systems meant to satisfy various traders' needs. From the sophisticated cTrader platform to the easy MetaTrader 4 (MT4), TopFX offers tools for both novice and seasoned experts. Traders may easily access the markets from anywhere using desktop, online, and mobile versions of these platforms.

#1 MetaTrader 4: Novice and expert traders will find MetaTrader 4 (MT4) perfect for its sophisticated charting capabilities and easy-to-use interface. It provides many technical analysis indicators and facilitates automated trading using Expert Advisors (EAs).

#2 cTrader: Designed for more experienced traders, cTrader offers fast execution, Level 2 pricing, and improved charting tools, so appealing to individuals who want accuracy trading.

TopFX makes sure traders may access their accounts and trade effortlessly from any device, anywhere in the world by providing these platforms on desktop, web, and mobile.

What Can You Trade on TopFX

TopFX gives users a lot of different trading tools, so they can spread their money around different types of assets. Traders can deal in forex, commodities, indices, stocks, and cryptocurrencies, and they have access to more than 1,000 instruments.

This huge selection makes sure that both new and experienced traders can trade in a wide range of global markets.

TopFX offers low spreads on a wide range of major, minor, and unusual currency pairs on the forex market. Traders can also put their money into commodities like gold, silver, and oil, or they can bet on how the global market will move by following measures like the S&P 500 and FTSE 100.

TopFX also lets people trade cryptocurrencies like Bitcoin, Ethereum, and Ripple, as well as stocks from big international companies, for those who want to invest in younger assets. TopFX is a flexible platform for traders who want to grow their trading strategies because it has a wide range of instruments.

TopFX Customer Support

There is a lot of customer service at TopFX to help traders at every stage of their trip. The forex broker offers support 24 hours a day, five days a week, so clients can get help even during the busiest trade times.

Traders can easily get in touch with TopFX's helpful customer service team through live chat, email, phone or TopFX website. They are always ready to answer questions and solve problems.

TopFX has quick customer service and also gives VIP clients a special account manager who helps them in a way that is specific to their needs. Traders with any account type—Raw, Zero, or Standard—can get support in multiple languages and use educational tools to help them make smart trading choices.

TopFX is a good choice for traders who want ongoing help because they care about their customers.

Advantages and Disadvantages of TopFX Customer Support

Withdrawal Options and Fees

TopFX gives traders a number of withdrawal choices that make it easy to get to their money. Customers can use their bank cards, credit or debit cards, or e-wallets like Skrill and Neteller to pay.

TopFX tries to process withdrawals quickly, but bank transfers can take anywhere from two to five business days, based on where you are and which bank you use. Withdrawals are free of charge at the broker, but based on the payment method, there may be fees from a third party.

Withdrawal choices are the same for all account types, such as Raw, Zero, Standard, and VIP. VIP clients, on the other hand, may get faster access to their funds through priority handling.

TopFX tries to give traders a variety of ways to receive their money, but traders should be aware that some payment providers may charge fees and take longer to process withdrawals than others.

TopFX Vs Other Brokers

#1. TopFX vs AvaTrade

Both TopFX and AvaTrade have significant histories, yet they offer various services for traders with varied demands. TopFX has rapid, low-fee trades. It offers MetaTrader 4 and cTrader with 1,000+ instruments. However, traders who like consistent prices enjoy AvaTrade's fixed spreads and MetaTrader 4 and MetaTrader 5 platforms and AvaTradeGO app.

TopFX deals with ECN and Raw accounts cheaply. However, AvaTrade has several teaching tools and features that make it easier for beginners. AvaTrade is regulated in multiple places, but CySEC and FSA keep TopFX safe. Both brokers are nice, but TopFX may be better for professionals who want more advanced features and AvaTrade for beginners.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. TopFX vs RoboForex

TopFX and RoboForex are well-known brokers with buyer incentives. TopFX's straightforward pricing and great liquidity for over 1,000 assets with minimal spreads are its best features. The broker supports MetaTrader 4 and cTrader, making it ideal for expert traders who require advanced tools and fast execution. However, RoboForex offers account types with floating and set spreads for traders of various skill levels.

TopFX offers low-cost ECN trading, while RoboForex offers substantial bonuses and huge leverage, which may attract riskier traders. RoboForex offers MetaTrader 4, MetaTrader 5, and cTrader together with its own software. This gives traders more choices. CySEC and FSA regulate TopFX, whereas IFSC regulates RoboForex. Based on their trading costs and tastes, traders can choose either one as safe.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. TopFX vs Exness

Both TopFX and Exness are popular exchanges, however they target different traders. Low spreads, institutional-grade liquidity, and MetaTrader 4 and cTrader are TopFX's trading platform. With over 1,000 goods, TopFX is ideal for expert traders who seek transparent prices and advanced trading platform However, Exness‘ large leverage and fast withdrawals make it a suitable choice for traders who desire more money control.

TopFX offers low-cost ECN trading with CySEC and FSA regulation. Exness is preferable for novices because it offers infinite leverage and inexpensive deposits. Exness and TopFX are safe trading platform, however Exness is better for fast withdrawals and leverage, while TopFX is better for tighter spreads and strong market performance.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: TopFX Review

To sum up, TopFX sticks out as a complete broker that provides fair spreads, a large selection of trading instruments, and advanced trading platforms such as MetaTrader 4 and cTrader2.

It's good for both new and experienced traders because it focuses on institutional-grade liquidity and fast delivery. CySEC and the FSA regulate the broker, which gives traders peace of mind that the trading setting is safe and clear.

TopFX has all the tools and information you need for a good trading experience, whether you want a wide range of assets to choose from or low trading costs.

Its focus on providing a range of account types and dependable customer service makes it a safe choice for users of all skill levels especially on their preferred trading platform.

TopFX is ultimately a well-rounded broker with competitive spreads, clean and safe TopFX trading platform. It suits both novice and professional traders with its large selection of trading tools and adaptable account choices. For individuals hoping to excel in the financial markets, TopFX is a dependable alternative since of its dedication to offer a flawless trading experience.

TopFX Review: FAQs

Is TopFX a regulated broker?

Yes, both the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA) oversee TopFX. This makes sure that dealing is safe.

What can I trade on TopFX?

Traders on TopFX can access over 1,000 instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

Does TopFX offer demo accounts?

Yes, TopFX offers demo accounts that allow traders to practice and test their strategies in a risk-free environment.

OPEN AN ACCOUNT NOW WITH TOPFX AND GET YOUR BONUS