Position in Rating | Overall Rating | Trading Terminals |

192nd | 4.5 Overall Rating |

Trade360 Review

Choosing a reliable broker is a key foundation for successful trading and long-term financial growth. A solid broker provides clear pricing, stable trading platforms, and secure handling of funds, helping traders interested in market longevity avoid unnecessary risks caused by poor execution or system issues. With many brokers offering similar financial products, what truly sets them apart is their trustworthiness and quality of support. Working with a dependable broker allows traders interested in scaling their portfolios to focus on strategy and risk management, without worrying about hidden charges, platform problems, or execution delays.

Trade360 is an online CFD broker offering trading on forex, commodities, stocks, indices, and other CFDs. It distinguishes itself with its proprietary CrowdTrading technology, which provides real-time market sentiment based on the collective activity of thousands of users. This feature is designed to give users insights into market behavior, serving as a vital tool for successful trading by helping individuals recognize trends and potential reversals more quickly. The platform supports ParagonEX and MetaTrader 5 (MT5), offering flexibility for various trading styles, whether you are a manual trader or prefer automated systems. While Trade360 operates under CySEC regulations in Cyprus—providing essential investor protections like fund segregation—it previously held an ASIC license in Australia, which was surrendered in 2022.

This review provides an in-depth look at Trade360, focusing on what traders interested in sentiment-based strategies need to know before using the platform. It covers key features such as the CrowdFeed sentiment tool, available trading platforms like ParagonEX and MetaTrader 5, and the range of CFD markets offered. By combining expert assessment with general user impressions, the review aims to help beginners and experienced individuals make informed decisions regarding Trade360’s sentiment-driven tools. Ultimately, successful trading depends on how a broker's market maker structure and costs, such as wider spreads on entry-level accounts, fit your specific trading style, goals, and risk tolerance.

What is Trade360?

Founded in 2013 and operated by Crowd Tech Ltd, Trade360 has established itself as a reputable forex broker and CySEC-regulated provider specializing in online CFD and forex trading. By operating under the strict oversight of the Cyprus Securities and Exchange Commission and the European Markets in Financial Instruments Directive (MiFID), Trade360 provides a high level of investor protection and transparency for EU-based clients. The platform offers a comprehensive portfolio of tradable assets, including major and exotic currency pairs, individual stocks, indices, commodities, and ETFs, allowing users to diversify their investment strategies through versatile Contracts for Difference (CFDs).

The broker’s primary competitive advantage is its proprietary CrowdTrading technology, a unique feature designed to provide real-time market sentiment insights. Unlike traditional platforms, Trade360 enables users to observe the collective behavior and positioning of other traders, offering a transparent look at whether the market is leaning toward a buy or sell sentiment. This “wisdom of the crowd” serves as a powerful decision-making tool, helping traders gauge market momentum and sentiment shifts before executing their own positions. This data-driven approach to social trading makes the platform particularly attractive to those who incorporate behavioral analysis into their market strategy.

In terms of technical infrastructure, Trade360 ensures flexibility by offering both its intuitive, web-based proprietary interface and the industry-standard MetaTrader 5 (MT5) platform. This combination allows for a seamless transition between the broker’s unique sentiment tools and a systematic approach to trading, utilizing the advanced technical analysis or automated trading features found in MT5. While the user-centric design and CrowdFeed are significant draws, prospective users should evaluate the broker’s cost structure, as basic accounts may feature wider spreads and higher minimum deposit requirements than some low-cost competitors. Ultimately, Trade360 remains a specialized choice for traders who prioritize high-quality sentiment data and a secure, regulated environment for their long-term trading goals.

Benefits of Trading with Trade360

Trading with Trade360 gives users access to a range of popular markets through a single CFD platform, including forex pairs, stocks, indices, and commodities. One of its standout features is CrowdTrading technology, which shows real‑time market sentiment and collective trader behavior — a tool aimed at helping traders gauge market interest before placing a trade. This sentiment overlay can be especially useful for those who like to see how other traders are positioned, adding an additional layer of insight alongside traditional chart analysis.

Another benefit is the flexibility in trading platforms: Trade360 supports both its proprietary ParagonEX platform and MetaTrader 5 (MT5), giving traders a choice between a modern web interface and one of the most widely used professional terminals. Mobile applications are also available — Trade360 offers a dedicated trading app for both Android and iOS devices that can be downloaded to trade on the go and includes features such as real‑time price feeds and access to its CrowdTrading sentiment tools. Regulation by authorities such as CySEC and previously ASIC offers a level of oversight and fund protection not always found with unregulated brokers. While traders should be mindful of pricing conditions like spreads, Trade360’s combination of sentiment tools, platform options, mobile access, and regulated status can make it attractive for those looking for an intuitive, multi‑market CFD trading experience.

Trade360 Regulation and Safety

Trade360 operates as a regulated CFD broker under the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with European Union financial rules. The broker is also authorized and regulated by the Financial Services Authority Seychelles (FSA) and holds a license from the Financial Services Commission Mauritius (FSC), allowing it to operate under the regulations of these jurisdictions. This multi-regulatory framework offers a level of oversight and protection not always found with unregulated brokers. In addition, Trade360 does not offer its services to residents of certain jurisdictions, including but not limited to the USA, Belgium, Iran, Canada, and North Korea.

Trade360 previously held an ASIC license in Australia, which was surrendered in 2022 due to regulatory concerns. This underscores the importance of ongoing due diligence when assessing a broker’s regulatory standing.

In terms of client safety, Trade360 employs advanced technologies and compliance structures to protect personal data and trading activity. The platform’s CrowdTrading sentiment tools are also offered within this regulated environment, giving users confidence in the operational standards.

Trade360 Pros and Cons

Pros

- Innovative CrowdTrading sentiment feature shows real‑time trader behavior

- Supports both proprietary platform and MetaTrader 5 (MT5)

- Regulated in multiple jurisdictions

- User-friendly interface for beginner and intermediate traders

Cons

- Typically wider spreads on entry‑level accounts

- Acts as a market maker, which can create conflicts of interest

- Low asset selection outside of equity CFDs and no cryptocurrencies

Trade360 Customer Reviews

Customer feedback on Trade360 is mixed and often leans toward the negative side on public review platforms, with a very low overall rating and many users reporting aggressive marketing and poor experiences with service follow‑up or account issues. Some reviewers specifically mention being contacted repeatedly and difficulty getting refunds or satisfactory support, while complaints about losing significant funds and questionable sales practices also appear in user comments. Overall, while the broker has some positive aspects and unique features, actual trader reviews often criticize the customer experience and raise caution about how the platform is marketed and operated.

Trade360 Spreads, Fees, and Commissions

Trade360 operates on a commission‑free basis, meaning it typically does not charge separate per‑trade commissions and instead embeds costs directly into the spreads you pay when opening a position. The broker’s spreads are generally considered higher than many larger CFD brokers, with typical EUR/USD spreads often around 3.0 pips or more, and other major forex pairs similarly wider, though exact values depend on the account type and market conditions.

Other trading costs include swap/rollover fees for positions held overnight, which vary by instrument and direction, and inactivity or maintenance fees in some regions (e.g., periodic account maintenance fees). Trade360 also may charge administration fees on hedged positions in certain cases. Deposit and withdrawal charges are usually not charged by the broker, but any fees from banks or payment processors are the trader’s responsibility. Overall, Trade360’s cost structure is transparent but tends to be less competitive than brokers with tighter spreads or commission‑based pricing.

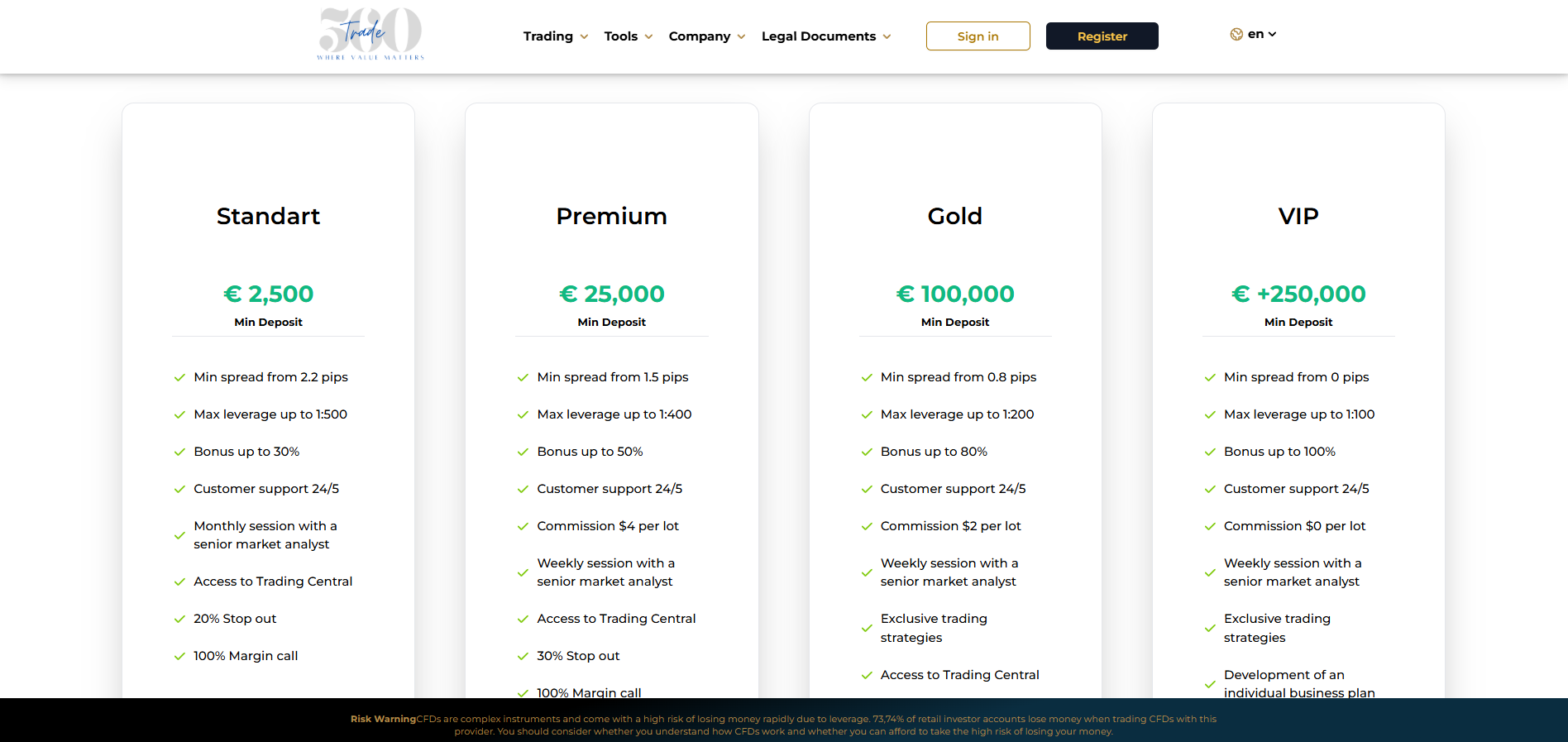

Account Types

Standard Account

- Low minimum deposit requirement (entry-level tier)

- Access to live CrowdTrading feed and trading signals

- Access to stocks, ETFs, forex, CFDs, options, and futures

- Bonus up to 30%

- Suitable for traders who want basic trading conditions with a reliable entry point

Platinum Account

- Mid‑level account tier with enhanced data and tools

- Offers access to more market conditions and additional support benefits

- Often provides tighter pricing and better spreads than the Standard tier

Gold Account

- Higher‑tier account with expanded market access and features

- Includes advanced alerts and trading insights

- Designed for more active or experienced traders who need deeper tools and service

VIP Account

- Top‑level account designed for high‑volume or professional traders

- Access to the best trading conditions, priority support, and advanced features

- Suited for users who trade large volumes or require personalized service

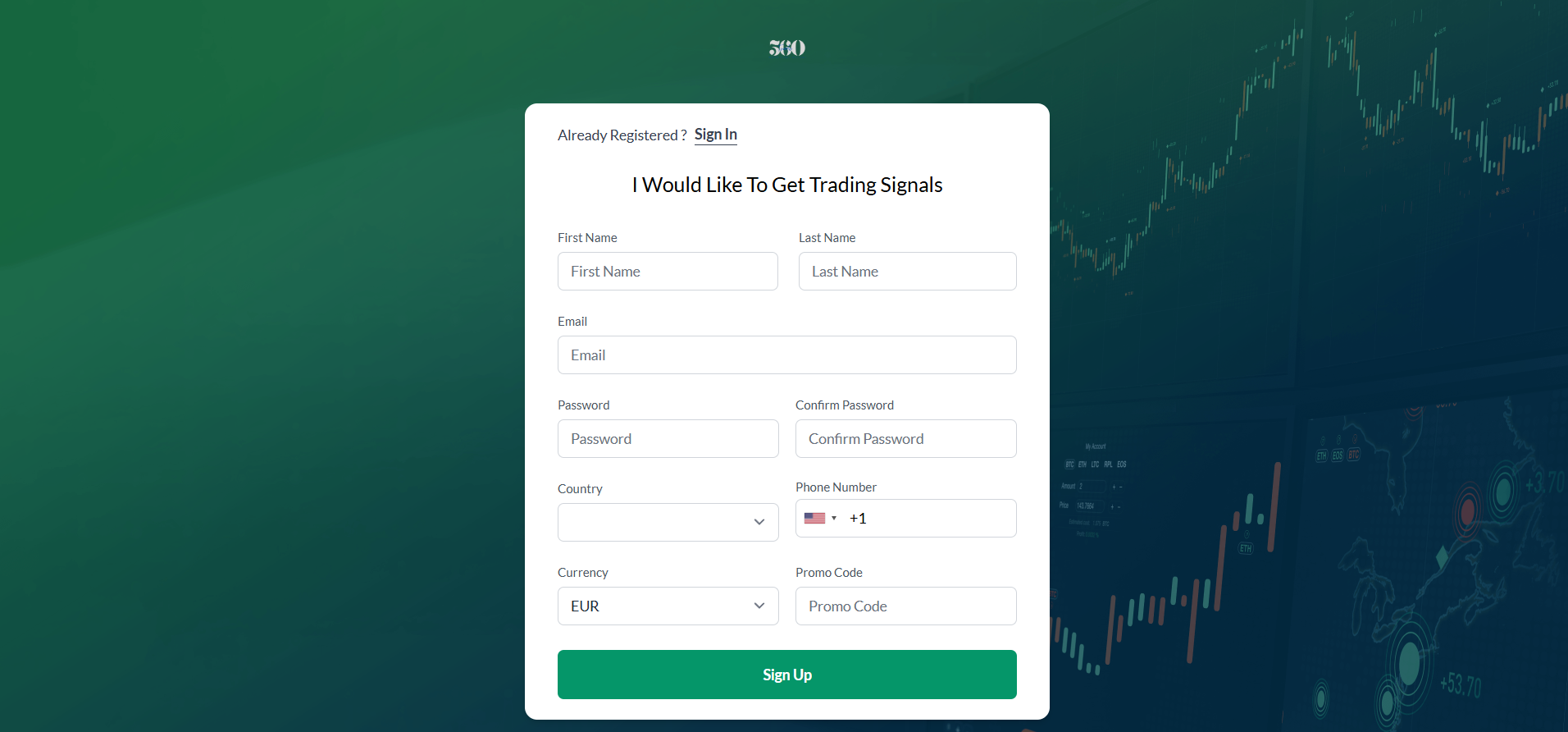

How to Open Your Account

- Go to the Trade360 registration page at https://client.trade360.cc/auth/register/.

- Enter your full name in the registration form.

- Provide your email address and create a secure password.

- Select your country of residence from the dropdown.

- Choose your preferred currency for the trading account.

- Agree to the Terms & Conditions and Privacy Policy, then submit the form.

- Verify your email (check your inbox for a confirmation link), then complete KYC verification by uploading your ID and proof of address to activate your account before funding.

Trade360 Trading Platforms

Trade360 provides traders with access to financial markets through two main platforms. Its proprietary ParagonEX platform features CrowdTrading sentiment tools, allowing users to see real-time market trends and collective trader activity alongside price charts. The platform is designed to be intuitive for both beginners and intermediate traders, offering integrated market data, order execution, and account management without the need for external software.

In addition to ParagonEX, Trade360 supports MetaTrader 5 (MT5), a widely used professional trading terminal that offers advanced charting, automated trading through Expert Advisors, customizable indicators, and flexible order types. This combination allows traders to choose between a social sentiment-driven interface on ParagonEX or the professional analytical tools of MT5, catering to a wide range of trading styles and experience levels.

What Can You Trade on Trade360

On Trade360, you can trade a wide variety of CFDs (Contracts for Difference) across multiple financial markets. This includes forex currency pairs, allowing you to speculate on the price movements of major and minor currencies. You can also trade stock CFDs from global companies, index CFDs representing major market benchmarks, and commodity CFDs such as gold, oil, and other raw materials. Additionally, the platform offers ETF CFDs, providing exposure to a range of exchange-traded funds.

However, it's important to note that cryptocurrencies are not available for trading on Trade360. Through these CFD products, traders can take both long and short positions without owning the underlying assets, offering flexibility in various market conditions. The platform is designed to accommodate a wide range of trading strategies, from forex speculation to exposure to equities and commodities, all within a single trading environment.

Trade360 Customer Support

Trade360 offers multiple ways to contact its customer support team, ensuring that communication channels remain open for traders needing assistance with account setup, platform navigation, funding, and general trading issues. Support can typically be reached through email and online contact forms submitted via the Trade360 website or client portal, reflecting the broker’s commitment to accessible client relations. Furthermore, the broker provides an extensive Help Center and FAQ section, which serves as a vital self-service resource for users seeking immediate answers to common questions regarding platform mechanics and regulatory compliance.

Building a solid reputation in the competitive brokerage industry often depends on the efficiency of these support systems. While Trade360 promotes accessible assistance, response times and the quality of communication may vary, particularly during periods of high market volatility or for complex technical inquiries. Some users report mixed experiences regarding responsiveness, suggesting that a broker's reputation for service is often viewed through the lens of individual user needs. Consequently, traders should be prepared to utilize a combination of direct support and the available self-service tools to resolve issues efficiently. Overall, Trade360’s customer support structure aims to uphold its reputation by helping clients manage their accounts effectively, though the speed and depth of assistance may differ across various account tiers.

Advantages and Disadvantages of Trade360 Customer Support

Withdrawal Options and Fees

Trade360 allows traders to withdraw funds using the same methods available for deposits, such as bank wire transfers, credit/debit cards, and e‑wallets, depending on what is supported in your region. The broker itself usually does not charge a direct withdrawal fee, although credit card and wallet providers may apply their own fees, and your bank or payment processor might also take a charge — these external costs are not covered by Trade360.

In practice, withdrawals made through Trade360’s online portal are processed as part of the broker’s funding system, and the timing can vary by method and geography. Since payment processors and banks may have their own processing times and fees, traders should check with their provider to understand any additional costs or expected transfer timing before requesting a withdrawal.

Trad360 Vs Other Brokers

#1. Trade360 vs AvaTrade

Trade360 and AvaTrade are both online brokers that let you trade CFDs, forex, and global markets, but they differ in scale, regulation, and product depth. Trade360 is known for its CrowdTrading sentiment feature and offers forex, stock, index, and crypto CFDs mainly through its own ParagonEX platform and MetaTrader 5, with a market maker structure and relatively simpler product scope. In contrast, AvaTrade is a larger, more established broker regulated in multiple major jurisdictions worldwide (including Central Bank of Ireland, ASIC, FSCA, and more), and provides a wider range of tradable instruments such as forex, stocks, commodities, indices, crypto, ETFs, and options across platforms like MetaTrader 4, MetaTrader 5, AvaTradeGO, and AvaOptions.

Verdict: Trade360 may appeal to traders who prefer a sentiment‑driven CFD experience with basic platform options, while AvaTrade typically suits traders seeking broader market access, stronger global regulation, and a wider selection of trading tools and platforms. Which broker is right for you depends on your priorities — whether that’s specialised sentiment features or comprehensive asset coverage and regulatory oversight.

#2. Trade360 vs RoboForex

Trade360 and RoboForex are both online brokers, but they cater to slightly different trader needs. Trade360 is a CFD-focused platform known for its CrowdTrading sentiment tool, offering trading on forex, stocks, indices, and commodities through its proprietary ParagonEX platform and MetaTrader 5, with wider spreads on entry-level accounts and a market maker structure. RoboForex, in contrast, provides a broader range of instruments including forex, CFDs, cryptocurrencies, metals, and energies, along with multiple platforms like MT4, MT5, R WebTrader, and R StocksTrader, and generally more competitive spreads and flexible account types.

Verdict: While Trade360 appeals to traders who want sentiment-driven insights and a simpler CFD experience, RoboForex suits those looking for cost-efficient trading, multiple platforms, and wider market access, making the choice largely dependent on individual trading style and priorities.

#3. Trade360 vs Exness

Trade360 is positioned as a premium service with a high $250 minimum deposit and some of the industry's widest spreads, starting at 4.0 pips for its entry-level “Mini” account. In contrast, Exness is built for extreme accessibility and high-frequency trading, offering a $10 minimum deposit and significantly tighter spreads that start from 0.3 pips on standard accounts and drop to 0.0 pips on professional accounts.

Verdict: Trade360’s sentiment tool may appeal to traders who value crowd insights, Exness tends to attract users who prioritize low trading costs, tight spreads, and simple access to multiple markets, so the choice largely depends on whether you value sentiment‑driven trading or competitive pricing and execution.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Trade360 Review

Trade360 is an online CFD and Forex broker best known for its CrowdTrading sentiment technology. This proprietary tool analyzes collective trader behavior in real-time, helping users identify potential market trends and reversals. The broker offers a flexible platform experience, supporting both its own web-based interface and the industry-standard MetaTrader 5 (MT5).

While Trade360 remains regulated by CySEC in Cyprus, its regulatory history is a significant point of consideration for prospective clients. In 2022, its Australian subsidiary (Sirius Financial Markets) surrendered its ASIC license following a major investigation. ASIC found the firm had used an offshore call center that employed pressure-selling tactics and provided unlicensed personal advice, leading to substantial client losses. Consequently, several former executives were banned from the industry for eight years.

Beyond regulatory concerns, traders should evaluate the broker's cost structure. As a market maker, Trade360’s spreads can be high—often reaching 4.0 pips on EUR/USD for basic account types. This is considerably higher than the 1.0–1.5 pip industry average. While the CrowdTrading insights offer a unique “social” edge, the combination of high trading costs and past regulatory disciplinary actions in Australia may be a deterrent.

Overall, Trade360 may appeal to those specifically seeking sentiment-driven data, but it requires a high degree of due diligence regarding costs and its shift in regulatory standing.

Also Read: MarketsVox Review 2024 – Expert Trader Insights

Trade360 Review: FAQs

Does Trade360 offer a demo account?

Yes. Trade360 provides a demo account that lets prospective traders test the platform and markets using virtual funds before trading with real money. Demo accounts allow you to familiarise yourself with features such as CrowdTrading and trading instruments without financial risk.

Is Trade360 a regulated broker?

Trade360 is regulated by the Cyprus Securities and Exchange Commission (CySEC) through its European entity, giving it a level of oversight and compliance with EU financial rules. Depending on your region, it may also operate under other regulated entities, though specific regulations and protections can vary by location.

What is Trade360 “CrowdTrading” and how does it work?

CrowdTrading is Trade360’s flagship sentiment tool. Unlike traditional technical indicators that analyze price, this tool analyzes the real-time behavior of other traders on the platform. It displays a percentage bar showing what proportion of the “crowd” is currently buying versus selling a specific asset.

OPEN AN ACCOUNT NOW WITH TRADE360 AND GET YOUR BONUS