UK Jobless Rate Falls, Yet Economic Worries Persist

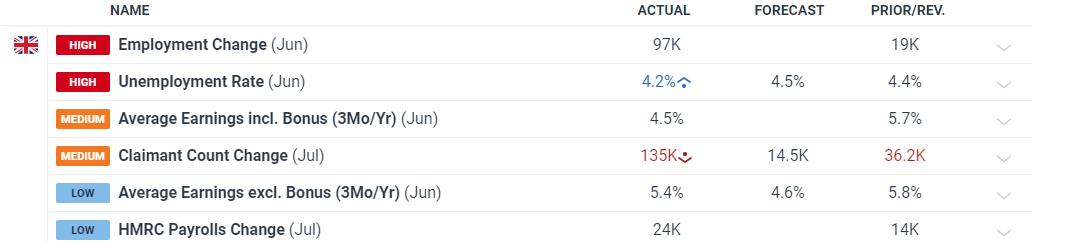

At first glance, the UK employment data signals unexpected resilience, with the unemployment rate falling from 4.4% to 4.2%, contrary to forecasts of an increase to 4.5%. Despite tight monetary policies dampening hiring intentions across the country, leading to a gradual rise in unemployment, this latest data offers a surprising deviation from the trend.

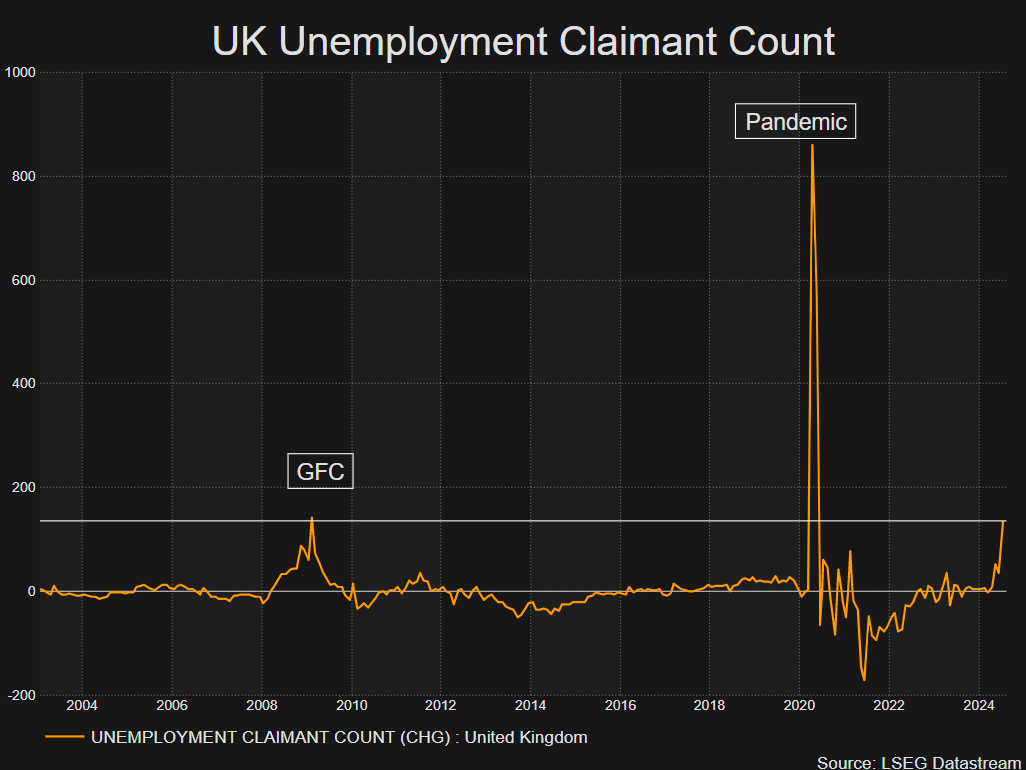

However, not all the news is positive. Average earnings continue to decline, although the decrease in ex-bonus data was slower than expected, coming in at 5.4% compared to the anticipated 4.6%. The most concerning figure, though, is the claimant count for July, which has surged dramatically. After a notable rise in May, where the number of people registering for unemployment benefits spiked to 51,900 from a previous norm of under 10,000, July's count has soared to an alarming 135,000.

The steep increase in unemployment benefit claims to levels not seen since the global financial crisis (GFC) has raised red flags. This development suggests that the recent strength in sterling could be fleeting. Nonetheless, there is still a chance that the pound might continue its ascent ahead of tomorrow's CPI data, which is expected to rise to 2.3%.

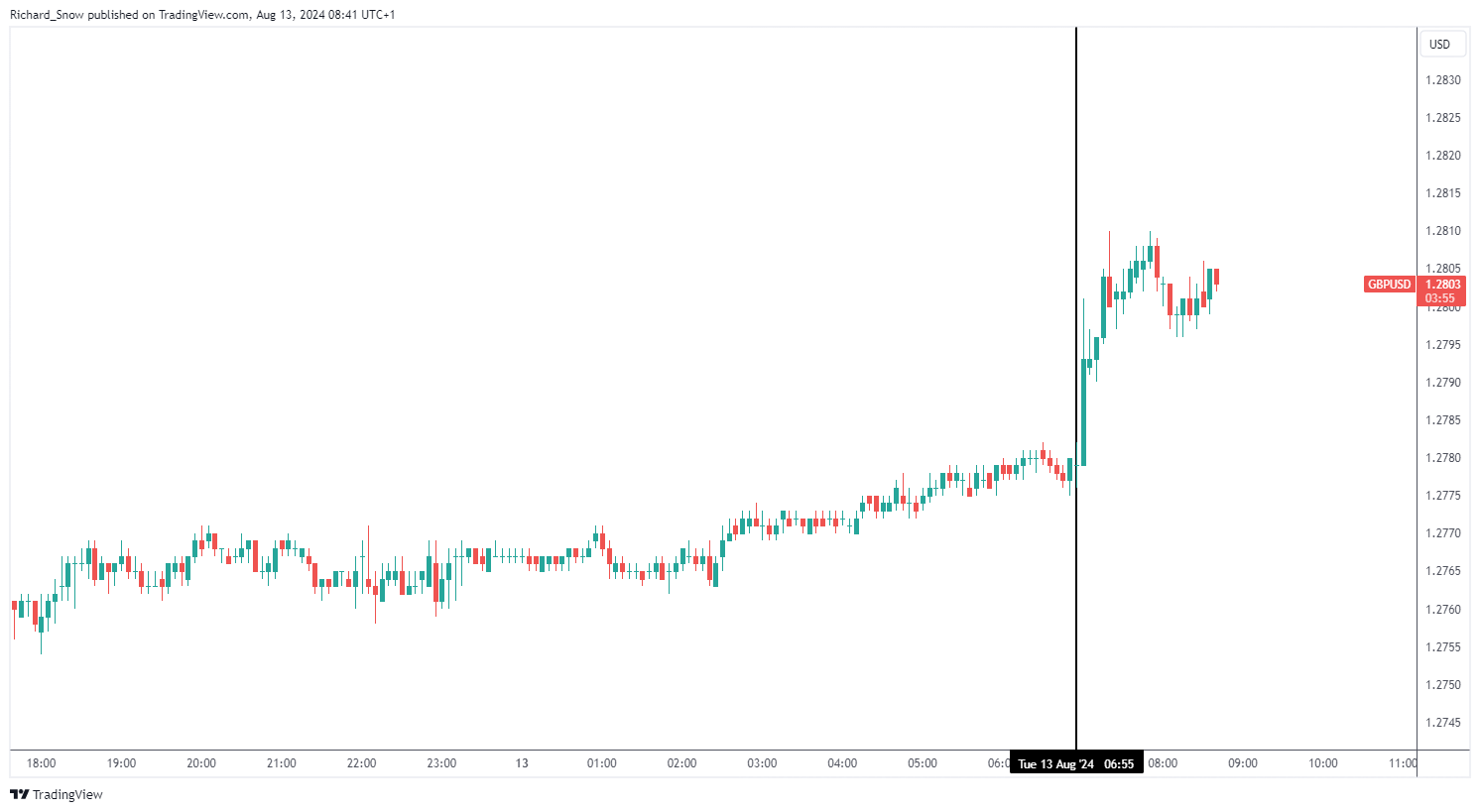

Pound Strengthens Amid Surprising Job Data

The pound received a boost following the unexpected drop in unemployment. A tighter job market than expected could rekindle inflation concerns as the Bank of England (BoE) anticipates that inflation may rise again after hitting the 2% target in May.

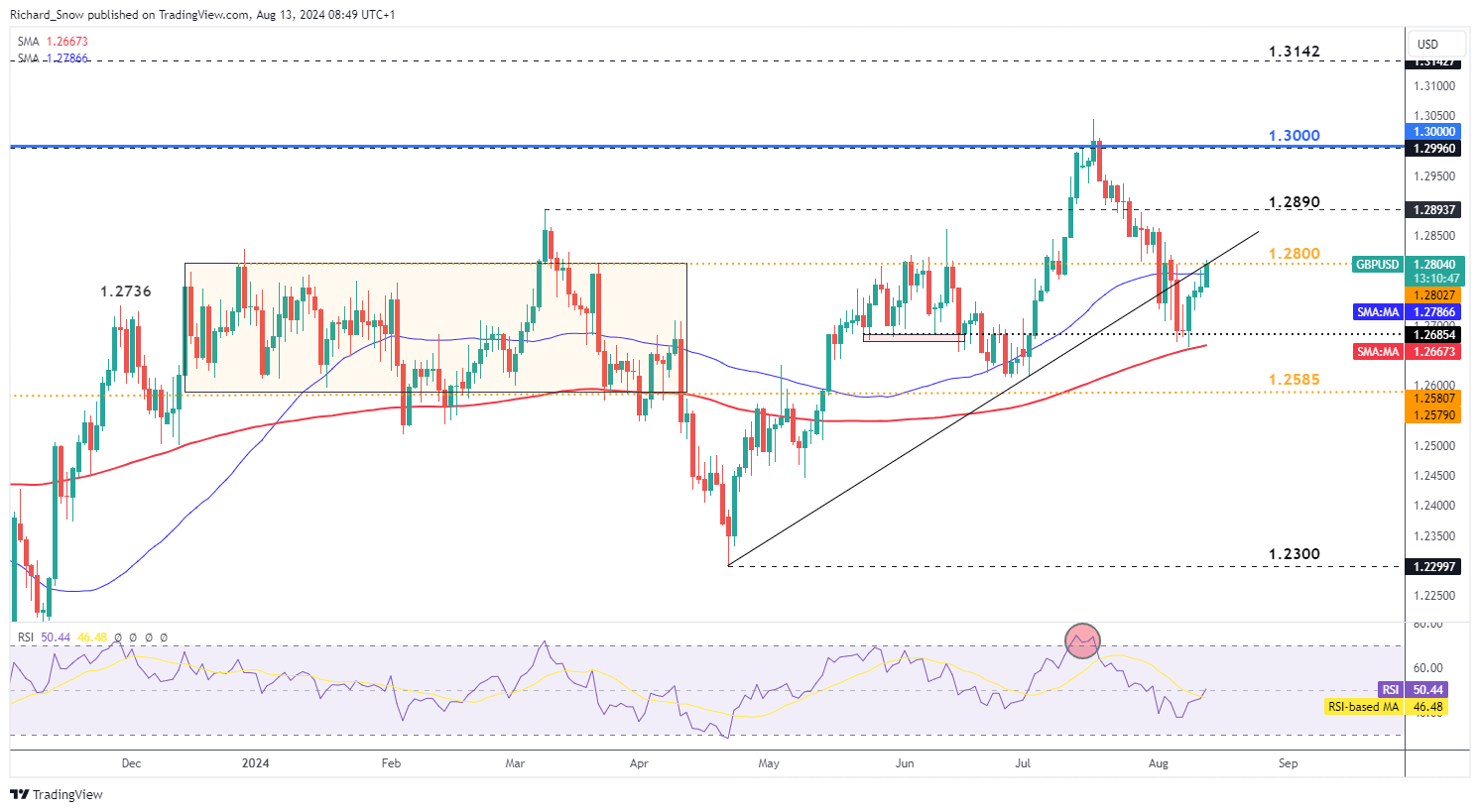

The GBP/USD pair saw a notable move following the jobs report, testing the critical 1.2800 level, a significant point of resistance that has held back bullish momentum earlier this year. Furthermore, the pair also tested the long-term trendline support, which has now turned into resistance.

Tomorrow’s CPI data could drive a further bullish advance if inflation meets or exceeds the forecasted 2.3%, with any upside surprise likely to add more fuel to the ongoing bullish pullback.