Position in Rating | Overall Rating | Trading Terminals |

194th  | 2.7 Overall Rating |  |

Uniglobe Markets Review

Choosing the right Forex broker is crucial for anyone looking to succeed in the foreign exchange market. A reliable broker not only provides a secure trading environment but also offers the necessary tools and resources to enhance your trading experience. The right broker can significantly impact your trading efficiency and profitability by ensuring quick execution, low spreads, and robust customer support.

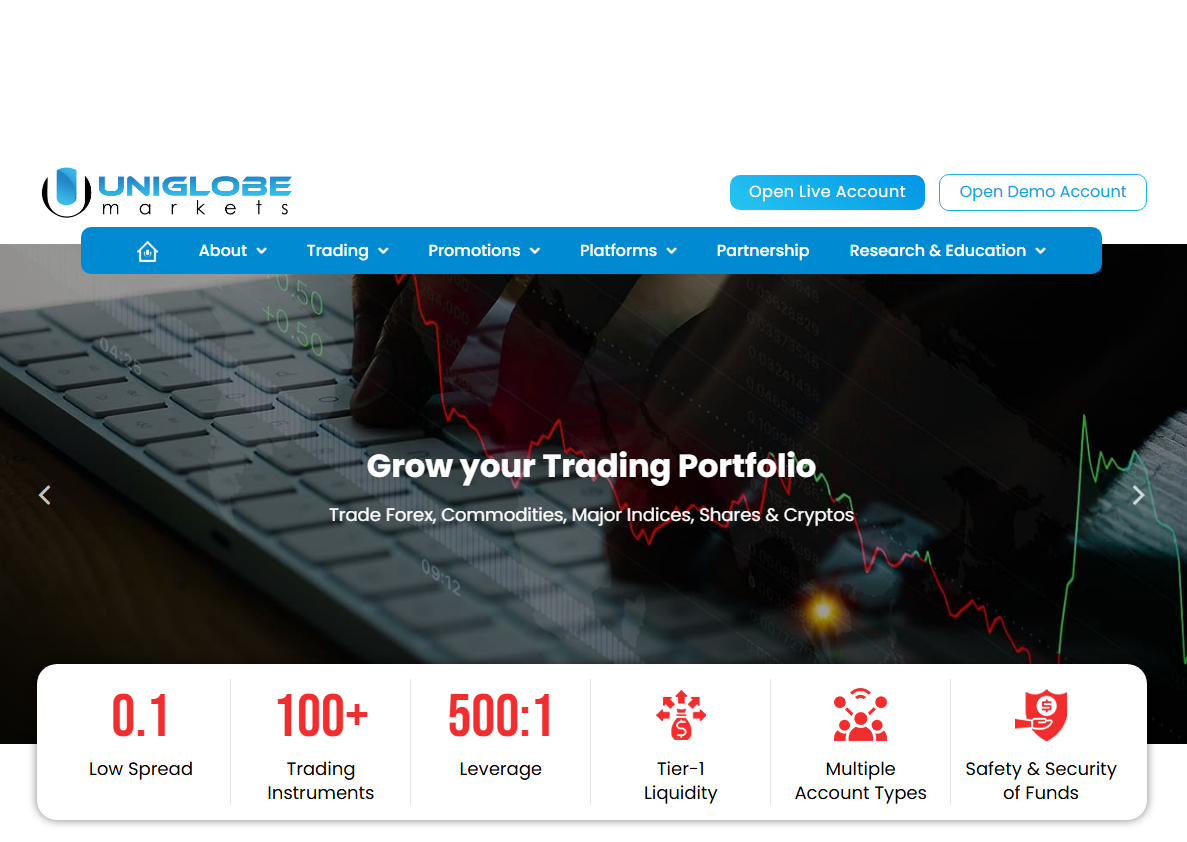

Uniglobe Markets stands out among Forex brokers due to its comprehensive range of services and commitment to providing a transparent trading environment. They offer a variety of account types, catering to both beginners and experienced traders. With their advanced MT4 and MT5 trading platforms, traders can access numerous financial instruments, including Forex, commodities, indices, and cryptocurrencies.

In this detailed review, I aim to provide an exhaustive evaluation of Uniglobe Markets, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Uniglobe Markets as your preferred brokerage service provider.

What is Uniglobe Markets?

Uniglobe Markets is a Forex broker that provides a wide range of trading services and tools. They offer various account types to cater to both beginners and professional traders, allowing flexibility and tailored trading experiences. The broker is known for its cutting-edge trading platforms like MT4 and MT5, which support trading in Forex, commodities, indices, and cryptocurrencies.

What sets Uniglobe Markets apart is their commitment to transparency and low trading costs. They provide competitive spreads starting from 0.0 pips and offer leverage up to 1:500, which can significantly enhance trading potential. Additionally, they have a strong focus on customer support, ensuring that traders have access to 24/7 dedicated assistance.

Benefits of Trading with Uniglobe Markets

Trading with Uniglobe Markets offers several significant benefits based on my experience with the broker. One of the key advantages is the variety of account types, which cater to both beginners and experienced traders. This flexibility allows for a tailored trading experience, accommodating different levels of expertise and investment strategies.

Another benefit is the availability of advanced trading platforms, such as MT4 and MT5. These platforms are well-regarded in the industry for their robust features, including automated trading capabilities and comprehensive charting tools. This ensures that traders have the necessary tools to execute their strategies effectively.

Uniglobe Markets also provides 24/7 customer support, which is crucial for addressing any issues that may arise during trading. The availability of multiple support channels, including phone, email, and live chat, enhances the overall user experience by ensuring timely assistance. This level of support is particularly beneficial for resolving urgent matters quickly and efficiently.

Uniglobe Markets Regulation and Safety

Uniglobe Markets is committed to providing a secure trading environment for its clients. The broker is regulated by reputable financial authorities, which ensures that they adhere to strict standards of transparency and safety. This regulation is crucial as it provides traders with an additional layer of protection and trust, knowing that their funds are handled with the utmost care.

From my trading experience, I found that Uniglobe Markets implements robust security measures to protect clients' data and funds. They use advanced encryption technologies and maintain segregated accounts to ensure that client funds are kept separate from the company's operational funds. This practice is essential for safeguarding traders' investments and enhancing trust in the broker.

Uniglobe Markets Pros and Cons

Pros

- Low minimum deposit

- Access to MT4 platform

- High leverage available

- ECN execution for trades

- No inactivity fees

- Variety of trading instruments

Cons

- Not regulated

- Limited reputation and trust issues

- No guaranteed stop loss

- No negative balance protection

Uniglobe Markets Customer Reviews

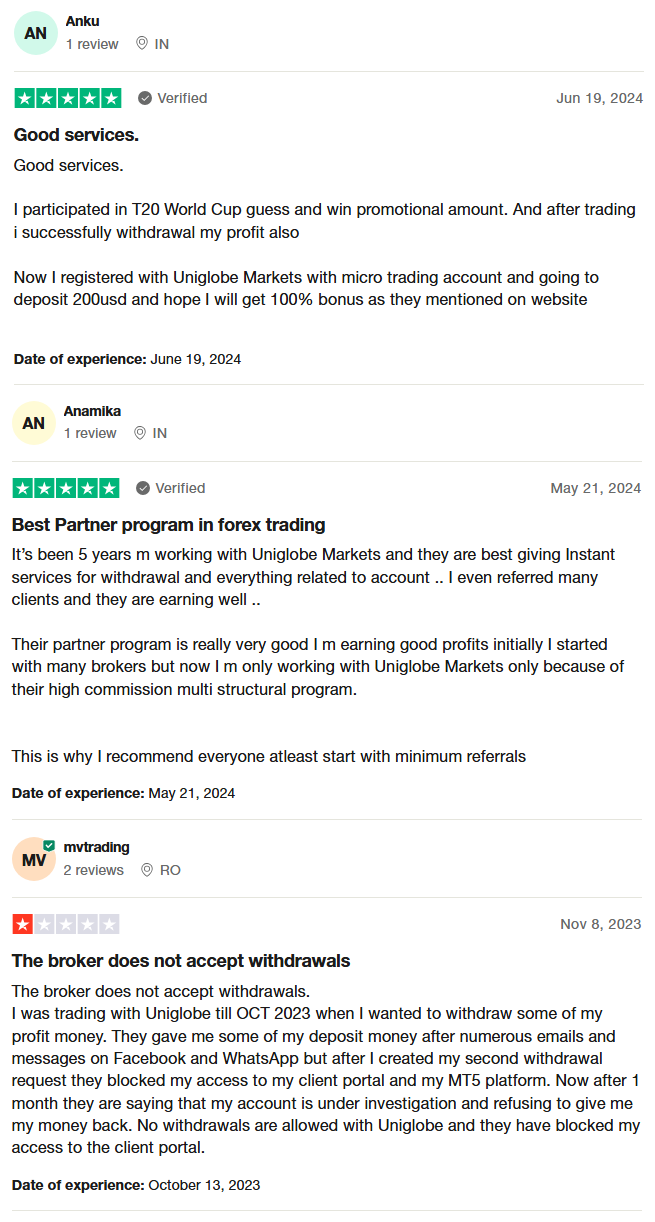

Customer reviews of Uniglobe Markets present a mixed picture. Some users praise the broker for their good services and promotional offers, noting successful withdrawals and satisfactory experiences with account management. Others highlight the instant services for withdrawals and profitable partner programs, which have led them to refer many clients and continue working with Uniglobe Markets due to the high commission structure.

However, there are serious concerns from other customers who report significant issues with withdrawals, citing instances where their access to the client portal and trading platforms was blocked after attempting to withdraw funds. These mixed reviews underscore the importance of carefully evaluating the broker's policies and user experiences before committing funds.

Uniglobe Markets Spreads, Fees, and Commissions

Weltrade offers a variety of account types, each with specific spreads, fees, and commission structures. Spreads start from 0.0 pips on the Digital Account and go up to 2.9 pips on the ZuluTrade Account. The Pro Account features spreads starting from 0.5 pips, while both the Micro and Premium Accounts start from 1.9 pips. This range provides flexibility depending on your trading style and needs.

One of the attractive features of Weltrade is the commission-free trading on most account types. Only the ZuluTrade Account incurs a commission fee of $1.50 per side, translating to $3.00 per round lot. This can be a significant consideration for active traders who are looking to minimize their overall trading costs. Additionally, Weltrade does not charge any fees for deposits but does apply withdrawal fees ranging from 0.5% to 2%, depending on the payment method used.

Weltrade also charges an inactivity fee of $15 per month for accounts that have been dormant for over three months. This is an important factor to consider if you plan to trade infrequently. Overnight swap fees apply to positions held overnight, varying based on the asset and account type. The broker provides transparent information on these fees, which can be accessed directly from the trading platforms MT4 and MT5.

Account Types

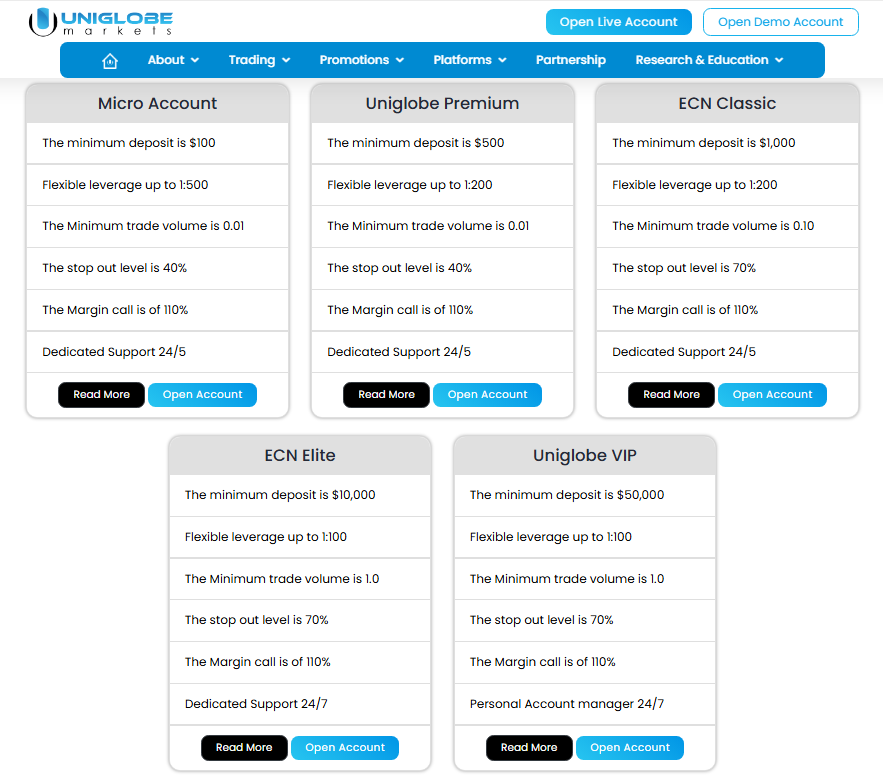

Uniglobe Markets offers a variety of account types tailored to different trading needs. Here’s a summary of each:

Micro Account

- Minimum deposit: $100

- Leverage up to 1:500

- Minimum trade volume: 0.01 lots

Uniglobe Premium

- Minimum deposit: $500

- Leverage up to 1:200

- Minimum trade volume: 0.01 lots

ECN Classic

- Minimum deposit: $1,000

- Leverage up to 1:200

- Minimum trade volume: 0.10 lots

ECN Elite

- Minimum deposit: $10,000

- Leverage up to 1:100

- Minimum trade volume: 1.0 lots

Uniglobe VIP

- Minimum deposit: $50,000

- Leverage up to 1:100

- Minimum trade volume: 1.0 lots

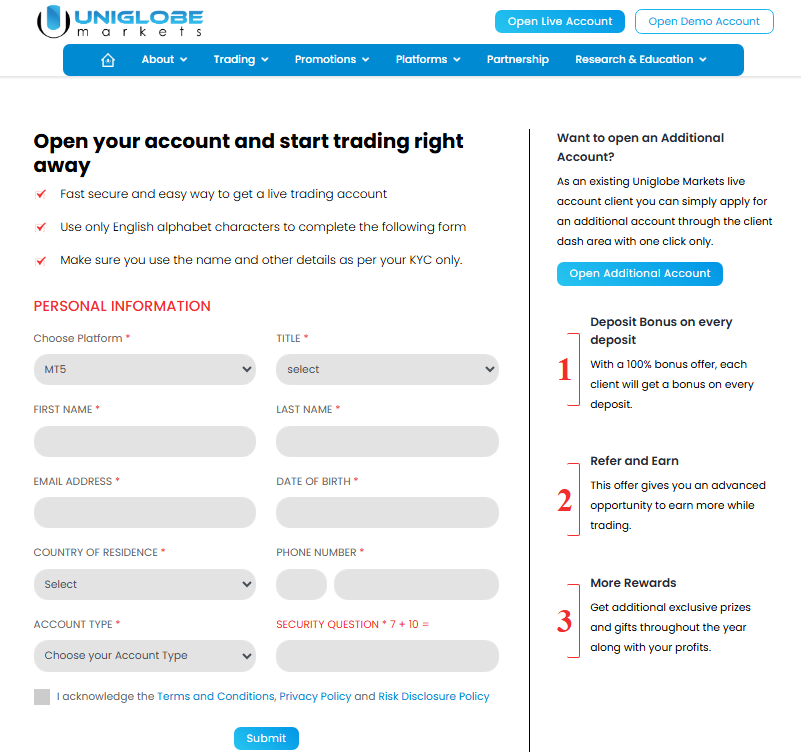

How to Open Your Account

- Visit the Uniglobe Markets website, choose your language from the upper left corner, and click “Open Live Account” on the right.

- Fill in your title, name, email, date of birth, country, and phone number. Choose your account type, pass the anti-bot check, and agree to the terms before clicking “Confirm.”

- Check your email for a verification link and click it to activate your account. You'll also receive login details for the MT5 terminal and user account.

- Return to the website, click “Login” in the upper right, enter your credentials, and log in.

- Click the red verification notification and upload the required documents.

- Wait for the verification process to complete.

- Navigate to the “Funding” tab and select “Deposit” to choose your preferred deposit method.

- Follow the instructions to fund your account, then use your login details to start trading on MT5.

Uniglobe Markets Trading Platforms

From my experience with Uniglobe Markets, I found their trading platforms to be highly efficient and user-friendly. They offer both MT4 and MT5 platforms, which cater to a wide range of trading instruments including forex, shares, commodities, indices, metals, and cryptocurrencies. The MT4 platform is known for its customizable trading environment, allowing various indicators, scripts, and expert advisors for automated trading. The MT5 platform enhances this with additional features like more order types and an integrated economic calendar, making it suitable for advanced trading strategies.

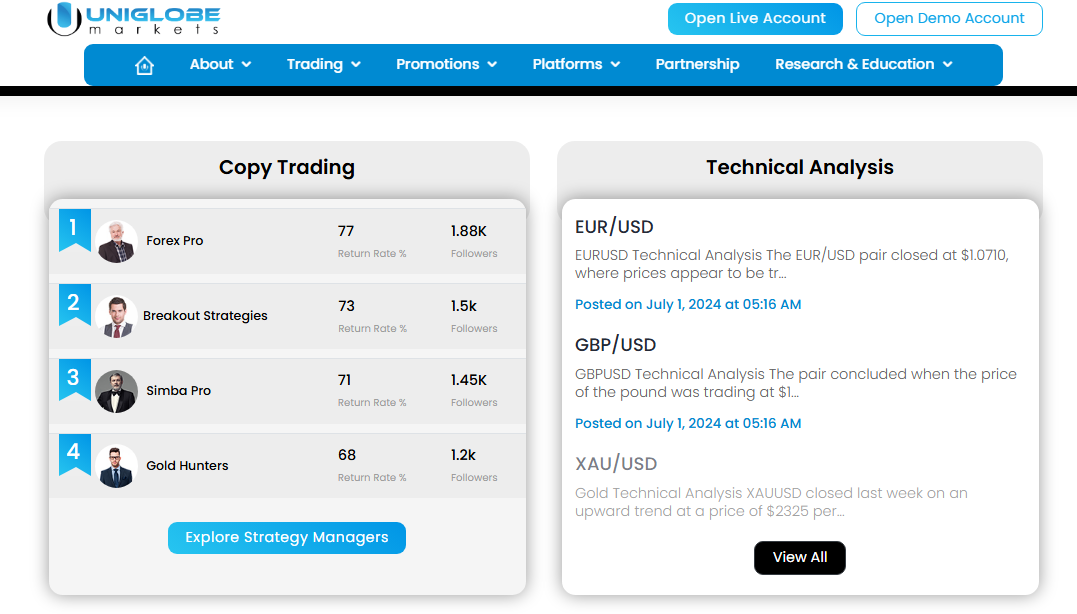

One of the standout features of Uniglobe Markets is their support for both desktop and mobile versions of these platforms, providing flexibility and convenience for traders on the go. I appreciated the fast execution and low spreads available on these platforms, which are crucial for effective trading. Additionally, Uniglobe Markets offers various tools such as copy trading, market news updates, and an economic calendar, which are invaluable for staying informed and making strategic decisions.

What Can You Trade on Uniglobe Markets

Trading with Uniglobe Markets has provided me with access to a diverse range of financial instruments. You can trade over 100 currency pairs in the Forex market, offering opportunities to profit from movements in major, minor, and exotic pairs. The platform's tight spreads and quick execution make it an excellent choice for forex traders seeking to capitalize on market fluctuations.

Uniglobe Markets also allows trading in commodities, which include popular assets like gold, silver, oil, and other energy products. These commodities offer a way to diversify your portfolio and hedge against inflation. The availability of both spot metals and energy commodities ensures that traders can find suitable opportunities regardless of market conditions.

In addition to forex and commodities, Uniglobe Markets provides access to global indices and share CFDs. This enables traders to speculate on the performance of major stock indices such as the S&P 500, NASDAQ, and DAX 30, as well as trade CFDs on shares of leading companies from around the world. This broad range of indices and shares enhances your ability to take advantage of trends in various sectors and markets.

Cryptocurrency trading is another significant feature offered by Uniglobe Markets. You can trade a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others. Cryptocurrencies provide unique opportunities due to their volatility and the growing adoption in financial markets. This makes Uniglobe Markets a versatile platform for those looking to explore digital assets alongside traditional financial instruments.

Uniglobe Markets Customer Support

Uniglobe Markets offers robust customer support tailored to meet the needs of traders. From my experience, they provide multiple channels for assistance, including email support for general, technical, and funding inquiries. Their dedicated team is available 24/7, ensuring that you can get help whenever you need it.

Additionally, Uniglobe Markets offers personalized support via phone and live chat, which is essential for resolving urgent issues quickly. The availability of multiple contact methods, including a direct phone line, enhances the overall trading experience, making it easier to manage your account and address any concerns promptly.

Advantages and Disadvantages of Uniglobe Markets Customer Support

Withdrawal Options and Fees

Uniglobe Markets offers several withdrawal options, making it convenient to access your funds. You can withdraw using bank transfers, credit cards, and various online payment methods like Skrill, Neteller, and cryptocurrencies. This variety ensures that you can choose the method that best suits your needs.

However, it's important to note that withdrawal fees do apply. For instance, withdrawals via credit cards incur a 1.2% fee plus an additional $3 or €2.7, depending on the currency. Cryptocurrency withdrawals also have a 1% fee with a minimum charge. Always check the specific fees associated with your preferred withdrawal method to avoid surprises.

Uniglobe Markets Vs Other Brokers

#1. Uniglobe Markets vs AvaTrade

Uniglobe Markets offers a variety of account types and advanced trading platforms like MT4 and MT5, with a focus on forex, commodities, and cryptocurrencies. AvaTrade, established in 2006, caters to over 300,000 clients globally, offering more than 1,250 financial instruments and a wide range of trading platforms, including proprietary ones. AvaTrade is heavily regulated across multiple jurisdictions and is known for its comprehensive educational resources. While both brokers provide a robust trading experience, AvaTrade’s regulatory oversight and extensive client base give it a distinct edge.

Verdict: AvaTrade is a better choice due to its extensive regulation and broader range of financial instruments, ensuring higher security and more trading opportunities.

#2. Uniglobe Markets vs RoboForex

Uniglobe Markets provides diverse account types and trading on popular platforms like MT4 and MT5, focusing on forex and commodities. RoboForex, established in 2009, offers over 12,000 trading options across eight asset classes and supports multiple platforms, including MetaTrader, cTrader, and RTrader. RoboForex is known for its competitive trading conditions, innovative technologies, and regular trading contests. While both brokers offer extensive trading opportunities, RoboForex's broader asset selection and advanced technological solutions make it a strong contender.

Verdict: RoboForex is preferable for its wider range of trading options and advanced platform choices, catering to various trading styles and needs.

#3. Uniglobe Markets vs Exness

Uniglobe Markets excels with its comprehensive account types and trading platforms like MT4 and MT5, focusing on forex, commodities, and cryptocurrencies. Exness, operating since 2008, provides CFDs for stocks, energy, metals, and over 120 currency pairs, including cryptocurrencies, with features like instant order execution and infinite leverage for small deposits. Exness is also known for its high monthly trading volume and reliable services. While both brokers offer robust trading environments, Exness's diverse asset offerings and superior trading conditions give it a competitive advantage.

Verdict: Exness is a better option due to its extensive range of assets and superior trading conditions, making it ideal for traders seeking comprehensive market access.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH UNIGLOBE MARKETS

Conclusion: Uniglobe Markets Review

Uniglobe Markets provides a broad range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies. Their advanced MT4 and MT5 platforms offer excellent tools for both novice and experienced traders. The broker is known for its competitive spreads, multiple account types, and robust customer support, making it a solid choice for many traders.

However, there are some concerns regarding the broker's regulation and withdrawal processes, which potential users should consider carefully. While Uniglobe Markets offers numerous advantages, ensuring you fully understand their fees and regulatory status is essential for making an informed decision.

Also Read: Weltrade Review 2024 – Expert Trader Insights

Uniglobe Markets Review: FAQs

What types of trading platforms does Uniglobe Markets offer?

Uniglobe Markets offers both MT4 and MT5 platforms, providing advanced trading tools and features suitable for traders of all levels.

Are there any fees for withdrawing funds from Uniglobe Markets?

Yes, Uniglobe Markets charges withdrawal fees depending on the payment method, such as 1.2% plus $3 for credit cards and 1% for cryptocurrency withdrawals.

Is Uniglobe Markets regulated?

Uniglobe Markets is not heavily regulated compared to some other brokers, which can be a concern for potential traders regarding security and transparency.

OPEN AN ACCOUNT NOW WITH UNIGLOBE MARKETS AND GET YOUR BONUS