FOMC Minutes Awaited as Traders Anticipate Rate Cuts

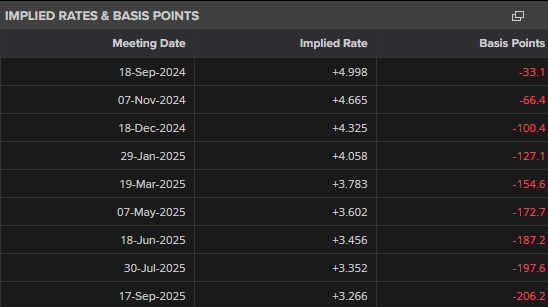

Later today, the FOMC meeting minutes will be released, offering deeper insights into why the Federal Reserve maintained interest rates at 5.25%-5.5%. Since the July meeting, economic data has increasingly signaled a weakening US economy, leading to speculation that the Fed may begin cutting rates in September. Currently, financial markets suggest a 67.5% probability of a 25-basis point cut and a 32.5% probability of a 50-basis point cut.

With the market already pricing in today’s FOMC minutes, traders are now focused on Chair Powell's upcoming speech at the Jackson Hole Symposium on Friday. Powell is expected to address the economic conditions that could justify rate cuts starting in September. The markets are eager to see if Powell aligns with the current expectations of 100 basis points of cuts this year or if he will temper these expectations. Given that only three FOMC meetings remain this year, achieving 100 basis points of cuts would necessitate a 50bp reduction at one of these meetings.

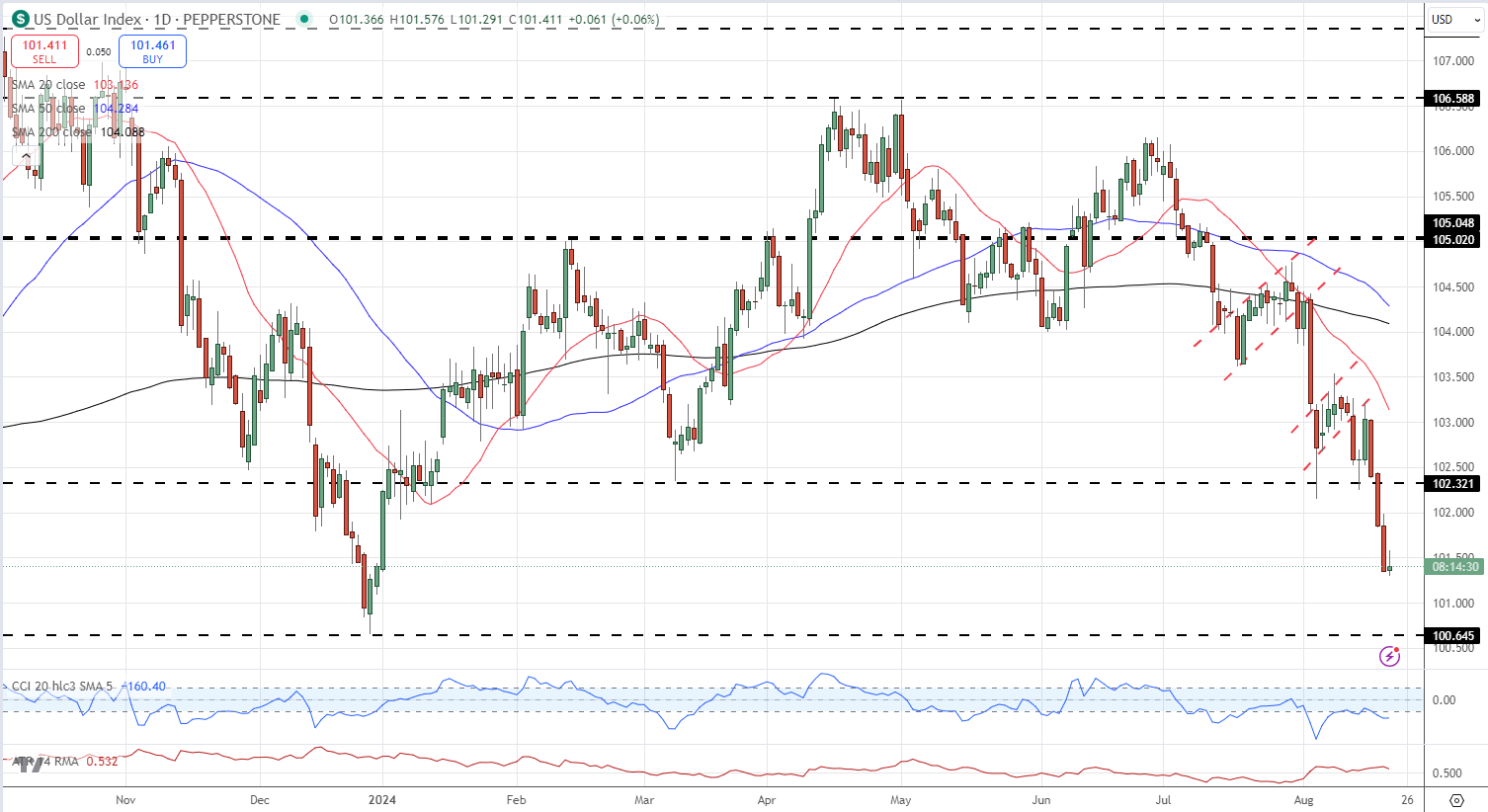

US Dollar Index Plummets as Market Prices in a Dovish Fed

The US dollar index (DXY) has experienced a significant decline over the past two months as traders factor in a more dovish stance from the Fed. The technical outlook for DXY remains bearish, with two downward flag formations on the daily chart indicating continued pressure on the dollar.

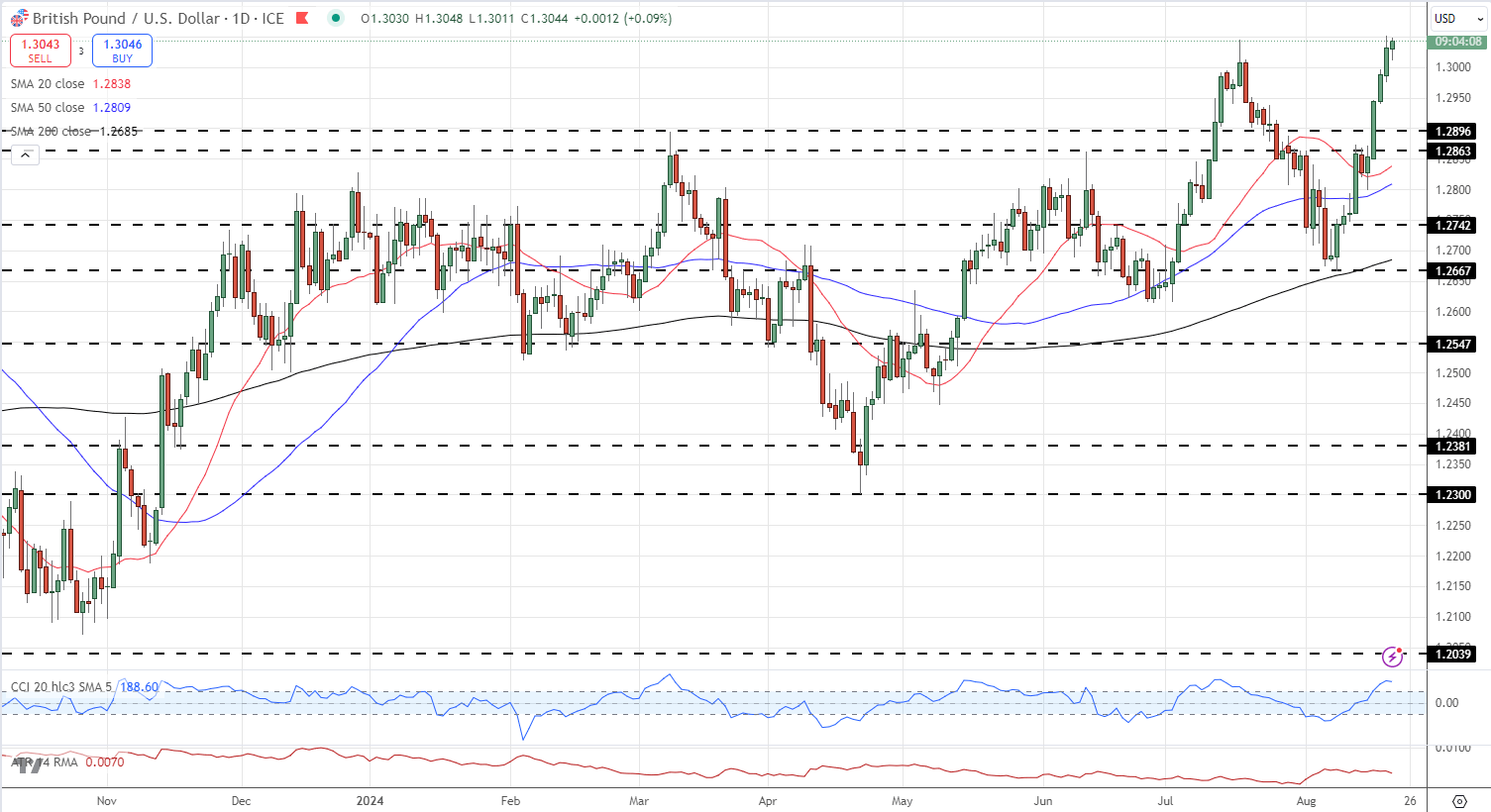

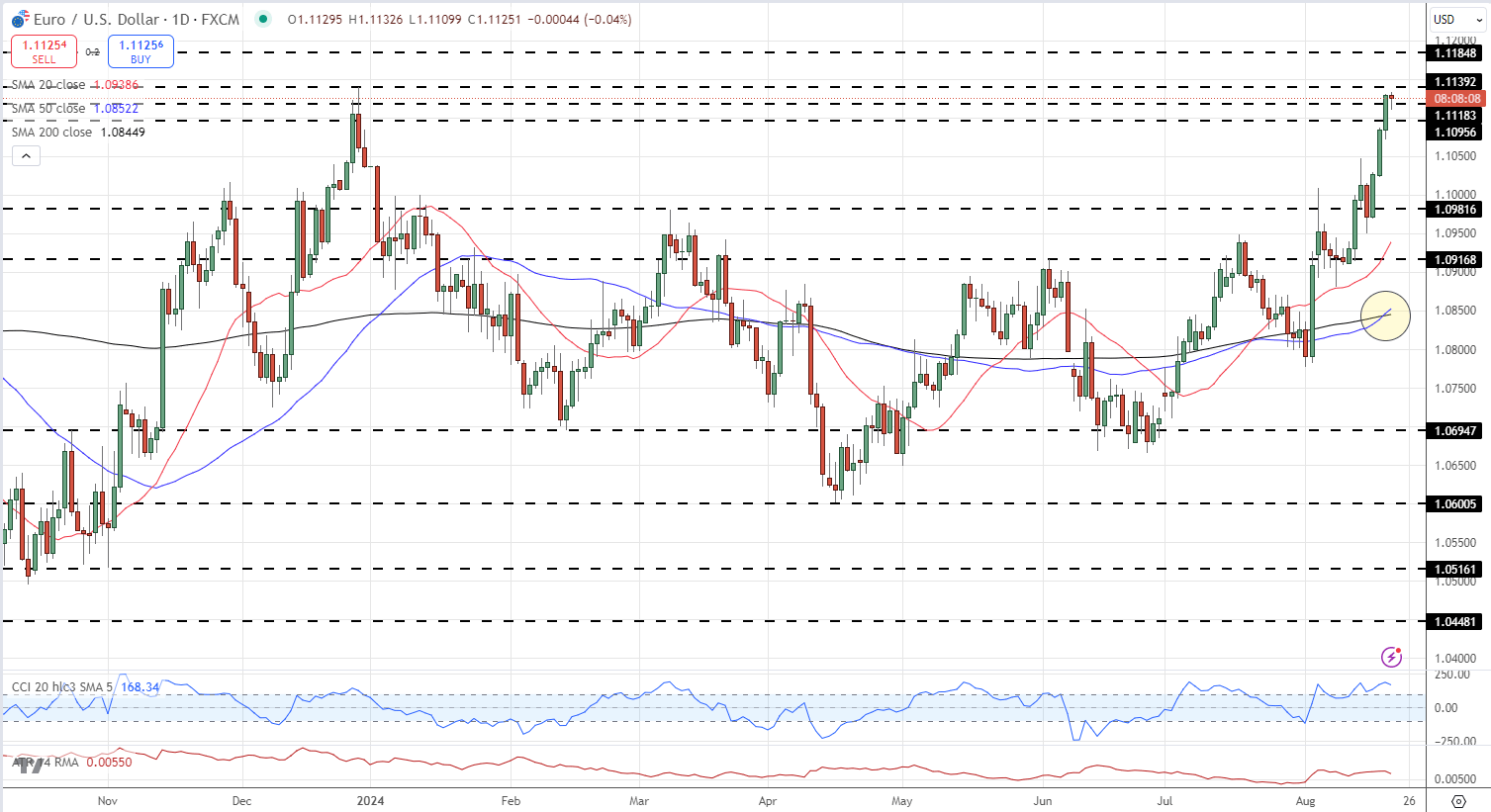

Euro and Sterling Hit Multi-Month Highs

The weak dollar environment has propelled both EUR/USD and GBP/USD to new multi-month highs.

EUR/USD has rebounded strongly after hitting a five-month low of 1.0600 in mid-April. The recent bullish crossover of the 50-day and 200-day simple moving averages suggests further gains for the pair in the coming weeks.

The GBP/USD daily chart also appears optimistic, with a consistent series of higher lows and higher highs since late-April. Although Sterling has recently strengthened on its own, the future trajectory of the pair will largely depend on the US dollar's performance.