US Inflation Remains in Focus as Fed Prepares for September Rate Cuts

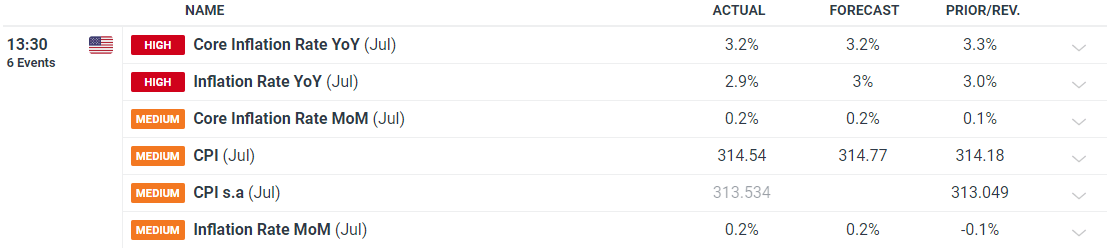

US inflation continues to be a central concern as the Federal Reserve prepares for potential interest rate cuts in September. Most inflation metrics aligned with expectations, though the yearly headline CPI slipped to 2.9%, slightly below the anticipated 3%.

Market Reactions Mixed Amid Recession Concerns

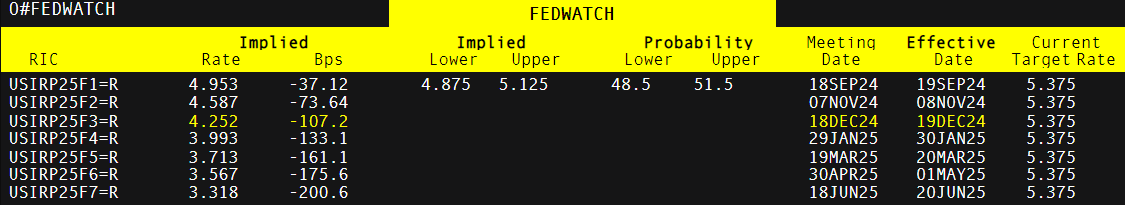

Market sentiment softened slightly after the meeting, with recession worries gaining traction. Weaker survey data, often a forward indicator of economic trends, has fueled fears that declining economic activity may be contributing to the recent inflation trends. The Fed’s GDPNow model projects Q3 GDP growth at 2.9%, in line with Q2, suggesting a stable economic outlook. The market remains divided on whether the Fed will opt for a 25 or 50 basis point rate cut.

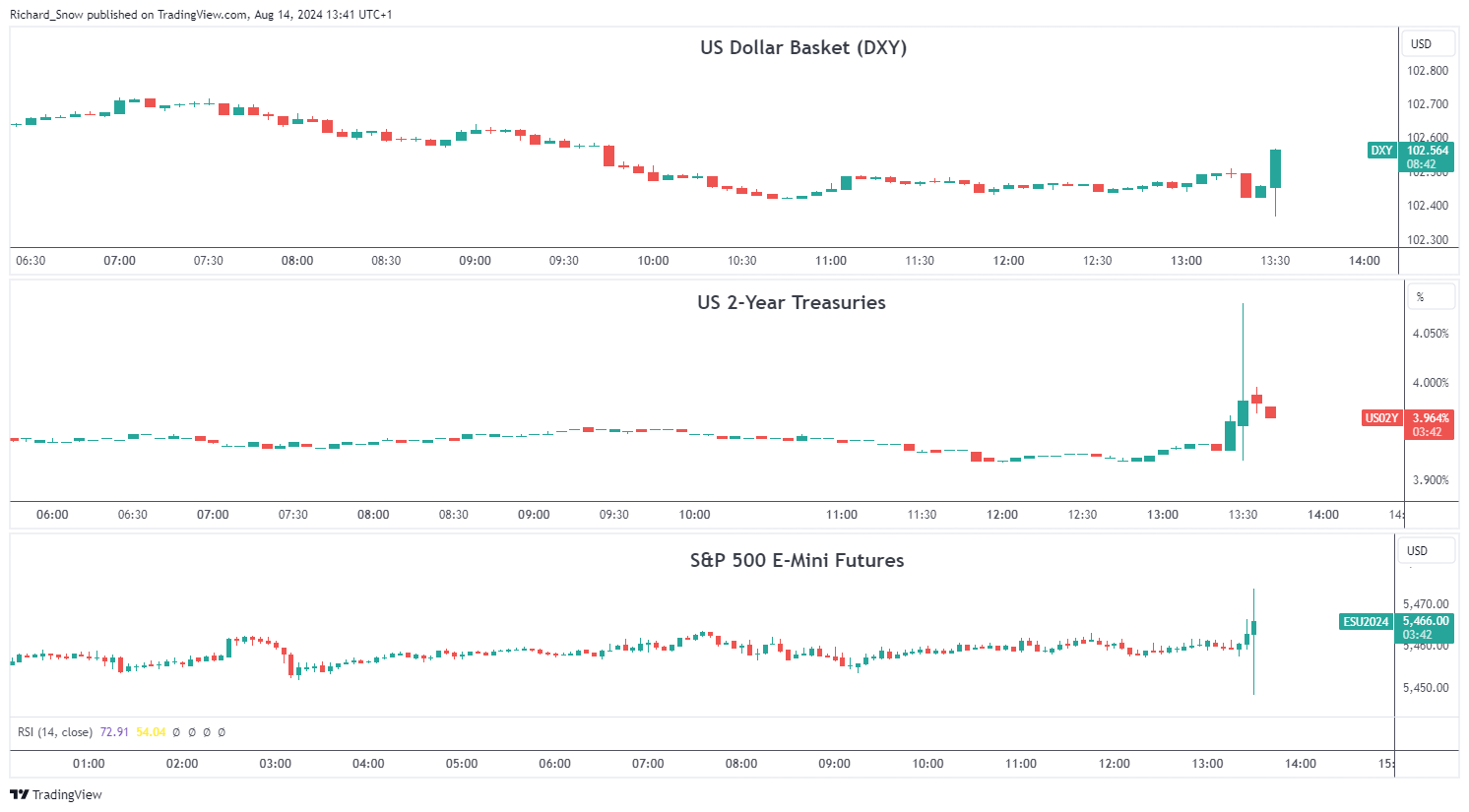

USD and Treasuries Rise Despite Inflation Aligning with Expectations

The US dollar and Treasury yields saw modest gains, which is unsurprising given the inflation data closely matched estimates. Despite the lower inflation figures, the market is beginning to unwind the overly bearish sentiment that followed last week’s volatile Monday session. Continued soft economic data could argue that the Fed’s policy has been overly restrictive, potentially leading to further depreciation of the dollar. The long-term outlook for the USD remains bearish as the Fed approaches its rate-cutting cycle.

US equity indices, particularly the S&P 500, have already bounced back from the brief selloff caused by a shift away from riskier assets following the Bank of Japan’s unexpected rate hike at the end of July. The S&P 500 has recovered last Monday’s losses as market conditions stabilize for now.