Ever wondered about diving into the world of cryptocurrency but felt overwhelmed? You're definitely not alone. For countless folks, the mere thought of navigating complex crypto exchange platforms or deciphering jargon was enough to put them off. But here's the game-changer: the Venmo app. What was once just a handy way to split bills has quietly become a surprisingly accessible gateway to digital assets, drawing in more and more users every single day. That’s right, Venmo crypto is making waves, and for good reason. It's truly a new era for how we interact with our money.

Your Familiar Venmo Account: The Easiest Entry Point to Crypto

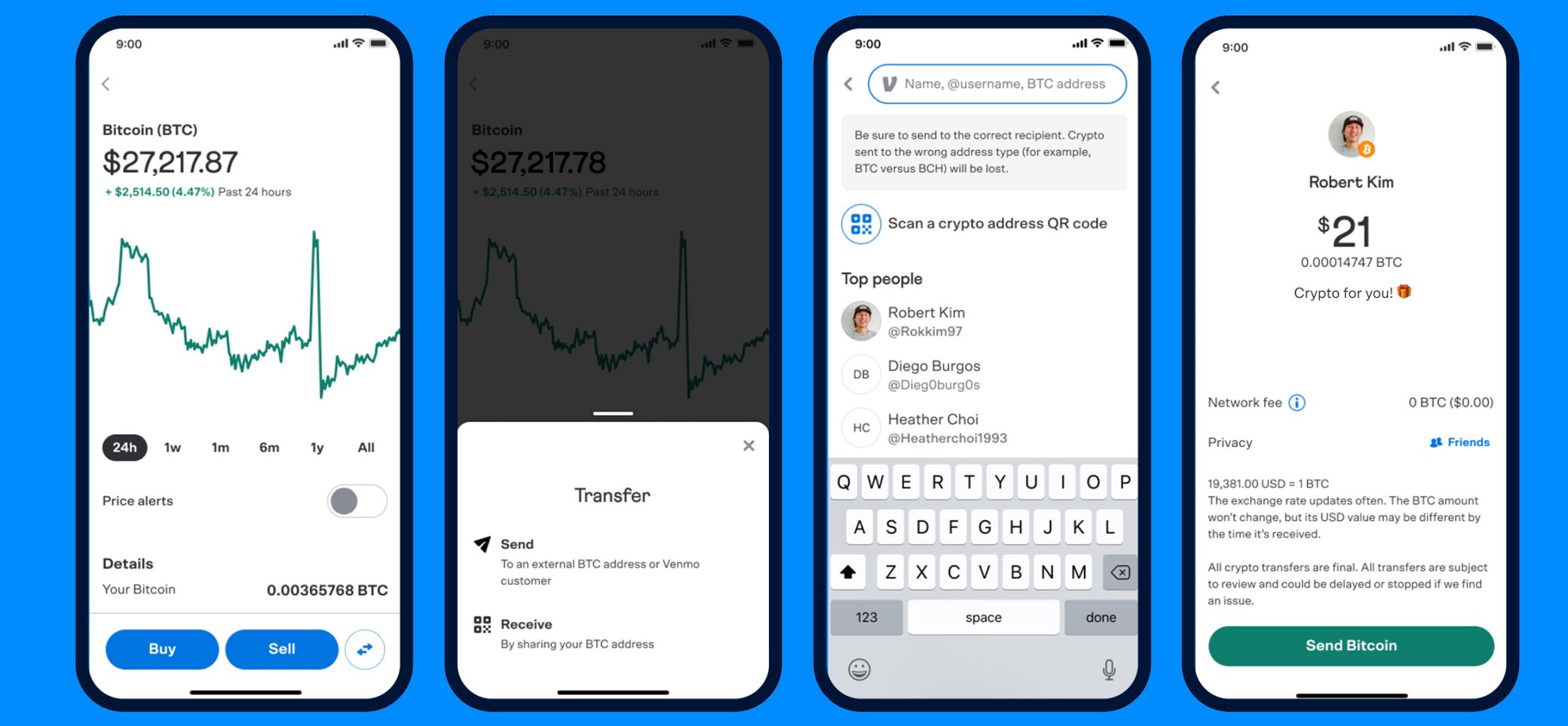

Let's face it, we love what's easy, and Venmo delivers on that promise. If you’ve got a Venmo account already set up, your first crypto purchase is literally just a few clicks away. No need for new apps, no baffling sign-ups. You simply use your existing Venmo balance or link a bank account or debit card as your chosen payment method. It's that seamless.

Think about it: the same debit card you use for your morning coffee can now power your entry into the world of Bitcoin or Bitcoin Cash. This incredible integration means you can buy crypto without skipping a beat, making crypto purchases feel less like a daunting financial maneuver and more like just another part of your everyday money management. It allows you to purchase crypto on your own terms.

Managing Your Digital Coins: Buying, Selling, and Staying in Control

Once you've made your initial purchase, exploring cryptocurrency on Venmo feels incredibly intuitive. You can instantly see how much crypto you own, watch its value fluctuate within the app, and decide when you're ready to sell crypto. The beauty is, when you do sell, that money flows directly back to your linked bank account or can instantly top up your Venmo balance for other payments or to pay with Venmo. This gives you more control over your digital assets than you might expect from such a user-friendly platform.

While the primary focus is on making crypto purchases and selling simple, Venmo also facilitates interaction. You can receive crypto from other Venmo users directly within the app, adding another layer to how you manage your cryptocurrency. For transferring crypto out to external wallets, it's generally restricted to maintain simplicity and security within the Venmo ecosystem – something to be mindful of for seasoned investors looking for full exchange functionality. Every transaction is designed to be transparent, helping you complete your crypto journey with confidence.

Built on Trust: Security and Regulation You Can Count On

Perhaps the biggest factor drawing in new users to Venmo crypto is the robust foundation of trust and security it stands upon. As a service of PayPal Inc., Venmo inherits a legacy of secure money transfer services. This isn't just a casual claim; PayPal Inc., a licensed provider of money transfer services (NMLS ID 910457), ensures that money transmission is provided in compliance with strict regulatory standards across the U.S. This means your purchase of cryptocurrency is handled by a fully licensed provider of money services, giving you peace of mind.

To further bolster security, Venmo employs strong measures like two-factor authentication to protect your account. They are also upfront about fees, detailing network fees and other transaction costs, helping you understand your tax obligations related to your digital assets. They actively encourage users to verify all details before committing to any purchase, emphasizing transparency. Even with something like a Venmo Card, the trust built into the Venmo app carries over, creating a holistic ecosystem for your money.

Venmo's Impact: Driving Mainstream Crypto Adoption

The massive growth of Venmo crypto indicates an undoubtedly rising inclination: eliminating the intimidation from digital assets is the guaranteed way to get them accepted on a large scale. Your ability to pay for crypto with Venmo and handle the digital assets with a familiar app so easily has made the scary part of it seem very straightforward. This is not just another function on your everyday app. Venmo is taking active steps towards tearing down the walls around cryptocurrency access (the same goes for its parent company, PayPal).

Notably, Venmo for business, even if it is now mainly focused on traditional payments, still has the underlying infrastructure that allows the purchase of crypto, which indicates that digital assets will become an integral part of commerce in the future. By providing an environment where crypto appears to be the next logical step in everyday financial management, Venmo is doing more than just selling Bitcoin or Bitcoin Cash. It is setting in the minds of people how cryptocurrencies in the future might just be a part of the mainstream economy. And for many, that will be a future worth investing in.