Weighted/ Exponential Moving Average

The Exponential Moving Average(EMA) also known as weighted moving average… A moving average deemed more powerful than the simple moving average especially in longer periods. The most popular and widely used EMA setting would be the 200 period setting. Hence in this article, we will explore the usage of EMA with the 200 period setting as a sample.

Weighted/Exponential Moving Average

- What is it?

- How is EMA calculated?

- How to use?

- Pros & cons

- 200 EMA breakdown

- Conclusion

- Rating

- Infographic

What is it?

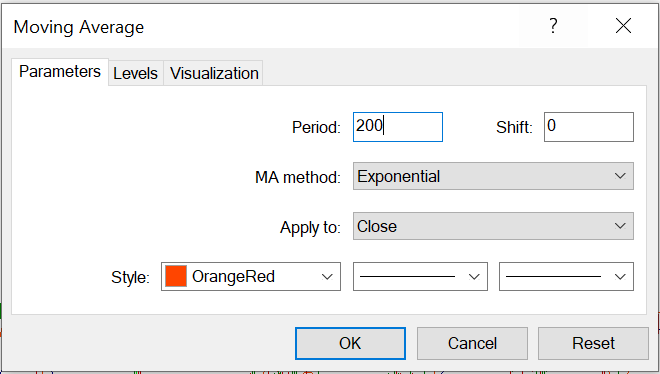

An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period. Similar to the Simple Moving Average(SMA), users are able to tweak the parameters of the indicator, which contains the period, shift, method and application. Firstly, the period of the indicator is the number of past candles taken into calculation. Secondly, the shift of the indicator is the change in the candles taken into calculation without changing the period, from the most recent candle. Thirdly, the method of the indicator refers to the type of calculation involved. Lastly, the application of the indicator refers to the type of sample data to be used for the calculation.

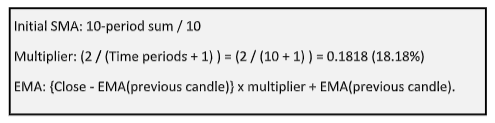

How is EMA calculated?

As similar as it may seem to its counterpart, the SMA, the EMA’s calculation is very different from the SMA. The calculation is done exponentially where it results in reflecting recent candles in a heavier weightage.

Instead of dividing the weightage of the calculation evenly among the candles in the period like the SMA, the EMA is able to provide a smoother and less choppy support and resistance.

Also read: Support and Resistance

How to use?

The EMA can be used in multiple ways. Like the SMA, it can be used as part of a crossover set up to find entries and exits. Also, it can be used to identify bullish and bearish trends. Both methods of using the moving average have been explored in the SMA article. Though they are quite similar, the main difference is that EMA is deemed by many to be a stronger dynamic support and resistance line. Thus, the main objective of this article will be targeted to uncover exactly how strong and reliable the EMA is in terms of dynamic support and resistance. With that, the most common period setting, 200, will be used here as a sample.

Also read: Simple Moving Average Trading Strategy

Pros & cons

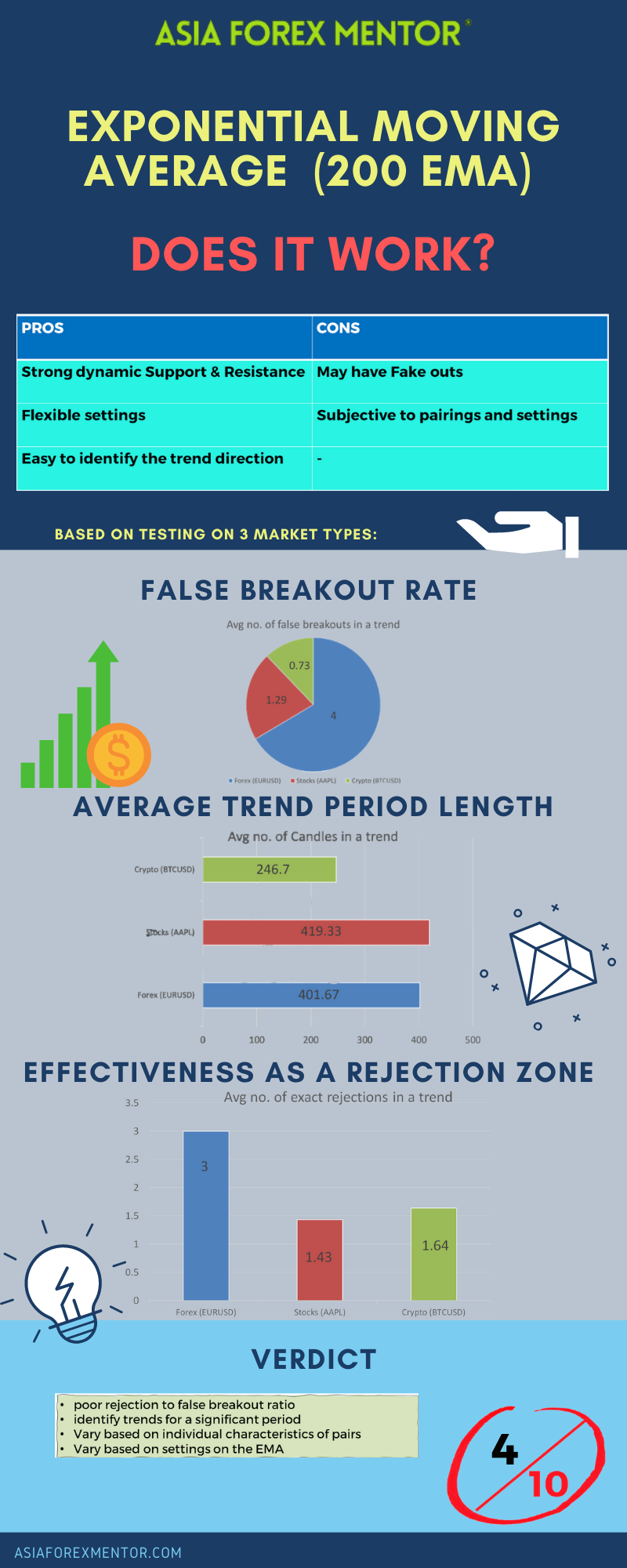

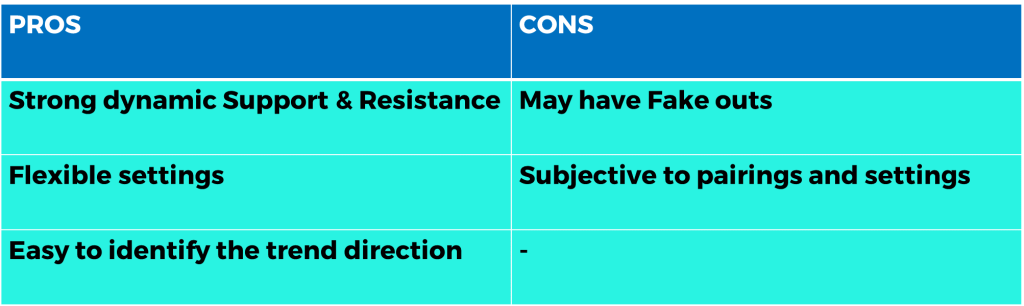

The EMA as mentioned is a good dynamic support and resistance line which also identifies the trends of the market relatively well especially in the long term. To top that off, it is flexible with customisable settings to suit unique trading strategies. However, it may still be prone to fake outs at times, especially when the support and resistance is a zone concept and thus a single line may not be 100% accurate at representing it, therefore using it alone as a gauge of support and resistance might lead to observed fake outs due to subjectivity. This is of course subjected to the characteristics of the individual pairings it is applied to and the settings on the EMA itself.

200 EMA breakdown

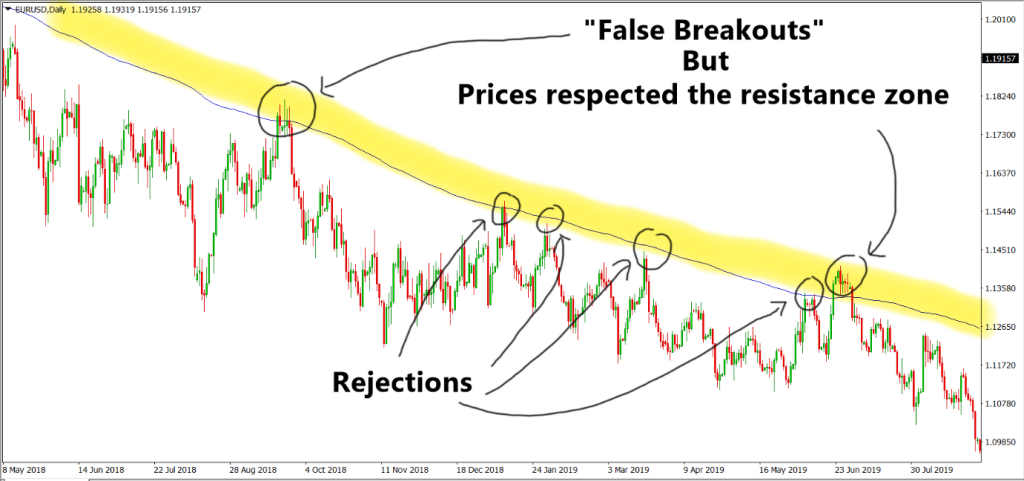

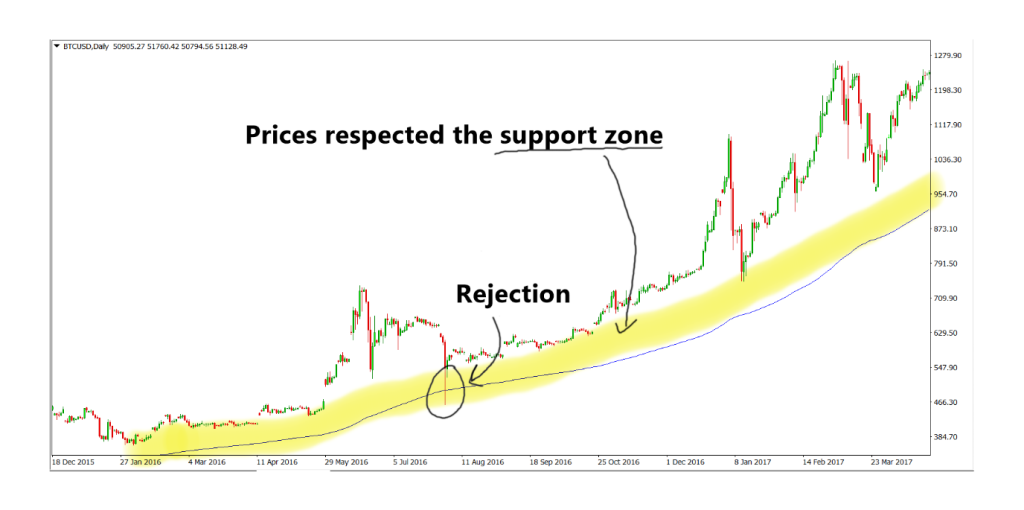

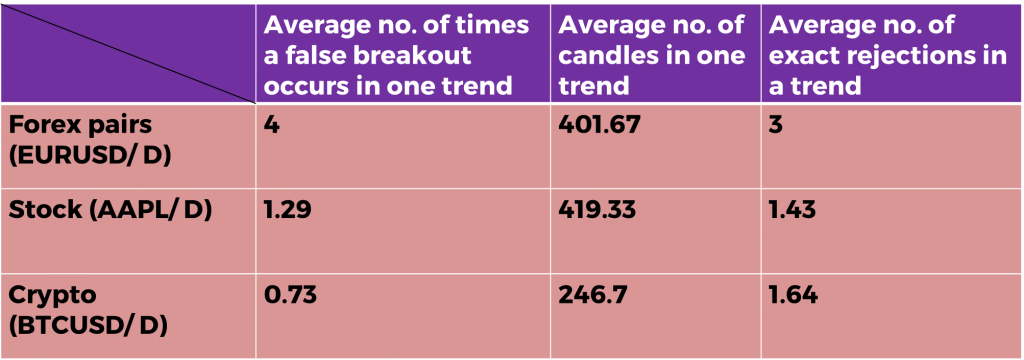

To evaluate the reliability and strength of the 200 EMA, we must first define what makes a good dynamic support and resistance line. The major factor to take into consideration will be the responsiveness of the support and resistance. To measure this, we will simply take the average number of exact rejections (no false breakouts) in a trend to determine if the 200 EMA aligns with the support and resistance zone in the market. Also, we can take the average number of times a false breakout occurs before the complete change in trend as further evidence to support the responsiveness of 200 EMA as a support and resistance. On top of that, for clarity, we will also be testing for the definition of a trend. A trend is a clear direction in the market, consisting of the formation of higher highs and higher lows(Bullish) or lower highs and lower lows(Bearish). Going further in-depth to measure a trend, we will take the average number of candles found in a trend until it changes to the other market direction. In this backtest we will be using EURUSD as a sample for Forex, AAPL as a sample for Stocks and BTCUSD as a sample for Cryptocurrencies. The figures below illustrate the results of the test. All tests were done in the Daily timeframe.

As shown in our backtest, the average no. of candles in one trend for EURUSD (Forex) is 401.67 candles, AAPL (Stocks) is 419.33 candles and BTC (Crypto) is 246.7 candles.

The average no. of times a false breakout occurs in one trend for EURUSD (Forex) is 4 times, AAPL (Stocks) is 1.29 and BTC (Crypto) is 0.73.

The average no. of exact rejections in a trend for EURUSD (Forex) is 3, AAPL (Stocks) is 1.43 and BTC (Crypto) is 1.64.

Conclusion

The EMA is able to be customised and tweaked according to the trader’s set-up. In this case the 200 EMA had a poor rejection to false break out ratio. However, it does a decent job in determining trends as it is able to determine on average about 356 candles in a trend. That is almost close to one year! Regardless, the weighted moving average / EMA can be a very powerful indicator to add to your set-up with the right settings, defining trends and assisting you in identifying rejection levels.

Rating

4/10

Infographic