Gold Price Movement

The gold price increased for the third consecutive day, nearing an all-time high in early Wednesday trading. Investors are closely watching the release of the US August CPI report, which will provide further clarity ahead of the Federal Reserve policy meeting next week.

Impact of US Inflation Data

If the August inflation figures align with expectations or show improvement, it would indicate that inflation is continuing its downward trend, heading towards the Fed’s 2% target. This scenario would support the likelihood of a 25 basis point rate cut. Markets are largely anticipating three 0.25% rate cuts by the end of the year. Still, recent weaker-than-expected US economic data has sparked concerns about a potential recession, leaving room for more aggressive Fed action.

The yellow metal is expected to remain well-supported due to anticipated policy easing and rising geopolitical tensions, which drive safe-haven demand. Investors seem less focused on political events like the US Presidential debate, preferring to base their decisions on economic data.

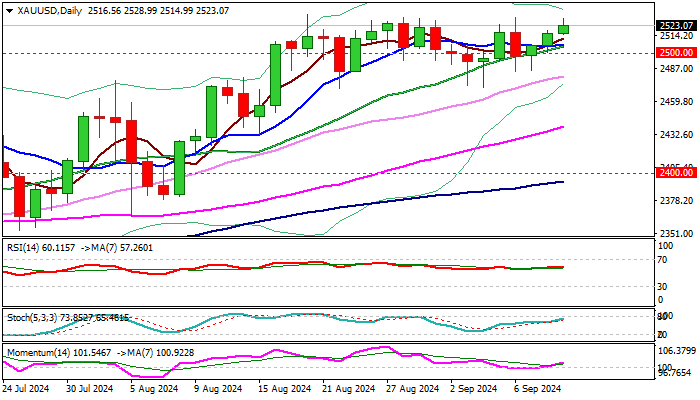

Firmly bullish technical indicators on the daily chart contribute to a positive outlook for gold. Although bulls may encounter resistance near the record-high zone, a break above the top of the multi-week consolidation range seems likely.

A breach of the $2431 peak could open the door to targets at $2554 and $2568 (Fibonacci projections), with the $2600 level being a round-figure barrier many analysts see as a potential year-end target.

In the near term, the bias remains upward as long as the price holds above the psychological $2500 support, which is also the midpoint of the recent $2531/$2470 range.

Resistance Levels: 2531; 2554; 2568; 2600.

Support Levels: 2514; 2507; 2500; 2480.