Position in Rating | Overall Rating | Trading Terminals |

191st

| 4.5 Overall Rating |

|

Valetax Review

Selecting a reputable broker is a fundamental pillar of a successful trading journey. A dependable partner ensures transparent pricing, reliable technology, and secure asset management, shielding you from avoidable financial risks and technical failures.

In a market saturated with similar financial products, the true distinction lies in a broker’s integrity and support quality. By partnering with a trustworthy firm, you can concentrate fully on your market strategies and risk control, rather than being distracted by execution delays or unexpected fees.

Valetax is an Valetax is an online forex broker and CFD broker that provides access to a wide range of trading instruments, including forex pairs, indices, commodities, metals, energies, and cryptocurrencies, using the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker offers high leverage, competitive spreads, copy trading, and an Analysis Center as part of its advanced tools for market analysis and trade execution. It is built for retail traders, especially those looking for low entry requirements, through Cent Accounts for small test trades and Standard Accounts with higher leverage. Valetax supports multiple payment methods, including local bank transfers and USDT (Tether), making account funding more accessible across regions. However, while these features may appeal to traders seeking convenience, a key consideration when choosing a trustworthy broker is regulation strength. Valetax’s offshore regulatory status, operating under jurisdictions like St. Vincent and the Grenadines without top-tier financial oversight, means limited fund protection and weaker investor safeguards, which increases overall trading and security risk for users.

This in-depth review examines Valetax by outlining both its advantages and points traders should think carefully about. It explains important details such as available account types, trading costs, funding and withdrawal options, and general trading conditions. Using a mix of expert assessment and feedback from actual users, the review is designed to help readers judge whether Valetax matches their trading goals and risk tolerance.

What is Valetax?

Valetax began as an online forex and CFD trading platform that aims to make financial markets accessible to traders worldwide. The company operates in multiple regions and claims to serve over 300,000 clients, offering trading access to forex, indices, commodities, metals, energies, and cryptocurrencies through popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Valetax emphasizes ease of use with mobile and web access so traders can monitor and manage accounts on the go, and it supports features such as 24/7 live chat support and market analysis tools for insight into trading opportunities.

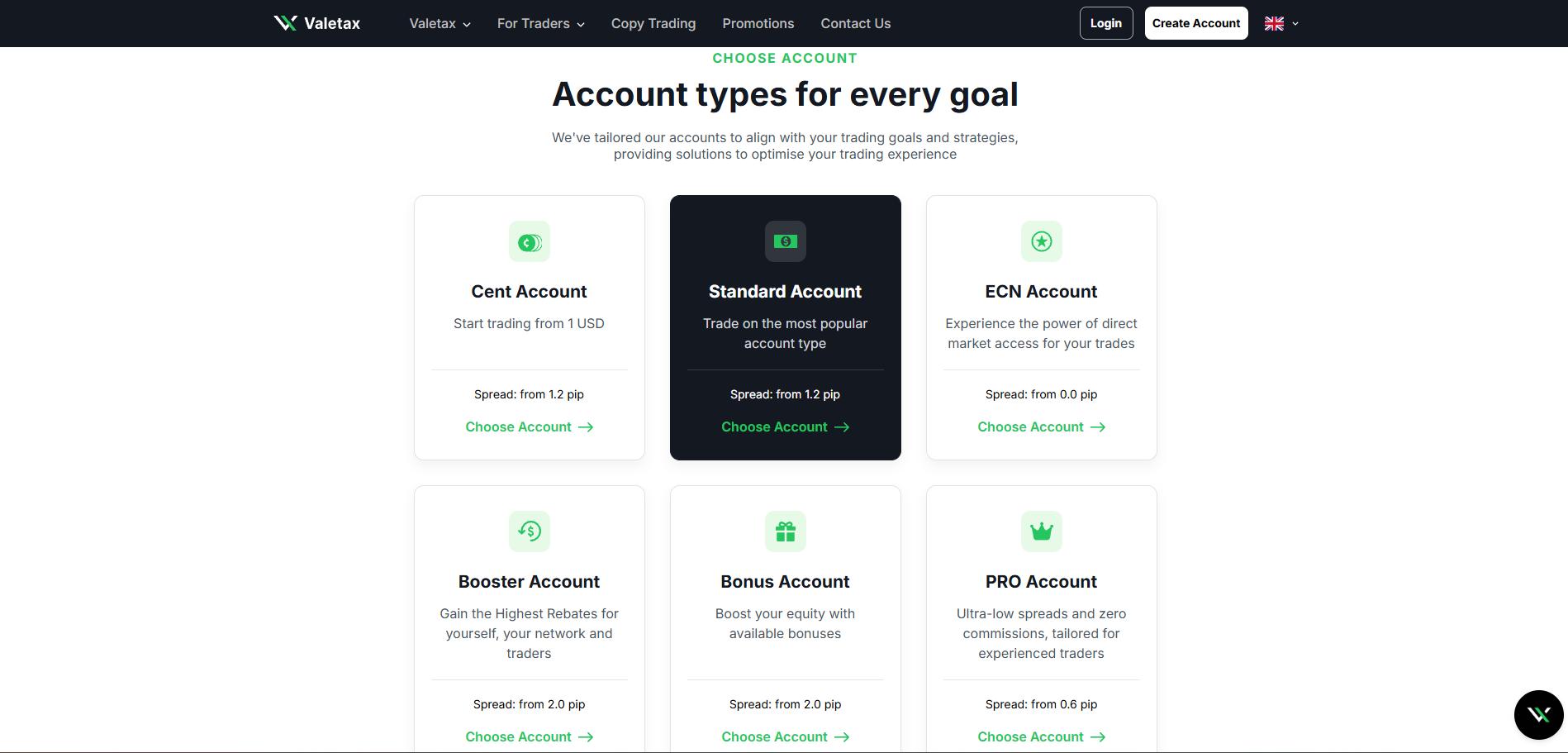

Over time, Valetax expanded its account offerings to cover a broad range of trading needs. It now provides six account types — including Cent, Standard, ECN, Booster, Bonus, and PRO accounts — each designed for different trading strategies and experience levels, with low starting deposits and varying leverage up to 1:2000. These options help both beginners and experienced traders test strategies with minimal capital or pursue more advanced execution conditions. Valetax also promotes competitive spreads, fast order execution, and multiple deposit/withdrawal methods to support flexible trading conditions.

On the regulatory front, Valetax is structured with registrations in offshore jurisdictions, including Valetax International Limited in Mauritius and Valetax Global Limited in St. Vincent and the Grenadines, which provide regulatory oversight from those bodies but do not equate to supervision by top-tier financial authorities. While the broker asserts compliance with industry standards and secure payment partnerships, its offshore status means traders should be cautious about fund protection and investor safeguards when comparing it to brokers regulated by major authorities.

Benefits of Trading with Valetax

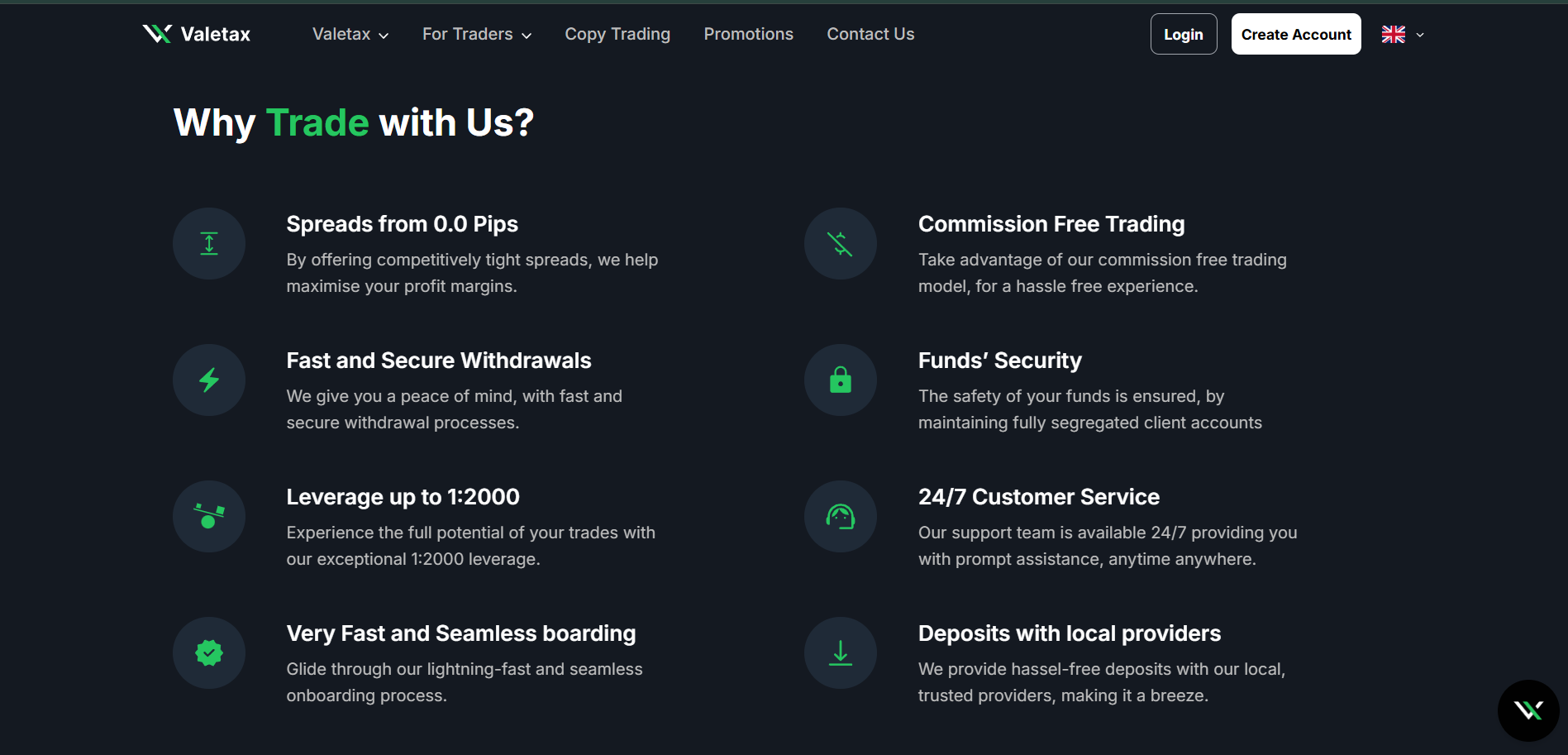

Valetax offers several advantages for retail traders looking for flexibility and easy access to financial markets. One of its key benefits is access to a wide range of instruments, including forex, indices, metals, energies, and cryptocurrencies, all tradable through the popular MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their reliable execution, advanced charting tools, and support for automated trading, making them suitable for both beginners and experienced traders. Valetex also lowers the entry barriers with Cent accounts, allowing traders to start with as little as $1, making it easier for newcomers to test strategies with minimal risk.

Additionally, Valetax offers multiple account types with varying leverage and spread structures, enabling traders to select conditions that best suit their trading style. The broker supports several payment methods, including local bank transfers and USDT (Tether), which enhances accessibility for traders across various regions. With tools like market analysis resources, copy trading features, and 24/7 customer support, Valetex provides a comprehensive trading environment. This combination of flexibility, low entry requirements, and strong support options makes Valetex an attractive choice for traders of all levels.

Valetax Regulation and Safety

Valetax claims to operate under regulatory oversight from authorities in Mauritius and St. Vincent and the Grenadines. Its entity Valetax International Limited is reported to be licensed by the Mauritius Financial Services Commission (FSC) under license number GB21026312, and Valetax Global Limited is registered in St. Vincent and the Grenadines (SVG) as an international business company with registration number 23398 BC 2016. While the FSC in Mauritius does provide licensing and supervision of financial services businesses, it is considered a mid‑tier/offshore regulator and does not offer the same level of investor protection and market oversight as top‑tier regulators like the UK’s FCA or Australia’s ASIC.

Because Valetax operates primarily under offshore regulation, fund safety safeguards are limited compared with brokers regulated by major authorities. There is no mandatory investor protection or compensation fund like those provided by regulators such as CySEC or FCA, and dispute resolution mechanisms are generally weaker in these jurisdictions. While the broker asserts that client funds are segregated and that it supports measures like negative balance protection, independent verification of these practices and the effectiveness of protections in real‑world scenarios is limited.

Valetax Pros and Cons

Pros

- Low minimum deposit make it easy for beginners to start trading

- Have their own trading platform

- Wide range of tradable instruments including forex, crypto, and commodities

- Competitive spreads and low fees on many account types

- Fast deposits and withdrawals reported by users in reviews

Cons

- Offshore regulation only, not supervised by major financial authorities, raising safety concerns

- No official demo account on some source

- Details on how spreads are calculated and whether it offers true ECN execution aren't fully disclosed

Valetax Customer Reviews

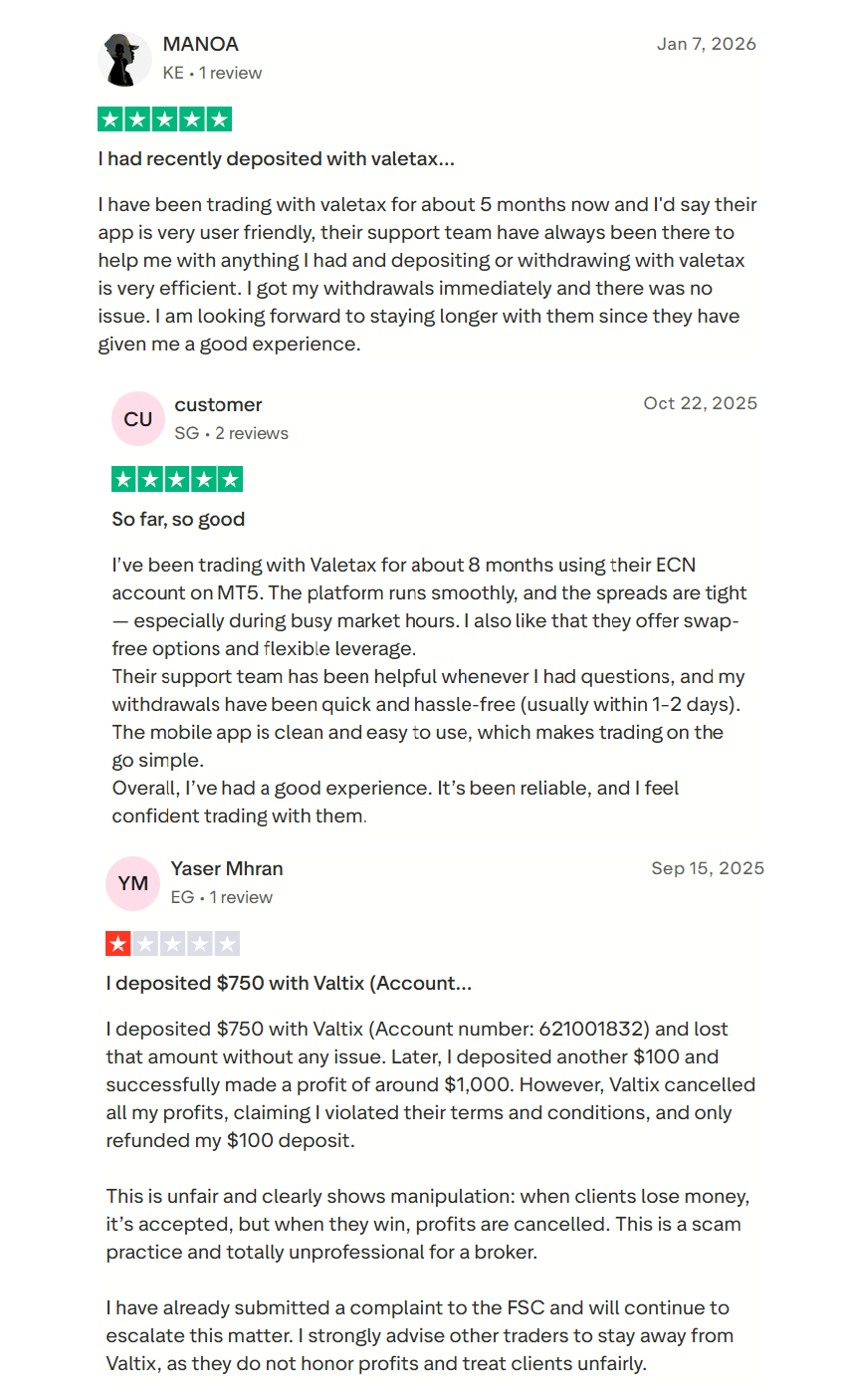

Many users of Valetax have had positive experiences, praising its user-friendly platform, fast deposits and withdrawals, and smooth trade execution, along with quick response from the customer support. However, negative feedback also exists, with some customers reporting issues like account funding not being credited, slow withdrawals, and restrictions after profits. Additionally, some users have complained about glitches and slow performance on the mobile platform, especially during periods of high market volatility.

Valetax Spreads, Fees, and Commissions

Valetax offers competitive spreads across its various account types. For those using ECN accounts, spreads can be as low as 0.0 pips, which is ideal for traders seeking tight, raw market pricing. Standard and Cent accounts generally start at around 1.2 pips, while PRO accounts offer spreads from 0.6 pips, providing flexibility depending on the trader's needs. The Booster and Bonus accounts tend to have wider spreads, which can vary depending on specific trading conditions.

In terms of commissions, Valetax typically does not charge additional fees for most account types, as the trading costs are included in the spread. However, the ECN account may have a separate commission per lot in exchange for tighter spreads and more direct market access. Valetax also boasts low or no additional fees on deposits and overnight swap fees, although traders may still incur charges from third-party payment providers. Overall, Valetax aims to provide a cost-efficient trading experience, with fees and costs largely determined by the chosen account type and the market conditions at the time.

Account Types

Cent Account

- Low minimum deposit

- Allows very small trade sizes

- Specifically designed for new traders or those testing strategies without committing large amounts of capital.

- Allows traders to practice with minimal financial exposure

Standard Account

- Commission-free trading

- Leverage up to 1:2000

- Suitable for casual and intermediate traders

- Ideal for everyday trading with flexible conditions

ECN Account

- Raw spreads starting from 0.0 pips

- Commission of $4 per lot

- Leverage up to 1:2000

- Ideal for active and high-frequency traders

- Suitable for scalping strategies

Booster Account

- Commission-free trading

- Spreads from 2.0 pips

- Leverage up to 1:2000

- Designed for traders seeking rebates and promotions

- Ideal for reward-focused trading

Bonus Account

- Commission-free trading

- Spreads from 2.0 pips

- Leverage up to 1:500

- Ideal for traders looking to boost equity through bonuses

- MT4 platform only

Pro Account

- No commission

- Spreads from 0.6 pips

- Leverage up to 1:2000

- Designed for professional traders

- Higher minimum deposit ($500)

- Ideal for advanced trading conditions and tight spreads

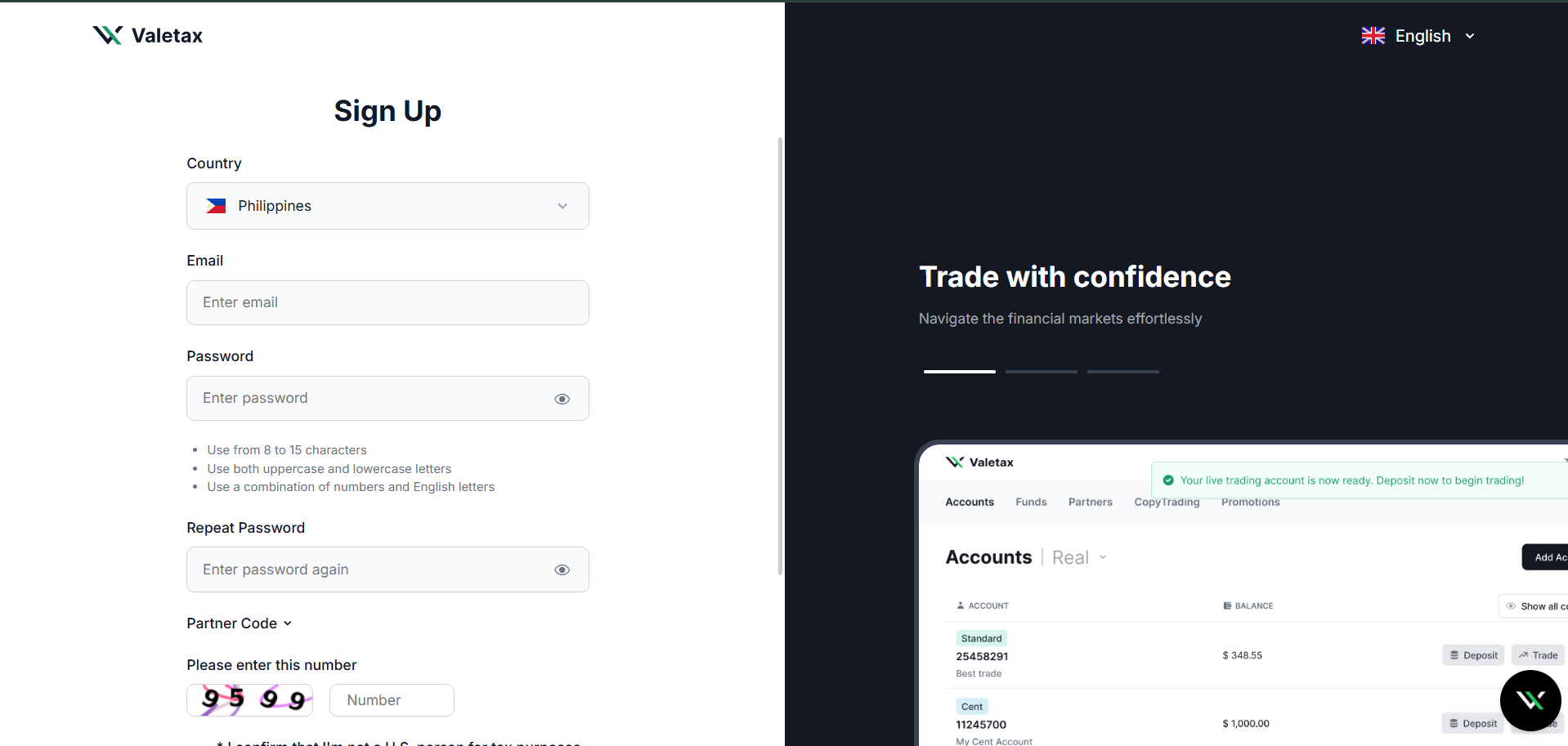

How to Open Your Account

- Start by heading over to the Valetax website. Look for the “Sign Up” or “Open Account” button.

- Valetax offers several account types, so pick the one that best fits your needs. If you're a beginner, the Cent Account could be a great place to start. If you’re more experienced, you might want to consider the ECN or PRO Account for better trading conditions.

- You’ll be asked to enter some personal information like your name, email address, and phone number. This is standard for all online brokers to ensure they can reach you when necessary.

- To comply with financial regulations, you may need to upload a copy of your ID (like a passport or driver’s license) and a proof of address (such as a utility bill or bank statement).

- After your account is set up, you’ll need to make a deposit to start trading. Valetax supports various payment methods, including local bank transfers and USDT. Choose the method that works best for you, and deposit the minimum amount for your chosen account type.

- After setting up your account, you can download either the Valetax Trading App or MT4/MT5 to start trading. The Valetax App is available for both Android and iOS, offering a simple, mobile-friendly interface for managing your account and placing trades on the go. Alternatively, you can use MT4/MT5 for more advanced features.

- Once you’ve installed the app or trading platform, log in to your account, make your first trade, and begin exploring the markets. You’ll have full access to your account, real-time market data, and the tools needed for trading, whether you use the mobile app or MT4/MT5 platform.

Valetax Trading Platforms

Valetax offers its users two powerful trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are highly regarded in the trading world for their advanced charting tools, technical indicators, and real-time market data, making them suitable for both beginners and experienced traders. MT4 and MT5 are known for their reliability, ease of use, and automated trading features, allowing traders to set up algorithms and execute trades without constant monitoring. These platforms provide multi-device access, enabling users to trade from desktop computers, web browsers, or mobile devices.

In addition to MT4 and MT5, Valetax also offers its own Valetax Trading App for Android and iOS users. The app allows traders to manage their accounts, view live market prices, and execute trades directly from their mobile devices. This app provides the same flexibility and functionality, allowing traders to stay connected and manage their positions on the go, without needing a desktop. Whether you choose the traditional MT4/MT5 platforms or the Valetax Trading App, Valetax ensures that traders have the tools they need for a seamless trading experience, no matter where they are

What Can You Trade on Valetax

On Valetax, traders have access to a wide range of instruments across various markets, all through CFDs (Contracts for Difference). This includes the ability to trade over 60 currency pairs in the forex market, such as popular pairs like EUR/USD and GBP/USD, as well as exotic pairs, providing ample opportunities for both short-term and long-term traders. In addition to forex, Valetax also offers trading in precious metals, including gold and silver, allowing traders to capitalize on fluctuations in the commodities market.

Moreover, Valetax provides access to global indices, such as the S&P 500 and NASDAQ 100, giving traders exposure to the performance of entire markets. For those interested in the growing digital asset market, Valetax also offers cryptocurrency trading, including major assets like Bitcoin and Ethereum. Other tradable assets on the platform include energy commodities like crude oil and natural gas, with markets driven by global supply and demand factors. Overall, Valetax allows traders to diversify their portfolios by offering a broad range of trading options, from traditional forex and metals to more niche assets like cryptos and energy commodities.

Valetax Customer Support

Valetax customer support is available 24/7 to help traders with questions or issues related to their accounts, deposits, withdrawals, or trading platforms. You can reach the support team through live chat directly on the Valetax website, which is often the fastest way to get a response for immediate concerns. You can also contact them by email at contact@valetax.com or by phone (+65 6931 5022) for more detailed inquiries or account‑related support.

Many users say Valetax’s support team responds quickly and is helpful with technical issues or funding questions, though experiences vary among traders. The broker’s support is designed to assist beginners and experienced users alike, whether you’re troubleshooting platform problems or learning how to use features like copy trading. Support may also help resolve payment or withdrawal issues when they arise.

Advantages and Disadvantages of Valetax Customer Support

Withdrawal Options and Fees

Valetax offers flexible withdrawal options to cater to traders worldwide. You can withdraw funds using several methods, including local bank transfers, online banking, and cryptocurrency withdrawals such as USDT (Tether). The broker does not charge its own withdrawal fees, allowing you to keep the full amount of your withdrawal. However, it’s important to note that third-party payment providers, like banks or crypto networks, may apply their own fees, which are beyond Valetax's control. The processing time for withdrawals can vary depending on the method used, with crypto withdrawals typically being processed in minutes to hours, while bank transfers may take a few business days.

Most withdrawals with Valetax are processed quickly, usually within 24 hours by the broker, though the final transfer time depends on the payment method and the third-party provider’s policies. A minimum withdrawal amount often applies, generally around $50, and you must ensure your account is fully verified before proceeding with a withdrawal. Overall, Valetax aims to provide quick, low-cost withdrawals but it's important to check with your payment provider for additional fees and timeframes.

Valetax Vs Other Brokers

#1. Valetax vs AvaTrade

Valetax and AvaTrade differ in several key areas, with Valetax standing out for its low minimum deposits, high leverage options, and easy access for both new and experienced traders, offering flexibility and quick entry into the markets. While AvaTrade has a much longer history (since 2006) and is regulated by top-tier authorities, providing strong investor protections, Valetax operates with offshore regulation, which may be a concern for traders seeking stronger oversight. However, Valetax provides competitive trading conditions with multiple account types and is ideal for traders looking for a more affordable, user-friendly platform, making it a solid choice for those prioritizing cost-effectiveness and ease of use.

Verdict: Valetax is an excellent choice for traders seeking low entry barriers, high leverage, and a user-friendly platform. With its competitive spreads, flexible account types, and ability to accommodate both new and experienced traders, it provides a solid trading environment for those looking to get started or test strategies with minimal capital. While it operates under offshore regulation, Valetax offers an affordable and accessible trading experience, making it a great option for those who prioritize ease of use and low-cost trading.

#2. Valetax vs RoboForex

Valetax is a newer online forex and CFD broker that focuses on low deposits, high leverage, and flexible account types accessible through platforms like MT4 and MT5, making it easy for traders of all levels to start trading quickly. RoboForex, on the other hand, has been operating since 2009 and offers a wider range of assets (over 12,000 instruments) and trading tools, along with various account types like Pro, ProCent, ECN, and Prime under FSC Belize regulation and membership in a compensation fund.

Verdict: Valetax offers a straightforward, cost‑friendly entry into forex and CFD trading, with low minimum deposits and flexible trading conditions that make it a strong choice for traders who want an accessible and user‑focused experience, especially if you’re starting out or prefer simplicity and affordability in your trading setup.

#3. Valetax vs Exness

While Exness is an established market leader, Valetax distinguishes itself by offering a more accessible and agile environment specifically designed for high-growth trading. Valetax lowers the barrier to entry with a minimum deposit of just $1, making it an ideal choice for traders who want to test strategies or start small without significant capital. Its standout feature is its ultra-high leverage of up to 1:2000, which provides traders with exceptional flexibility and purchasing power that often exceeds the limits found at more traditional brokers.

Verdict: Valetax has leapfrogged competitors with its intuitive, proprietary mobile app and a highly rewarding partnership ecosystem—featuring automated rebates paid out every two hours—that prioritizes the individual's growth alongside the broker's. For the modern trader who wants a nimble, tech-forward partner that offers maximum flexibility and a community-driven approach, Valetax provides a dynamic edge that the larger, more rigid market leaders simply cannot offer.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Valetax Review

Valetax is a flexible and user-friendly trading platform that offers low entry barriers, making it an excellent choice for both beginner and experienced traders looking to align their trading activity with specific financial goals. With a minimum deposit as low as $1 and high leverage options up to 1:2000, it allows traders to start small while taking advantage of significant market opportunities. The broker supports popular platforms like MT4 and MT5, as well as its own mobile app, providing accessibility and convenience through a wide range of platform features for managing trades and accounts on the go. Valetax’s competitive spreads, fast execution, and multiple account types cater to different trading strategies, whether for testing ideas with a Cent account or engaging in more advanced trading with ECN or PRO accounts.

While Valetax operates with offshore regulation in Mauritius and St. Vincent and the Grenadines, it offers an accessible and cost-effective trading environment with no withdrawal fees and flexible deposit methods. The broker's 24/7 customer support ensures that traders receive assistance whenever needed. Although its regulatory status may raise concerns for traders who prioritize top-tier oversight and a highly secure environment, Valetax compensates with an intuitive platform, affordable trading conditions, and dynamic tools like market analysis and copy trading features. For those seeking a low-cost, flexible, and accessible trading experience, Valetax stands out as a solid option for entering the markets.

Also Read: MarketsVox Review 2024 – Expert Trader Insights

Valetax Review: FAQs

What is Valetax and what can I trade on it?

Valetax is an online forex and CFD broker that lets you trade a wide range of instruments, including forex currency pairs, metals (like gold and silver), global indices, energies (such as oil), and cryptocurrencies (like Bitcoin and Ethereum). All trades are executed via CFDs, meaning you can speculate on price movements without owning the underlying assets.

What trading platforms does Valetax support?

Valetax supports the industry‑standard platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for advanced charting, technical tools, and automated trading capabilities. It also offers its own Valetax Trading App for Android and iOS, allowing you to manage your account and place trades from your mobile device.

How do I open an account with Valetax?

To open an account, go to the Valetax website, choose your preferred account type (e.g., Cent, Standard, ECN, PRO), complete the registration form with your personal details, and upload identity verification documents. After your account is verified, deposit funds using supported methods (like bank transfer or USDT) and start trading via the Valetax App or MT4/MT5.

Are there any fees for deposits and withdrawals?

Valetax does not charge its own withdrawal fees, and deposits are generally fee‑free from the broker side. However, third‑party payment providers (banks, e‑wallets, or crypto networks) may apply their own fees. Withdrawal times and minimum amounts depend on the method you choose, and your account must be fully verified before withdrawals can be processed

OPEN AN ACCOUNT NOW WITH VALETAX AND GET YOUR BONUS