The floating exchange rate refers to an exchange plan where a nation’s currency price reflects its forex market value based on demand and supply relative to other currencies. Thus, this type of currency structure is different from other options where the government predominantly or entirely decides the exchange rate.

Also Read: How To Trade Currency

Contents

- How the Floating Exchange Rates System Works

- What Makes Fixed Exchange Rates Different

- The Floating Exchange Rates History

- Frequently Asked Questions

- References:

How the Floating Exchange Rates System Works

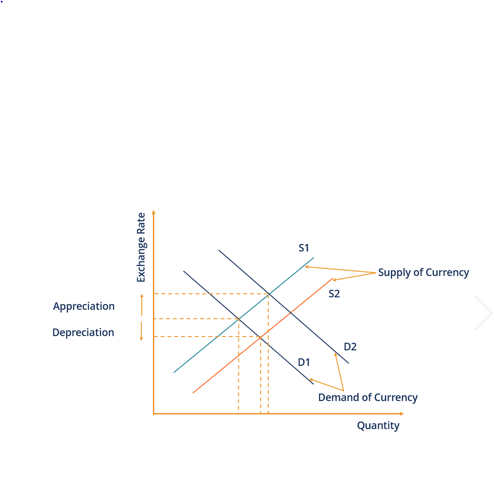

Generally, the floating exchange rate strategy reflects long-term currency price fluctuations that indicate the relative interest rate and economic strength differences between countries. On the other hand, short-term fluctuations in a floating exchange rate currency system mean disasters, rumors, speculations, and daily demand & supply for the foreign currency.

In a case where demand outstrips supply, the currency rises. Where supply outstrips demand, the money falls. Yet, extreme short-term fluctuations can call for the central bank’s intervention even in a floating rate system. Although most nations’ currencies are floating, governments and central banks occasionally step in whenever the money becomes too low or high.

Whenever the currency is too low or too high, it can impact the economy negatively. It can also affect debt repayments aptitude and overall national trade. Central banks and governments often try to set measures to regulate the currency’s value.

What Makes Fixed Exchange Rates Different

The central bank and government determine a pegged or fixed exchange rate. In this case, they set the exchange rate against other widely traded currencies such as the yen, euro, or US dollar. Hence, the government will sell and buy its currency against the fixed currency to maintain the fixed exchange rate regime.

Some countries that have pegged their currencies against the US dollar include Saudi Arabia and China. After the Bretton Woods system collapsed in 1968 and 1973, the world’s significant economies switched to the floating exchange market.

The Floating Exchange Rates History

The Bretton Woods Conference established a gold standard for all currencies in July 1944. In general, the meeting included attendees from 44 countries who were close allies during World War II. The conference set regulations for an elaborate fixed exchange rate plan and established the World Bank and the IMF (International Monetary Fund).

Most participating countries pegged their currency to the US dollar and established a standard gold price of about $35 per ounce. In any case, the conference permitted the adjustments of minus or plus one percent. Hence, the US dollar became a reserve currency that all central banks carried out interventions to stabilize or adjust rates.

Unfortunately, this system faced its first large crack in 1967 due to a run-on gold and the British pound attack that resulted in a 14.3% devaluation. Hence, President Richard Nixon withdrew the US currency from the gold standard system in 1971. The scheme collapsed by late 1973, and participating currencies opted to float freely in international trade.

The floating exchange system now enabled the central banks to sell or buy their local currencies to maintain or adjust the exchange rate. This strategy can help stabilize a volatile stock exchange market or attain a significant transformation in the exchange rate. For that reason, central banks groups for the G-7 nations like United States, United Kingdom, Japan, Italy, Germany, France, and Canada worked together to increase the impact of coordinated interventions.

In general, interventions are often short-term and rarely succeed. An excellent example of an intervention that failed was in 1992 when financier George Soros led a major currency attack on the British pound. This intervention happened after the British pound entered the ERM (European Exchange Rate Mechanism) in October 1990. Generally, the ERM intended to limit currency volatility for the euro, and it was still in the planning stages.

Sir George believed that the British pound had fallen into an extremely high rate. Thus, he planned a concerted currency attack. The Bank of England got forced to devalue its currency. Hence, they withdrew from the ERM. Records indicate that this failed intervention costed the UK about 3.3 billion euros in the treasury. On the other hand, George made more than one billion dollars profit.

The bottom line is that central banks and governments can intervene indirectly in the stock markets by lowering or raising interest rates to monitor investors’ funds flow within a country. Due to the historical failure of attempts to control currencies within tight bands, many governments opt to float their money and use economic tools to allow them to nudge it in one direction if it moves beyond their comfort zones.

Also Read: A Complete Guide To Currency Risk

Frequently Asked Questions

1. What are the Implications of Floating Rates?

The floating nominal exchange rate can result in long-term currency price fluctuations that reflect the countries' relative interest rate and economic strength differences. Short-term results of the floating exchange rate fluctuations translate to daily demand & supply for the currency, disasters, rumors, and speculations.

2. What happens if exchange rates are floating freely?

Generally speaking, a floating exchange rate regime describes an exchange rate plan where a country’s money value gets determined by its relative demand and supply of other countries' currencies. Unlike countries with a fixed exchange rate regime, currencies in a floating exchange rate system get traded freely with no restrictions.

3. How does the floating exchange rate affect the economy?

The most remarkable economic impact of the floating exchange rates system is that it allows the fiscal and monetary authorities to pursue internal objectives free. It offers freedom for major economic factors such as price stability, stable growth, and full employment. In any case, any exchange rate change intends to stabilize and promotes these objectives automatically.

References:

1. https://www.investopedia.com/trading/floating-rate-vs-fixed-rate/

2. https://corporatefinanceinstitute.com/resources/knowledge/economics/floating-exchange-rate/

3. https://en.wikipedia.org/wiki/Floating_exchange_rate