Contents

- What is a Slippage?

- How Slippage Works?

- How to Evade Dispersed Exchanges Slippage?

- How to Increase Slippage Tolerance Percentage?

- Slippage Tolerance in Crypto

- Things to Keep in Mind About Slippage Expected Price

- Conclusion

- FAQs

What is a Slippage?

A Slippage refers to the alteration in the anticipated trade price and the execution price of a trade. This occurs whenever but it is mostly seen during times of high volatility amidst the use of market orders.

This also occurs when a bulky order is carried out but there is the limited volume of the price chosen to preserve the present bid or ask spread.

Take note that slippage is more pronounced in crypto markets and on any decentralized exchange (DEX) like Pancakeswap and Uniswap.

This is a result of the high levels of price volatility . Now, it also contributes to the common problems faced by altcoins like how much liquidity and low volume.

Also Read: Slippage Trading

How Slippage Works?

The Slippage doesn’t signify a positive or negative moment because even the slightest change in the proposed value and real execution cost passes for a slippage.

When a client’s order is accomplished, the asset is bought or sold at a very friendly price obtainable by a market maker or an exchange.

This activity can yield more promising results and results that are, equal, or not promising than the proposed execution price.

Ending implementation price vs. the proposed implementation price are classified as no slippage, negative slippage, or positive slippage. It occurs amidst the delay amongst an ordered trade and when it is finalized because market prices change quickly. The term ‘Slippage” is used often under separate conditions for each scene.

A limit order averts any damaging slippage. The order transmits the essential threat of the trade not being implemented if the supposed price seizes to go back to the boundary level.

In practice, the risk increases depending on situations whereby market fluctuations are evident.

The fluctuations occur quickly and limit the amount period left for a trade to be concluded by the proposed execution price.

How to Evade Dispersed Exchanges Slippage?

The moment between the period you approve a deal, and the minute the transactions gets confirmed on a blockchain, price slippage happens. When the block chain is supported with loads of dealings, mineworkers rank and routes the transaction giving the maximum gas.

To avoid and lessen slippage, spend more on gas or a quick gas sum that assures you of the transaction getting settled immediately. This is to avoid price slippage. Deal on a layer two solution where you pay less for faster transactions.

The transactions made on layer 2’s are low-priced than on Ethereum. Make an adjustment to the slippage tolerance levels from high or low for the different situations to ensure your transaction gets chosen. Also, break up large buys into smaller chunks.

How to Increase Slippage Tolerance Percentage?

The platform used tells the changes that would be faced. You can change your rates as you deem fit but slippage tolerance can be increased in some ways.

Max Slippage Tolerance:

Since there is no max slippage tolerance, you can set the rate you desire.

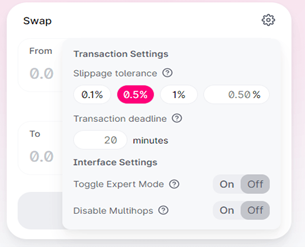

Adjust Slippage Tolerance at Uniswap:

The slippage tolerance for Uniswap is 0.5%. Click on the gear icon located at the top right corner of the browser to adjust your slippage in the swap interface.

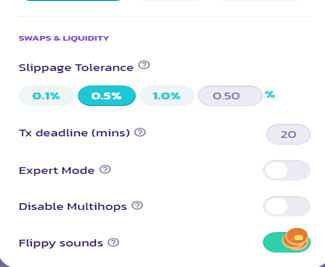

Adjust Slippage Tolerance at Pancakeswap:

The default slippage tolerance for Pancakeswap is 0.5%-1%. Click on the Settings icon located at the top corner of the browser to adjust slippage tolerance.

Slippage Tolerance in Crypto

Before executing any trade on DEX, understand slippage tolerance because it's not the same as trading stocks. Using platforms such as Pancakeswap and Unswap will make you acquainted with slippage.

The volatility in asset price can create such a situation whereby the executed price is different from the quoted and expected price when trading crypto.

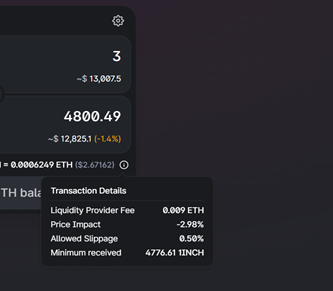

The expected percentage difference between the intended and executed prices is called slippage. For a less experienced trader, slippage can become a frustratingly slippery slope. Pick an interest in understanding the volatility of cryptocurrency.

Things to Keep in Mind About Slippage Expected Price

Mistakes would always occur when setting orders and limits. But when dealing with slippage, use smaller transactions for the exchange. With Ethereum gas fees rising, transactions would cost more. Lower slippage would be noticed when the transaction is done for popular pairs so this is not a problem.

Transactions for small coins would carry high slippage tolerance, so keep a tab on that. Keeping tabs on available liquidity will result in lowering down slippage tolerance thanks to price volatility.

Entering Positions

Do not confuse a stop-limit order with a stop-loss. A limit order and stop-limit order are used to take a position. Using those types of orders, you don’t make a trade if you can’t get the deal you set. You can miss out on a rewarding opportunity and also avoid slippage when placing limit orders.

To ensure that your trade can be executed, use a market order. Although there is a likelihood of ending up with a slippage or an inferior price.

Be sure of your trades to make use of stop-limit or limit orders to take or leave your positions. Make sure to avoid anything that would cost you unnecessary slippage. There are fast-moving market conditions that need market orders for strategies. This is to put you in and out of the trade.

Exiting Positions

While in a trade with funds involved, you have little or no control unlike the minute you go into the trade. Market orders might come in handy here; they would help get you out of the position faster. You can also use limited orders to exit the market under more promising conditions.

When you set a stop for your loss, you might use a market order (an order that gets you out in unfavorable price conditions).

This would make sure that you have an exit instead of losing the deal but not at the preferred price. A limit order for stop loss will make the order to go in at the price you desired except it is going against you.

This is the reason why you should focus on a market order for stop loss to make sure that the loss incurred doesn’t get bigger than expected; experiencing slippage might be the cost.

Conclusion

Slippage tolerance is a term that beginners and expert traders should be aware of. The world of decentralized exchanges is evolving and becoming vital for traders to understand popular terms like price impact, and slippage among others. To become a pro in trading, take note of slippage tolerance.

Also Read: What Is Implied Volatility

FAQs

What should my slippage tolerance be?

Slippage tolerance differs with the exchange used. You have the power to set the maximum percentage of the price movement you can bear. Setting it above your order might lead to loss.

What does slippage mean?

Slippage is the difference between the expected price of a trade and the price at which the trade is executed. The slippage in question can occur at any given time but is most evident during periods of higher volatility with the use of market order.

What is a 2% slippage?

Setting a 2% slippage means that the transaction would cost more than the expected price and the order would not execute.

What is the slippage tolerance on Pancakeswap?

The slippage tolerance on Pancakeswap is between 0.5% and 1%.