The Continuous Linked Settlement (CLS) system is a vital mechanism that minimizes settlement risk in foreign exchange transactions. Suppose you're an investor, a financial institution, or someone involved in Forex trading. In that case, understanding the ins and outs of CLS can significantly impact your trading experience and risk management. This specialized system ensures that both sides of a foreign exchange transaction are completed simultaneously, adding an extra layer of security and efficiency to each trade.

In this comprehensive guide, we'll walk you through the complexities of CLS, breaking it down into easily digestible segments. We'll cover its origins, functionality, the role of CLS Bank International, and how it interacts with major and central banks. This article aims to enhance your understanding of settlement risk and foreign exchange, especially concerning the CLS system. Whether you're a seasoned trader or new to the FX market, this information is vital for safer and more efficient trading.

What is Continuous Linked Settlement?

(Photo: Wikipedia)

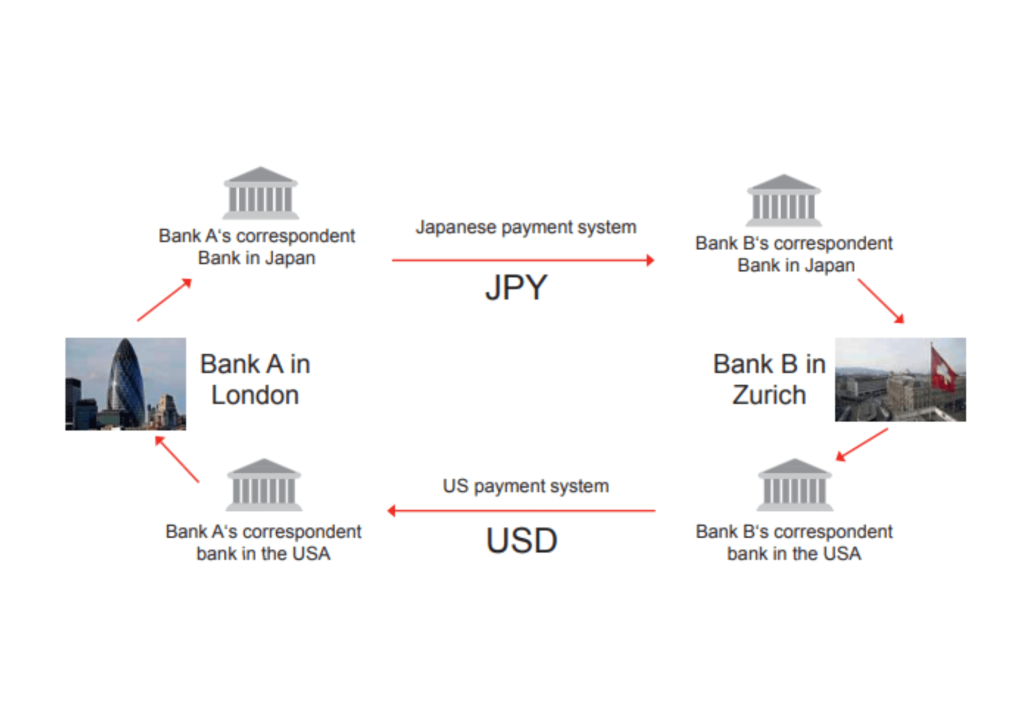

Continuous linked settlement is a system developed to tackle the problem of settlement risk in the fast-paced FX market. Operated by CLS Bank International, this unique platform provides an avenue for the simultaneous settlement of foreign exchange transactions. This means that both sides of an FX transaction—each involving a different currency—are settled simultaneously. The system acts as a third party, making sure that the currency bought is exchanged for the currency sold only when both sides can fulfill their obligations.

The core principle behind continuous linked settlement is payment versus payment, ensuring that payments are made by both parties involved. The CLS system supports many FX transactions, including spot trades, forward contracts, and even some currency swaps. Major banks, financial institutions, and even third-party organizations can use CLS to ensure safer and more effective trades, thereby strengthening the overall infrastructure of the FX market.

Also Read: The Market Structure in Forex

Why is CLS Important?

The importance of the Continuous Linked Settlement (CLS) system is deeply rooted in its ability to mitigate settlement risk—the risk that one party will fail to deliver on their end of the foreign exchange transaction. The concept of payment versus payment is integral here. CLS provides a safety net by ensuring that the currencies involved in a trade are exchanged only when both parties meet their obligations. This minimizes the chances of financial loss due to default and adds a layer of trust and reliability to the FX market.

Moreover, CLS also brings operational efficiencies into the settlement process, streamlining how financial institutions, major banks, and other market participants handle FX transactions. Its centralized approach enables the netting of settlement obligations, thus reducing the liquidity needs of settlement members. This makes the FX market more secure and efficient, reinforcing the system's critical role in global finance.

How Does CLS Work?

The Process

In a typical CLS process, both sides of a trade are settled simultaneously. The CLS settlement process confirms that both currencies are available. This is crucial for reducing foreign exchange settlement risk.

Participants

Member banks are key players. Each settlement member has a net position that is calculated. This settlement member's net position reflects all the FX trades done by the bank. Besides member banks, third-party financial institutions can also take part. They are called CLS participants.

Supported Currencies

The system supports a wide range of currencies, from the US and Canadian Dollar to the Australian, New Zealand, and even the South African Rand, among others.

Settlement Date and Time

Transactions usually occur on the normal settlement day. The process is typically completed within a five-hour window.

Also Read: What is Liquidity Coverage Ratio

The Role of CLS Bank

At the heart of the Continuous Linked Settlement system is the CLS Bank. This member bank serves as the central hub for all activities. It is responsible for collecting and storing all the transaction data, calculating settlement members' net position, and executing the CLS settlement process. It plays a critical role in ensuring that operational efficiencies are maintained. This means the bank ensures that transactions are settled correctly and that settlement members and CLS participants have accurate, up-to-date information.

CLS Bank is overseen by various central banks, ensuring that it adheres to international regulations and standards. Regulatory bodies like the Basel Committee on Banking Supervision frequently review the bank's operations. Moreover, CLS Bank works closely with major banks and other financial institutions, ensuring that the system remains adaptive to market needs and changes. This collaborative approach among CLS Bank, major banks, and regulators ensures the system's reliability and trustworthiness, making it essential to mitigate foreign exchange settlement risk.

Regulatory Oversight

Regulatory oversight is a key aspect of the Continuous Linked Settlement (CLS) system, ensuring that it operates within the boundaries of international financial laws and standards. The central banks of the currencies that are part of the CLS system play a pivotal role in this oversight. Institutions such as the Basel Committee on Banking Supervision also provide governance, laying down the rules and best practices that CLS Bank and settlement members should follow. These guidelines are often highlighted in publications like the BIS Quarterly Review, offering insights into the system's effectiveness and areas for improvement.

The regulatory scrutiny ensures that the CLS system is transparent, reliable, and secure for all parties involved—from major banks to financial institutions and third-party participants. Regulatory oversight also helps adapt the system to market changes and emerging risks, ensuring its long-term sustainability. This oversight adds another layer of security and confidence, making the CLS system a preferred choice for managing FX settlement risk.

Risks and Limitations

While the Continuous Linked Settlement (CLS) system is highly effective in mitigating FX settlement risk, it is not without its risks and limitations. Despite its many advantages, these limitations should be considered when evaluating the CLS system's role in reducing settlement risk.

Limited Currency Inclusion

Despite its global reach, the CLS system does not cover all currencies. While it includes major currencies like the US Dollar, Pound Sterling, and Euro, it may exclude others like the Israeli Shekel or the South Korean Won. Traders dealing in less common currencies need to be aware of this limitation.

Operational Risk

The CLS system relies on intricate technology and data submission from settlement members. This makes it vulnerable to operational risks like system glitches or human errors. Disruptions in the technology infrastructure could hinder the CLS settlement process.

Cybersecurity Threats

Like any other digital platform, the CLS system is susceptible to cybersecurity risks. A successful cyber-attack could compromise the integrity of FX transactions and put settlement members and CLS participants at risk of financial loss.

Data Accuracy

For the CLS process to work effectively, settlement members and financial institutions must submit accurate and timely data. Incorrect data submissions can lead to miscalculations in the settlement members' net position, complicating the settlement process.

Cost and Complexity

While CLS adds a layer of safety to FX transactions, it also introduces complexity and costs. Member banks and other participants may need to adapt their systems to interface with CLS, incurring additional operational expenses. The costs and complexity could be a barrier for smaller institutions.

Conclusion

Continuous Linked Settlement (CLS) has revolutionized the way foreign exchange transactions are conducted. Reducing FX settlement risk has become an invaluable tool for settlement members and financial institutions involved in the FX market. Whether you're trading Pound Sterling, Swiss Franc, or Japanese Yen, understanding the CLS concept can greatly benefit your transactions.

By adhering to regulatory standards set by central banks and gaining widespread acceptance among major banks, the CLS system has proven its worth in ensuring safer and more efficient foreign exchange settlement.

Also Read: Identifying Bank Manipulation & Forex Day Trading Strategy

FAQs

What is Payment Versus Payment in CLS?

Payment versus payment is a key principle in the CLS system. It ensures that both sides of a foreign exchange transaction are settled simultaneously. This eliminates the settlement risk that one party will fail to fulfill their obligation.

Who Oversees the CLS System?

The CLS system is overseen by various central banks and regulatory bodies like the Basel Committee on Banking Supervision. These institutions ensure that CLS operates within international financial laws and standards.

Can All Banks Participate in the CLS System?

Not all banks are settlement members of CLS, but many major banks are. Other financial institutions can also participate as CLS participants through a settlement member. However, there are costs and complexities involved in joining the system.