In the realm of finance, liquidity refers to the ability to quickly convert assets into cash without causing a significant impact on its value. It's a fundamental concept that underpins the efficiency and stability of markets. For banks, liquidity is the lifeblood that allows for the facilitation of short-term obligations, such as customer withdrawals and interbank transactions.

Liquidity is crucial not only for maintaining operational efficacy but also for building trust among stakeholders. For investors and traders like us, liquidity ensures that we can enter or exit positions at will, offering us the flexibility to capitalize on market opportunities or limit losses. Inefficient liquidity can result in slippage and higher transaction costs, hampering profitability.

Given its paramount importance, various metrics and ratios have been developed to assess liquidity levels. This article will zero in on one such critical metric: the Liquidity Coverage Ratio (LCR). Designed to evaluate the short-term resilience of financial institutions, LCR has far-reaching implications for market stability and risk assessment. Understanding this ratio can provide valuable insights for investment decisions and risk management strategies.

Definition of Liquidity Coverage Ratio

In the highly leveraged world of Forex trading, understanding various financial ratios is not just advantageous—it's essential. One such key ratio is the Liquidity Coverage Ratio (LCR). Simply put, LCR measures a bank's ability to cover its short-term liabilities with high-quality liquid assets (HQLA). In layman's terms, it tells us how well a bank can withstand a 30-day financial stress scenario by liquidating easily convertible assets.

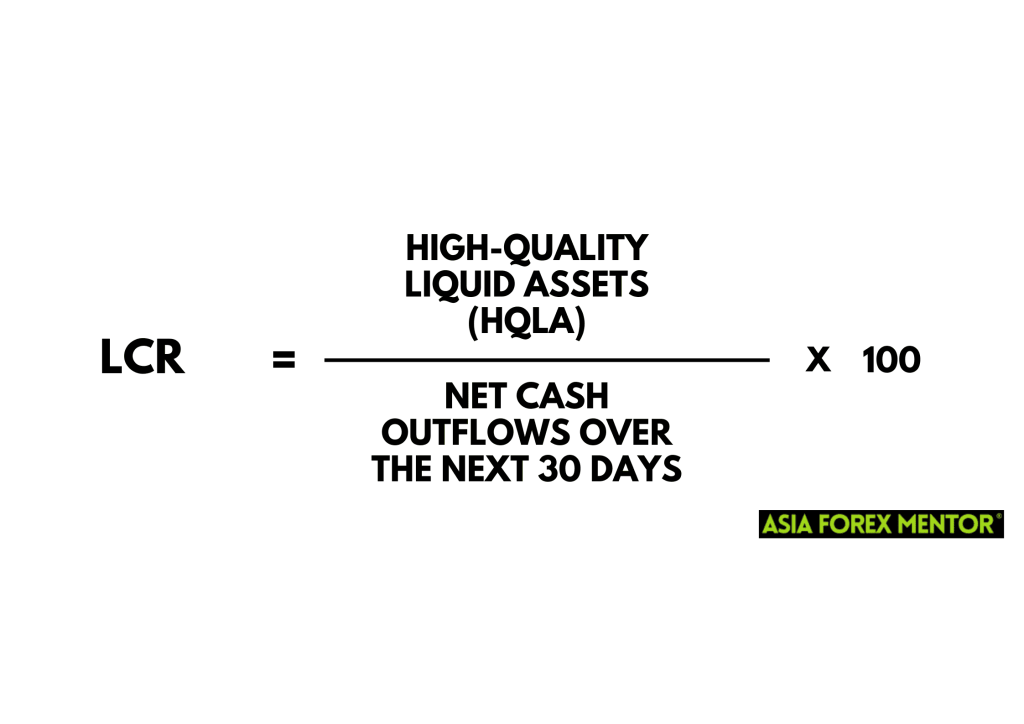

Diving into the technical definition, the LCR formula is as follows:

The objective is to maintain an LCR of 100% or more, indicating that a bank has enough HQLA to meet its 30-day net cash outflows in case of a financial crisis.

Breaking down the components:

- High-Quality Liquid Assets (HQLA): These are assets that can be quickly sold or used as collateral to obtain liquidity. They are typically low-risk and easily convertible to cash, such as government bonds.

- Net Cash Outflows over the next 30 days: This includes both expected cash outflows like withdrawals, loan repayments, and margin calls, minus any expected cash inflows within a 30-day period.

For Forex traders and investors, understanding a bank's LCR can provide crucial insights into its financial stability. A bank's ability to meet its short-term obligations can have a domino effect on currency value, interest rates, and overall market volatility—factors that significantly impact Forex trading strategies and investment decisions.

Purpose and Importance

Navigating the Forex market involves dealing with a web of variables, and bank stability is one of them. This is where the Liquidity Coverage Ratio (LCR) becomes particularly relevant. From a regulatory perspective, LCR serves as a critical tool for central banks and financial authorities. Regulatory bodies such as the Basel Committee on Banking Supervision mandate a minimum LCR to ensure that banks are capable of withstanding liquidity stress scenarios. Non-compliance could result in penalties, reinforcing the need for banks to maintain adequate liquidity levels.

When it comes to financial stability, the LCR is akin to a safety net. A robust LCR ensures that banks have enough high-quality liquid assets to counteract short-term liabilities. This stability, in turn, has a ripple effect on various financial markets, including Forex. Financial institutions with strong LCRs are less likely to collapse in crises, thus contributing to a more stable economic environment.

Lastly, for risk assessment, the LCR serves as a reliable metric. By evaluating a bank's LCR, you can gauge its liquidity risk, which is invaluable for traders and investors. A low LCR could indicate a higher probability of liquidity-related issues, which can lead to heightened volatility or even insolvency events—factors that significantly impact currency value and trading conditions.

Also Read: Forex Risk Management

How Liquidity Coverage Ratio Works

Getting to grips with how the Liquidity Coverage Ratio (LCR) works can offer invaluable insights for Forex trading. Let's break it down:

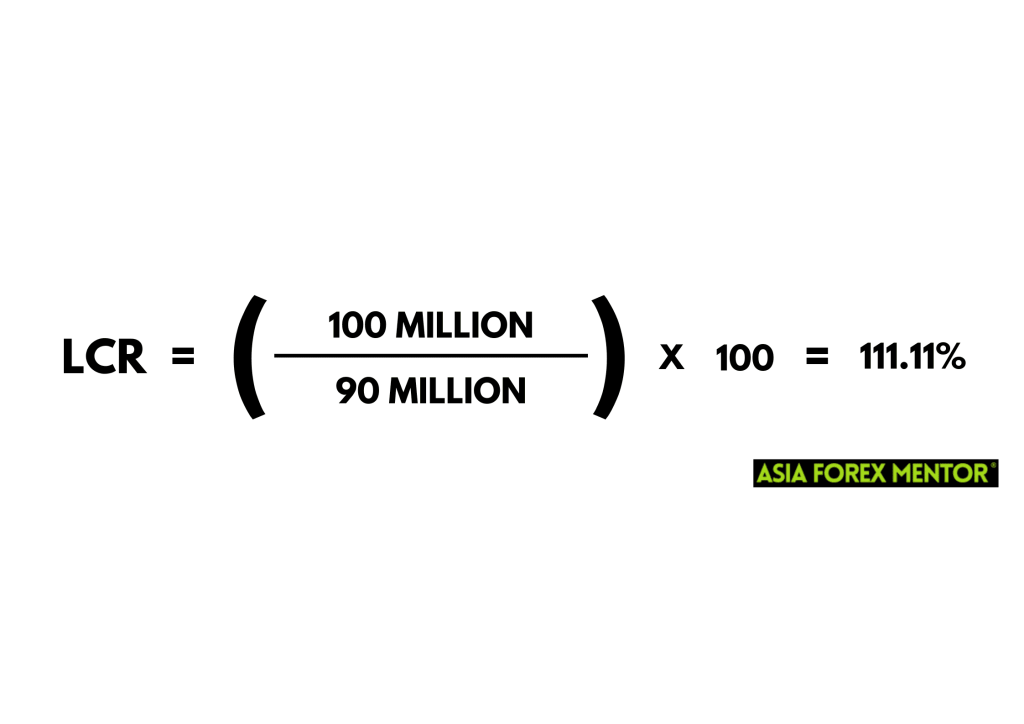

Starting with the calculation, let's walk through a simplified example. Assume Bank A has $100 million in High-Quality Liquid Assets (HQLA) and expects Net Cash Outflows of $90 million over the next 30 days. The LCR would be calculated as follows:

This result indicates that Bank A has enough liquid assets to cover its short-term liabilities, as the LCR is above 100%.

What are High-Quality Liquid Assets (HQLA) exactly? These are assets that are extremely liquid and can be turned into cash rapidly and with little impact on their price. Government bonds, Treasury bills, and cash are all examples. The role of HQLA is critical: they serve as a reserve that may be quickly drawn upon to cover short-term obligations, thus acting as a financial cushion.

Finally, let us look at Net Cash Outflows. This word refers to the predicted cash leaving the bank less any cash coming in during a set period of time, often 30 days. It's an important indicator since it shows the overall liquidity a bank requires to survive a financial stress scenario. In essence, it estimates worst-case outflows, assisting both banks and investors in preparing for poor situations.

Understanding the mechanics of LCR can arm Forex traders and investors with valuable information about the stability of financial institutions, which can, in turn, influence trading strategies and risk assessments.

LCR in the Investment World

In the investment landscape, the Liquidity Coverage Ratio (LCR) holds significance for both banks and investors, especially in the realm of Forex trading.

Firstly, for Banks and Financial Institutions, maintaining an adequate LCR is not just a regulatory requirement but also a cornerstone of financial health. An LCR that meets or exceeds the mandated levels builds confidence among shareholders, creditors, and the market at large.

A high LCR signals that a bank can weather short-term liquidity shocks, thereby reducing the risk of default. This stability is particularly important in international Forex markets, where currency values are impacted by a multitude of factors, including the strength and stability of financial institutions.

On the other hand, for Investors, having a grasp of LCR can be an added tool in the analytical toolkit. Understanding a bank's LCR can provide insights into its financial stability. For Forex traders and investors, this is vital information. A bank with a strong LCR is less likely to face liquidity issues, making it a more secure counterpart for trading and investment.

Furthermore, LCR levels can have an impact on interest rates and, by extension, currency value. Because of the lower risk, an institution with a high LCR may offer lower rates on its products, thus influencing the attractiveness of specific currencies.

Pros and Cons

As someone deeply involved in financial trading, understanding the pros and cons of metrics like the Liquidity Coverage Ratio (LCR) is integral to making informed decisions. Let's delve into both the advantages and the drawbacks of using this ratio.

Advantages:

- Risk Mitigation: LCR serves as an excellent tool for gauging a bank's ability to withstand liquidity shocks. For traders, a high LCR can signify reduced counterparty risk, making it a more attractive trading partner.

- Market Confidence: Institutions that consistently maintain a high LCR tend to instill greater market confidence. This stability can positively influence currency value and trading conditions.

- Regulatory Alignment: Being a globally recognized standard, LCR allows for easier comparison across banks, irrespective of geographical location. This uniformity is beneficial when looking for international trading opportunities.

Drawbacks:

- Reduced Profitability: To maintain a high LCR, banks often have to hold low-yield assets. This conservative stance may reduce potential returns for both the bank and its investors.

- Liquidity Hoarding: During economic uncertainty, there's a tendency for banks to hoard high-quality liquid assets to maintain a strong LCR, which can exacerbate liquidity issues in the broader market.

- Short-term Focus: While LCR is excellent for assessing short-term liquidity risk, it doesn't provide insights into longer-term financial stability. Traders looking at longer time horizons may find this metric less useful.

How LCR Differs from Other Liquidity Ratios

When diving into liquidity ratios, it's imperative to recognize that while they may seem similar, each serves a specific purpose and offers unique insights. Let's explore how the Liquidity Coverage Ratio (LCR) stands apart from other liquidity ratios.

Comparison with Other Ratios:

- Current Ratio: Unlike the LCR, which focuses on a 30-day window, the current ratio measures a company’s ability to pay off its short-term liabilities with its short-term assets, typically within a year. LCR is more tailored for assessing immediate liquidity risk.

- Quick Ratio: Also known as the acid-test ratio, this metric excludes inventory from its short-term assets. While it offers a more stringent liquidity test than the current ratio, it's still not as specialized as LCR in addressing immediate, short-term liquidity needs.

- Operating Cash Flow Ratio: This ratio uses cash from operations to assess a company's liquidity. However, it doesn't specifically account for high-quality liquid assets, which is a cornerstone of LCR.

Unique Features of LCR:

- Regulatory Focus: LCR is not just an internal metric but a globally recognized regulatory standard, specifically designed for financial institutions.

- High-Quality Liquid Assets (HQLA): LCR places a premium on assets that can be quickly and easily converted to cash with minimal impact on price. This is a specific requirement that sets it apart from other liquidity ratios.

- Stress Test Element: LCR considers a stressed 30-day scenario for net cash outflows, making it specialized for gauging resilience under adverse conditions.

Conclusion

We can say that Liquidity Coverage Ratio should not be treated as a Swiss Army knife when it comes to financial metrics. It might be good for assessing short-term risks and can be a reliable indicator to check market stability, but using this tool solely does not accurately assess risks.

Always keep in mind that LCR is not a long-term stability indicator. During turbulent times, relying too much on LCR can even distort market liquidity. I advise to use it wisely, but never use it as a sole metric to assess risks. Like any smart trader, you'll want to balance your insights from LCR with other financial ratios and market indicators to get a 360-degree view of your trading landscape.

Also Read: What is the MOVE Index?

FAQs

What types of assets qualify as High-Quality Liquid Assets (HQLA) in LCR?

High-Quality Liquid Assets (HQLA) are primarily low-risk, easily convertible assets that a bank can quickly liquidate to generate cash. Examples include government bonds, Treasury bills, and cash reserves. The emphasis is on quality and liquidity; these assets should have a proven track record of ease of liquidation even in stress scenarios.

How often do banks need to calculate and report their LCR?

The frequency of reporting can vary based on the jurisdiction and the specific regulatory agency in charge of the financial institutions. However, banks are frequently obliged to calculate and report their LCR on a monthly basis. This enables authorities to maintain a tight check on the banking sector's short-term liquidity risks.

Can LCR be used for companies outside the banking sector?

While LCR is primarily designed for regulated financial institutions like banks, its underlying principle of comparing liquid assets to short-term liabilities can be conceptually applied to other companies. However, it's worth noting that LCR is specially tailored to meet regulatory standards for banks and might not offer the same level of insight when applied to non-banking entities.