In the world of foreign exchange, or forex for short, there are a lot of special terms. One of the most interesting terms you might come across is “exotic currency pairs.” These are about trading less common currencies from places that are growing economically against the big currencies used by countries with strong economies. This article takes a deep dive into what makes exotic currency pairs both fascinating and a bit risky. It's a great read for anyone interested in forex trading, especially if you're just getting started or not too familiar with the financial market.

This piece is meant to be a handy guide to help both beginners and those who've been around the block a few times in the forex world. We'll get into what exotic currency pairs are all about, showing you both the opportunities they offer and the challenges they might bring. Whether you're new to trading or looking to expand your knowledge, understanding exotic currency pairs could really open up new possibilities for you. It's all about giving you the know-how you need to navigate through the ever-changing waters of the forex market.

What are Currency Pairs?

In the forex market, the concept of a currency pair is foundational. It's how two different currencies are quoted against each other. The first currency listed is known as the base currency, and it's quoted in terms of the second currency or quote currency. This setup is what makes buying and selling currencies possible, acting as the heartbeat of the entire forex trading system.

Understanding currency pairs is crucial for anyone looking to dive into forex trading. They represent the exchange rate between two currencies, showing how much of the quote currency is needed to purchase one unit of the base currency. This mechanism not only supports the basic function of foreign exchange but also opens up a world of trading opportunities, from the major pairs involving the world's strongest currencies to the more volatile exotic pairs from emerging markets.

Major vs. Exotic Currency Pairs

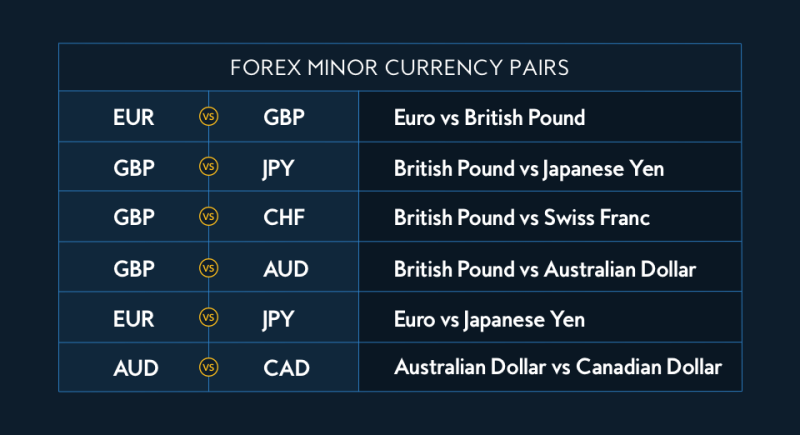

Major currency pairs feature the heavyweight currencies of the global economy, such as the US Dollar (USD), Euro (EUR), and British Pound (GBP). These pairs dominate the forex market, thanks to the vast economies they represent and the high volume of trading they generate. They are the go-to for traders seeking stability and predictability in their investments, serving as benchmarks for the health of the global financial system.

In contrast, exotic currency pairs introduce a blend of one major currency and another from an emerging market or smaller economy, adding diversity and excitement to forex trading. Examples like the Singapore Dollar (SGD), South African Rand (ZAR), and Turkish Lira (TRY) showcase the vast range of trading opportunities beyond the major pairs. These pairs often come with higher volatility and potential for significant gains, appealing to traders loo

king for more dynamic and potentially rewarding trading scenarios.

Why Trade Exotic Currency Pairs?

Trading exotic currency pairs can be an enticing endeavor, primarily because of their volatility and the potential for high returns. The fluctuating nature of currencies like the Brazilian Real (BRL), Mexican Peso (MXN), and the Russian Ruble (RUB) can create opportunities for astute traders to capitalize on rapid price movements. These pairs allow investors to venture beyond the relative safety of major pairs, tapping into the economic dynamics of emerging markets, which can offer rewarding prospects under the right conditions.

However, the very factors that make exotic pairs potentially lucrative also introduce higher risks and less liquidity. Unlike their major counterparts, exotic currency pairs are not traded as heavily, which can lead to wider spreads and less predictable movements. This lack of liquidity can make it more challenging to enter or exit positions at desired prices, increasing the risk of slippage. Traders interested in the exotic forex market must therefore approach with caution, equipped with a solid strategy and a keen awareness of the geopolitical and economic factors that can sway these currencies.

Challenges in Trading Exotic Pairs

Studying the foreign exchange market demands a keen understanding, especially when dealing with exotic pairs. These currencies are directly influenced by the economic health and political climate of emerging market economies. Traders need to keep a close eye on political instability, interest rates, and economic indicators within these regions, as these factors can cause significant fluctuations in the value of exotic forex pairs. Such depth of knowledge ensures traders can make informed decisions, potentially turning the inherent risks of these markets into opportunities for gain.

The impact of these variables on exotic pairs is often more pronounced than on major currencies, given the relative fragility of emerging market economies. Political events, for example, can lead to sudden and sharp movements in currency values, while changes in interest rates by central banks can attract or deter foreign investment, affecting currency strength. Hence, trading in this segment of the forex market requires not just a grasp of financial principles but also an awareness of global geopolitical and economic developments. This dual focus can help traders navigate the complexities of exotic pairs, leveraging volatility for potential returns while managing the heightened risks.

Strategies for Trading Exotic Currency Pairs

Successful trading strategies for exotic pairs often leverage technical analysis and swing trading techniques, alongside a deep understanding of exchange rates. Technical analysis helps traders identify patterns and trends in currency movements, offering insights into potential future movements. Swing trading, on the other hand, aims to capitalize on gains in the forex market over a period from several days to weeks, which can be particularly effective in the volatile markets of exotic pairs. This combination, coupled with a solid grasp of how global events affect exchange rates, allows traders to make informed decisions, maximizing opportunities for profit while minimizing risks.

Adapting one's trading style is crucial when dealing with the heightened risks of exotic pairs. The unpredictability of these markets, due to factors like political instability and economic changes in emerging economies, demands flexibility and a proactive approach to risk management. Strategies such as setting stop-loss orders, diversifying portfolios, and keeping abreast of global economic news are vital. By tailoring their approach to the unique challenges of exotic pairs, traders can navigate these waters more safely, turning potential risks into rewarding opportunities.

Benefits of Trading Exotic Pairs

Trading exotic currency pairs opens the door to potentially untapped markets, offering a unique avenue for diversification beyond the more traditional and heavily traded currencies. This diversification can enhance a trading portfolio by spreading risk across a wider range of currencies, including those from emerging markets. Such markets often experience rapid economic changes that can lead to significant currency fluctuations, presenting opportunities for astute traders to capitalize on these movements. Engaging with exotic pairs, therefore, not only broadens the horizon of investment options but also introduces the potential for higher returns, albeit with increased risk.

The allure of trading in exotic markets lies in the opportunity to benefit from the dynamic nature of emerging economies. These economies can offer rapid growth potential, which, in turn, can result in more pronounced currency movements compared to developed countries. For traders willing to delve into the complexities of these markets, the rewards can be substantial. However, it requires a keen understanding of the factors that influence currency values in these regions, including political stability, economic policies, and global commodity prices. As such, trading exotic pairs is not just about seeking profit but also about embracing the challenge of navigating the intricacies of the global financial landscape.

Risks Associated with Exotic Currency Pairs

Exotic currency pairs are characterized by their thin trading volumes and high volatility, which can lead to rapid and significant exchange rate fluctuations. This aspect of trading exotic pairs requires traders to be especially vigilant, as the unpredictable nature of these markets can result in sudden price movements that may not favor their positions. The volatility is largely due to the economic and political uncertainties in emerging markets, making these currencies more susceptible to swift changes in valuation.

Moreover, the wider spreads and higher costs associated with exotic pairs are a reflection of their lower liquidity and increased risk. The spread, or the difference between the buying and selling price, tends to be larger with exotic pairs, which means traders could be facing higher transaction costs right from the start. These factors combined make trading in exotic currencies a more complex endeavor, necessitating a well-thought-out strategy and a higher tolerance for risk. Traders must account for these challenges in their trading plans, ensuring they have adequate measures in place to manage potential losses.

Selecting a Forex Broker for Exotic Pairs

Selecting the appropriate forex broker is a critical step for traders aiming to venture into the world of exotic currency pairs. A suitable broker not only provides access to a broad selection of exotic pairs but also ensures competitive spreads and robust trading platforms. These features are essential for navigating the complexities of the forex market efficiently and effectively. A good broker enhances trading experiences by offering comprehensive tools and resources, enabling traders to make informed decisions and manage their trades with greater precision.

Among the reputable brokers in the market, AvaTrade stands out as a prime choice for traders interested in a wide variety of currency pairs. With over 50 major, minor, and exotic currency pairs, AvaTrade caters to a diverse trading community, ensuring that traders have ample opportunities to engage with the market. Similarly, Exness is another noteworthy broker, offering over 45 major, minor, and exotic currency pairs. These brokers are known for their commitment to providing traders with a conducive trading environment, highlighting their importance in the successful trading of exotic currency pairs.

Conclusion

Trading exotic currency pairs offers a unique blend of opportunities and challenges that are not found in dealing with more conventional currency pairs. These pairs, which include currencies like the South African Rand or the Mexican Peso, can provide significant rewards due to their volatility and the potential for large fluctuations. However, this same volatility introduces a higher level of risk. Successful traders in the forex market are those who have a deep understanding of these dynamics. They invest time in thorough research and craft carefully thought-out trading strategies specifically tailored to navigate the complexities of exotic forex pairs.

Understanding the principles of foreign exchange is crucial when trading exotic currencies. A solid foundation in forex trading basics, combined with up-to-date information on the political and economic conditions affecting these currencies, is essential for making informed decisions. This knowledge allows traders to anticipate market movements and manage risks more effectively. Regardless of whether a trader is drawn to the potential of the South African Rand for its ties to commodity prices or the Mexican Peso for its close economic links with the United States, success hinges on a comprehensive strategy that includes a keen awareness of global economic indicators, geopolitical events, and an adept application of trading tools and techniques.

FAQs

What are exotic currency pairs?

Exotic currency pairs involve one major currency, like the US Dollar (USD), Euro (EUR), or British Pound (GBP), paired with the currency of an emerging market or a smaller economy, such as the South African Rand (ZAR) or the Mexican Peso (MXN). These pairs are less commonly traded than major or minor pairs and often exhibit higher volatility and wider spreads.

Why trade exotic currency pairs?

Traders opt for exotic currency pairs due to their potential for high returns stemming from their volatility. These pairs can offer unique opportunities that are not available with more stable major or minor pairs. However, they also come with increased risks and require a solid understanding of the involved countries' economic and political situations.

What should I consider before trading exotic currency pairs?

Before trading exotic currency pairs, consider their high volatility, the wider spreads, and the potential for rapid and significant price movements due to economic, political, or social events in the emerging markets. Successful trading in these pairs requires thorough research, a well-crafted strategy, and effective risk management practices to navigate their complexities and capitalize on their opportunities while minimizing potential losses.