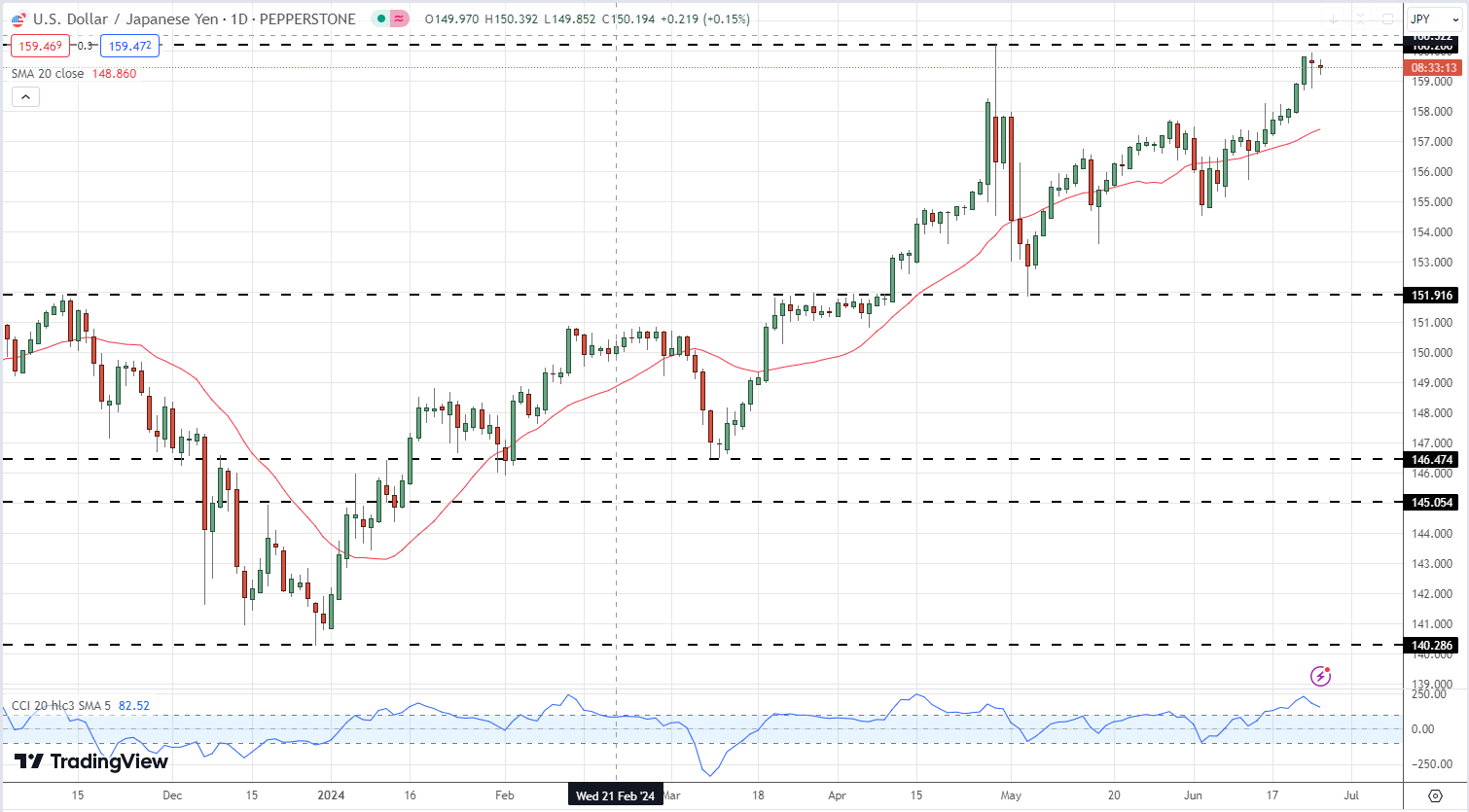

USD/JPY – Interpreting Market Sentiment

Recent retail trader data indicates a deep divide in the USD/JPY market, with only 16.98% of traders holding net-long positions, translating to a notable short-to-long ratio of 4.89 to 1.

Although there's a slight increase in net-long traders by 1.36% since yesterday, there has been a decrease of 10.94% over the week. On the flip side, net-short traders have risen by 0.51% daily and 22.33% weekly.

This data, combined with our contrarian analysis, suggests a potential for continued USD/JPY price rises, though the mixed signals from current positioning present a complex trading outlook.

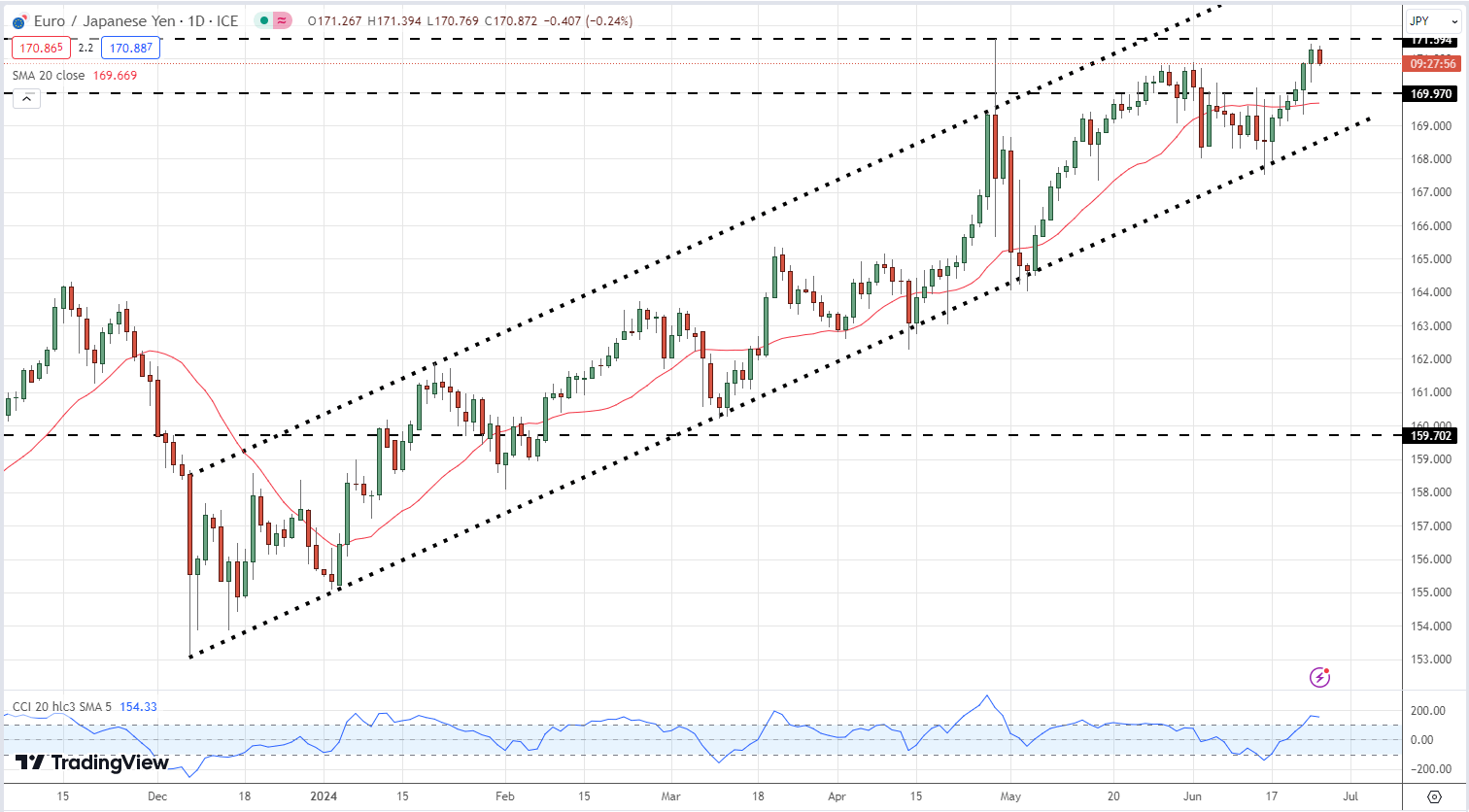

EUR/JPY – A Bullish Contrarian View

The latest data reflects a significant shift in EUR/JPY retail trader sentiment. Only 16.49% of traders are net-long, with the short-to-long ratio widening to 5.07 to 1.

Net-long positions have dropped by 13.75% since yesterday and 31.34% over the week, while net-short positions have increased by 8.20% daily and 19.90% weekly.

Our contrarian perspective, considering the growing net-short positions, underscores a strong bullish outlook for EUR/JPY, indicating a robust contrarian trading bias.

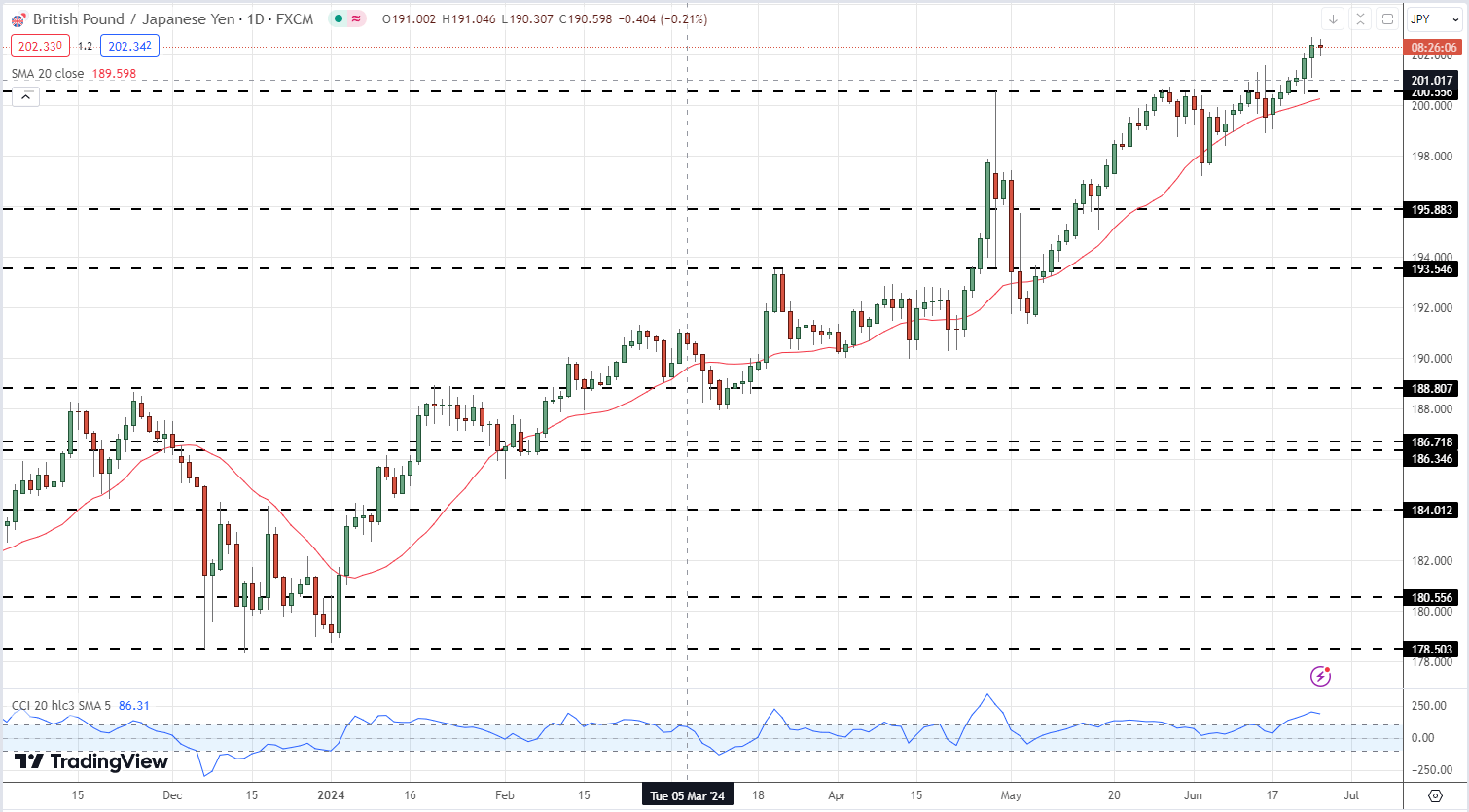

GBP/JPY – Net-short Traders Predominate

Data indicates that 22.28% of traders are currently net-long on GBP/JPY, with a short-to-long ratio of 3.49 to 1.

The count of net-long traders has decreased by 3.95% since yesterday and 10.99% over the last week, while net-short traders have increased by 2.60% since yesterday and 15.82% over the last week.

Adopting a contrarian stance to market sentiment, the prevalent net-short positioning suggests that GBP/JPY prices might continue to rise. The increase in net-short positions both from yesterday and last week supports a stronger bullish sentiment for GBP/JPY.