Governor Bullock Highlights Adaptable Strategy Amid Economic Uncertainty

During a Q&A session in Armidale, RBA Governor Michele Bullock underscored the central bank's priority on managing inflation, despite growing concerns about economic challenges. This stance bolstered the Australian dollar.

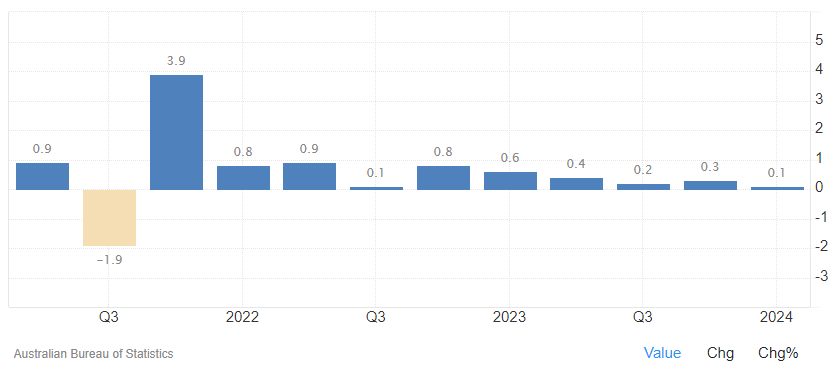

On Tuesday, the RBA unveiled its updated quarterly forecasts, increasing projections for GDP, unemployment, and core inflation. This comes even as signs suggest Q2 GDP growth may be sluggish. High interest rates have adversely impacted the Australian economy, leading to a marked reduction in quarter-on-quarter growth since early 2023. The economy narrowly avoided contraction in Q1 2024, posting a modest 0.1% growth compared to Q4 2023.

Bullock noted that the RBA considered a rate hike during Tuesday’s meeting, which lowered the odds of a rate cut and strengthened the Aussie dollar. While the RBA views the risks to inflation and the economy as “broadly balanced,” its main focus remains on reducing inflation to the 2%-3% target range over the medium term. According to the RBA’s forecasts, inflation (CPI) is expected to hit 3% in December before rising to 3.7% by December 2025.

Without consistent price declines, the RBA may continue contemplating potential rate hikes, despite market expectations of a 25-basis point (bps) cut before the year’s end.

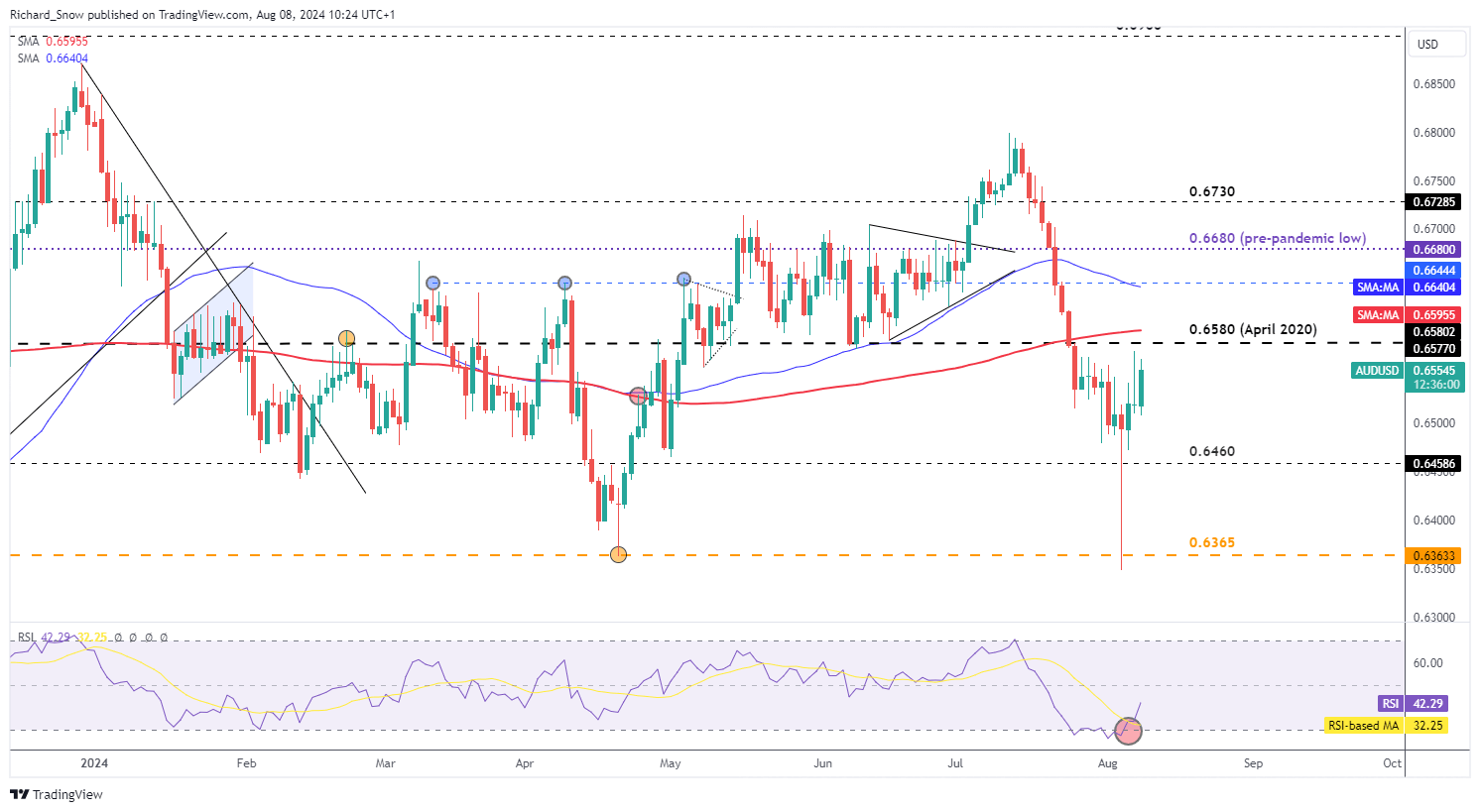

AUD/USD Recovery Faces Resistance

The AUD/USD pair has rebounded significantly since Monday’s global market volatility, with Bullock's remarks on a potential rate hike aiding the Aussie in regaining lost ground. However, the recovery appears constrained by the nearest resistance level at 0.6580, which has previously halted upward movements.

Another challenge is the 200-day simple moving average (SMA), situated just above the 0.6580 mark. The Aussie may consolidate around this level, with the next significant move likely depending on the upcoming US CPI data. Support is seen at 0.6460.

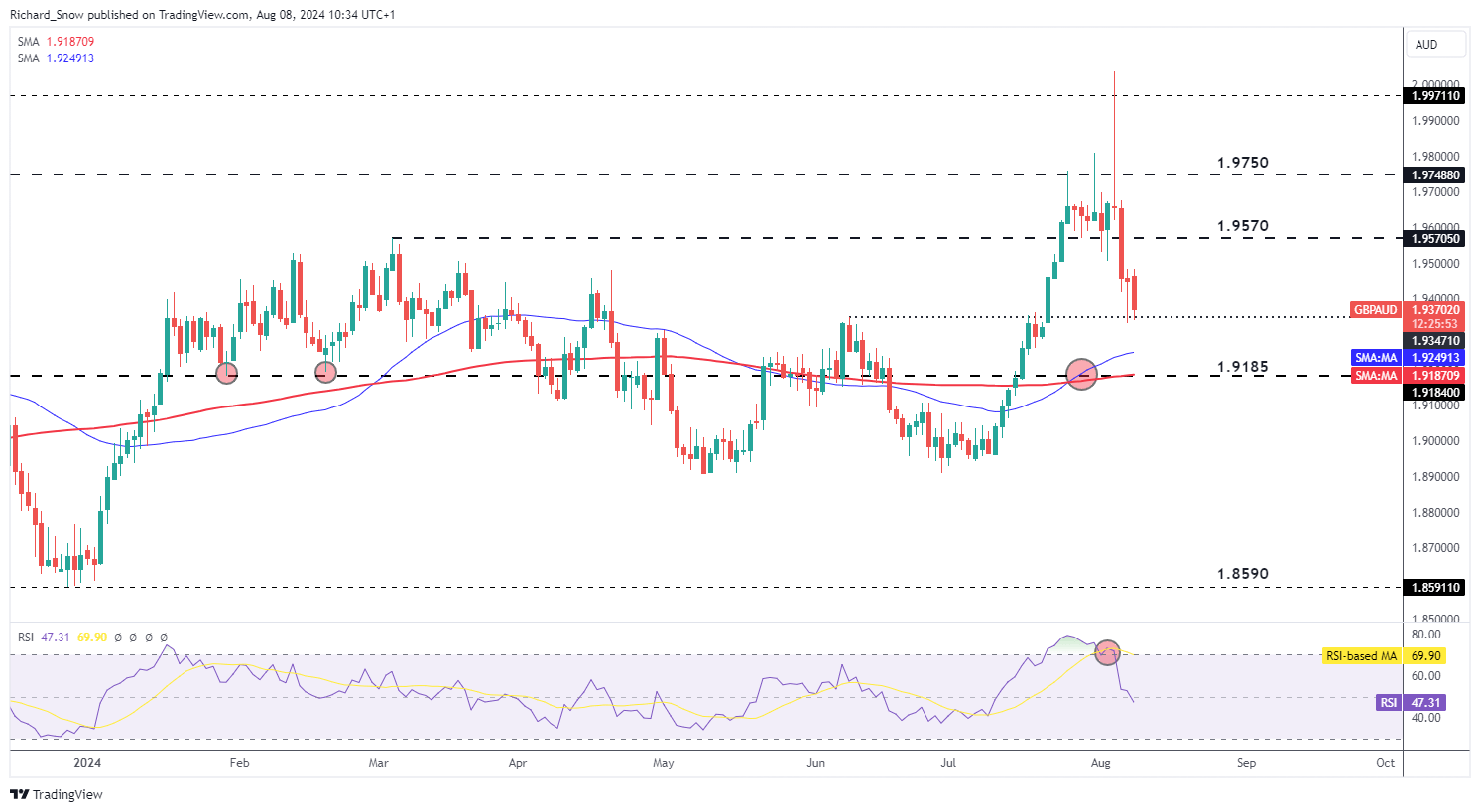

GBP/AUD Falls After Spike – Rate Cut Bets Adjusted

The GBP/AUD pair has significantly corrected after a sharp spike on Monday. The volatility pushed the pair above 2.000 before retreating by the day's close. The Sterling appears vulnerable after last month’s rate cut surprised some market participants, leading to a bearish adjustment.

Currently, the GBP/AUD decline is testing the 1.9350 swing high from June, with the 200 SMA suggesting the next support level is around 1.9185. Resistance is seen at 1.9570, the March 2024 high.