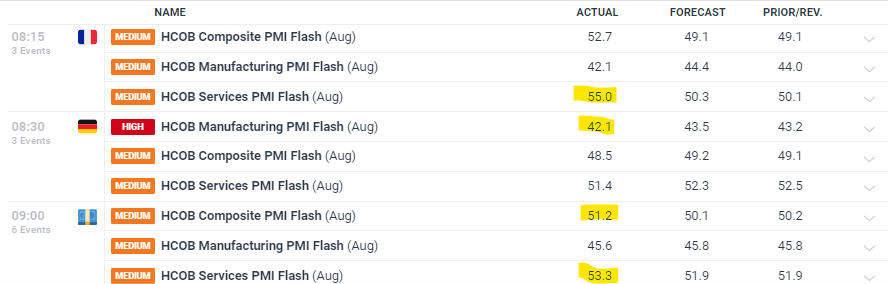

Economic Activity Shows Mixed Signals in Eurozone

Economic activity in the Eurozone saw an uptick in August, according to the latest HCOB PMIs. However, HCOB chief economist Dr. Cyrus de la Rubia cautions that the underlying fundamentals may not be as robust as they appear.

“It’s a story of two contrasting sectors. The manufacturing sector is still stuck in a recession, while the services sector continues to expand at a reasonable pace. However, with the temporary boost from the Olympics in France fading and declining confidence within the Eurozone’s service industry, it seems likely that the challenges faced by the manufacturing sector will soon start to impact services as well.”

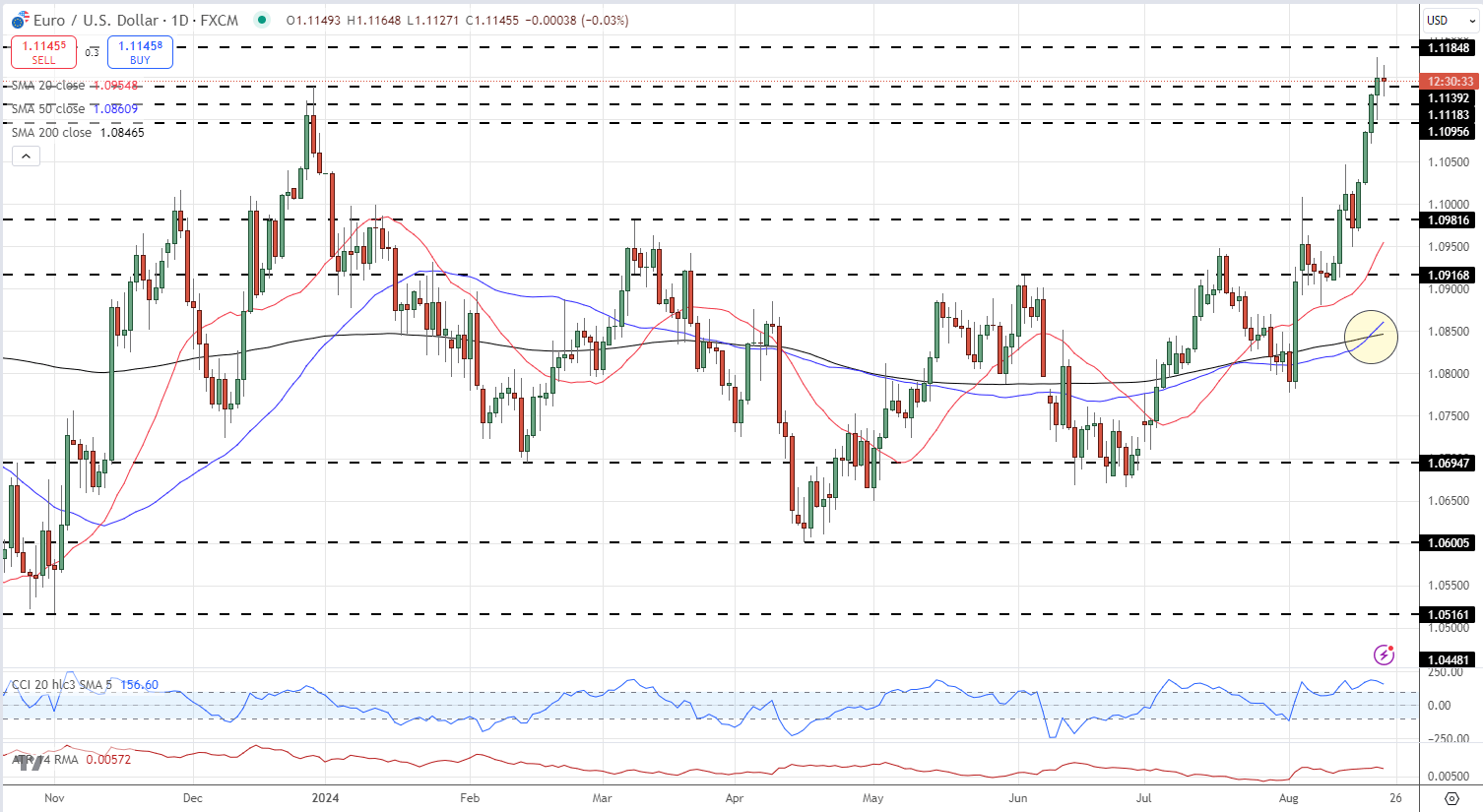

Euro Reaches 13-Month High Against Weak US Dollar

The Euro hit a fresh 13-month high against the US dollar on Monday and is close to setting another new high today. The US dollar remains under pressure as the Federal Reserve gears up for a series of anticipated interest rate cuts, expected to begin in September. This Friday, Fed Chair Jerome Powell's speech at the Jackson Hole Symposium could provide the market with more insight into the central bank's current stance and the expected pace of future rate cuts.

Today's EUR/USD price movement is likely to stay within Monday's range of 1.1099-1.1174, with a retest of yesterday’s high being the more probable scenario.