When trading, one of the most important tools you must have is a trading journal, and not just any trading journal but a reliable one. One that can change the way you trade. A trading journal that excellently lets you keep track of every entrance, exit, and choice, which helps you find patterns, repair mistakes, and improve your strategy over time. Now, this is a great trading strategy for serious traders as journaling helps you stay disciplined, look back on past trades, and be organized in your trading, whether you're just starting out or have been doing it for a while and want to grow.

With that, the Asia Forex Mentor team has put together the top 10 best trading journals in 2026 based on their features, level of easiness and real trader reviews. This guide talks about technologies that work for varied styles, budgets, and goals, from simple logbooks to advanced analytics platforms. You may choose the one that works best for you by looking at the important features, pros, and cons of each entry.

What is a Trading Journal and Why Does It Matter?

A trading journal is a way to keep track of and look back on your trades. It keeps record of important information such as the entry, exit, position size, setup, and outcome. Some trading journals also have screenshots or comments about the market and how to make decisions.

Owning trading journal is always an edge its objective is always to make more accurate succeeding trades, trading journal data and keeps an eye on your trading performances. When you look back at your past trades, you can see patterns: what works, what doesn't, and where you keep making the same mistakes. This makes your process less biased. It helps you sharpen your edge, stay accountable, and not make decisions based on your feelings over time.

Through journaling, you are able to establish good discipline and clarity, but it needs to be consistent. Entering data by hand can take a long time. However, for professional traders, it's one of the best strategies to improve execution. Key terms include, setup (your trade condition), strike rate (win percentage), and R-multiple (risk-to-reward ratio) and drawdown (how much your account drops from peak to bottom during losses).

How to Choose the Best Trading Journals

In picking the best trading journal, start with the most important characteristics. Find tools that help you record important trade information, including as entrance, exit, size, strategy, and outcome. Screenshots or labeling would be great too. Strong journals let you look at your success in terms of win rate, R-multiple tracking, and equity curve analysis. Also, make sure the platform works with your broker, trading platform , or lets you import CSV files. Your notebook should fit your trading strategy, whether you use automated systems, scalping, or swing trading.

It’s really important that it’s easy to use as it should make your work easier, not harder. Some platforms even let you interact with your data in plain English, making analysis accessible even for non-technical users. If you can, pick one with a clean interface, easy navigation, and as little manual entry as possible. Think about the price: some tools let you buy them once, while others require a subscription. If you’re just starting out, get something cheap that you can grow into.

Last but not least, make sure there is active user support and a community, and look for a responsive support team to help resolve issues quickly. A program with good updates, documentation, user communities, and customization features like journal templates can really help you learn and keep using it for a long time. The perfect diary should feel like a natural part of your trading process, no matter how new or experienced you are. So below, we carefully choose the the top 10 best trading journals for every trader.

How We Chose the Tools

At Asia Forex Mentor, we based the ranking on what traders care about most, such as how well they track and analyze data and how well they work with major platforms. We put products with excellent core functionality, a seamless user interface, and important performance measures like win rates, R-multiples, and trade tagging at the top of our list. Each tool was systematically analyzed for its effectiveness in improving trading outcomes.

We also looked at the prices, user reviews, platform reliability, and the repute of each tool in the trading community. We chose based on security, continuing maintenance, and any unique features, like AI insights or automated journaling, as well as evaluating the new features introduced by each platform. We wanted to show tools that would work for both new and experienced traders, making sure they were high-quality, easy to use, and valuable in the long run. Having a reliable trading journal is absolutely essential for traders who want to improve their results and maintain discipline.

10 Best Trading Journals List

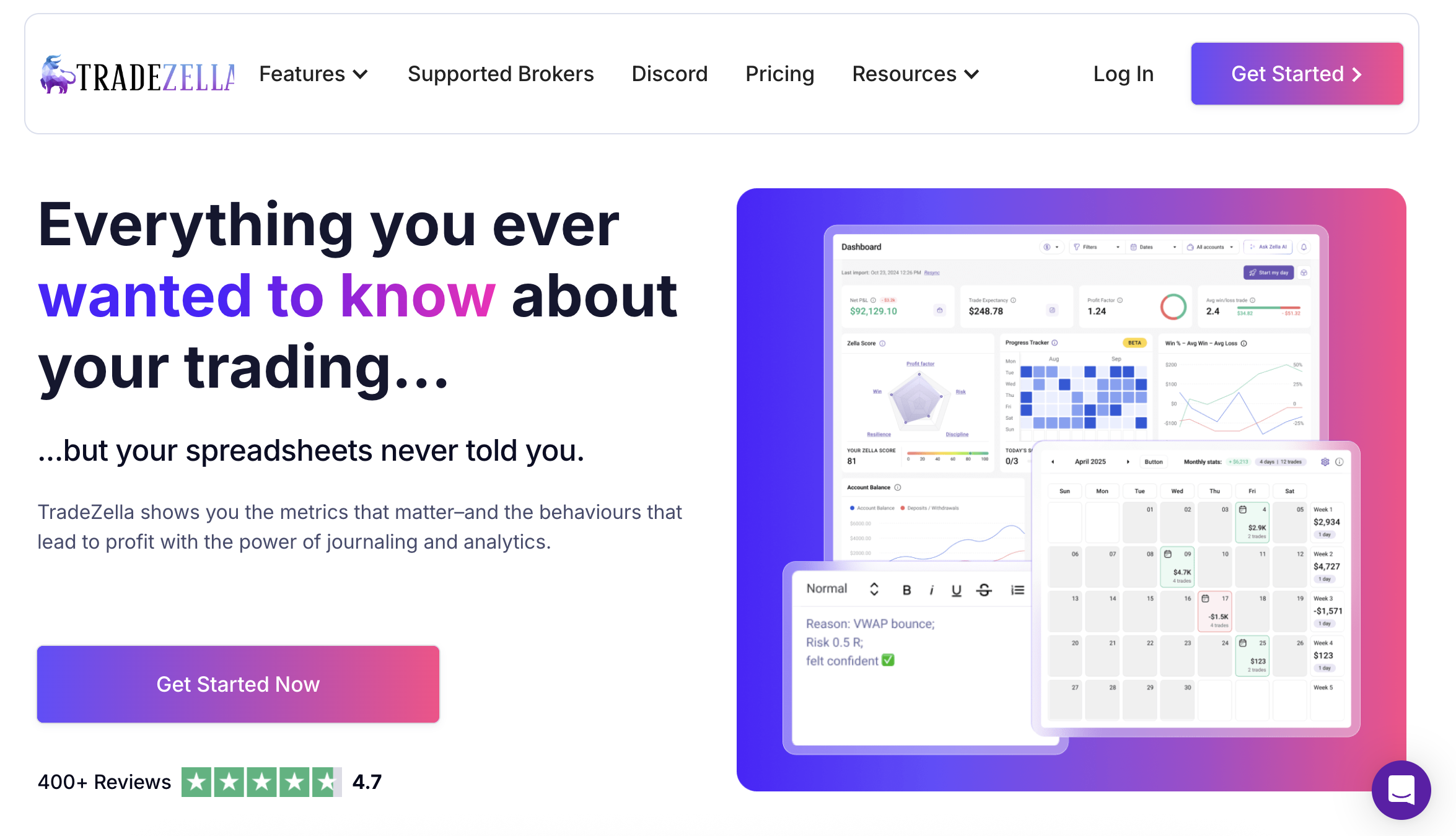

#1. TradeZella

What is TradeZella

TradeZella is a trading diary tool that helps traders keep track of their performance, look back at earlier deals, and refine their techniques for forex, equities, crypto, and futures. It automatically brings in deals from brokers that it works with and shows you things like win/loss ratios, entry and exit points, even tagging your emotions. Zella, a trader and influencer, built the platform. It has tools like trade replay, a strategy playbook, and a backtesting simulator, as well as a trading simulator for practicing and refining trading strategies in a risk-free environment, all of which are meant to help traders become more disciplined, see patterns, and trade more clearly.

TradeZella also helps users review their performance on each trading day to identify areas for improvement.

Advantages and Disadvantages of TradeZella

TradeZella Pricing and Features

TradeZella offers Basic Monthly ($24), and Premium Monthly ($33) subscriptions with a 7-day money-back guarantee for new users. TradeZella is a powerful journaling system with analytics, customized tags, and performance tracking. Live charts, filtering transactions by criteria, and MAE/MFE metrics, the Zella Scale, and Best Exit Analysis allow traders to examine entrances, exits, and risk. A built-in notebook allows template uploads, picture uploads, and chart modification for any trading style.

TradeZella does not provide paper trading or real-time trade execution and does not offer a free plan or lifetime purchase. No mobile app means desktop use only if your broker is unsupported, and trades must be manually uploaded. While its sleek interface and trader-focused metrics are well-regarded, its pricing may deter beginners or casual traders searching for a free or one-time solution.

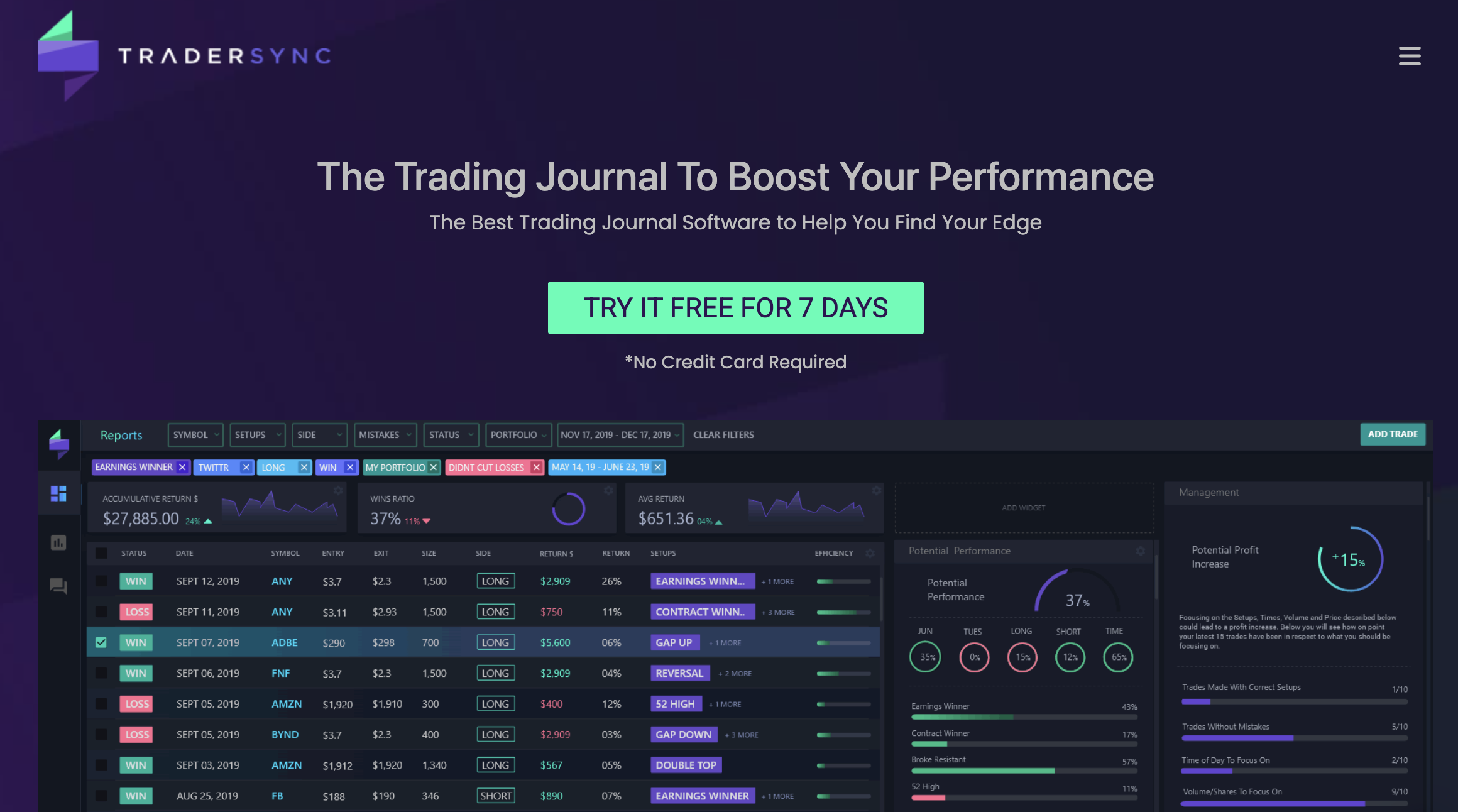

#2. TraderSync

What is TraderSync?

TraderSync is an online trading journal that helps traders keep track of, organize, and improve their performance across asset classes, such as stocks, options, forex, futures, and crypto. TraderSync makes it easy to log and analyze options trades as part of your overall trading performance. It also allows users to manage and track performance across multiple accounts for comprehensive analysis. It does this by easily importing trades from over 900 brokers and giving traders tools like tagging, interactive charts, and AI insights to look for patterns and improve their strategies.

Advantages and Disadvantages of TraderSync

TraderSync Pricing and Features

TraderSync has four levels of pricing: Basic (Free), Pro ($29.95 per month), Premium ($49.95 per month), and Elite ($79.95 per month). Users can log deals by hand using the free Basic plan, but it doesn't have comprehensive analytics. The Pro plan adds basic reports and chart replay, while the Premium plan adds AI feedback, a trade simulator, and tracking of setups. The Elite plan has all the features of the other plans, plus advanced filters, the best trade monitoring, exit analysis, and unlimited trade storage.

Some limits, nevertheless, apply to all programs. You can only replay charts if you have the Pro plan or higher. Automated trade imports, trade management tools, and AI-driven insights are only available with the Premium and Elite plans. All plans have mobile app compatibility, although some sophisticated customization and analytics features are only available to the highest tier. To get complete journal automation, detailed performance analytics, and graphic exit reviews, users need to pay for higher subscriptions.

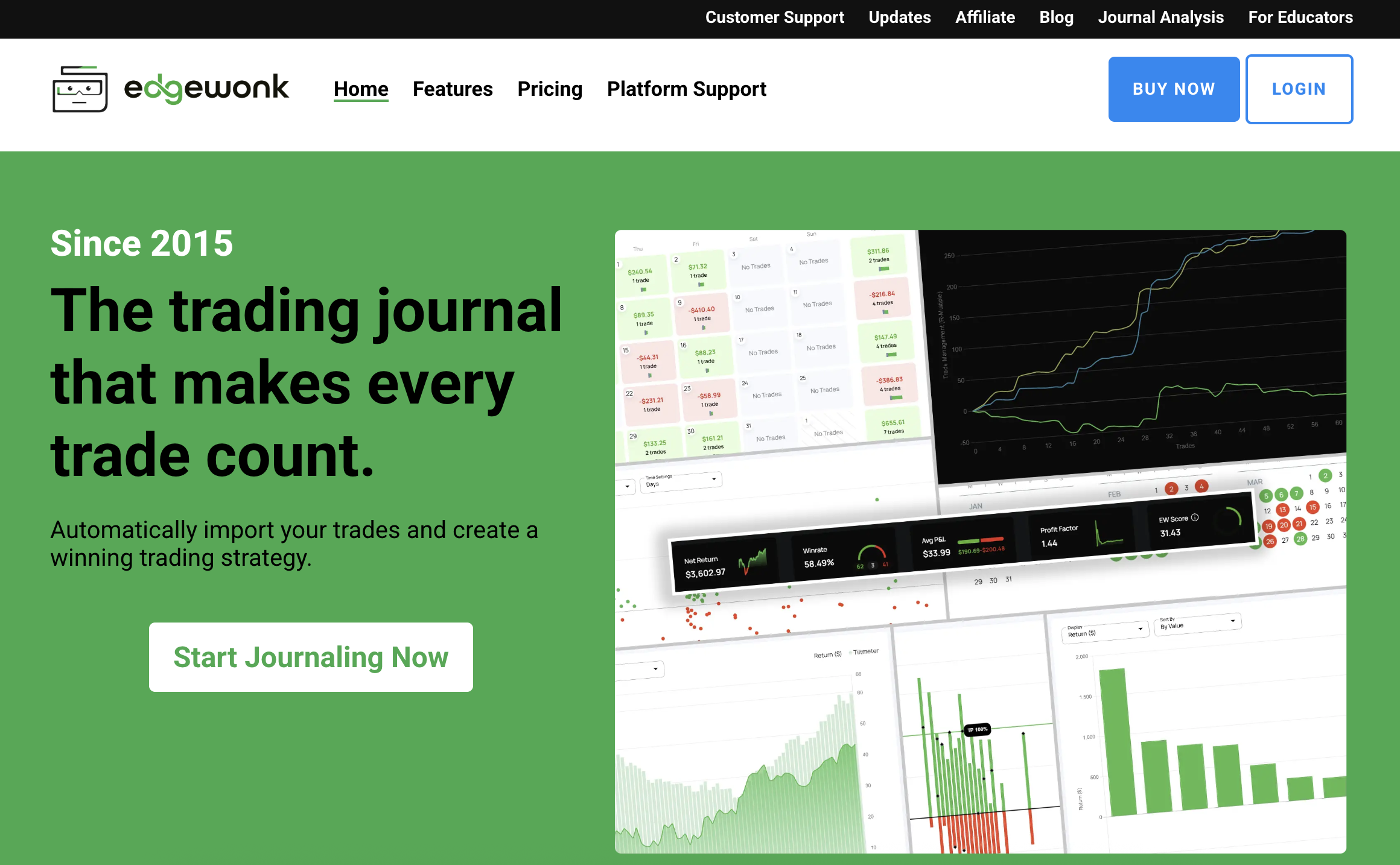

#3. Edgewonk

What is Edgewonk?

Edgewonk is a trading journal that professional traders may customize. Users can also create their own trading journal with personalized templates and metrics, making it a flexible alternative to online trading journals. It works with markets including forex, stocks, futures, crypto, CFDs, and options. It allows you to bring in transactions, keep track of performance indicators like expectation, win rate, and profit factor, look at behavior, and make extensive visual reports that show you patterns in your trading that you might not have noticed before.

Advantages and Disadvantages of Edgewonk

Edgewonk Pricing and Features

You may buy Edgewonk as a one-time desktop license for $169 yearly with added VAT. This includes free upgrades and access for life. There is no free version of Edgewonk, and you can't sign up for a membership that lasts forever.

The tool lets brokers and traders import trades using CSV files or directly from MetaTrader, Interactive Brokers, and other major platforms. It has behavioral analytics, customisable visual dashboards, trade labeling, expectancy monitoring, and a separate area for looking at emotional elements like tilt and discipline. It works on Windows and macOS, however there is no mobile app. Instead of automatically syncing with brokers, it needs to be imported manually.

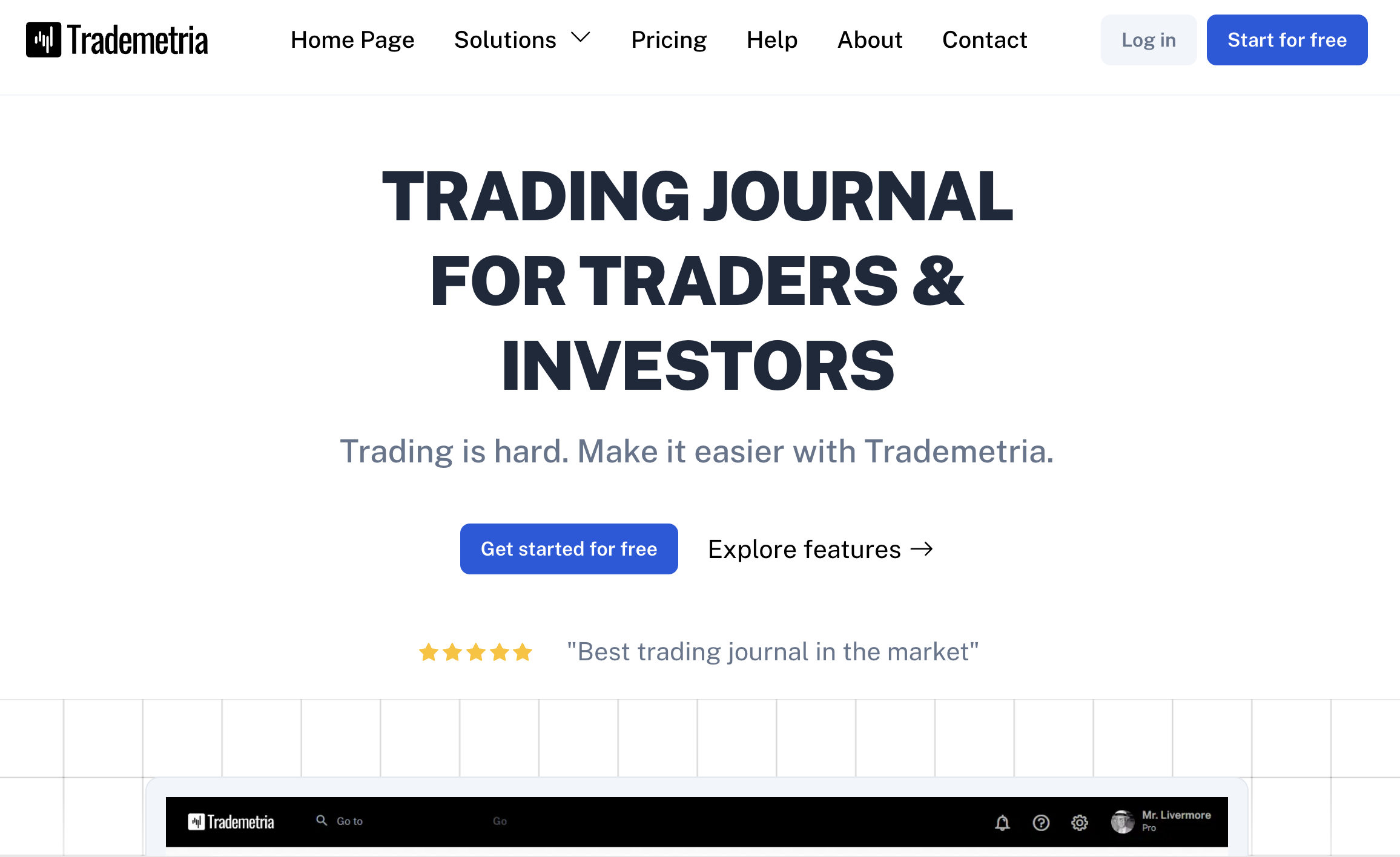

#4. Trademetria

What is Trademetria?

Trademetria is a trading journal and portfolio tracker that works with stocks, forex, crypto, futures, options, and CFDs. It allows customers import trades from more than 140 brokers around the world, and supports comprehensive trade journaling for all major asset classes, either by hand, using CSV, or through an API. Then, it does analytics and simulations to find patterns in trading and performance.

Advantages and Disadvantages of Trademetria

Trademetria Pricing and Features

For basic use, Trademetria has a free plan that lets you import up to 30 times a month, supports one account, gives you essential performance data, a WYSIWYG journal editor, image uploads, daily reports, AI insights, and broker auto-sync. The Basic plan costs $29.95 a month, and lets you import up to 500 trades a month. The full Pro plan costs $39.95 a month, and lets you import as many trades as you want, supports up to 50 accounts, has better portfolio tracking, API access, and full analytics.

#5. Tradervue

What is Tradervue?

Tradervue is an online trading journal that started in 2011. Trusted by traders worldwide, it helps users track and analyze their trading performance. It allows traders keep track of their trades, look back at them, and evaluate them in depth. It works with stocks, options, futures, and currency, and it can automatically import data from brokers so you can keep track of everything easily. It has professional-level statistics and sharing features that are useful for both individual traders and mentors.

Advantages and Disadvantages of Tradervue

Tradervue Pricing and Features

Tradervue has a free plan with strict trade limits. It also has Silver ($29.95/month) and Gold ($49.95/month) tiers that give you full analytics, tagging, filtering, and mentor sharing. It works on the web and automatically imports trades from more than 80 brokers. Its pricing, a less current UI than newer tools, and a free tier that is too limited for aggressive traders are some of its drawbacks.

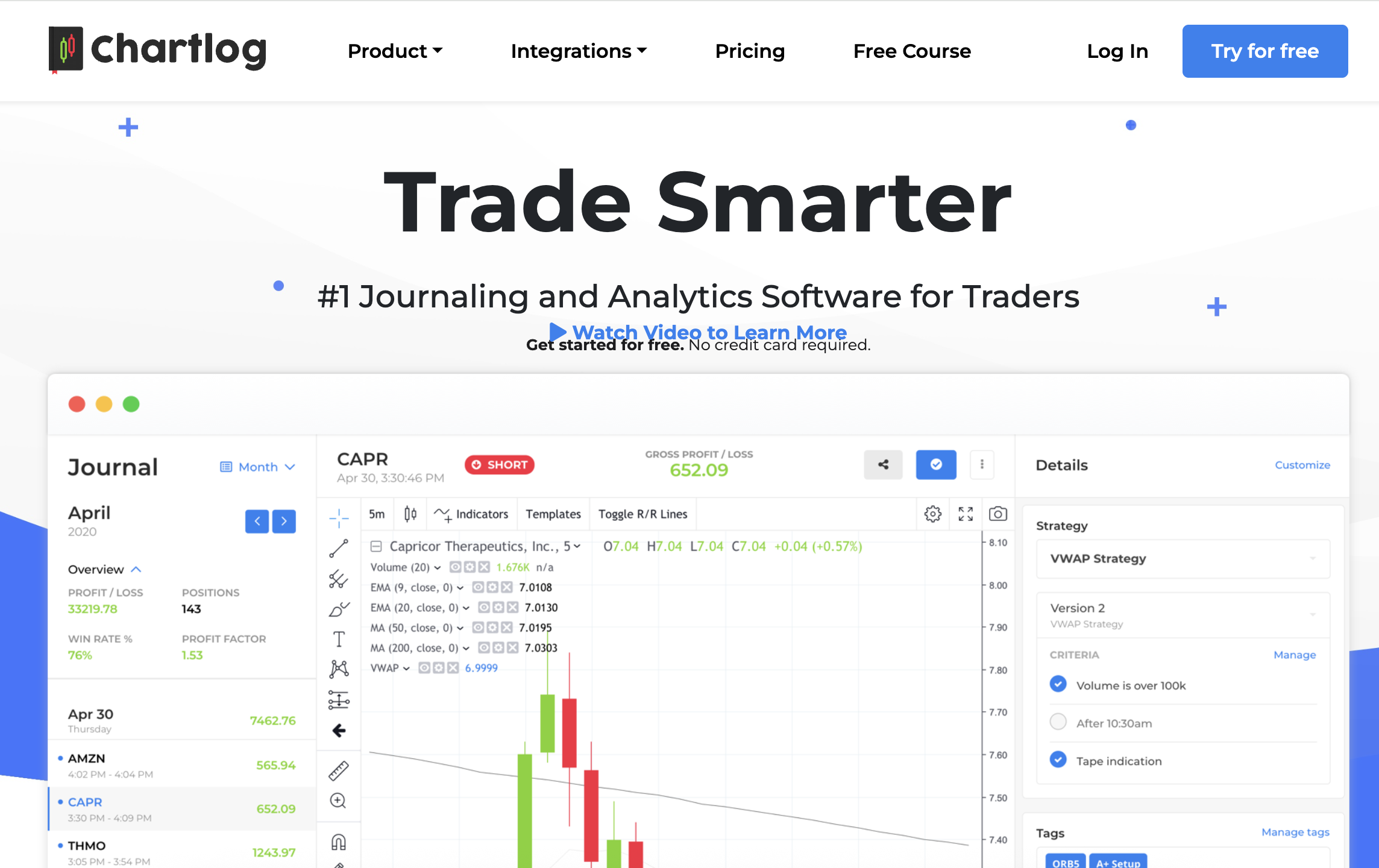

#6. Chartlog

What is Chartlog?

Chartlog is a web-based trading journal and analytics tool that lets traders automatically input deals, look at specific performance information, and see their trades on interactive TradingView-powered charts. It takes raw trading data and turns it into insights that make traders think about the mechanics and psychology underlying their trades. It has journaling workflows and strategy analysis in one easy-to-use interface, which is important for improving your plan. Users can also attach screenshots to their journal entries, making it easier to document trades visually and enhance trade analysis.

Advantages and Disadvantages of Chartlog

Chartlog Pricing and Features

Chartlog has three plans: Lite ($14.99/month), Standard ($29.99/month), and Pro ($39.99/month). All of them come with unlimited journaling and auto-import. The higher tiers add strategy tracking, comprehensive reports, and back-testing. It's web-based and easy to use, but it relies a lot on trader discipline and still doesn't have many direct ties to brokers.

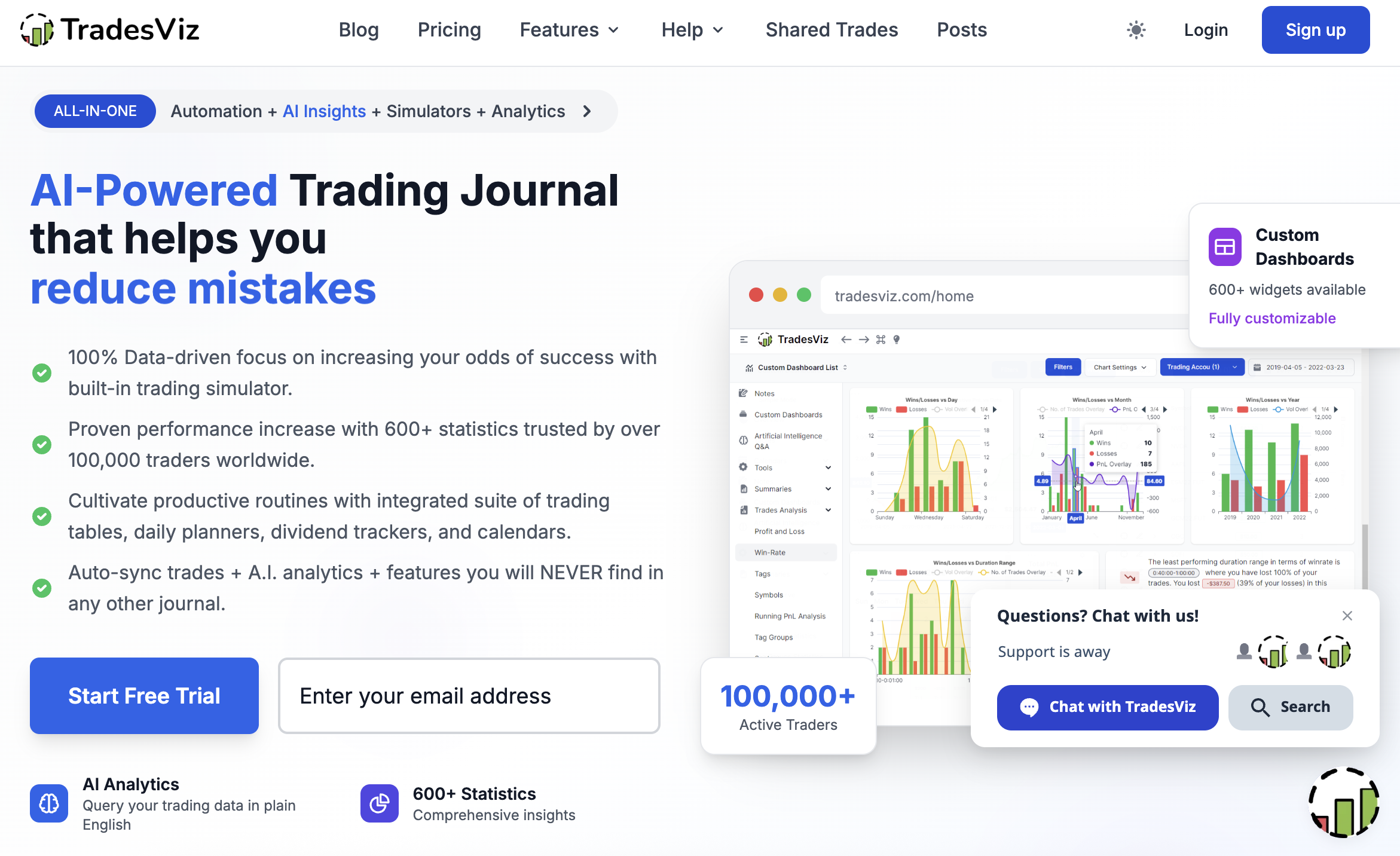

#7. TradesViz

What is TradesViz?

TradesViz is a web-based trading journal that records trades in a variety of markets, including stocks, options, futures, forex, crypto, and indices. It also combines analytics, simulation, and AI-powered insights into a single platform. TradesViz regularly introduces new features such as enhanced analysis tools, advanced simulation capabilities, customizable dashboards, and improved data import functionalities to enhance user experience. It syncs automatically with more than 200 brokers or lets you import data by hand. It gives traders over 600 charts and information to help them analyze, reflect, and improve their edge. It has features like configurable dashboards, AI Q&A—where users can interact in plain English to get insights without technical jargon—and multi-asset simulators with access to extensive historical market data for backtesting and analysis, making it useful for both new and experienced traders who want to stay consistent and get better.

Advantages and Disadvantages of TradesViz

TradesViz Pricing and Features

TradesViz has a great free starting tier that lets you do up to 3,000 stock trades a month. Premium plans include Pro, which costs around $19 a month and comes with unlimited imports, analytics, custom dashboards, and AI Q&A. Platinum, which costs about $29 a month and comes with simulators, options flow tools, exit/backtest analysis, checklist/trade planning, and dividend tracking, is the next level up. Even though it has a steep learning curve, it is still one of the most flexible and affordable trading journal systems for dedicated traders.

#8. StonkJournal

What is StonkJournal?

StonkJournal is a free, web-based trading journal platform that makes it easy to add trades to your daily routine. It has rapid manual entry, visual monitoring features, and easy-to-use statistics, all without adverts or selling your data. It covers a wide range of assets, including stocks, options, futures, cryptocurrencies, and FX. StonkJournal also serves as an easy-to-use stock journal, allowing you to track and review your trades efficiently. Its basic, easy-to-use interface makes it easy to think about and review. It’s made from my own passion and feedback from the community, and it’s meant to be easy to use, open, and always changing.

Advantages and Disadvantages of StonkJournal

StonkJournal Pricing and Features

StonkJournal is completely free and has no adverts. It has a simple manual-entry trading log for a variety of asset classes. It has a simple, customisable UI, a calendar view, tagging, visual metrics, and easy data entry, all without any obstacles or paywalls. It doesn't have the ability to import trades, extensive analytics, or full documentation, though, so it's best for traders who prefer simplicity and reflection over automation.

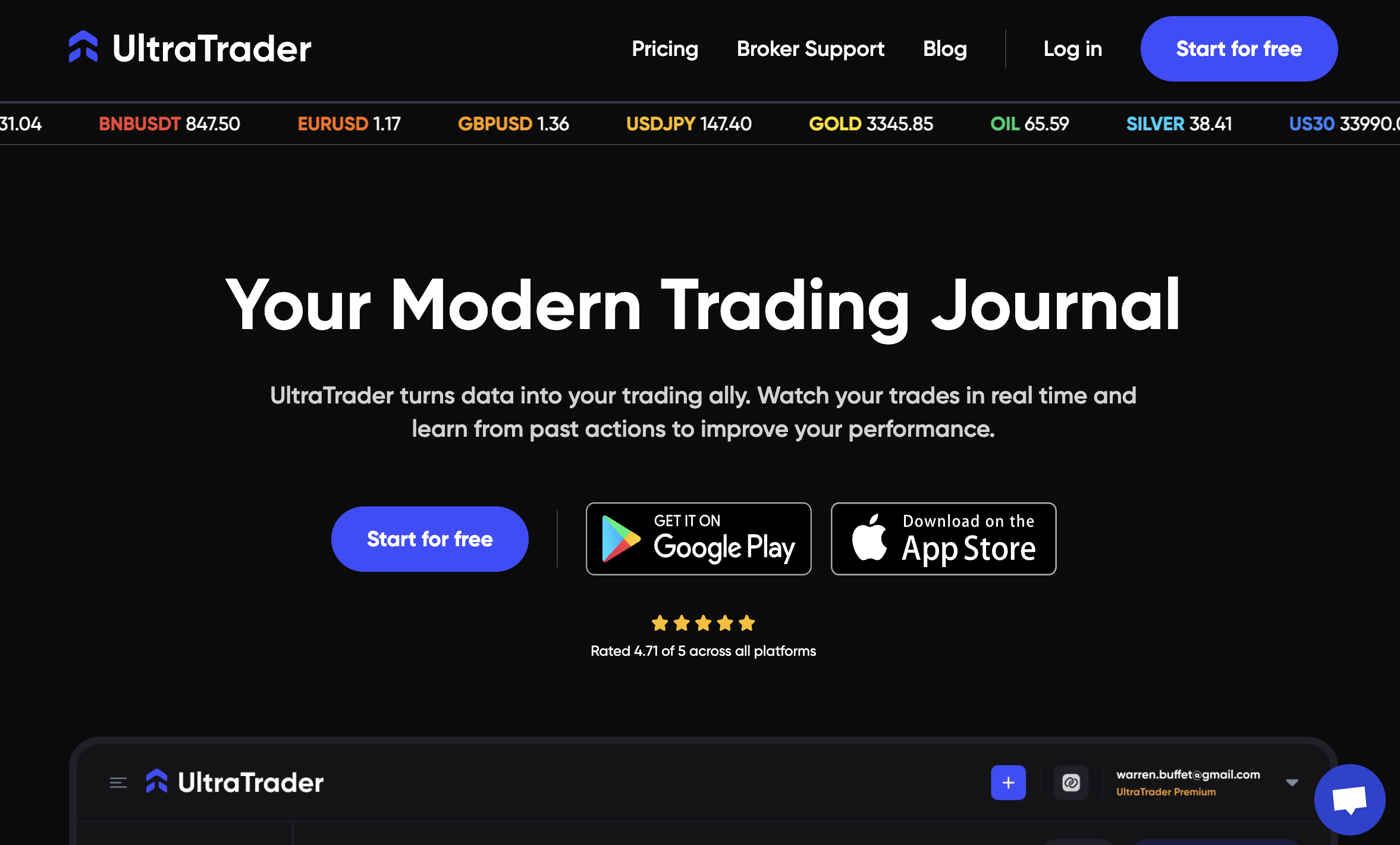

#9. UltraTrader

What is UltraTrader?

UltraTrader is a modern trading journal platform (web, mobile, desktop) that lets traders keep track of and evaluate their trades in real time across a wide range of assets, including crypto, forex, stocks, indices, and commodities. It has features including portfolio tracking, paper trading, and CSV export. UltraTrader is designed to meet the needs of serious traders seeking advanced analytics and performance tracking. It can automatically import trades from prominent brokers and exchanges like Binance, Bybit, MetaTrader 4/5, MEXC, and others. It offers useful analytics and structured journaling to help you think about and improve your performance.

Advantages and Disadvantages of UltraTrader

UltraTrader Pricing and Features

UltraTrader has a freemium approach, which means that it gives you a basic trading diary for free with features like auto-imports, live tracking, and journaling tools. Pricing around $12.50 a month and $150 yearly. It gives you access to advanced analytics, full portfolio metrics, dashboards, and simulation tools. It is strong and works on many platforms, although newer traders may find it hard to understand at first.

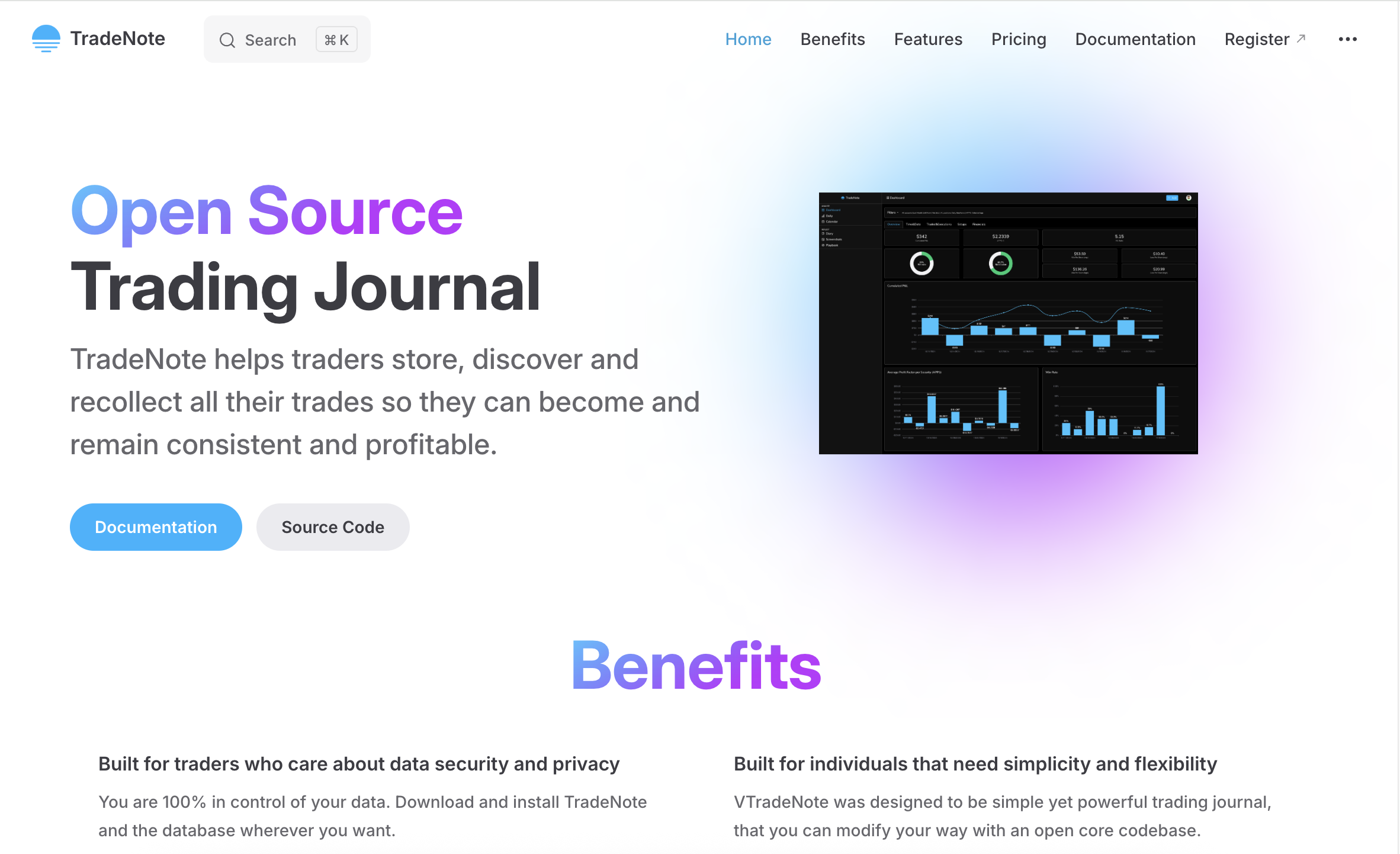

#10. TradeNote

What is TradeNote?

TradeNote is a trading journal that you may use online to help you keep track of your deals, log them, and evaluate them. It works with many sorts of assets and lets traders write down trade information, add screenshots, and make notes on entries to help them think about their trades and come up with better strategies. TradeNote also enables users to track their profits and losses for each trade, providing valuable insights into trading performance. To help traders be more consistent and do better, the platform focuses on usability and structure.

Advantages and Disadvantages of TradeNote

TradeNote Pricing and Features

TradeNote is a free version that you can host yourself. Setting it up is a little tricky, but you have complete control over your data and journaling functions. A cloud-hosted option ($4.99/month) comes with hosting, priority support, and easier setup, which gives you access to extensive analytics and customization. The platform is web-based and easy to use, however self-hosted users still have to enter trades by hand, and broker integration is limited.

Tips for New Users

When you first start a trading journal, you should try out a few different platforms to see which one works best for your trading style and needs. Some platforms are specifically designed for day traders who require rapid trade entry and detailed performance analysis to support their fast-paced trading. You can try out different tools before deciding to buy one because many of them offer free trials or simple versions. Look for platforms that offer important tools like trade imports, customizable tags, and performance analytics. These will help you keep track of your deals and make them better over time.

Beginners often make the mistake of not keeping a log regularly. Writing in a journal on a daily basis is important for building good habits and getting better at strategy, while maintaining focus on avoiding repeated mistakes, no matter how well or how poorly a trade goes. Emotional insights are just as important. Labeling your feelings during a trade can help you see patterns in how you act that affect how well you do. Do more than just write down your trades in your trading book to get the most out of it. Review your entries and trends on a regular basis, and make changes to your strategies as needed to keep improving your approach and trading discipline, experimenting with different strategies to find what works best for you.

Also Read: Top 10 Backtesting Tools That Gives You Real Edge in 2026

Conclusion

Picking the right trade journal is very important if you want to become more disciplined in your trading and have more long-term success. With the right tool, you can keep track of your trades, look at how well you’re doing, and find patterns that can help you improve your tactics. By tracking your P&L and analyzing trading patterns, you can sharpen your trading edge over time and make more informed decisions. TradeZella and TraderSync are two of the best options. They have a lot of useful features, such as the ability to import trades, track performance, and make tags that you can change. This makes them great for both new and experienced traders.

You can stay organized, spot trends, and make better decisions over time if you choose the right book. In the end, the best tool is the one that works best for your trade style and goals. Take the time to look into and try out the different platforms until you find the one that fits your needs the best. This will help you with your trade for a long time.