Anzo Capital Review

Anzo Capital is a forex and CFD broker that caters to retail traders by providing access to a variety of trading instruments, including forex pairs, commodities, indices, and metals. Established in Belize, Anzo Capital aims to offer a straightforward trading experience through its MetaTrader 4 platform, which is popular among both beginners and experienced traders.

The broker’s account types accommodate different trading needs, with options for standard and ECN accounts. Both accounts offer competitive spreads, but ECN accounts come with lower spreads and commission fees, making them attractive for traders seeking cost-effective trades.

Anzo Capital emphasizes customer support by offering 24/5 service and a range of educational resources for traders looking to improve their skills. The broker also provides a demo account, allowing beginners to practice without risking real money.

What is Anzo Capital?

Anzo Capital is a global forex and CFD broker that provides retail traders access to a range of financial markets, including forex, indices, commodities, and metals. Established in Belize, Anzo Capital is regulated by the International Financial Services Commission (IFSC), aiming to offer a reliable trading environment with a focus on transparency and client security. Company Overview Anzo Capital Limited is registered in Belize with its headquarters in Belize City.

The broker supports the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and powerful trading tools. Anzo Capital offers different account types, including standard and ECN accounts, catering to traders with various strategies and experience levels.

Anzo Capital Regulation and Safety

Anzo Capital is regulated by the IFSC of Belize, which oversees the broker's operations to ensure compliance with financial standards and client safety practices. While IFSC regulation is less stringent compared to authorities like the FCA or ASIC, it still imposes requirements on brokers to maintain transparency and safeguard client funds.

The broker prioritizes security measures by offering segregated client accounts, keeping clients' funds separate from its operational funds. This segregation is intended to protect client assets from any potential company liabilities. Additionally, Anzo Capital uses SSL encryption on its platform, helping to secure personal and transaction data for safer trading. Here at Anzo Capital Limited customer funds are held in segregated bank accounts, i.e. they are fully separated from the company funds.

Anzo Capital Pros and Cons

Pros

- Competitive spreads

- MT4 platform

- 24/5 support

- Demo account

Cons

- Limited regulation

- No MT5 platform

- Few educational resources

- Withdrawal fees

Benefits of Trading with Anzo Capital

Trading with Anzo Capital comes with several benefits that aim to enhance the trading experience for all levels of traders. The broker provides access to the widely-used MetaTrader 4 platform, known for its robust tools and user-friendly design, making it easier for traders to analyze markets and execute trades effectively.

Anzo Capital offers competitive spreads, especially on ECN accounts, which helps reduce trading costs and improve profitability for high-volume traders. The availability of multiple account types, including Islamic and demo accounts, allows traders to choose options that fit their experience level and trading preferences.

With a variety of trading instruments such as forex, indices, commodities, and metals, Anzo Capital allows for diversified trading. Additionally, the broker’s 24/5 customer support ensures traders can get assistance when needed, enhancing the reliability of their trading experience.

Anzo Capital Customer Reviews

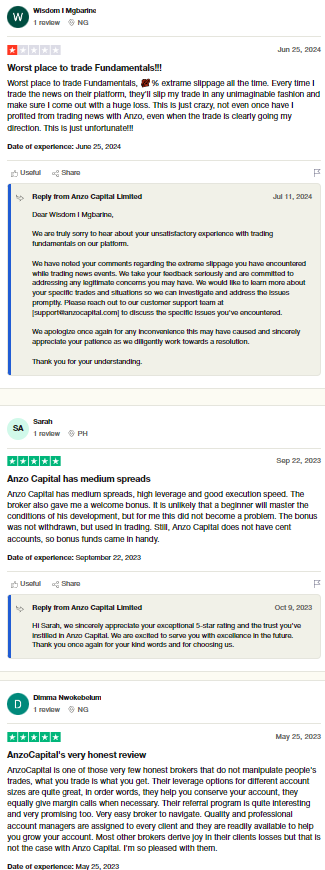

Anzo Capital has received mixed customer reviews that highlight both positive and negative experiences. Many traders appreciate the competitive spreads and access to the MetaTrader 4 platform, which is known for its stability and range of trading tools. Users often mention the ease of account setup and the availability of multiple account types, which helps them find a suitable trading experience.

On the downside, some traders report delays in withdrawals and limited customer support availability, especially outside business hours. While Anzo Capital's 24/5 support is helpful for many, some users feel that 24/7 assistance would be beneficial. Additionally, a few reviews mention concerns about the limited educational resources, which may not be ideal for beginners looking to improve their trading skills.

Anzo Capital Spreads, Fees, and Commissions

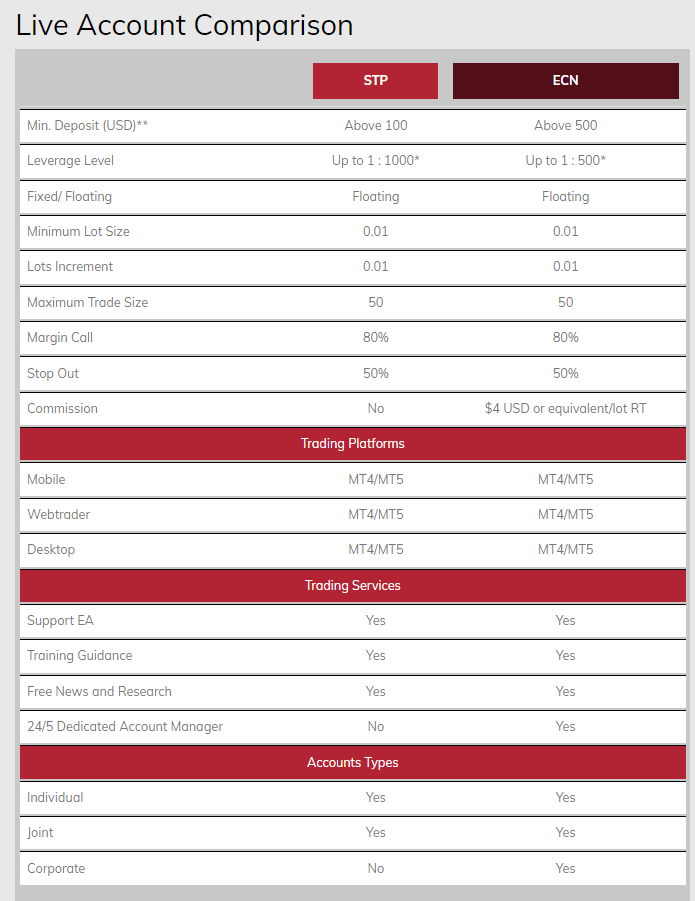

Anzo Capital offers competitive spreads across its account types, with lower spreads available on ECN accounts compared to standard ones. Standard accounts have zero commission fees, with slightly higher spreads to cover trading costs, while ECN accounts feature tighter spreads but charge a commission per trade, appealing to cost-conscious traders.

The broker’s fee structure includes potential costs for account inactivity and withdrawals, with fees varying by withdrawal method. E-wallets and cryptocurrency withdrawals typically have lower fees, while bank transfers may come with higher charges. This flexibility allows traders to select the most cost-effective options based on their transaction preferences.

Anzo Capital maintains transparent pricing for its spreads and fees, which helps traders make informed decisions about their trading costs. This structure is particularly beneficial for high-frequency traders who prioritize minimizing expenses for maximum profit retention.

Account Types

Anzo Capital offers a variety of trading account types tailored to meet different trading needs, from beginners to advanced traders. Each account type comes with unique features, including spread options, commission structures, and minimum deposit requirements, allowing traders to choose the best fit for their trading style and goals.

STP Account

Ideal for beginners, this account offers fixed spreads with no commissions, making it straightforward for those who prefer transparent costs and simple trading.

ECN Account

Designed for more experienced traders, the ECN account provides lower spreads and charges a commission per trade, allowing for potentially more cost-effective trading on high-volume orders.

Demo Account

A practice account with virtual funds that lets traders test strategies and familiarize themselves with the platform risk-free before trading with real money.

Most of these accounts has high leverage and monitored by financial services agency. The trading volume of these accounts are different as successful traders want a high margin trading that's why the broker set the different account's leverage. Using the multi account manager, traders can do online trading while observing the trading signals in competitive trading conditions.

How to Open Your Account

Opening an account with Anzo Capital is a straightforward process that takes just a few steps. Follow this guide to get started quickly:

Step 1: Visit Anzo Capital’s Website

Go to the official Anzo Capital website and click on the “Open Account” or “Sign Up” button to begin the registration process.

Step 2: Complete the Registration Form

Fill out the registration form with your personal details, including your name, email, and phone number. You’ll also need to select your preferred account type.

Step 3: Verify Your Identity

Upload the required identification documents, such as a valid ID and proof of address, to comply with regulatory requirements.

Step 4: Fund Your Account

Choose a funding method, apply the minimum deposit, and start trading. Anzo Capital supports multiple payment options, including bank transfers and e-wallets.

Step 5: Start Trading

Once your account is approved and funded, you can access the MetaTrader 4 platform and begin trading across various markets.

In order to do a trading execution, the traders must download a trading platform.

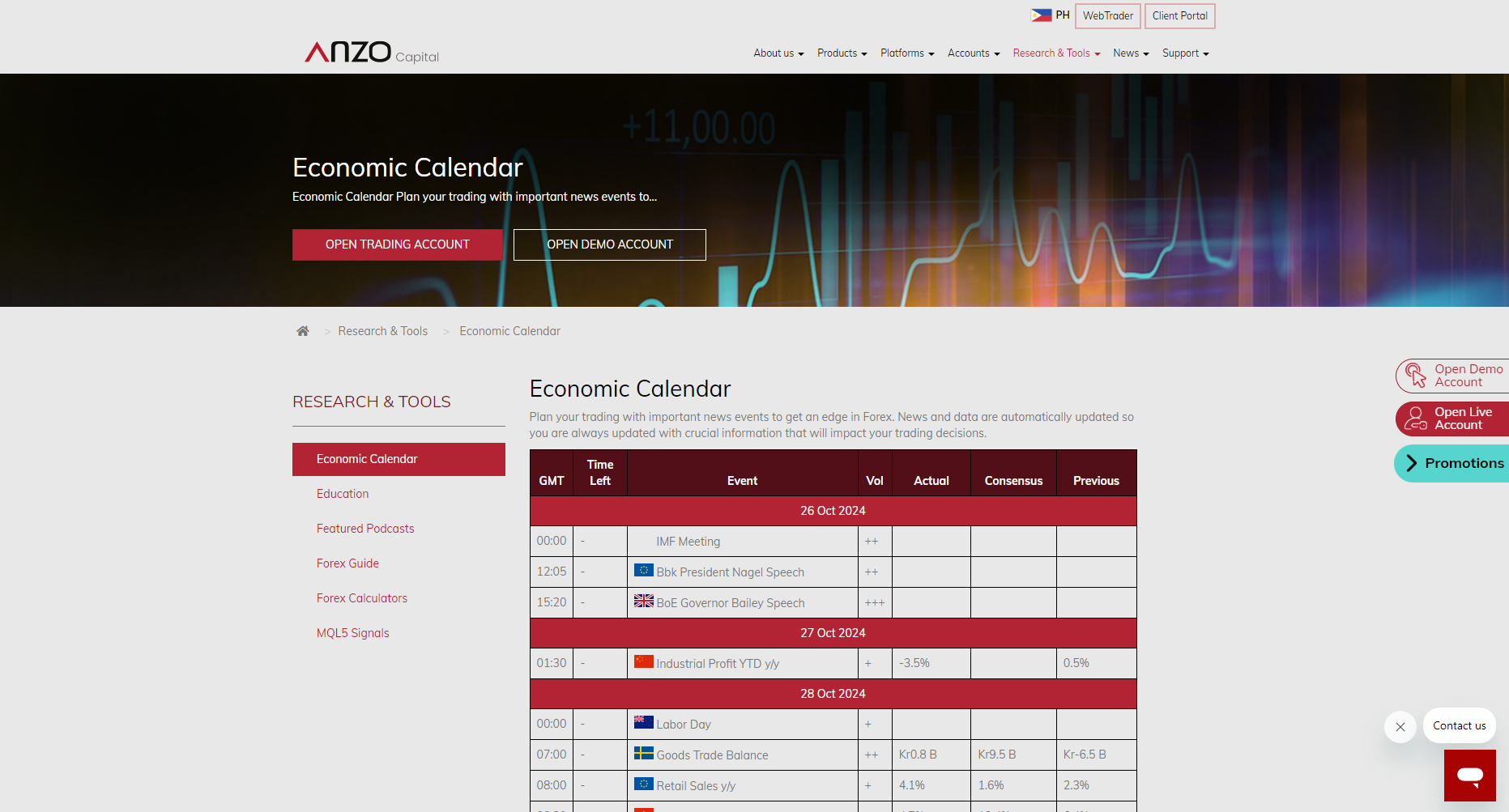

Anzo Capital Trading Platforms

Anzo Capital offers several MetaTrader 4 (MT4) platform options that cater to different trading styles and accessibility needs. By providing MT4 across desktop, web, mobile, and multi-terminal setups, Anzo Capital ensures flexibility for traders managing trades from various devices and locations.

MT4 Desktop

The desktop platform delivers a full suite of features like advanced charting tools, in-depth technical analysis, and Expert Advisors (EAs) for automated trading, making it ideal for serious traders.

MT4 WebTrader

Accessible from any web browser, MT4 WebTrader allows traders to trade on the go without downloading software, offering core MT4 tools for convenience and flexibility.

MT4 Mobile

Available on both iOS and Android, the MT4 mobile app enables traders to manage trades in real-time, providing live quotes, one-click trading, and key analytical tools.

MT4 Multi-Terminal

Built for managing multiple accounts, the Multi-Terminal version allows traders and account managers to oversee multiple portfolios simultaneously, perfect for professionals handling client accounts.

What Can You Trade on Anzo Capital

Anzo Capital provides a wide range of trading instruments to meet diverse market interests and trading strategies. From currency pairs to commodities, Anzo Capital allows traders to build versatile portfolios across multiple asset classes, all accessible via the MetaTrader 4 platform.

Forex

Trade on major, minor, and exotic currency pairs with competitive spreads, allowing access to one of the most liquid and active markets globally.

Indices

Anzo Capital offers a selection of major global indices, enabling traders to speculate on stock market performance without directly investing in individual stocks.

Commodities

Traders can diversify with commodities like gold, silver, and oil, providing opportunities to hedge against inflation and market volatility.

Metals

Precious metals, including gold and silver, are available for trading, offering a safe-haven asset option for risk management and portfolio diversification.

Anzo Capital Customer Support

Anzo Capital provides 24/5 customer support aimed at assisting traders during active market hours. The support team is available through multiple channels, including email, phone, and live chat, allowing traders to reach out in their preferred way and get timely responses to trading-related queries.

While the support team is responsive, some users note the absence of 24/7 support, which can be a drawback for traders in different time zones or those needing assistance over the weekend. Anzo Capital’s multilingual support and range of contact options are appreciated by global users, though limited live chat hours may affect the experience for some.

Advantages and Disadvantages of Anzo Capital Customer Support

Withdrawal Options and Fees

Anzo Capital offers various withdrawal options to ensure traders can access their funds quickly and conveniently. Each withdrawal method has associated fees, allowing traders to choose the most cost-effective and suitable option for their needs.

Bank Wire Transfer

Reliable for large withdrawals, bank transfers typically have higher fees and may take 3-5 business days to process.

Credit/Debit Card

Withdrawals to credit or debit cards are usually processed faster than bank transfers, but may include processing fees based on the card provider.

E-wallets

Options like Skrill or Neteller offer fast, low-fee withdrawals, ideal for traders who prioritize speed and lower costs.

Cryptocurrency

Anzo Capital supports crypto withdrawals for selected assets, providing quick and secure transactions with minimal fees, especially suitable for crypto traders.

Anzo Capital Vs Other Brokers

#1. Anzo Capital vs AvaTrade

Anzo Capital and AvaTrade are both established brokers, yet they cater to slightly different trader needs. Anzo Capital offers access to the MetaTrader 4 (MT4) platform, focusing on forex and CFDs with competitive ECN spreads and a straightforward fee structure, including swap-free accounts for Muslim traders. AvaTrade, however, provides a more extensive platform range, including MT4, MT5, and AvaTrade’s proprietary web and mobile platforms, which are beginner-friendly and feature-rich. AvaTrade also supports a broader selection of assets, including cryptocurrencies and options trading, catering to traders looking for diverse asset classes. In terms of regulation, AvaTrade is regulated by multiple tier-1 financial authorities like ASIC and the FCA, offering a higher level of oversight than Anzo Capital, which is regulated by the IFSC of Belize.

Verdict: For traders seeking a wide range of assets and stronger regulatory oversight, AvaTrade is a more comprehensive choice. Anzo Capital, however, remains a viable option for those focused on cost-effective forex trading and the MT4 experience.

#2. Anzo Capital vs RoboForex

Anzo Capital and RoboForex are competitive brokers with unique offerings geared toward different trading styles. Anzo Capital primarily focuses on forex and CFDs through the MetaTrader 4 (MT4) platform, offering ECN and standard account types with competitive spreads and commission-based pricing on ECN accounts. RoboForex, in contrast, provides a broader range of platforms, including MT4, MT5, cTrader, and its own R Trader, which appeals to traders looking for versatility and specialized trading tools. RoboForex also stands out with its variety of trading instruments, including forex, stocks, indices, and cryptocurrencies, and offers unique features like cent accounts for smaller trades. Additionally, RoboForex holds multiple regulatory licenses, including from CySEC and the IFSC, while Anzo Capital is regulated only by the IFSC of Belize, which may impact trader confidence in terms of oversight.

Verdict: RoboForex offers a more extensive platform selection and asset diversity, making it ideal for traders seeking flexibility. Anzo Capital, however, remains suitable for those focused on forex and cost-effective trading through a streamlined MT4 experience.

#3. Anzo Capital vs Exness

Anzo Capital and Exness both cater to forex and CFD traders but differ in platform choices and account offerings. Anzo Capital focuses on MetaTrader 4 (MT4) with standard and ECN accounts, delivering competitive spreads, low commission fees, and 24/5 support for straightforward trading. Exness, on the other hand, supports both MT4 and MT5, allowing traders access to advanced features and a wider range of trading tools. Exness also offers a broad selection of account types, including cent accounts and professional-level options with tighter spreads and higher leverage. Exness has multiple tier-1 regulatory licenses, such as those from CySEC and the FCA, providing enhanced regulatory assurance compared to Anzo Capital, which is regulated by the IFSC of Belize.

Verdict: Exness is better suited for traders wanting flexibility with trading platform options and regulatory strength, while Anzo Capital remains a competitive choice for those seeking cost-effective trading through a simpler MT4 setup.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH ANZO CAPITAL

Conclusion: Anzo Capital Review

In conclusion, Anzo Capital offers a range of features that appeal to both beginner and experienced traders, including access to the popular MetaTrader 4 trading platform, competitive spreads, and various account types. The broker’s flexibility in trading platforms and instruments—covering forex, commodities, indices, and metals—allows for diversified trading opportunities, making it a versatile choice.

While Anzo Capital’s 24/5 customer support and account options provide convenience, some areas like limited regulation and occasional withdrawal delays could be improved. Overall, Anzo Capital may be worth considering for traders comfortable with its regulatory framework and focused primarily on forex and CFD trading, although traders seeking 24/7 support or more comprehensive regulation may want to consider other options.

Anzo Capital Review: FAQs

What is Anzo Capital?

Anzo Capital is a forex and CFD broker that offers access to various financial markets, including forex, commodities, indices, and metals. The broker provides trading through the MetaTrader 4 platform and offers account types for different trading preferences.

Is Anzo Capital regulated?

Yes, Anzo Capital is regulated by the International Financial Services Commission (IFSC) of Belize. While IFSC regulation ensures compliance, it may not be as rigorous as regulations from authorities like the FCA or ASIC.

What account types does Anzo Capital offer?

Anzo Capital provides Standard, ECN, Islamic, and Demo accounts. Each account type caters to different trading needs, from commission-free trading on standard accounts to lower spreads with commission on ECN accounts.

OPEN AN ACCOUNT NOW WITH ANZO CAPITAL AND GET YOUR BONUS