Hong Kong Equities Lead Declines Amid Weak Chinese Data

Hong Kong stocks experienced their sharpest decline in a week following disappointing Chinese data released on Saturday. This left traders speculating whether Chinese authorities will introduce strong stimulus measures to support the economy. Meanwhile, markets in Japan, South Korea, and mainland China were closed for a holiday, and Asian trading of US Treasuries was also suspended.

Global Central Bank Decisions Take Center Stage

This week marks the anticipated start of the US easing cycle, part of a 36-hour monetary marathon that includes key policy decisions from Brazil, South Africa, the UK, and Japan. Traders are debating whether the Federal Reserve will opt for a quarter-point or half-point rate cut, while the Bank of Japan (BOJ) is expected to maintain its current rates following its recent market-moving increase.

The yen surged, becoming the top-performing major currency, while the US dollar weakened following an alleged assassination attempt against former President Donald Trump. This added to investor anxiety ahead of the Federal Reserve's next move.

Katrina Ell, director of economic research at Moody's Analytics, told Bloomberg Television, “There’s significant uncertainty around the Fed's easing cycle, particularly its pace.” She added that the BOJ’s upcoming communication will be crucial to providing clarity on its future actions after last month’s shake-up.

With major Asian markets closed investors are approaching this week cautiously, keeping an eye on regional trade data and Bank Indonesia's policy decision ahead of the Fed's meeting. Despite Southeast Asia's attractive valuations, optimism contrasts with China, where recent data showed a sharp slowdown in factory output, consumption, and investment in August, along with a six-month high unemployment rate.

China's central bank hinted at plans to boost efforts against deflation and introduce further policies to revive the economy after weak credit data underscored private sector concerns.

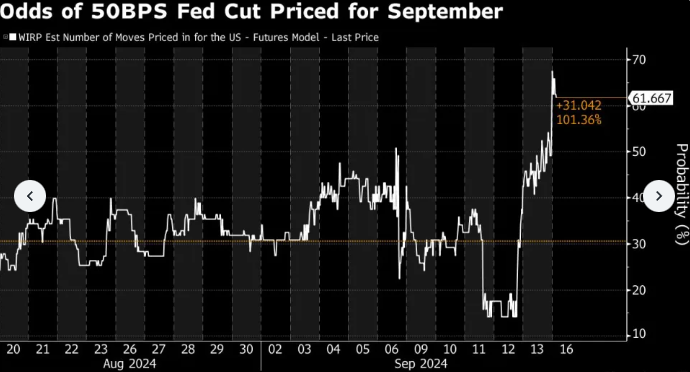

Renewed speculation of a 50-basis point Fed rate cut led to a second consecutive weekly decline in Treasury yields, with two-year notes hitting their lowest levels in two years by Friday. Markets are currently pricing in around 110 basis points of rate cuts by year-end, according to Bloomberg data.

Martin Whetton, head of financial markets strategy at Westpac Banking Corp., noted, “This week’s focus is on whether the Fed will opt for a 25 or 50 basis point cut.” He added, “At the very least, markets are expecting a dovish cut given the recent data and the current policy stance.”