Continued Pressure on the Aussie Dollar

The Australian dollar continues to face challenges. Despite a previous boost from the Reserve Bank of Australia's (RBA) strong stance on inflation and potential rate hikes, recent US inflation data has led to renewed rate hike expectations from the Federal Reserve as soon as September.

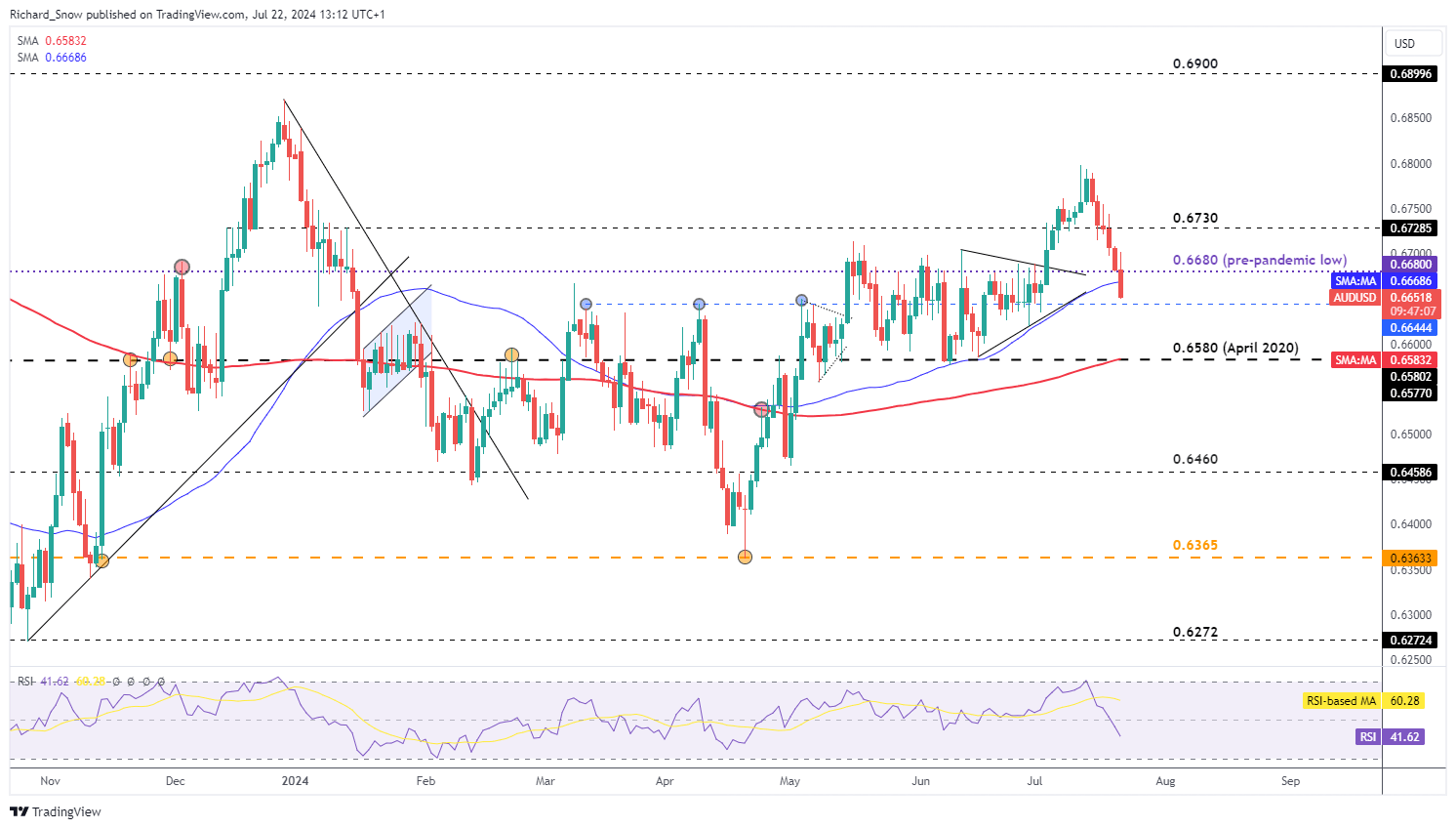

Since dropping into oversold territory on July 12th, indicated by the RSI, AUD/USD has been in a persistent decline. Factors such as profit-taking, political uncertainties, and a declining S&P 500 are currently impacting the Aussie dollar. The potential for further trade tensions due to rising US political risks, including concerns about a Trump presidency and its implications for US-China relations, also weighs heavily on the currency.

Key Support Levels and Potential Rebounds

The AUD/USD is now testing the 0.6644 level, a significant support that restricted bullish movements between March and May this year. The next level to watch is 0.6580 (last seen in April 2020). This aggressive selloff might slow down this week, especially with the upcoming US PCE data, which could further indicate progress against inflation (a lower PCE might weaken the dollar). While the short-term bearish trend is strong, the 200-day simple moving average aligning with the 0.6580 level could be a critical point for bears to push for a reversal.

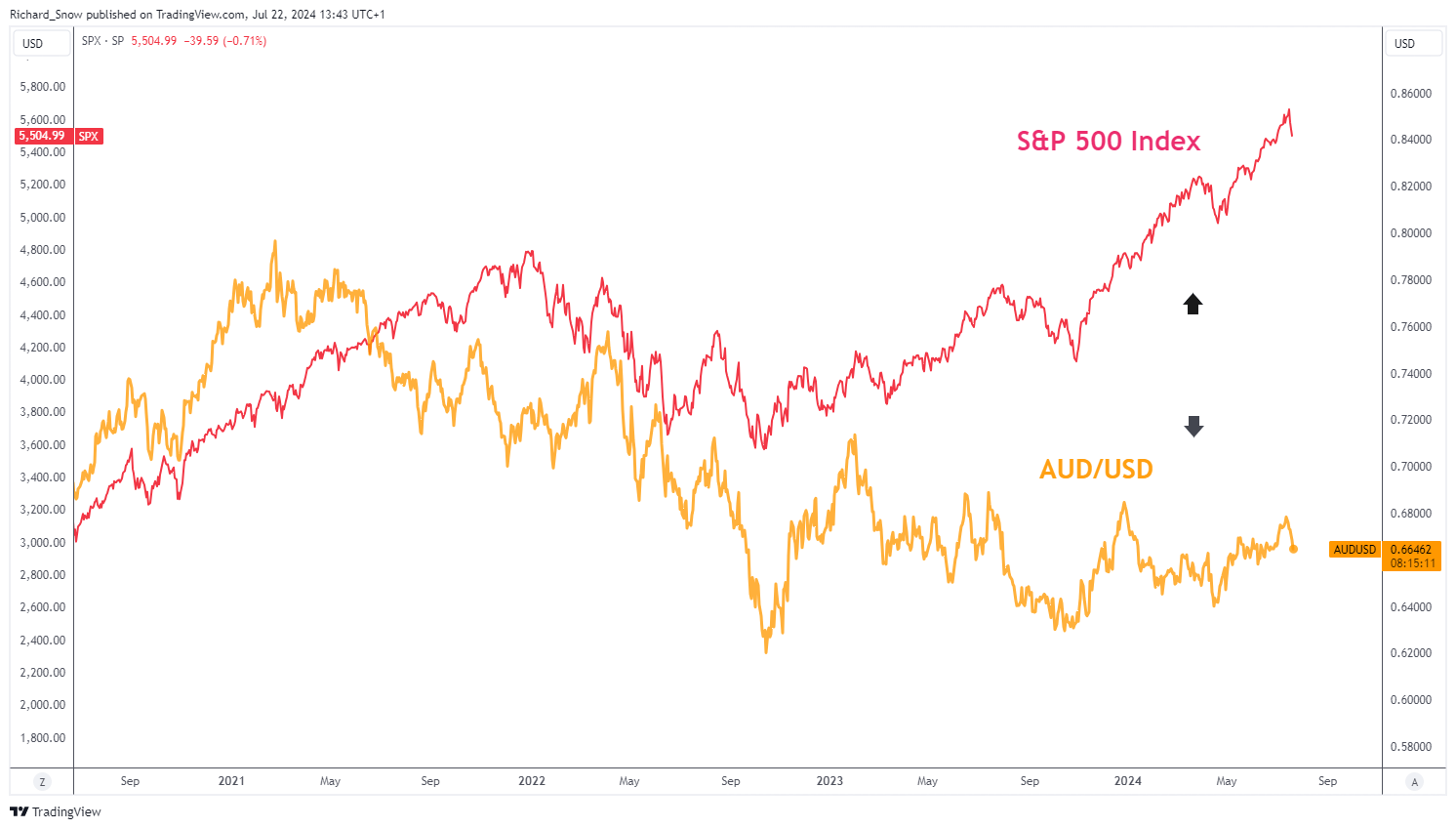

Typically, the Australian dollar has a positive correlation with the S&P 500 index. However, this correlation has weakened recently, with the S&P 500 continuing to rise while the Aussie dollar fell.

Both the Aussie dollar and the S&P 500 Index closed lower last week. The Aussie continued its decline on Monday, even as S&P futures pointed to a higher opening.

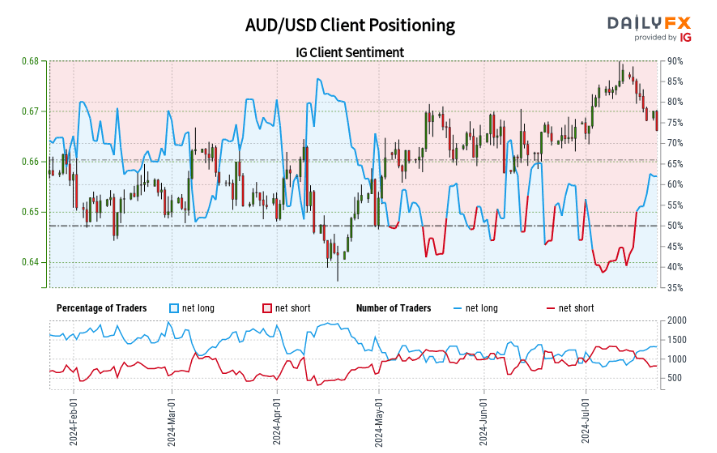

Market Sentiment and Trader Positioning

Recent data on retail trader positions shows a significant imbalance:

- Net-long positions: Up 10.21% since yesterday, a 57.97% increase from last week.

- Net-short positions: Down 5.36% since yesterday, a 37.63% decrease from last week.

Currently, 64.57% of traders hold long positions, resulting in a long-to-short ratio of 1.82 to 1.