AZAforex Review

In the dynamic world of Forex trading, selecting the right Forex broker is crucial for success. These brokers act as intermediaries, giving traders access to currencies, commodities, and other financial instruments. Choosing the right Forex broker can make a significant difference in your trading experience and profitability. In this context, let's explore what makes AZAforex a noteworthy contender in the brokerage market.

AZAforex stands out with its comprehensive range of trading services. The brokerage caters to diverse trading preferences, offering Forex, Cryptocurrencies, CFDs on Precious Metals, Energies, Stocks, Indices, and even Binary Options. Such a wide array of options not only provides flexibility but also opens avenues for diversification, essential in risk management.

In this review, I delve into AZAforex's offerings with the eye of an expert trader and the experiences of fellow customers. My aim is to provide a thorough analysis, highlighting the strengths and weaknesses of AZAforex. From evaluating its features, commission structure, and account types to scrutinizing transaction procedures, this review strives to offer a balanced and informative perspective, aiding your decision-making in Forex trading.

What is AZAforex?

Established in 2016, AZAforex has made its mark as a multi-asset broker. Known for its sophisticated proprietary platform and ECN trading capabilities, the brand caters to a diverse clientele. With over 120,000 registered users, AZAforex stands out for its variety of deposit methods, appealing to a broad range of traders.

At the core of AZAforex's offerings is the Mobius Trader 7 trading terminal, accessible on all devices. This modern platform is designed for efficiency, boasting fast order execution at a speed of 0.1 seconds, coupled with tight spreads. This combination ensures a smooth trading experience, crucial for both novice and seasoned traders.

AZAforex offers its clients an extensive range of trading instruments, including Forex, CFDs, indices, energies, and binary options. The broker's commitment to convenience is evident through features like account transfer services with exchange at market spreads. Moreover, the fixed spreads on ECN trading further enhance the trading experience, making it more predictable and transparent for traders.

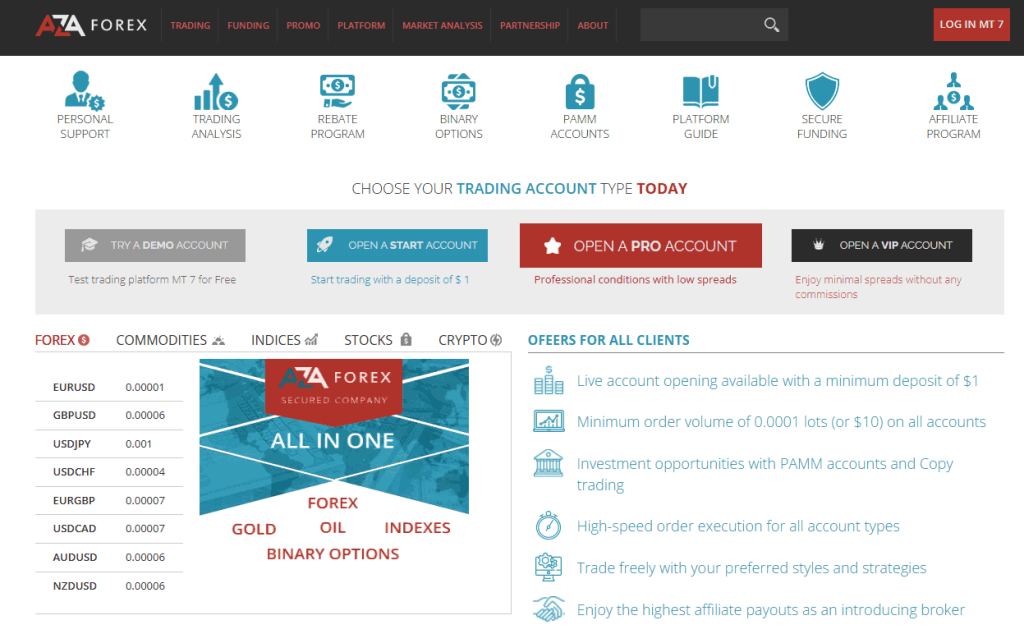

Benefits of Trading with AZAforex

Trading with AZAforex, I've noticed their flexible approach to incentivizing traders. They offer a variety of incentives, including their own rebate system, diverse bonus types, free strategy analysis, and valuable trading signals. This array of incentives not only enhances the trading experience but also provides practical tools to improve trading strategies.

As a trader at AZAforex, I've had access to a wide range of trading instruments. The ability to trade CFDs and binary options is particularly notable. This versatility allows me to diversify my trading portfolio and explore different markets, which is vital for managing risk and capitalizing on various market conditions.

Starting with AZAforex was remarkably easy due to their attractive starting conditions. The minimum deposit requirement of just USD 1 and the option of leveraging up to 1:1000 make it accessible for both beginners and experienced traders. This low entry barrier is excellent for those testing the waters in Forex trading and for seasoned traders looking to maximize their trading potential.

AZAforex Regulation and Safety

Through my experience with AZAforex, I've learned that it's registered and licensed offshore in the Marshall Islands by the Global Financial Services Authority (GLOFSA). It's important for traders to know that GLOFSA is not widely recognized as a reputable regulatory authority. This means that the supervision and oversight of brokers like AZAforex in these jurisdictions tend to be quite lax, with limited fund protection measures in place.

Understanding the regulatory environment of a broker is crucial, especially when it comes to the safety and security of your investments. The fact that AZAforex operates under a less stringent regulatory regime should be a key consideration for any trader, particularly those who prioritize fund security and stringent regulatory compliance in their trading activities.

AZAforex Pros and Cons

Pros

- Diverse incentive tools including rebates and bonuses.

- Offers CFDs and binary options trading.

- Low initial deposit requirement (USD 1).

- High leverage option (up to 1:1000).

- Multiple account base currencies (16 fiats, 6 crypto).

- Copy trading and PAMM account options.

- Free VPS for VIP accounts.

- Availability of a demo account.

Cons

- Absence of regulatory licensing.

- Proprietary platform instead of popular MetaTrader platforms.

- Safety concerns due to unregulated status.

- Withdrawal fees for certain payment methods.

- Limited educational resources.

- Negative feedback from some customers.

- No access to MetaTrader.

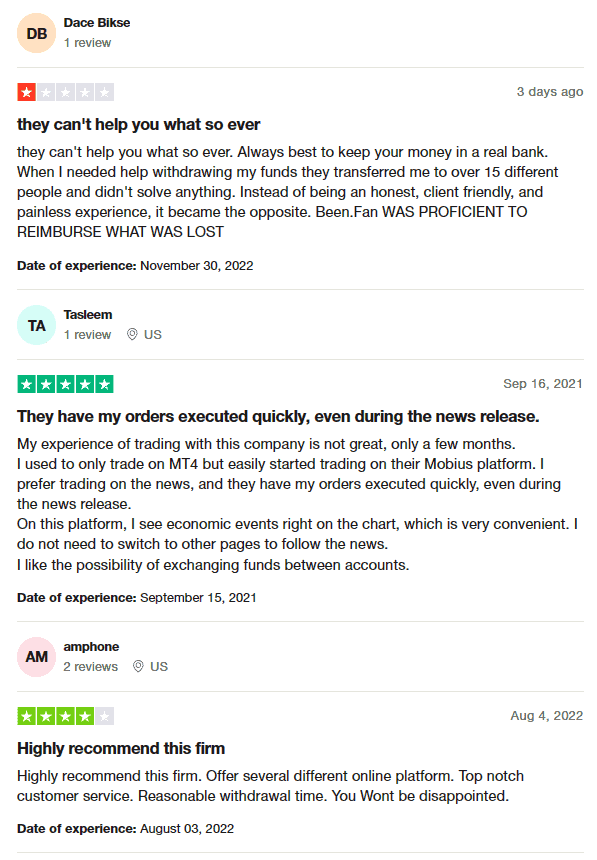

AZAforex Customer Reviews

AZAforex, with a 2.9-star rating on Trustpilot, elicits mixed responses from its customers. Some traders have faced challenges, particularly when trying to withdraw funds, citing a lack of effective support and an overly complicated process. However, others appreciate the trading experience on AZAforex's Mobius platform, highlighting its quick order execution, especially during news releases, and the convenience of viewing economic events directly on the chart. The ability to transfer funds between accounts is also noted positively. A segment of users highly recommends AZAforex for its diverse online platforms and commendable customer service, alongside reasonable withdrawal times.

AZAforex Spreads, Fees, and Commissions

In my experience trading with AZAforex, the spreads, fees, and commissions are a mixed bag. AZAforex advertises competitive spreads, such as 0.1 pips for EUR/USD, but these are mainly available for those who can deposit $10,000 into a VIP account. For retail traders using the Start account, the spreads are higher, starting from 1.1 pips for the same currency pair. This disparity is somewhat disappointing, especially when compared to what industry leaders like IC Markets or XM offer.

The Pro account at AZAforex offers a middle ground with minimum spreads of 0.5 pips. However, the $2,000 initial deposit might be a hurdle for beginners. While commission-free trading is an option, I found that there are ECN commissions of 0.003% in the Pro account.

A significant drawback with AZAforex is the deposit fees on bank transfers, credit/debit cards, and some e-wallets, which range between 5-6%, plus a $0.50 transaction fee. Although AZAforex claims to cover fees for larger deposits, the thresholds are high: over $100 for e-wallets, $300 for cards, and $1,000 for bank transfers. This aspect can be a deciding factor, especially for traders making smaller or more frequent deposits.

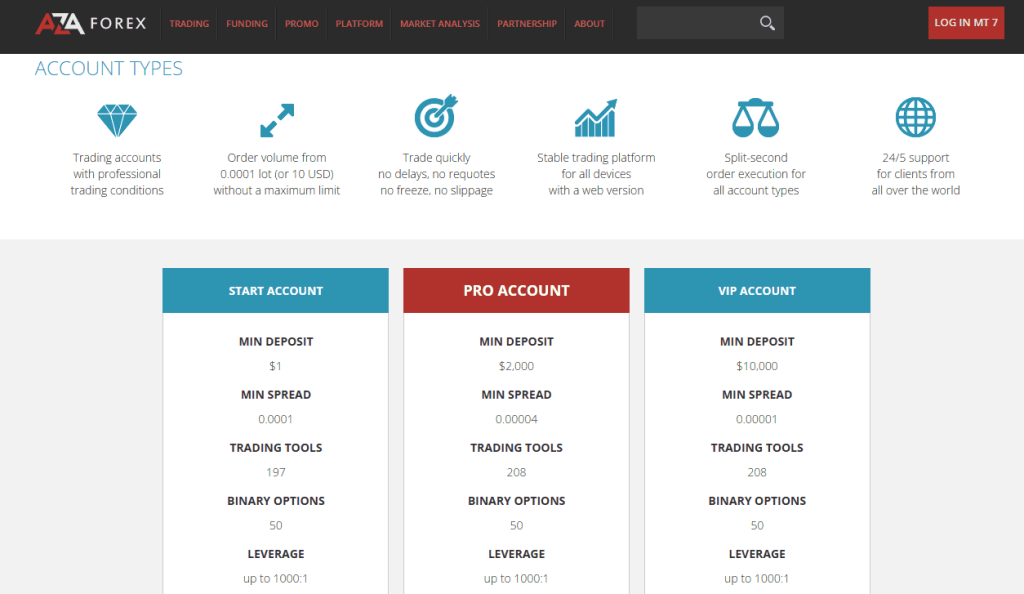

Account Types

Each account type caters to different levels of traders, from novices to seasoned investors. The Start account is particularly accessible for beginners with its minimal deposit requirement. The Pro and VIP accounts offer more advanced features like ECN execution and access to a broader range of fixed spreads. Additionally, all account types support swap-free Islamic trading and offer access to PAMM accounts, rebates, and loyalty bonuses, subject to certain deposit criteria.

After testing the various account types offered by AZAforex, I can outline them as follows:

Start Account

- Execution: Market

- Minimum Deposit: $1

- Currencies with Fixed Spreads: Not available

Pro Account

- Execution: Market, ECN

- Minimum Deposit: $2,000

- Currencies with Fixed Spreads: 13 available

VIP Account

- Execution: Market, ECN

- Minimum Deposit: $10,000

- Currencies with Fixed Spreads: 13 available

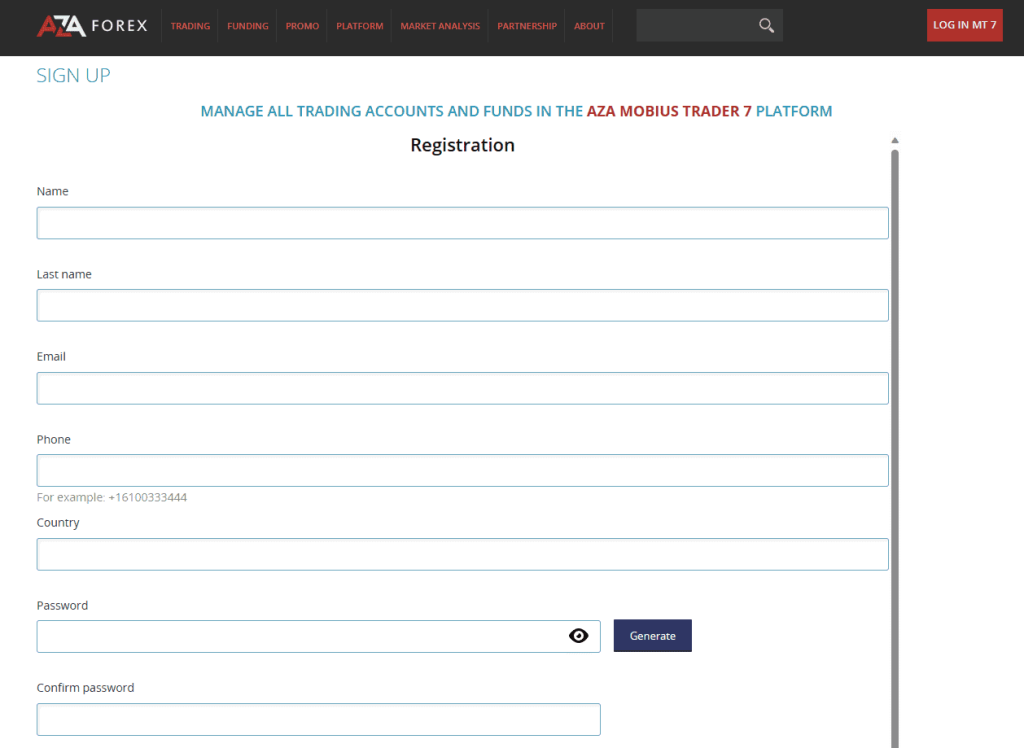

How to Open Your Account

- Enter your full name and contact information on the sign-up page.

- Select a secure password and submit your details.

- Look for a confirmation email in your inbox.

- Click the provided link in the email to access your ‘Personal Area'.

- Once logged in, you have the option to open multiple trading accounts.

- Use your dashboard to deposit or withdraw funds.

- Edit your account details as needed from the dashboard.

- Begin exploring the trading options and tools available in your account.

AZAforex Trading Platforms

Based on my experience with AZAforex, the broker exclusively offers its proprietary Mobius Trader 7 platform to all clients. I was quite impressed with Mobius 7, which is tailored for both beginners and experienced traders. This multi-asset terminal comes equipped with a comprehensive suite of technical analysis tools, analytics, educational resources, research capabilities, and a community for traders. The platform's thorough overview, including tutorials on chart operation, order placement, and customization, is notably helpful.

In addition to the desktop version, the Mobius 7 trading platform is accessible via a mobile app. This app, available for both iOS and Android devices, mirrors many features of the desktop platform. It includes a full range of order types, various time periods, complete trading history, three types of charts, real-time market data, and a news feed. From my usage, I found the Mobius 7 app user-friendly and well-structured, although it may not be as intuitive as some other trading apps in the market.

What Can You Trade on AZAforex

In my trading experience with AZAforex, I have explored its wide range of over 130 tradable assets, covering essential asset classes and including cryptocurrencies. I found their forex offerings particularly competitive, with a selection of 62 currency pairs encompassing major, cross, and exotic pairs such as EUR/GBP, EUR/AUD, and GBP/USD.

One of the standout features of AZAforex is its binary options. These options are ideal for short-term traders as they allow for earning a fixed payout based on whether the price of an asset will rise or fall. The platform offers 59 binaries with the potential for payouts of up to 90%.

Besides these, AZAforex provides a variety of other instruments:

- CFD Stocks: Trade CFDs on 33 different stocks, including major companies like Apple, Amazon, Barclays, and Uber.

- Cryptocurrencies: Trade in 10 different cryptocurrencies, including ADA, BCH, BTCX, and ETH.

- Indices: Access to 7 indices, including the UK100 and USA500.

- Commodities: Options to trade in commodities like gold, oil, and other energies, with pairs in EUR and USD.

This diverse range of instruments makes AZAforex a versatile platform for traders looking to diversify their portfolios across different market sectors.

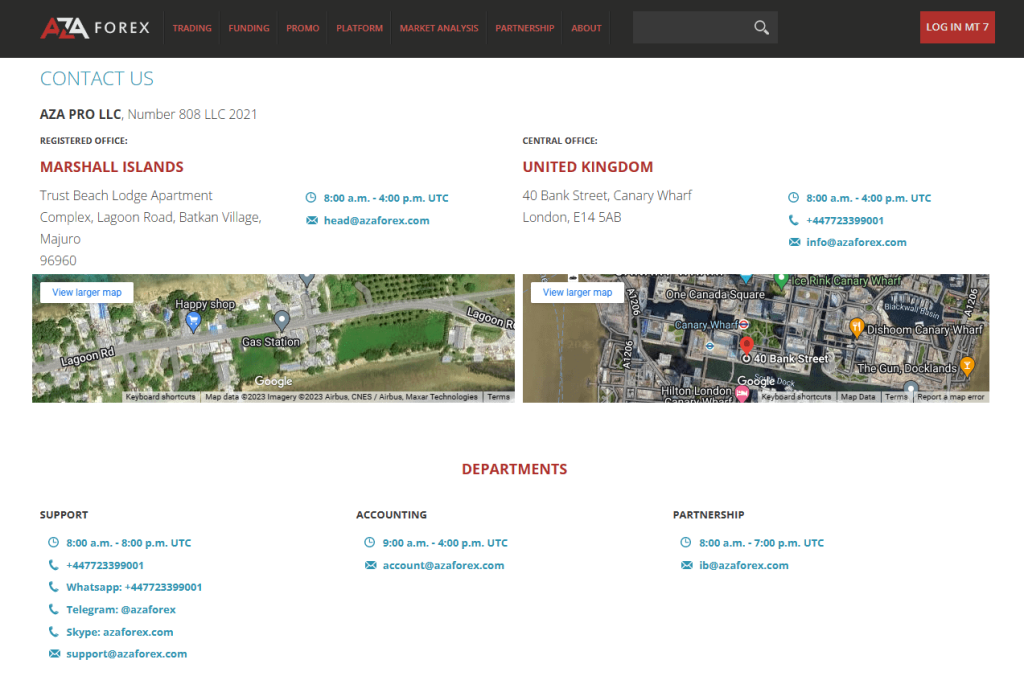

AZAforex Customer Support

In my dealings with AZAforex, I've noted that their customer support is available 12/5, which falls short of the ideal, considering the Forex market operates 24 hours a day. It's crucial for traders to have support aligned with market hours, and I typically recommend brokers that offer customer service at least 24/5, coinciding with popular market timings.

However, AZAforex does offer a decent range of support methods. You can reach their team from 8:00 am to 8:00 pm UTC. This timeframe provides a reasonable window for addressing queries or issues, but it may not cater to the needs of traders active outside these hours. The availability and methods of support are key factors to consider when choosing a broker, especially for those who trade in different time zones or rely on immediate assistance.

Advantages and Disadvantages of AZAforex Customer Support

Withdrawal Options and Fees

When using AZAforex, I found that their withdrawal options are quite versatile, matching the variety of their deposit methods. The platform allows a minimum deposit of just $1, making it highly accessible for many traders.

The available deposit methods at AZAforex include:

- Cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Credit and debit cards, including Visa and Mastercard.

- E-wallets such as Skrill, Neteller, and Advcash.

These methods are also applicable for withdrawals. The low minimum withdrawal amount of $10 for bank cards is commendable. However, the transaction fees for Visa and Mastercard withdrawals, which can be 3-5% plus a $10 fee, are notably higher compared to many leading brokers. This aspect of their fee structure is something traders should consider, especially if they plan to use these card options for withdrawals.

AZAforex Vs Other Brokers

#1. AZAforex vs AvaTrade

AZAforex is an unregulated broker with a focus on a wide range of trading instruments and a proprietary trading platform. It offers competitive spreads and a low minimum deposit but is limited by its unregulated status and high withdrawal fees for certain methods.

AvaTrade, on the other hand, is a well-established, regulated online Forex and CFD broker since 2006, boasting a large client base and a strong regulatory framework. With its commitment to providing a comprehensive trading experience, AvaTrade is heavily regulated and offers a wider range of financial instruments across multiple jurisdictions.

Verdict: AvaTrade tends to be a better choice for most traders due to its robust regulatory compliance, diverse trading options, and global reach. Its strong regulatory framework offers a higher level of security and trust, which is crucial in online trading.

#2. AZAforex vs RoboForex

AZAforex offers a range of trading options with a focus on binary options and a proprietary platform but lacks regulatory oversight.

RoboForex, established in 2009, is known for its advanced trading conditions, diverse trading platforms, and FSC regulation. It caters to a wide range of traders with its extensive asset offerings and technologically advanced platforms, including MetaTrader and cTrader.

Verdict: RoboForex is generally a better option, especially for traders looking for a regulated environment, diverse trading platforms, and a wide array of trading instruments. Its regulatory status and platform variety provide a more secure and flexible trading experience.

#3. AZAforex vs Exness

AZAforex offers a user-friendly platform and a range of trading instruments, but its unregulated status can be a concern for some traders.

Exness, a Cyprus-based broker operational since 2008, excels with a high trading volume and offers a variety of CFDs, over 120 currency pairings, and other instruments. It stands out for its low commissions, instant order execution, and unlimited leverage on small deposits.

Verdict: Exness is the more favorable choice for traders prioritizing low commissions, a wide range of instruments, and regulatory security. Its broad selection of accounts and strong operational history make it a more reliable and versatile option for traders.

Conclusion: AZAforex Review

AZAforex offers a compelling option for traders with its diverse trading opportunities and advanced features like copy trading and PAMM accounts. The broker's proprietary platform adds to its appeal for those seeking unrestricted trading options.

However, it's crucial to weigh these benefits against significant drawbacks. The lack of regulatory oversight and poor security features at AZAforex raise concerns about its reliability. Additionally, the limited customer service hours might not suffice for all traders. Beginners, in particular, might find more regulated alternatives with better security and support more appropriate. This balance is vital for informed decision-making when considering AZAforex as a trading option.

Also Read: HFM Review 2024 – Expert Trader Insights

AZAforex Review: FAQs

Is AZAforex Good For Beginners?

AZAforex might appeal to beginners due to its low minimum deposit of $1 and the availability of a free demo account. However, the lack of regulatory oversight is a significant concern, as it means beginners won't have negative balance protection or access to compensation schemes.

Is AZAforex Regulated?

AZAforex is registered in the Marshall Islands by the Global Financial Services Authority (GLOFSA), but it's important to note that GLOFSA is not widely recognized as a stringent regulatory authority. This means AZAforex operates with less oversight compared to brokers regulated by more reputable agencies.

Can You Trade Cryptocurrencies on AZAforex?

Yes, AZAforex offers the option to trade in cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Litecoin. This adds to the diversity of trading instruments available on their platform, catering to traders interested in the dynamic crypto market.