At Asia Forex Mentor, we know that finding the right Forex broker in Japan can make a huge difference in your trading journey. With so many options out there, it can feel overwhelming to pick the one that’s truly reliable. Japan has one of the most regulated Forex markets, which means choosing a broker with a solid reputation and the right features is crucial for protecting your investments. That’s why we’ve put together this list of the five best Forex brokers in Japan for 2026—to help you make an informed decision without the hassle.

Each broker we recommend offers something unique, from low fees to advanced tools or top-notch customer support. Whether you’re just getting started or you’ve been trading for years, these brokers provide the security and features that can help you trade with confidence. Our goal is to give you a clear view of your best options, so you can focus on what matters—your trading success.

What to Look for in a Forex Broker in Japan

If you're interested in forex trading in Japan, finding the right broker is key. There are several important factors to consider before making your decision, especially since the forex market can be a bit tricky to navigate if you're new to it. Let's break down the key things you should keep in mind when choosing a forex broker in Japan.

Overview of the Regulatory Environment in Japan

One of the biggest advantages of trading in Japan is the strong regulatory environment. The Japan Financial Services Agency (JFSA) is the main regulator overseeing forex brokers. Their primary goal is to ensure that brokers operate fairly and protect traders' funds. This means that any broker regulated by the JFSA has to follow strict rules and provide a high level of security for your money. So, it's important to make sure your broker is JFSA-regulated to avoid any shady operations.

Aside from the JFSA, there are other organizations like the Japan Securities Dealers Association (JSDA) that help maintain order in the market. But for most traders, the JFSA is the key player to watch out for.

Why Safety, Regulation, and Fund Security Matter

When it comes to forex trading, you want to feel confident that your funds are safe. A regulated broker offers protection for your money and ensures that it’s handled responsibly. This way, you avoid nasty surprises like brokers disappearing with your deposits. Brokers that are regulated by the JFSA are required to have certain capital reserves, which makes sure they can handle any major market movements and keep your money secure.

Always check that your broker is transparent about their security measures, including how they safeguard your funds and protect your personal information. After all, trading should be about growing your money, not worrying about losing it.

Key Features to Consider

When choosing a broker, look beyond the flashy ads and bonuses. There are four major features that you should focus on:

- Platform usability: Make sure the trading platform is easy to use and navigate. It should offer all the tools you need, like charts and indicators, without being overly complicated. If a platform feels clunky or confusing, you’ll have a hard time focusing on your trades.

- Spreads and commissions: Forex trading involves costs, and the main ones to watch are spreads (the difference between buy and sell prices) and commissions. Lower spreads and commissions will help you keep more of your profits.

- Leverage: In Japan, brokers are limited by regulation when it comes to leverage. For most major currency pairs, the maximum leverage is 25:1, which is relatively conservative compared to other countries. This protects traders from excessive risk, but it's still important to understand how much leverage a broker offers and if it fits your trading style.

- Customer service: A good broker should offer responsive and helpful customer service, preferably in both Japanese and English. This is especially important if you run into technical issues or need assistance with your account.

The 25 Best Forex Brokers in Japan

#1. AvaTrade: Best Overall for Traders in Japan

What is AvaTrade?

AvaTrade is a globally recognized forex and CFD broker renowned for its robust trading platforms and comprehensive educational resources. In Japan, AvaTrade stands out as one of the best brokers due to its strict adherence to Japanese financial regulations, ensuring a secure and trustworthy trading environment for investors. The broker offers a wide range of trading instruments, including major and exotic currency pairs, commodities, and indices, catering to both novice and experienced traders. Additionally, AvaTrade provides exceptional customer support and user-friendly interfaces, making it accessible and reliable for the Japanese trading community. These key attributes solidify AvaTrade’s reputation as a top-tier broker in Japan’s competitive forex market.

Advantages and Disadvantages of AvaTrade

AvaTrade Commission and Fees

When trading with AvaTrade in Japan, traders benefit from an array of key features designed to enhance their trading experience. AvaTrade offers multiple trading platforms, including the popular MetaTrader 4 and 5, as well as its proprietary AvaTradeGO mobile app, ensuring flexibility and ease of use across devices. The broker maintains competitive fees and commissions, with low spreads on major currency pairs and transparent pricing structures that eliminate hidden costs. Additionally, AvaTrade provides leverage options tailored to Japanese regulations, allowing traders to manage their risk effectively. Other notable features include automated trading capabilities, extensive educational materials, and 24/5 customer support, all contributing to a seamless and cost-efficient trading environment for Japanese investors.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. OANDA

What is OANDA?

OANDA is a well-established forex and CFD broker, known for its strong regulation, including in Japan under the Japan Financial Services Agency (JFSA). It offers competitive trading conditions with no minimum deposit requirement, access to over 70 currency pairs, and spreads starting as low as 0.2 pips. OANDA's platform is available on MetaTrader 4 and 5, and users can also benefit from advanced tools like TradingView and Autochartist. However, fees may apply for bank withdrawals, and there are inactivity charges for dormant accounts.

Advantages and Disadvantages of OANDA

OANDA Commission and Fees

When trading with OANDA in Japan, traders benefit from no minimum deposit requirements, tight spreads starting from 0.2 pips, and a wide range of forex pairs. The platform offers popular tools like MetaTrader 4 and 5, and additional resources such as Autochartist and TradingView for advanced analysis. Fees include standard trading commissions and potential charges for bank withdrawals or inactive accounts. OANDA is regulated by the JFSA, ensuring a secure trading environment for Japanese users.

OPEN AN ACCOUNT NOW WITH OANDA AND GET YOUR WELCOME BONUS

#3. IG

What is IG?

IG is a globally acclaimed forex and CFD broker known for its extensive market access and innovative trading technology. In Japan, IG is celebrated as one of the best brokers due to its strong commitment to regulatory compliance with the Financial Services Agency (FSA), ensuring a safe and reliable trading environment for Japanese investors. IG offers a vast array of trading instruments, including major and minor currency pairs, indices, commodities, and cryptocurrencies, catering to both beginner and advanced traders. Additionally, IG provides exceptional customer service, comprehensive educational resources, and a highly intuitive trading platform, making it a preferred choice for traders seeking quality and trustworthiness in Japan’s competitive forex market.

Advantages and Disadvantages of IG

IG Commission and Fees

IG offers access to the advanced MetaTrader 4 platform as well as its proprietary IG Trading platform, providing flexibility and powerful tools for market analysis. The broker is known for its competitive fees and transparent commission structures, with low spreads on major currency pairs and no hidden charges, ensuring cost-effective trading. IG also provides leverage options that comply with Japanese regulations, allowing traders to manage their risk effectively. Additional features include extensive educational materials, 24/7 customer support, and robust security measures to protect client funds. These attributes make IG a standout broker for Japanese traders seeking a reliable and feature-rich trading platform.

OPEN AN ACCOUNT NOW WITH IG MARKETS AND GET YOUR WELCOME BONUS

#4. Exness

What is Exness?

Exness is a leading forex and CFD broker celebrated for its high-speed execution and extensive range of trading instruments. In Japan, Exness is recognized as one of the best brokers due to its unwavering commitment to regulatory compliance with the Japanese Financial Services Agency (FSA), ensuring a secure and trustworthy trading environment for local investors. The broker offers a variety of account types tailored to different trading needs, including cent accounts for beginners and ECN accounts for professional traders. Additionally, Exness provides exceptional customer support in Japanese, user-friendly trading platforms, and comprehensive educational resources, making it an ideal choice for both novice and experienced traders in Japan’s competitive forex market.

Advantages and Disadvantages of Exness

Exness Commission and Fees

When using Exness in Japan, traders gain access to a range of essential features crafted to improve their trading journey. Exness provides platforms like MetaTrader 4 and 5, alongside its exclusive Exness WebTrader, offering both versatility and robust tools for comprehensive market analysis. The broker is acclaimed for its competitive pricing and transparent commission models, featuring tight spreads on primary currency pairs and no concealed fees, which ensures economical trading. Additionally, Exness offers high leverage options that adhere to Japanese regulatory standards, enabling traders to effectively manage their risk. Other notable features include rapid and secure methods for deposits and withdrawals, automated trading functionalities, a wealth of educational resources, and round-the-clock customer support, all of which contribute to a smooth and productive trading environment for investors in Japan.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#5. Interactive Brokers

What is Interactive Brokers?

Interactive Brokers is a globally recognized online broker that excels in providing a broad range of investment options, including stocks, options, futures, and forex. It stands out as one of the best brokers in Japan due to its access to 150 global markets, advanced technology, and commitment to regulatory compliance under the Financial Services Agency (FSA). With its low fees and extensive range of products, Interactive Brokers is an ideal choice for both retail and institutional investors in Japan.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Commission and Fees

Traders benefit from advanced features like the Trader Workstation (TWS) platform, offering powerful tools for market analysis. The broker's competitive fee structure includes low commissions across various asset classes, with spreads as narrow as 1/10 pip on forex and no hidden charges. Interactive Brokers also offers tiered pricing, meaning fees decrease with higher trading volumes, ensuring cost efficiency. Investors gain access to real-time data, numerous order types, and 24/7 customer support tailored to their needs.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR BONUS

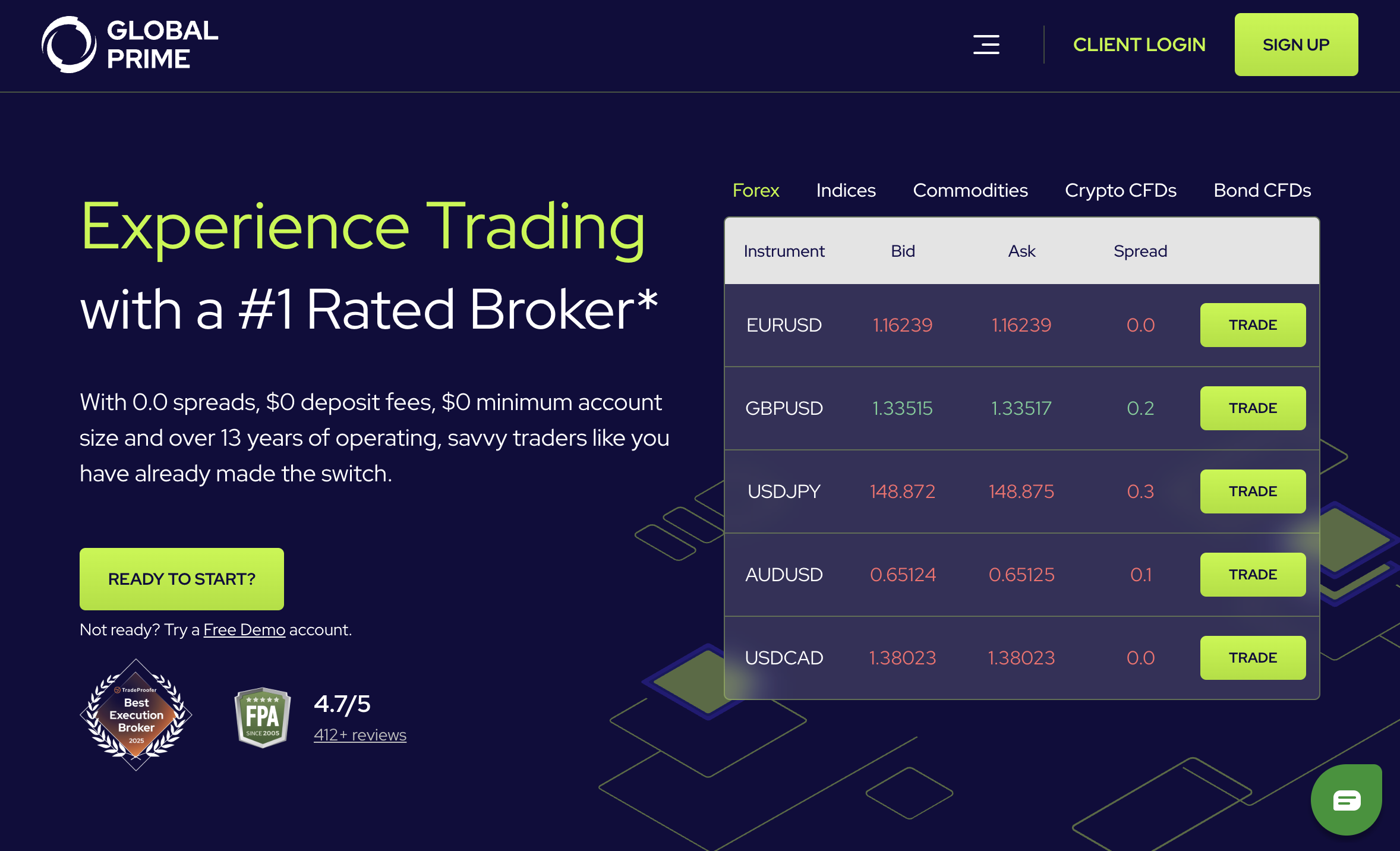

#6. Global Prime

What is Global Prime

Global Prime, a forex and CFD broker launched in 2010, is well-known for its transparent pricing, rapid execution, and tight spreads. It is regulated by ASIC in Australia and the VFSC in Vanuatu, with customer monies maintained in separate accounts for security.

Advantage and Disadvantage of Global Prime

Global Prime Commission and Fees

Global Prime charges $3.50 per side ($7 round trip) for Forex and Metals in the Raw Account, but no commission for the Standard Account. Crypto CFDs incur a 0.1% cost, whereas US Share CFDs and Indices are commission-free. Swap fees are applicable to overnight positions. There are no deposit, withdrawal, inactivity, or hidden fees; however, intermediary bank costs may apply.

OPEN AN ACCOUNT NOW WITH GLOBAL PRIME AND GET YOUR BONUS

#7. Vantage

What is Vantage?

Vantage Markets is a multi-asset FX and CFD broker that has won awards and has been in business for more than 15 years. It is licensed in several places, including ASIC (Australia), the FCA (UK), and CIMA (Cayman Islands). It has a lot of different instruments, including as forex, commodities, indices, shares, ETFs, and bonds. It also works with platforms like MetaTrader 4/5, TradingView, and its own tools. It is important that it allows Japanese clients, which makes it easy for people in Japan to register accounts and trade in their own market.

Advantage and Disadvantage of Vantage

Vantage Commission and Fees

Vantage provides two basic account kinds, which affect commissions and fees. The Standard STP Account has no direct commissions, with costs included in the tight floating spreads. The RAW ECN Account charges a flat commission of $3.00 per normal lot, per side ($6 round trip), in exchange for ultra-tight spreads beginning at 0.0 pips. There are no fees to open an account, but a $50 deposit is necessary to begin trading. Swap-free accounts do not incur overnight interest costs, however there is an administration fee. Aside from these, Vantage does not charge deposit, withdrawal, or inactivity fees; however, intermediary bank charges may apply.

OPEN AN ACCOUNT NOW WITH VANTAGE AND GET YOUR BONUS

#8. GO Markets

What is GO Markets?

GO Markets is a well-known forex and CFD broker that has been around for a long time. They are recognized for having low costs, tight spreads, and quick digital account setup, which usually takes only one day. It has more than 1,800 instruments to choose from, such as FX, commodities, indices, shares, ETFs, and cryptocurrencies. It also supports complex tools like MT4, MT5, and cTrader, and it gives active traders free VPS hosting. Broker rankings that include traders from Japan show that GO Markets accepts Japanese clients and offers services that meet their market needs, such as low deposit limits and easy withdrawal processes.

Advantage and Disadvantage of GO Markets

GO Markets Commission and Fees

GO Markets sets its prices based on the type of account you have. The Standard Account doesn't charge any commissions, but the spreads are greater, starting at 0.8 pips. The GO Plus+ Account does charge a low commission of roughly $7.00 per standard lot in USD (or about AU$3.00 per side for AUD accounts), and the spreads can be as tight as 0.0 pips. There are different fees for different markets. For example, there is no commission on XAUUSD trades and minor commissions on Share CFDs when positions are started and liquidated. GO Markets does not charge internal fees for deposits or withdrawals, while intermediary or receiving banks may add their own charges.

OPEN AN ACCOUNT NOW WITH GO MARKETS AND GET YOUR BONUS

#9. VT Markets

What is VT Markets?

VT Markets, an Australian-based worldwide forex and CFD broker formed in 2015, offers a comprehensive range of instruments, including currency pairings, commodities, indices, shares, ETFs, and bonds, across popular platforms like MT4, MT5, TradingView, and its unique VT Markets app. The broker is authorized by respected agencies such as ASIC (Australia), FSCA (South Africa), and FSC (Mauritius), and serves clients from over 160 countries, including Japan. VT Markets periodically offers JPY-denominated promos, such as no-deposit bonuses for Japanese residents.

Advantage and Disadvantage of VT Markets

VT Markets Commission and Fees

VT Markets bases its price on account type. The Standard STP account is commission-free, with fees incorporated into the spread, which normally begins at around 0.8 pips. The RAW ECN account has substantially tighter spreads (beginning at 0.0 pips), but charges a $3 commission per lot per side. Deposits are usually free, but withdrawals may be subject to processing costs depending on the payment type. Traders should also be aware that swap costs are levied for holding positions overnight, with the rate varying according to the instrument and account type. Some Standard STP accounts may be swap-free by default.

OPEN AN ACCOUNT NOW WITH VT MARKETS AND GET YOUR BONUS

#10. TMGM

What is TMGM?

TMGM, which stands for TradeMax Global Markets, is a multi-regulated FX and CFD broker based in Australia. Established in 2013, it is regulated by ASIC (Australia), VFSC (Vanuatu), FMA (New Zealand), and FSC (Mauritius) and offers over 12,000 trading instruments on platforms such as MT4, MT5, and IRESS. The broker explicitly allows Japanese clients and offers a variety of account options, including swap-free Islamic accounts.

Advantage and Disadvantage of TMGM

TMGM Commission and Fees

TMGM provides both commission-based and commission-free accounts. The Edge Account charges a $7 round-turn commission per normal lot on forex trades, with spreads starting at 0 pips and especially competitive during peak hours. The Classic Account has no commissions, but spreads are higher, beginning at roughly 1 pip. There are no deposit, inactivity, or internal withdrawal costs, but bank transactions may incur third-party charges. Swap costs apply when positions are held overnight, however swap-free accounts are available for traders who do not want to pay overnight interest. The primary distinction between account types is that the Edge Account offers lower spreads with commissions, whilst the Classic Account offers bigger spreads without commissions.

OPEN AN ACCOUNT NOW WITH TMGM AND GET YOUR BONUS

#11. FOREX.com

What is Forex.com?

FOREX.com is a global FX and CFD broker that operates in several regulated areas, including the U.S., UK, Canada, Australia, Singapore, and Japan, through its licensed Japanese subsidiary. It was formed in 1999. Known for its history and firm regulatory footing, it serves over 750,000 active clients globally and is part of a publicly traded financial group. People in Japan trust FOREX.com because it has a lot of trading assets, uses both its own and popular third-party platforms, and is a good place to trade.

Advantage and Disadvantage of Forex.com

Forex.com Commission and Fees

FOREX.com imposes a $5 USD fee for every $100,000 USD transacted on their RAW Spread accounts. These accounts also have very narrow spreads, with key currency pairs having spreads as low as 0.0 pips. Standard accounts don't charge a commission on forex trades; instead, they use spreads. On the other hand, CFD trades have different commissions depending on the market. For instance, Japanese stocks have a minimum of JPY 1,000 and a 0.05% fee. When you maintain CFD positions overnight, you also have to pay swap or overnight finance fees on top of these commissions.

OPEN AN ACCOUNT NOW WITH FOREX.COM AND GET YOUR BONUS

#12. FxPro

What is FxPro?

FxPro is a global FX and CFD broker that started in 1999 and now serves traders in more than 170 countries, including Japan. The FCA, CySEC, SCB, and FSCA are some of the most important financial regulators that oversee it. It has more than 2,200 products for trading, including FX, commodities, indices, shares, futures, and cryptocurrencies. FxPro works with MT4, MT5, cTrader, and its own FxPro Edge platform. This means that you can use both manual and automated trading tactics with it.

Advantage and Disadvantage of FxPro

FxPro Commission and Fees

The cost of trading with FxPro depends on the type of account you have. Standard accounts include everything, so there are no extra fees. The charges are integrated right into the spreads, which usually start at 1.2 pips. Raw+ and Elite accounts have tighter spreads, starting at 0.0 pips, but they also charge a commission of $3.50 per lot per side ($7 round-turn). FxPro doesn't charge account fees or most withdrawal fees, although some payment providers might. Also, under certain situations, e-wallet withdrawals to Skrill, Neteller, or PayPal may be subject to fees. If you don't make any transactions for six months, you'll have to pay inactivity fees. The first price is a one-time $15 account maintenance fee, and after that, you'll have to pay $5 every month. VIP accounts are offered for traders who do a lot of business. They have lower spreads and lower commissions.

OPEN AN ACCOUNT NOW WITH FXPRO AND GET YOUR BONUS

#13. Dukascopy

What is Dukascopy?

Dukascopy is a bank and online broker based in Switzerland. Its main office is in Geneva, and FINMA regulates it. Dukascopy Japan K.K. is also part of the business. It is a Type-1 licensed broker under the Japan Financial Services Agency (JFSA), which lets Japanese traders legally trade FX and CFDs. Japanese clients who use the unique JForex platform get the same prices and liquidity as users from across the world.

Advantage and Disadvantage of Dukascopy

Dukascopy Commission and Fees

Dukascopy charges fees based on the amount of trading and the type of asset. The normal charge for currency pairs is roughly $5 every $1 million exchanged. For precious metals and CFDs, the rate is about $7.50 per $1 million. There are minimum commissions, such $1.00 for every EUR/USD trading and $1.50 for every Gold trade. Higher trading volumes or larger account equity can lower rates. Also, there is a 2% cost for deposits made with a payment card (2.5% for currencies other than major ones), and there are swap fees for positions that are open overnight. Dukascopy also charges typical bank card fees for issuing cards, using them every month, taking money out of ATMs, and converting currencies.

OPEN AN ACCOUNT NOW WITH FXPRO AND GET YOUR BONUS

#14. FBS

What is FBS?

FBS is a forex and CFD broker that works around the world. It was founded in 2009 and is regulated in Belize, Cyprus, and Australia. It offers a wide range of tools, such as forex, indices, commodities, and stock CFDs, which can be accessed through platforms like MetaTrader 4 and 5. FBS works with Japanese clients and helps them get into foreign markets by offering strict entry standards, demo accounts, and flexible funding choices.

Advantage and Disadvantage of FBS

FBS Commission and Fees

FBS usually doesn't charge commissions on its regular accounts. Instead, the expenses are integrated into the spread, which is the difference between the buy and sell prices of an asset. Most of the time, spreads on these accounts start at about 0.6 pips for major pairings. But some types of accounts, like the ECN account, levy a tiny fee in exchange for substantially tighter spreads, which can be as low as 0.0 pips. varying types of assets may also have varying fees. For example, equities or index CFDs may have different fees than currency pairings. FBS, like most brokers, imposes swap fees for keeping leveraged positions open overnight. These fees might be good or bad depending on the trade. On the plus side, FBS doesn't charge fees for deposits, withdrawals, or not using your account, however certain payment processors may charge their own costs for transactions.

OPEN AN ACCOUNT NOW WITH FBS AND GET YOUR BONUS

#15. Plus500

What is Plus500?

Plus500 is an online broker that is well-known around the world for trading CFDs. It offers a wide range of assets, including FX, commodities, indices, cryptocurrencies, and stocks. It is publicly traded in London and follows rules set by the FCA (UK), ASIC (Australia), and MAS (Singapore), among others. Plus500 is also licensed to do business in Japan, and anyone who live there can use it.

Advantage and Disadvantage of Plus500

Plus500 Commission and Fees

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR BONUS

#16. Saxo Bank

What is Saxo Bank?

Saxo Bank is an online multi-asset broker based in Denmark that was created in 1992. It is regulated by top-tier authorities such as the Danish FSA, UK FCA, ASIC, MAS, and Japan's FSA through Saxo Bank Securities Ltd. It gives you access to more than 71,000 assets, including FX, equities, ETFs, commodities, indices, bonds, options, futures, and cryptocurrencies. Japanese residents can establish new accounts through its licensed subsidiary. They can trade on the advanced platforms SaxoTraderGO and SaxoTraderPRO.

Advantage and Disadvantage of Saxo Bank

Saxo Bank Commission and Fees

The fees and commissions at Saxo Bank depend on the type of account you have (Classic, Platinum, or VIP) and the products you trade. Commissions for stocks and ETFs start at 0.03% per trade. For listed options, they usually vary from $0.75 to $2.00 per contract, depending on the tier. Forex trading has tight spreads, starting at about 0.4 pips for main pairings. CFDs have cheap commissions and prices that are competitive. Saxo additionally charges custody fees on assets, which are roughly 0.12% per year for Classic accounts and 0.08% per year for VIP accounts. When trading in various currencies, there is also a modest currency translation fee of about ±0.25%.

OPEN AN ACCOUNT NOW WITH SAXO BANK AND GET YOUR BONUS

#17. IC Markets

What is IC Markets?

IC Markets is a well-known forex and CFD broker with its main office in Sydney, Australia. It was formed in 2007. ASIC oversees it, and it lets you trade on MT4, MT5, and cTrader. It has a good reputation for quick execution, low latency, and lots of liquidity. IC Markets is one of the biggest brokers in the world by trading volume. It is especially popular with algorithmic traders, scalpers, and high-frequency traders.

Advantage and Disadvantage of IC Markets

IC Markets Commission and Fees

There are two primary types of MetaTrader accounts at IC Markets: Standard and Raw Spread. The Standard account doesn't charge a commission; instead, it adds a spread markup to the raw interbank prices. The Raw Spread account gives you direct access to raw liquidity provider spreads, which can be as low as 0.0 pips. There is a flat cost of $3.50 per standard lot round turn on both MT4 and cTrader accounts. IC Markets doesn't charge fees for inactivity, deposits, or withdrawals, but banks and payment processors might. If you hold leveraged positions after the market closes, you will have to pay swap or overnight finance fees. IC Markets also has a Raw Trader Plus rebate program for traders that trade a lot. This program lowers the effective cost of trading by giving back some of the fees that were paid.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR BONUS

#18. IronFX

What is IronFX?

IronFX is a global forex and CFD broker that is regulated in several places. It was formed in Cyprus in 2010. It helps traders in more than 180 countries and gives them access to currency, commodities, indexes, shares, futures, and metals. The broker lets you trade using MetaTrader 4 as well as its own web and mobile platforms. It also has Islamic accounts that don't charge swaps. IronFX has established its business by offering a wide range of products and assistance in many languages.

Advantage and Disadvantage of IronFX

IronFX Commission and Fees

The fees for IronFX varies a lot on the type of account. There is no commission on standard accounts, although spreads are usually bigger, starting at about 1.6 to 1.7 pips. On the other hand, Zero Spread accounts have spreads starting at 0 pips and carry a commission of roughly $10 every round-turn lot. IronFX may charge more than just spreads and commissions. For example, they may charge wire transfer fees for deposits and withdrawals, inactivity fees for accounts that aren't used, and possible mark-ups on some trades. If you open an account through an Introducing Broker (IB), you may have to pay part of the trading cost to the IB. Like most registered brokers, IronFX may also take out taxes as needed by law.

OPEN AN ACCOUNT NOW WITH IRONFX AND GET YOUR BONUS

#19. Eightcap

What is Eightcap?

Eightcap is a forex and CFD broker that was established in 2009. It is authorized by many organizations, including ASIC (Australia), CySEC (Cyprus), and the Securities Commission of the Bahamas. It offers more than 800 traded assets, including FX, indices, commodities, equities, and cryptocurrencies. The broker offers trading on MT4, MT5, and TradingView, making it appealing to both manual and automatic traders looking for a diverse global offering.

Advantage and Disadvantage of Eightcap

Eightcap Commission and Fees

Eightcap's costs vary depending on the account type selected. The Standard Account does not impose fees, and trading charges are integrated into the spread, which normally starts around 1 pip for key currency pairs such as EUR/USD. The Raw Account, on the other hand, has incredibly competitive spreads of 0.0 pips and charges a commission of $3.50-$7.00 per regular lot, each side (round-trip depending on currency). In addition to spreads and costs, Eightcap charges swap or overnight finance fees for leveraged positions held after the trading day's closure, with rates varied by instrument. The broker does not charge fees for deposits or most withdrawals, although intermediate banks may levy transfer or conversion costs. Unlike some competitors, Eightcap does not charge inactivity fees, making it a cost-effective option for traders who value flexibility in their activity levels.

OPEN AN ACCOUNT NOW WITH EIGHTCAP AND GET YOUR BONUS

#20. Octa

What is Octa?

Octa is a global forex and CFD broker that started in 2011. It is regulated by the Mwali International Services Authority, CySEC in Cyprus, and FSCA in South Africa. It works with clients in more than 150 countries and lets them trade through MetaTrader 4, MetaTrader 5, and its own OctaTrader platform. Octa is a low-cost broker that caters to both new and experienced traders. It is known for its quick withdrawals and options that don't require a swap.

Advantage and Disadvantage of Octa

Octa Commission and Fees

Octa doesn't charge any extra costs for trading because it works on a 0% commission premise. Instead, the cost of trading comes from floating spreads, which start at 0.6 pips and change based on how the market is doing. Traders only pay for the difference between the purchase and sell prices of instruments because spreads are the only expense. Octa also doesn't charge for deposits or withdrawals, and it often pays third-party transaction fees, which makes it more appealing to traders who want to save money. Octa also doesn't charge for overnight swaps, which makes it very appealing to long-term traders and people who want swap-free (Islamic) accounts.

OPEN AN ACCOUNT NOW WITH OCTA AND GET YOUR BONUS

#21. NinjaTrader

What is NinjaTrader?

NinjaTrader is a U.S.-based futures brokerage and trading software platform that started in 2003. It has a license from the CFTC and NFA to act as a futures commission merchant and an introducing broker. NinjaTrader is made for trading futures and has comprehensive charting, market research, and automation tools. It works on desktops, the web, and mobile devices. It is a popular choice for active, high-volume traders because it focuses on futures markets.

Advantage and Disadvantage of NinjaTrader

NinjaTrader Commission and Fees

NinjaTrader uses a tiered commission structure based on the account plan, with lower rates on the Monthly Plan and the lowest on the Lifetime License. Traders also pay exchange, NFA, and clearing fees, plus optional costs like market data subscriptions. Additional charges may include wire transfer fees, inactivity fees, and a 1% currency conversion fee.

OPEN AN ACCOUNT NOW WITH NINJATRADER AND GET YOUR BONUS

#22. MooMoo

What is MooMoo?

Moomoo is a global investing and trading platform founded in 2018 by Futu Holding. It provides commission-free trading in stocks, ETFs, and options, as well as comprehensive charting, market data, and research tools. Moomoo is available in Japan through Moomoo Securities Japan, which is licensed by local regulators and allows trading in both US and Japanese shares, including NISA accounts. This makes it appealing to Japanese ordinary investors looking to access both domestic and international markets with a single account.

Advantage and Disadvantage of MooMoo

MooMoo Commission and Fees

OPEN AN ACCOUNT NOW WITH MOOMOO AND GET YOUR BONUS

#23. Webull

What is Webull?

Webull is a U.S.-based electronic brokerage and trading platform that started in 2017. It is registered by the SEC and FINRA and lets users trade stocks, ETFs, options, futures, and cryptocurrencies on both mobile and desktop without paying any fees. It has advanced charting capabilities, trading after hours, and paper trading. Webull also has a licensed subsidiary in Japan called Webull Japan. This lets people in Japan trade U.S. and Japanese stocks with access to the local market.

Advantage and Disadvantage of Webull

Webull Commission and Fees

OPEN AN ACCOUNT NOW WITH WEBULL AND GET YOUR BONUS

#24. Optimus Futures

What is Optimus Futures?

Optimus Futures is a U.S.-based brokerage that has been around since 2005 and focuses on trading options and futures. The CFTC has registered it, and the NFA has accepted it as a member. This gives you access to more than 40 futures trading platforms, including as CQG, Rithmic, Sierra Chart, and TradingView. The broker is known for focusing on professional and active traders. They offer great customer service, cutting-edge trading technology, and clear pricing.

Advantage and Disadvantage of Optimus Futures

Optimus Futures Commission and Fees

OPEN AN ACCOUNT NOW WITH OPTIMUS FUTURES AND GET YOUR BONUS

#25. InstaForex

What is InstaForex?

InstaForex is a global forex and CFD broker that started in 2007 and is based in the British Virgin Islands. The BVI FSC and CySEC keep an eye on it. It has a lot of different instruments, like more than 110 forex pairs, stock CFDs, commodities, indices, and cryptocurrencies. You may trade them on platforms like MT4, MT5, and its own WebTrader. The broker also has special features including PAMM accounts, copy trading (ForexCopy), and learning materials.

Advantage and Disadvantage of InstaForex

InstaForex Commission and Fees

InstaForex fees depend on the account type, standard accounts have no commissions but wider spreads (e.g., 3 pips on EUR/USD), while commission-based accounts offer spreads from 0 pips with about $30 per lot. CFDs have a 0.1% fee, and withdrawal costs range from 1.5% to 2%, going up to 5% with multiple payment systems. Swap fees also apply for overnight positions.

OPEN AN ACCOUNT NOW WITH INSTAFOREX AND GET YOUR BONUS

Forex Trading Regulations in Japan

In Japan, forex trading is strictly regulated to protect traders and ensure fair practices. The Financial Services Agency (FSA) is the primary regulator overseeing forex brokers in Japan. The FSA ensures that brokers follow strict guidelines, such as holding licenses and adhering to compliance requirements. These include maintaining proper risk management systems and transparent trading conditions.

For japanese traders, safety is a top priority. Japan has an investor protection scheme, including the Japan Investor Protection Fund, which covers clients in case of broker insolvency. Additionally, brokers must provide access to dispute resolution mechanisms in case any issues arise between the trader and the broker.

In 2026, there have been some regulatory changes impacting forex trading in Japan, including tighter restrictions on leverage limits to protect retail investor accounts and prevent excessive risk. The FSA also continues to monitor forex trading platforms for transparency and fairness. These regulations make forex trading legal and provide a secure trading environment for japanese forex traders.

Japan's regulatory environment ensures trading costs are transparent, and brokers in Japan offer well-regulated forex broker services. Whether you're using advanced trading tools or starting with retail CFD accounts, you can trust that your trades are executed fairly. The focus on safety and compliance makes Japan a preferred destination for both japanese forex brokers and international brokers offering services in the country.

This regulatory framework is crucial for active traders and those engaging in trading CFDs or trading forex. Market research, trading tools, and lower trading costs are key for japanese traders seeking the best forex broker options. Thanks to these robust measures, forex trading in Japan remains a safe, efficient, and fair environment for all investors.

Conclusion

In conclusion, finding the best forex broker in Japan for 2026 requires considering factors like regulation, fees, and platform features. Brokers like AvaTrade, IG, Exness, Interactive Brokers, and others offer strong compliance with the FSA, competitive spreads, and advanced trading tools. Whether you’re a beginner or experienced trader, each broker offers unique benefits, from educational resources to powerful market research tools and low trading costs. By evaluating these key aspects, traders can confidently select the best broker for their forex trading needs in Japan.

Also Read: The 5 Best Forex Brokers in Singapore in 2026

FAQs