Position in Rating | Overall Rating | Trading Terminals |

200th  | 2.4 Overall Rating |  |

Crystal Ball Markets Review

Choosing the right Forex broker is crucial for anyone venturing into the world of forex trading. The right broker can significantly influence your trading success by providing reliable trading platforms, competitive spreads, and excellent customer service. Forex brokers act as intermediaries between you and the currency market, and their role involves executing trades on your behalf and offering the necessary tools and support to help you navigate the complex world of forex trading.

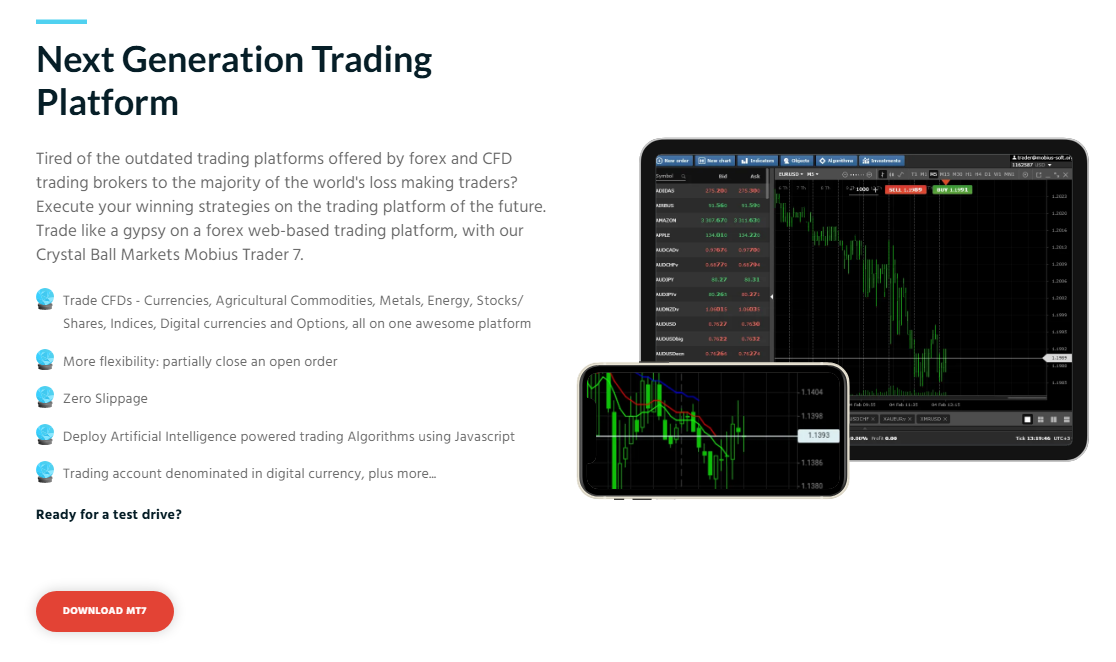

Crystal Ball Markets stands out in the crowded field of forex brokers with its robust offering. Founded in 2020, it provides a comprehensive online platform that supports trading in currencies, metals, energy, stocks, indices, cryptocurrencies, and options. What sets Crystal Ball Markets apart is its cutting-edge Mobius Trader 7 platform, designed to cater to both beginners and advanced traders by supporting AI-powered trading algorithms and offering instant execution with zero slippage.

In this detailed review, I aim to provide an exhaustive evaluation of Crystal Ball Markets, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Crystal Ball Markets as your preferred brokerage service provider.

What is Crystal Ball Markets?

Crystal Ball Markets is a forex broker that offers a wide range of trading options including currencies, metals, energy, stocks, indices, and cryptocurrencies. They provide a user-friendly trading platform called Mobius Trader 7, which is suitable for both beginners and advanced traders. The platform supports AI-powered trading algorithms and ensures instant execution with zero slippage.

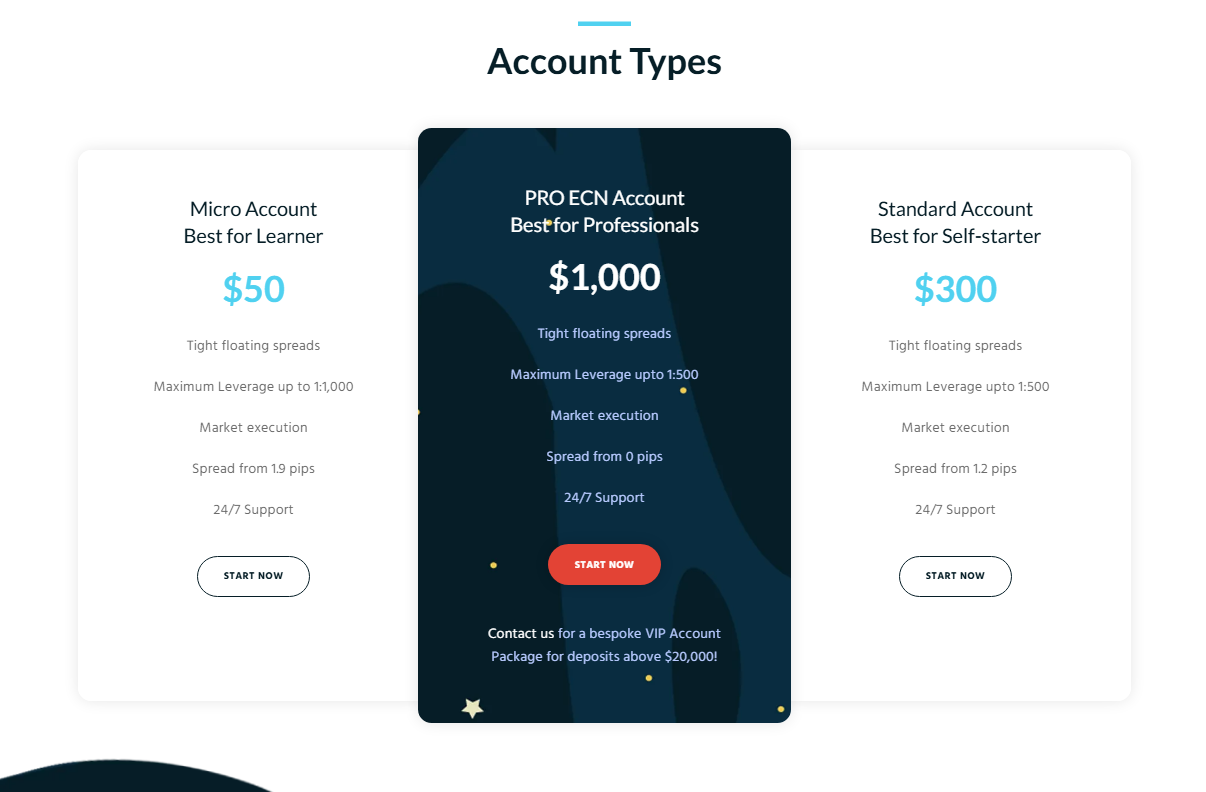

The broker was established in 2020 and has quickly gained recognition for its competitive trading conditions. They offer several account types, including a Micro Account with a minimum deposit of $50, a Standard Account with a minimum deposit of $200, and a PRO ECN Account that requires a $1,000 minimum deposit. Each account type provides different benefits such as tight spreads and high leverage options.

Crystal Ball Markets Regulation and Safety

Crystal Ball Markets operates under regulatory oversight to ensure the safety and security of its clients. The broker is registered in Saint Vincent and the Grenadines and also has an entity regulated by FINTRAC in Canada. This dual regulation provides a level of credibility and trust, indicating that the broker adheres to financial laws and regulations.

The importance of knowing a broker's regulatory status cannot be overstated. Regulatory oversight means that client funds are protected, often held in segregated accounts, and that there are measures in place to prevent fraud and malpractice. With Crystal Ball Markets, knowing they comply with FINTRAC rules offers peace of mind that your investments are handled within a secure framework.

Additionally, Crystal Ball Markets employs a segregated withdrawal guarantee fund of $100,000, which further enhances the safety of your funds. This guarantee ensures that even in unlikely events of financial instability, clients' funds remain protected. Such safety measures are crucial for traders who want to ensure their capital is secure while they focus on trading strategies.

Crystal Ball Markets Pros and Cons

Pros

- High leverage up to 1:1,000

- Multiple account types available

- AI-powered trading algorithms

- No deposit fees

- Fast execution with zero slippage

Cons

- Unclear withdrawal fees

- Limited regulatory oversight

- Relatively new broker

Benefits of Trading with Crystal Ball Markets

Trading with Crystal Ball Markets offers several notable benefits. The platform provides a diverse range of trading instruments, including forex, cryptocurrencies, indices, stocks, and commodities. This variety allows me to diversify my portfolio and explore different markets with ease.

One of the standout features is the AI-powered trading algorithms available on the Mobius Trader 7 platform. This advanced technology enhances trading efficiency and accuracy, making it suitable for both novice and experienced traders. Additionally, the platform's instant execution and zero slippage policy ensure reliable and precise trade executions.

The availability of multiple account types, such as the Micro, Standard, and PRO ECN accounts, caters to different trading needs and experience levels. With tight spreads and high leverage options, I found it flexible enough to support various trading strategies. Furthermore, the 24/7 customer support is responsive and helpful, which is crucial for resolving any issues quickly.

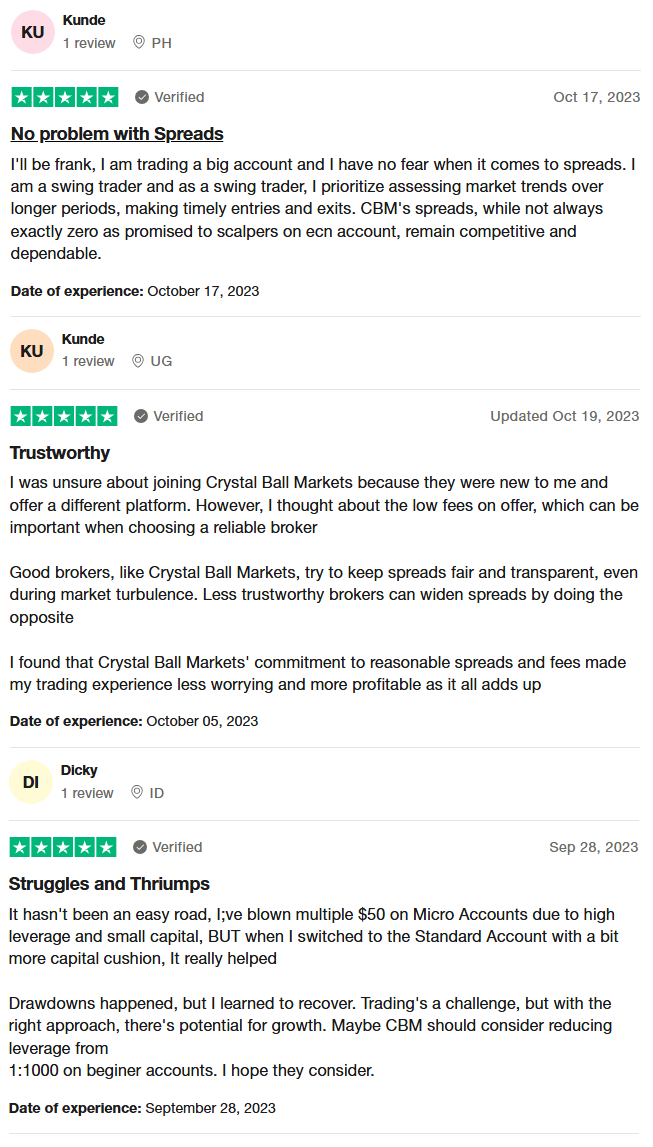

Crystal Ball Markets Customer Reviews

Crystal Ball Markets receives generally positive customer reviews, with many traders highlighting their satisfaction with the broker's competitive and dependable spreads. Some users initially hesitated to join due to unfamiliarity with the platform, but they were ultimately drawn by the low fees offered, which can significantly enhance profitability. Although one trader experienced challenges with high leverage on Micro Accounts, switching to a Standard Account with more capital provided better stability and recovery potential.

Crystal Ball Markets Spreads, Fees, and Commissions

When it comes to spreads, fees, and commissions, Crystal Ball Markets offers attractive features for various traders. The spreads on the Micro Account start from 1.9 pips, making it accessible for beginners. For experienced traders, the Standard Account provides spreads starting from 1.2 pips, suitable for those requiring tighter spreads. A significant advantage is their no deposit fees policy, allowing full use of your deposit for trading. However, withdrawal fees are determined on a case-by-case basis, which could impact frequent withdrawals.

For professional traders, the PRO ECN Account offers spreads from 0 pips, which is essential for those needing the tightest spreads. This account involves a commission per trade, varying by volume and frequency. The competitive spreads and transparent fee structure make Crystal Ball Markets a viable option for traders at all levels.

Account Types

When trading with Crystal Ball Markets, you can choose from three different account types, each tailored to meet specific trading needs:

Micro Account

- Minimum Deposit: $50

- Tight floating spreads

- Maximum Leverage: up to 1:1,000

- Market execution

- Spread from 1.9 pips

Standard Account

- Minimum Deposit: $300

- Tight floating spreads

- Maximum Leverage: up to 1:500

- Market execution

- Spread from 1.2 pips

PRO ECN Account

- Minimum Deposit: $1,000

- Tight floating spreads

- Maximum Leverage: up to 1:500

- Market execution

- Spread from 0 pips

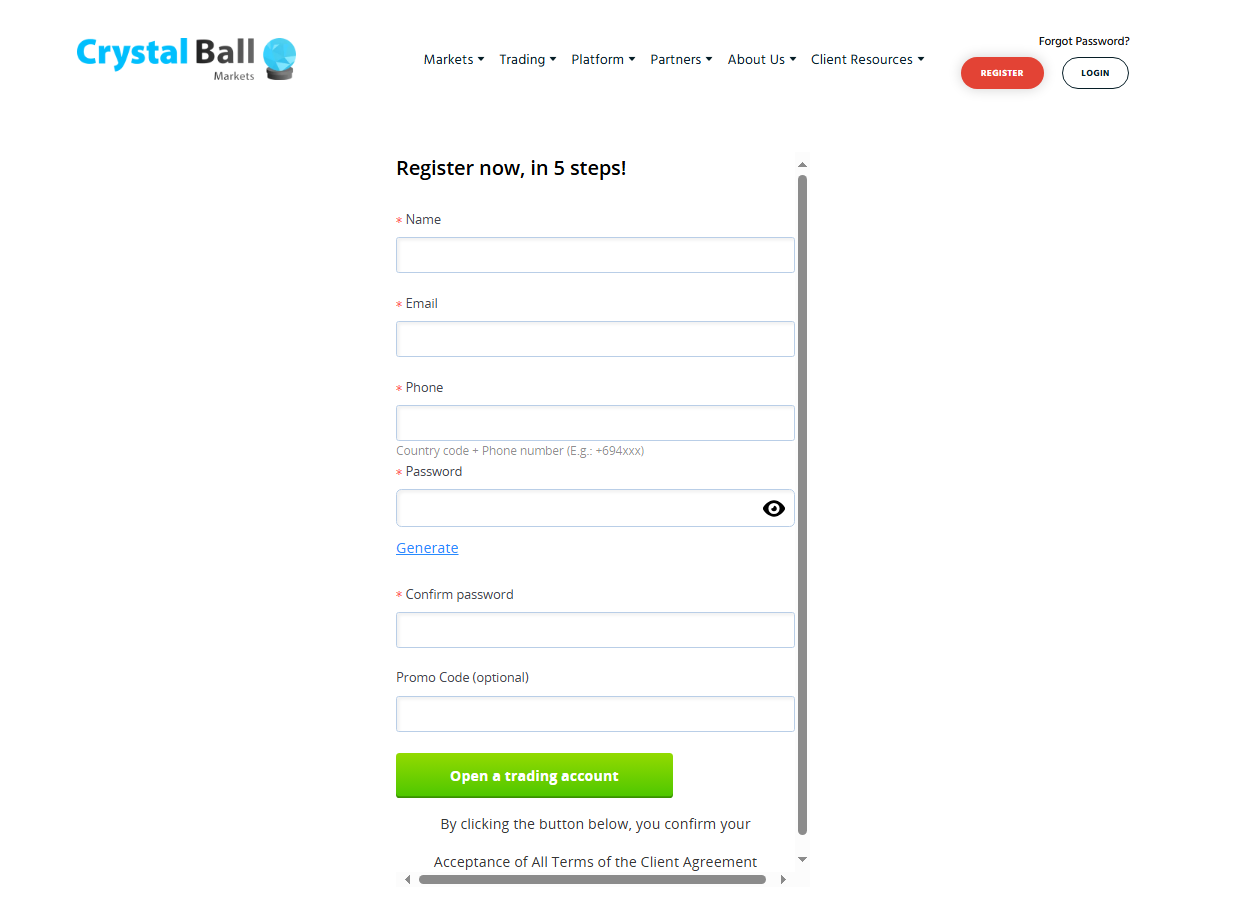

How to Open Your Account

- Go to the Crystal Ball Markets website and click the “Register” button located at the upper right corner of the homepage.

- Fill in your personal information including name, email, phone number, password, and confirm your password. Then click “Open a Trading Account.”

- You will receive a confirmation email. Click the link in the email to verify your account.

- Log in to your new account on the Crystal Ball Markets website.

- Complete the KYC (Know Your Customer) process by uploading the required identification documents such as a passport or driver’s license, and a utility bill for address verification.

- Once your documents are verified, proceed to fund your account. You can choose from several payment methods including bank transfer, Visa, MasterCard, Perfect Money, or Bitcoin.

- After funding your account, choose the type of trading account that suits your needs: Micro, Standard, or PRO ECN.

- Download the Mobius Trader 7 platform to start trading. The platform is available for Windows, Mac, Linux, and mobile devices.

Crystal Ball Markets Trading Platforms

When trading with Crystal Ball Markets, I found their platform offerings to be quite versatile. They primarily use Mobius Trader 7 (MT7), which is available for both desktop and mobile devices. This platform stands out due to its user-friendly interface that accommodates both beginners and advanced traders, making it easy to navigate and execute trades efficiently.

The MT7 platform supports AI-powered trading algorithms, which is a significant advantage for those interested in automated trading. This feature allows traders to deploy complex strategies without manual intervention, enhancing trading efficiency and accuracy. The platform's instant execution and zero slippage policy further boost its reliability, ensuring that trades are executed at the intended prices.

What Can You Trade on Crystal Ball Markets

Trading on Crystal Ball Markets offers a wide variety of instruments, making it a versatile platform for different trading strategies. Forex trading is a major component of what you can do here, with a broad range of currency pairs available. This includes both major pairs like EUR/USD and GBP/USD, as well as minor and exotic pairs, providing plenty of options for currency traders.

In addition to forex, you can trade a variety of cryptocurrencies. The platform supports popular digital currencies such as Bitcoin, Ethereum, and Litecoin, among others. This flexibility is great for those who want to diversify their portfolio with crypto assets, taking advantage of the volatility and growth potential in this market.

Crystal Ball Markets also allows you to trade indices and stocks. You can access major stock indices from around the world, including those from the US, UK, and Europe. Furthermore, trading stock CFDs means you can trade shares of major companies without owning the actual stocks, providing a simpler way to speculate on stock price movements.

Commodities trading is another area where Crystal Ball Markets excels. You can trade precious metals like gold and silver, as well as energy commodities such as crude oil and natural gas. This range of commodities offers additional diversification opportunities and can be a hedge against market volatility.

Lastly, the platform includes binary options trading. This feature is somewhat unique in the current market environment and allows for straightforward trading based on whether you believe the price of an asset will go up or down. It adds another layer of trading opportunities and can be an interesting way to engage with the market.

Crystal Ball Markets Customer Support

When it comes to customer support, Crystal Ball Markets excels in providing accessible and responsive service. They offer 24/7 customer support, ensuring that you can get assistance whenever you need it. This round-the-clock availability is crucial for traders who might encounter issues or have questions at any time of the day or night.

You can reach out to their support team via email at support@crystalballmarkets.com . In my experience, they respond promptly and professionally, addressing any queries or concerns efficiently. This level of service helps build confidence and trust, knowing that help is always just an email away.

For more direct communication, you can call their customer support phone number at +44 1244 94 1257. Having the option to speak directly with a representative can be very reassuring, especially when dealing with urgent matters. The support team is knowledgeable and provides clear, helpful information.

Additionally, Crystal Ball Markets is physically located at Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines. This information adds a layer of transparency and trust, giving clients a tangible point of reference for the company's operations.

Advantages and Disadvantages of Crystal Ball Markets Customer Support

Withdrawal Options and Fees

Withdrawing funds from Crystal Ball Markets is straightforward and offers several options. You can use bank transfers, Visa, MasterCard, Perfect Money, and Bitcoin to withdraw your money. This variety allows you to choose the most convenient method based on your preferences and financial setup.

While the broker boasts about not charging deposit fees, withdrawal fees can vary and are determined on a case-by-case basis. This lack of transparency regarding fees might be a concern for frequent traders. However, the convenience of multiple withdrawal options somewhat offsets this issue, making it easier to access your funds.

Crystal Ball Markets Vs Other Brokers

#1. Crystal Ball Markets vs AvaTrade

Crystal Ball Markets, established in 2020, offers a wide range of trading instruments and innovative features like AI-powered trading algorithms. However, it lacks the extensive regulatory oversight that AvaTrade has. AvaTrade, a veteran in the industry since 2006, serves over 300,000 clients from more than 150 countries with a comprehensive suite of over 1,250 financial instruments. AvaTrade's strong regulatory framework across multiple jurisdictions and its long-standing reputation provide a more secure trading environment compared to Crystal Ball Markets.

Verdict: AvaTrade is the better choice due to its extensive regulation, global reach, and established reputation in the trading community, offering a safer and more reliable trading experience.

#2. Crystal Ball Markets vs RoboForex

Crystal Ball Markets provides a modern trading experience with various instruments and high leverage options but is relatively new and less regulated. RoboForex, operating since 2009, offers over 12,000 trading options across eight asset classes and is regulated by the FSC. RoboForex’s diverse trading platforms, including MetaTrader and cTrader, cater to a wide range of trading styles and levels. Additionally, RoboForex's ContestFX feature offers unique opportunities for traders to win real money through demo contests, adding a competitive edge to its offerings.

Verdict: RoboForex stands out for its extensive range of trading options, advanced platforms, and innovative features like ContestFX, making it a superior choice for traders seeking variety and competitive opportunities.

#3. Crystal Ball Markets vs Exness

Crystal Ball Markets, although innovative with features like AI trading, falls short in comparison to Exness’s more robust offerings. Exness, founded in 2008, provides a comprehensive trading environment with over 120 currency pairs, CFDs on various assets, and notable features such as immediate order execution and infinite leverage on small deposits. Exness's established regulatory compliance and extensive market presence offer a more stable and secure trading platform compared to the newer and less regulated Crystal Ball Markets.

Verdict: Exness is preferable due to its extensive market presence, superior regulatory compliance, and advanced trading conditions, providing a more reliable and professional trading environment.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH CRYSTAL BALL MARKETS

Conclusion: Crystal Ball Markets Review

Crystal Ball Markets offers a versatile trading environment with a variety of instruments, including forex, cryptocurrencies, indices, stocks, and commodities. Their innovative features like AI-powered trading and multiple account types cater to both beginners and experienced traders. However, the broker’s relatively new presence and limited regulatory oversight can be a concern for some.

Customer support is available 24/7 and provides multiple contact options, which is a significant advantage. Nonetheless, the lack of transparency regarding withdrawal fees and the absence of a live chat feature might be drawbacks. Crystal Ball Markets presents a promising platform but potential traders should be aware of its limitations.

Also Read: Saracen Markets Review 2024 – Expert Trader Insights

Crystal Ball Markets Review: FAQs

What types of accounts does Crystal Ball Markets offer?

Crystal Ball Markets offers three account types: Micro, Standard, and PRO ECN, catering to different levels of trading experience with varying minimum deposits and spreads.

Are there any fees for withdrawing funds from Crystal Ball Markets?

Yes, withdrawal fees are determined on a case-by-case basis, which means the exact fees can vary depending on the method and amount.

What trading platforms are available at Crystal Ball Markets?

Crystal Ball Markets uses Mobius Trader 7 (MT7) for desktop and mobile, offering advanced features like AI-powered trading algorithms and instant execution.

OPEN AN ACCOUNT NOW WITH CRYSTAL BALL MARKETS AND GET YOUR BONUS