Forex traders for years were addicted to simple price patterns when creating trading strategies to predict beneficial trading options and to s but also to describe normal market dynamics.

Because of these, the usual formations such as flags, and double bottoms and tops were frequently practiced in the currency markets, but also in plenty of alternative markets.

The enthusiasm for traditional patterns has suppressed the diamond chart pattern that offers benefits and is present in currency markets.

The diamond top forms usually at appreciable uptrends. It adequately signals approaching shortfalls and retracements with corresponding precision.

Learn how to use the Diamond chart formation a solid technical analysis tool that indicates a reversal of an uptrend.

Contents

- Diamond Chart Pattern

- Comparable to a Head and Shoulders Pattern

- Bearish Diamond Formation

- Bullish Diamond Formation

- Diamond Pattern Trading Strategy

- Using a Price Oscillator

- Conclusion

- FAQs

Diamond Chart Pattern

With the expanding cash flow of the currency market, this pattern can be located much quicker in the currency market than in its value-based counterpart, where holes in price action happen often, expelling some of the demands for identifying the diamond top.

This rare chart pattern can be used with any time frame, most frequently daily and hourly charts, the large fluctuations that are observed in Forex markets will provide traders with ample options for trade.

Also Read: Harmonic Patterns

Comparable to a Head and Shoulders Pattern

Diamond formation is unique and visually has some characteristics that remind to a head and shoulders pattern. It is very easy to mix up the diamond pattern and the head and shoulders pattern because they basically mirror each other.

The offset characteristic of the head and shoulders chart pattern can be recognized by the head positioned closer to the shoulder and the tail nearer to the right.

The right time to make a trade is by finishing the pattern. The breakdown is most possible to occur upon the creation of the diamond, and shorting at the end of the right shoulder can turn out to be constructive.

With a stop loss, brokers can bar losses in case of the breakdown of the analyzed pattern. It is recommended to place the stop loss at the last crest before the completion of the diamond.

The best exit is the right shoulder with the development in the highest crest and the inmost crevice in the pattern. The diamond pattern’s breakdown is more earnings capacity than just the disparity between the crest and channel but at the same time more risk.

Bearish Diamond Formation

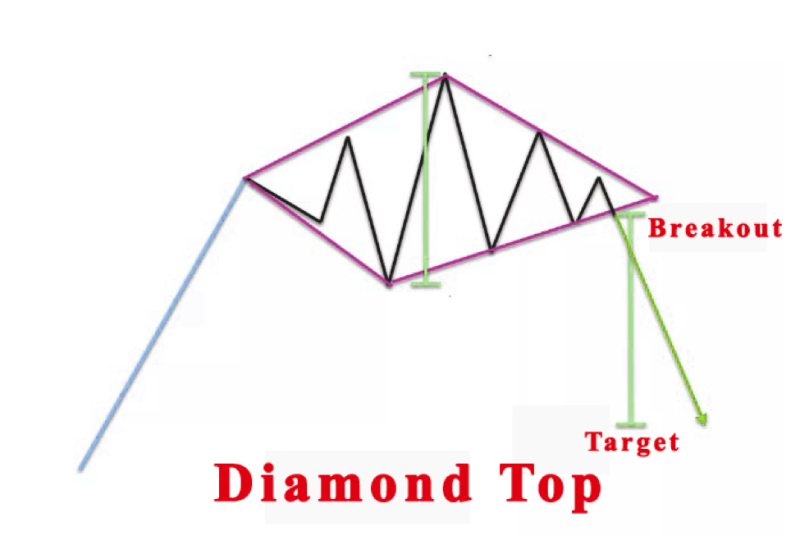

The bearish diamond top chart pattern can be observed as a sequence of up-and-down price swings that feature the arrangement of the head and shoulders formation.

To be more precise the left shoulder and head join to create a trendline, the head, and the right shoulder are joined to create another trendline.

This forms the trendlines for the upper section of the bearish diamond top formation. While the lower part, traders can join the swing lows within the channel that creates the V shape.

If you are looking at the illustration you can observe the bearish diamond pattern plus on the chart the breakout entry signals displayed for trading the structure, together with the patterns target level. While the short entry signal, that is initiated at the break and close under the lower right-hand line inclining upward.

Investors have a habit of expecting the breakout under this line without the concern for a close below it. This is a possible entry point as well, but remember that it will result in more deceitful signals as related to anticipating for the breakout and close condition.

The price target for the formation is estimated with a measured move tactic, to be more accurate it estimates the peak to valley length in the structure, and then displays that span downward from the breakout point.

This creates a level at which we can expect the follow-through on the breakout to begin to retreat or potentially reverse. This means a good take profit level and trade exit.

Bullish Diamond Formation

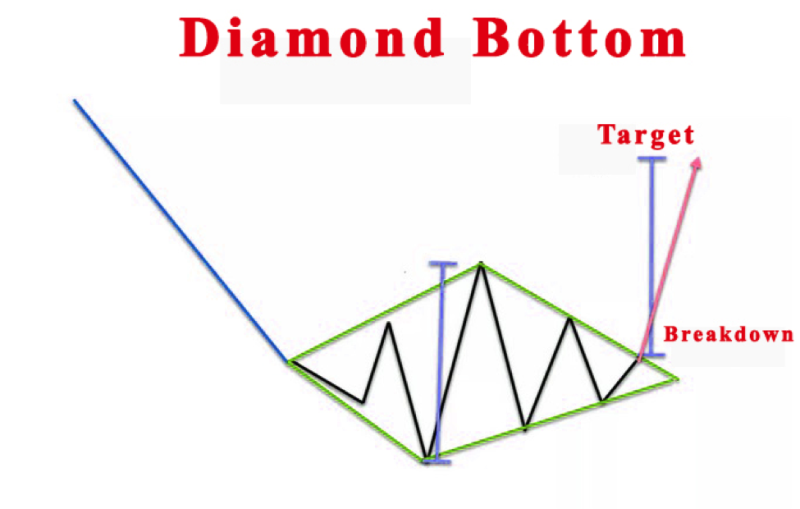

We can turn our attention to the flip-side of the bearish diamond pattern, and that is the bullish diamond pattern, also known as a diamond bottom, that forms in the background of a downtrend.

Usually, we will observe a strong price move lower, and then a unification stage that divides out the up and down swing points of the diamond bottom.

In this instance, the look is reminiscing of the inverted head and shoulders formation. Traders need to connect the crests and channels within the formation in an analogous appearance as stated previously.

When the four trendlines are marked around the structure, it can be verified that the four lines are uniform in shape and can approve the structure as a bullish diamond pattern.

A close look at the illustration that represents the diamond bottom, will reveal that the structure is foreshadowed by a downward price move.

These can then observe by the up-down arrangement in the diamond structure that is defined by the two upper trendlines evincing downward, and the two lower trendlines declaring upward.

The long entry signal is initiated with the break and close over the upper right-hand line slanting downward. A frequent technique is to anticipate a real breakout and close instead of just a breakout over this trendline with the intention to stop the formation of erroneous indicators and probable whipsawing price action in the area.

Traders can estimate the upper price target by calculating the high to low within the confined format. If the stretch is measured and placed on the chart, it can be extending that same length from the breakout point displaying upward to come at the preferred target level.

Once the price reaches this level, investors need to plan on leaving the position or at least a large portion of it, and maybe leave certain profitable trading opportunities open if so wished.

Diamond Pattern Trading Strategy

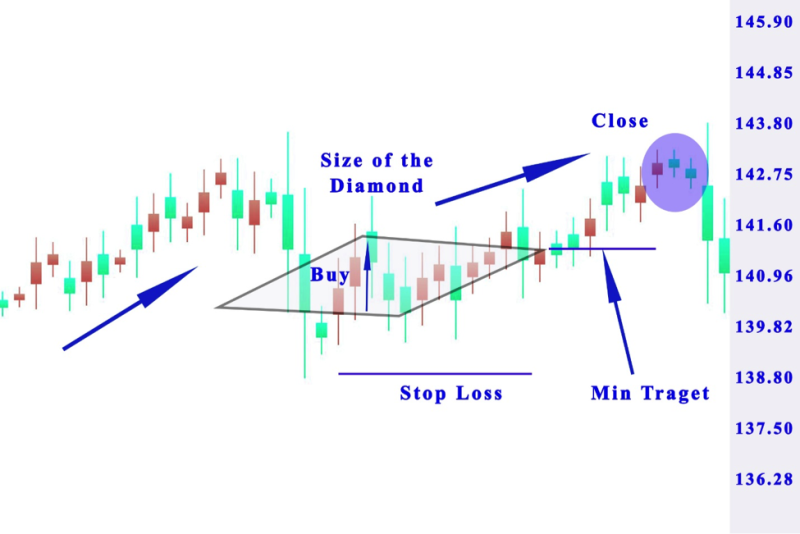

Understanding how the preferred pattern is used is important before implementing it in a trading strategy.

Investors can verify the existence of a diamond form on a chart. After this moment traders can join the market if the starting line of the diamond chart patterns is fractured putting a stop loss over the closing top.

Investors s have to remain in the market for a little price move balanced the diamond. We can brush off the VWMA breakouts before achieving the target.

Check the example of a trade:

The arrows on the diagram calculate and use the dimensions of the diamond as a slightest target for the investment. Traders can compute the VWMA in the chart for more earnings from the investment.

In the lower part of the chart, you have the volume indicator in order so you can observe the quantity of transactions.

While the diamond chart pattern is forming volumes are approximately high.

Because of that traders verify the existence of a bullish trend on the chart.

When the price action goes over the right side of the diamond, traders should put a stop loss.

The price eventually initiates a bullish trend. When the three periods pass since the start of the long trade, the price action completes the minimum target.

We can move on and discuss the bullish trade:

The following example is of fictional volatile assets.

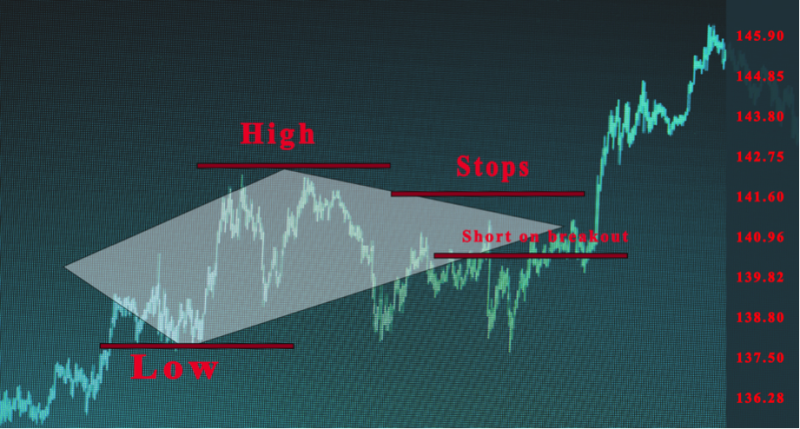

The chart is a bearish diamond chart pattern. Since it is more volatile and accounts for larger daily price fluctuations.

The illustration begins with a price rise, and finishes with a pattern of a diamond top.

The pattern is verified when the price goes over the lower edge of the pattern. Showing the indicator to sell the stock. Investors need to short sell the stock and implement a stop loss in the pattern as displayed on the illustration.

The price begins to decline afterward. Lest then half an hour after we short the stock, the price action comes to the target. Still, we have the possibility to increase earnings by remaining in the trade.

You can observe that the price declines more and the volumes are increasing at that time, that instructs extra further verification of the Diamond pattern and the presence of a bearish trend.

Using a Price Oscillator

One of the most important rules is t verify the signal and the diamond top pattern is no different. Using price oscillators traders can improve the precision of their trade because instruments like these can gauge price action momentum and be used to verify the break of support or resistance.

Conclusion

Profitable technical traders use the diamond patterns to gauge price action momentum and identify trend reversal. The pattern can have both bullish and bearish implications. The bullish diamond pattern is also known as diamond bottom and the bearish diamond pattern is called a diamond top.

The chart pattern is defined by four limited trend lines defining two support lines under and two resistance levels over the joined latest lows and highs.

Diamond reversal patterns are implemented in different types of financial markets among them the stock market, crypto market, forex market, and futures markets.

Traders are more reserved about using the pattern when compared with other chart patterns. it is crucial to know that the pattern is identifiable and when manifest it offers great trading possibilities.

Based on experience it is known that the diamond top pattern forms after growth in market prices tend to provide for a higher probability trade set up than the diamond bottom pattern which happens after a recession in market prices.

You can do your own testing to find out if inclinations adjust with the markets you trade and then make investment decisions.

Also read: How To Trade Spot Rate

FAQs

What Is a Diamond Pattern Called?

The diamond market pattern is also known as diamond top, and the pattern is used to identify reversal of a trend.

Is Diamond Pattern Bullish?

The bearish diamond formation is a technical analysis pattern used to identify a reversal after an uptrend.

Is Diamond Pattern Bearish?

It can be a bearish pattern when use to locate a reversal after a downtrend.

Is Diamond Top Bullish?

No, only the diamond bottom formation is perceived as a bullish indicator.