Euro Rate Cut Likely as ECB Eyes Economic Stimulus

A 25 basis point rate cut by the ECB this week is widely anticipated, following multiple committee endorsements. Since the fourth quarter of 2022, the European economy has seen minimal growth, with GDP expansion close to zero. Recent progress in controlling inflation, which experienced a minor setback in April, has provided the ECB the flexibility to reduce interest rates for the first time since 2019.

Despite April's inflation rates exceeding expectations, they remain close to the 2% target.

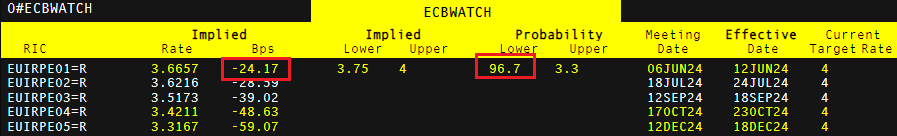

Market expectations are leaning heavily towards a rate cut, with a 96.7% likelihood. Observers are particularly keen on any signals the ECB might offer about future cuts and their timing. According to earlier statements, the ECB might pause rate changes in July to evaluate the effects of the initial reduction and to consider new economic data.

Market Implied Interest Rate Cuts

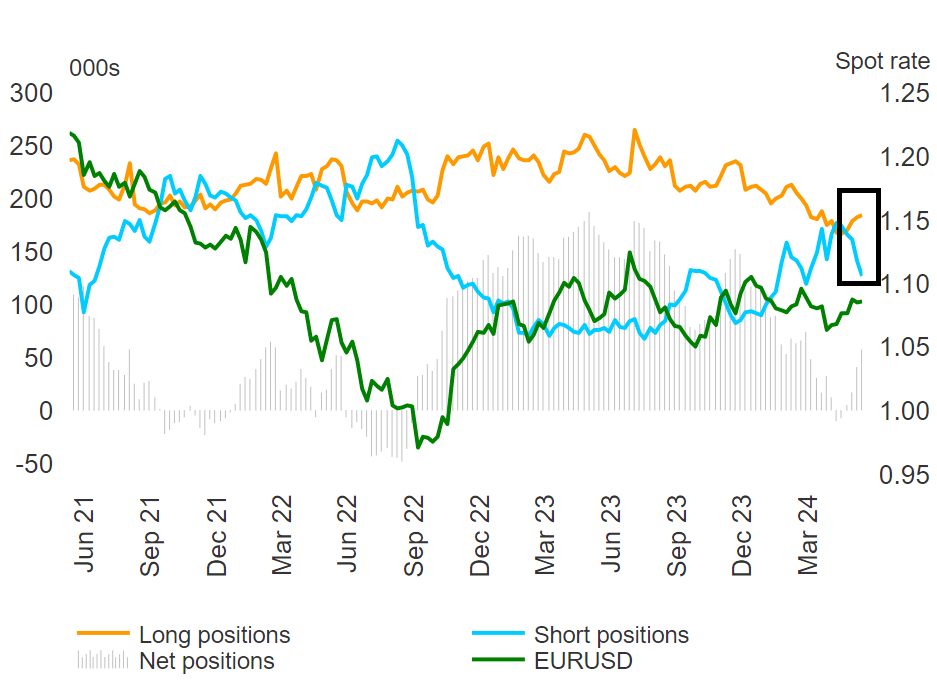

Euro Sees Positioning Shift: Potential Upside Ahead

Recent trends show a significant reduction in euro short positions by speculative money managers, with an increase in long positions, suggesting potential gains for the euro as net positions become positive.

Commitment of Traders Report (CoT) for Euro Positioning with EUR/USD Price Action

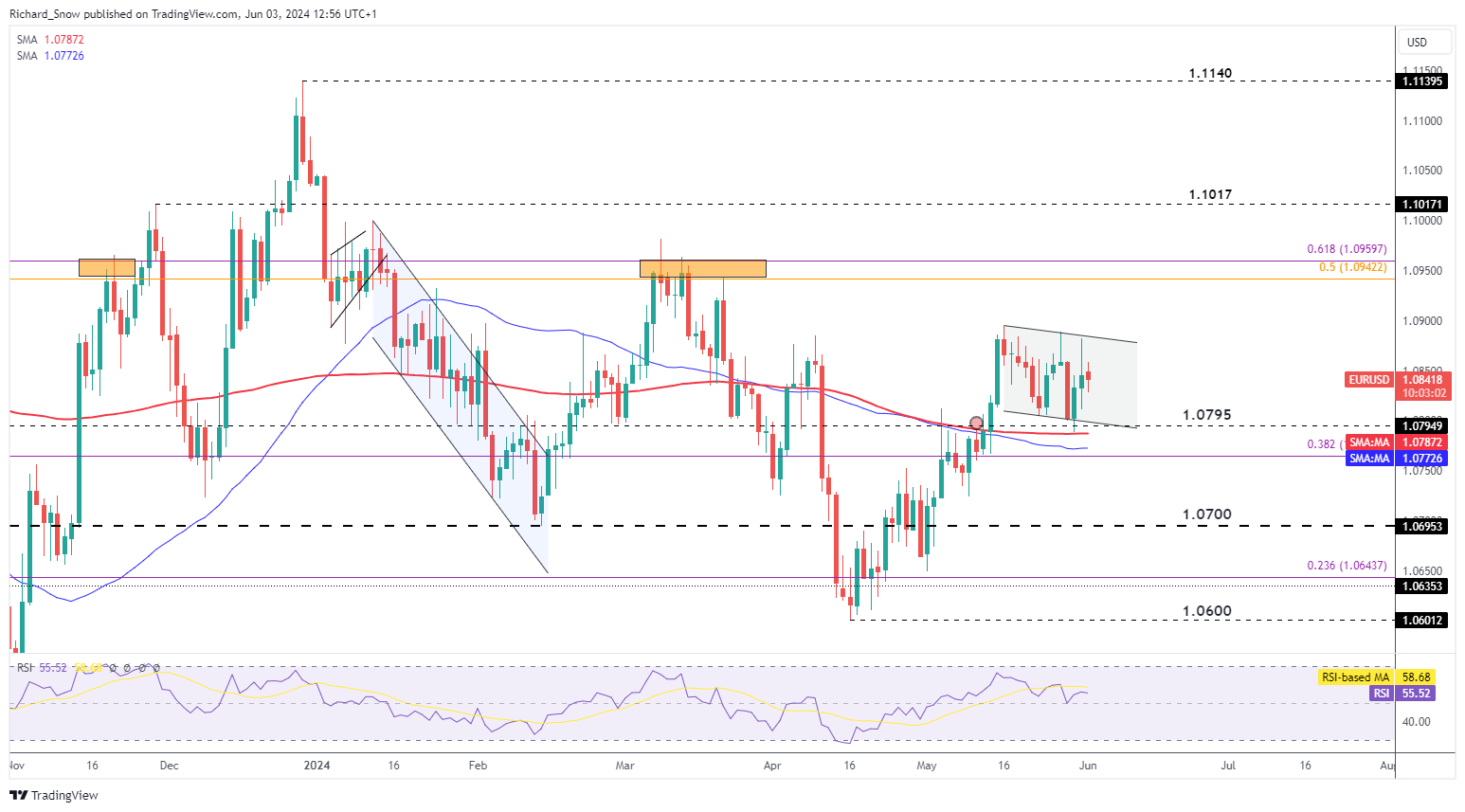

EUR/USD Outlook: Potential Gains on US Economic Disappointment

The US Economic Surprise Index indicates that upcoming US data may continue to disappoint, reflecting ongoing restrictive monetary conditions and a resumption of the disinflation process.

These factors have supported a rise in the EUR/USD pair, which has gained 2.8% since its low in April.

Although it has been trading within a slight downward channel since mid-May, support is found at the channel's lower boundary and the 200-day SMA around 1.0800, with resistance at channel highs and then at 1.0942/1.0950.

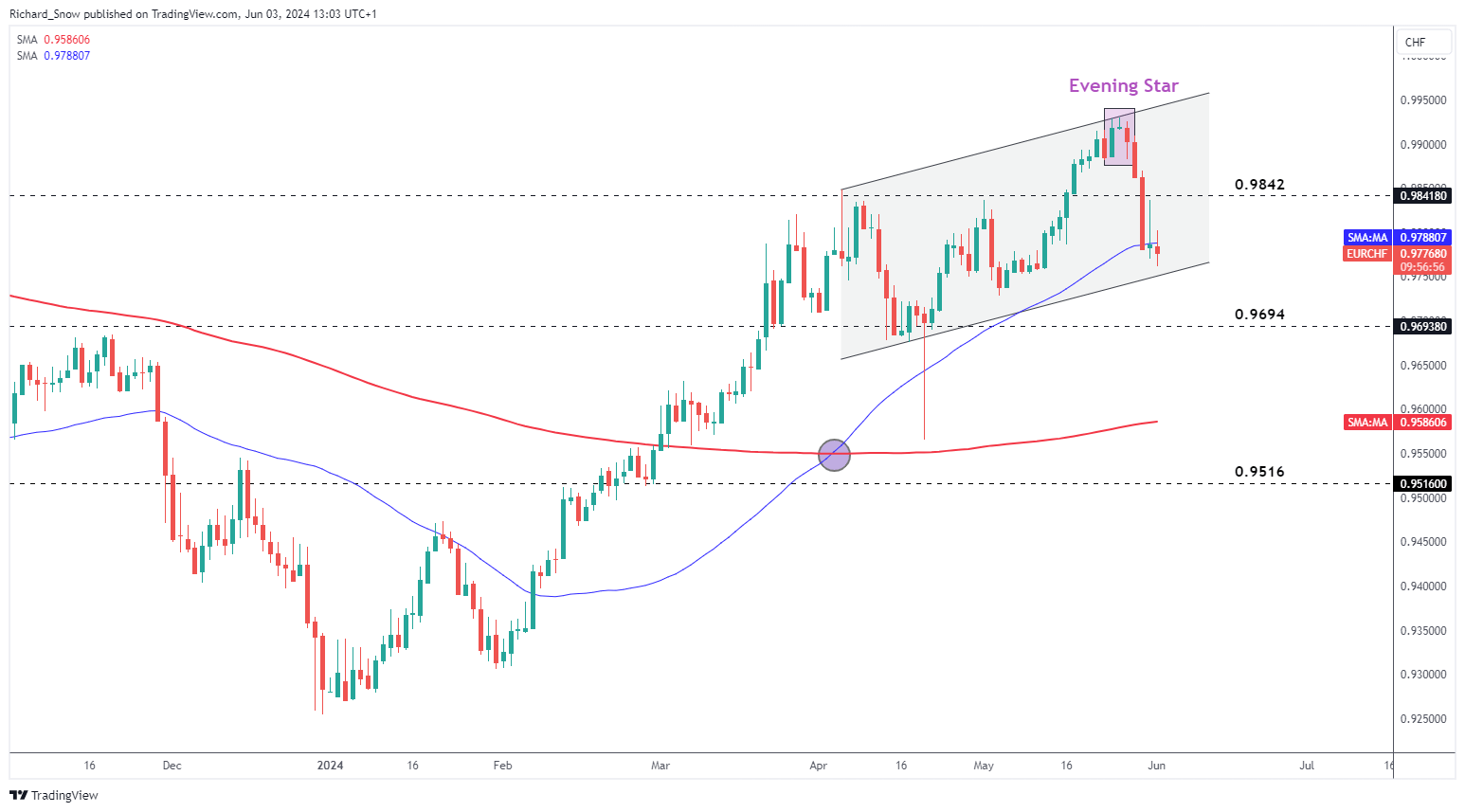

SNB's Jordan Highlights Inflation Risks, Influencing Franc

Thomas Jordan, the outgoing SNB Chairman, recently discussed the potential inflation risks due to a weakening Swiss Franc. His remarks have led to a strengthening of the Franc, causing a dip in the EUR/CHF pair.

Following the SNB’s early rate cut in March, the Franc began to depreciate, a trend which stabilized towards the end of May as marked by an evening star formation.

This pattern suggests a bearish outlook for EUR/CHF, which recently broke below the 50-day SMA. The next significant support levels are at 0.9694, followed by the 200-day SMA at 0.9565.