A fixed exchange rate or a pegged exchange rate describes an exchange rate system where the monetary authority pegs or sets the currency value against another country’s worth, another measure of value, or a basket of currencies. There are several risks and benefits to using the fixed exchange rate regime.

In any case, the fixed exchange rate regime can help to stabilize a country’s currency exchange rate by directly selecting its exchange value in a predetermined ratio to a more stable, different, or more internationally prevalent currency. Yet, the exchange rate with its peg does not change depending on the stock market conditions. This strategy is unlike other international monetary fund options like the floating exchange regime.

In general, the fixed exchange rate plan makes investments and trade between the two countries more predictable and manageable. It is a strategic plan for small economies that borrow in foreign currency where external trading plays a significant part in the GDP. It can also be a strategic approach for managing currency fluctuations such as inflation.

This currency approach allows control over the pegged currency by the reference value. For that reason, whenever the reference value falls or rises, it follows that the currency values pegged to it will decrease or increase depending on other commodities and currencies with which the pegged currency gets traded.

In simple words, a pegged currency depends on the reference currency value to dictate its current value at any time. The Mundell-Fleming model explains further that a fixed exchange rate with perfect capital mobility prevents a government from utilizing domestic monetary policies to attain macroeconomic stability.

The country’s central bank in a fixed exchange rate system uses an open market regime and remains committed to selling or buying its currency at a fixed rate to maintain its pegged ratio. Hence, it holds a stable value of its currency with the reference currency value. Yet, the central bank can sell foreign currency it reserved and buy back its domestic money during a time of private sector net demand to help maintain the desired exchange rate.

The result is that it creates an artificial domestic money demand to increase its exchange rate value. On the other hand, the central bank buys foreign money to add domestic cash in the stock market to maintain the market equilibrium at a fixed price when there is incipient domestic money appreciation.

Right now, large economies' currencies do not peg or fix their exchange rates. The People’s Republic of China is the last large economy that used the fixed exchange rate regime. They adopted the managed exchange rate system in July 2005, which is somewhat more flexible than the fixed-rate exchange system.

Also Read: Currency Risk

Contents

- Open Market Fixed Exchange Rates

- Central Bank Flat Trading

- Excess Demand for US Dollars

- Excess Supply of the US Dollars

- Benefits of the Fixed Exchange Rate

- Disadvantages Of Fixed Exchange Rate

- Frequently Asked Questions

- References:

Open Market Fixed Exchange Rates

A government that wants to maintain the fixed exchange rate system sells or buys its currency through the open market. This statement explains why the government preserves foreign currencies reserves. The government usually sells its currency and buys foreign currency whenever the exchange rate drifts far above the fixed benchmark rate.

Hence, it impacts the currency price and decreases its value. Whenever it buys the money, it gets pegged to that currency and price increases to cause its relative currency value to get closer to the intended relative currency value.

The government buys its currency in the stock market by selling its reserves whenever the exchange rate shifts far below the fixed exchange rate. It creates an immense demand on the stock market and enables the domestic currency to increase its value to the fixed exchange rate value.

Central Bank Flat Trading

Another approach to maintain the fixed exchange rate would be to make it illegal to trade currency at a specific rate. However, this approach is challenging to enforce. In general, it can result in a black market using foreign currencies. Yet, governments that have monopolies over all money conversions are successful at applying this approach.

The Chines government used this approach to maintain a currency peg and tightly banded float against the United States dollar. Hence, the government would buy an average of one billion US dollars daily to keep the fixed exchange rate system. Henceforth, the country successfully maintained a fixed exchange rate system throughout the 1990s using a government monopoly over all yuan currency conversions with other currencies.

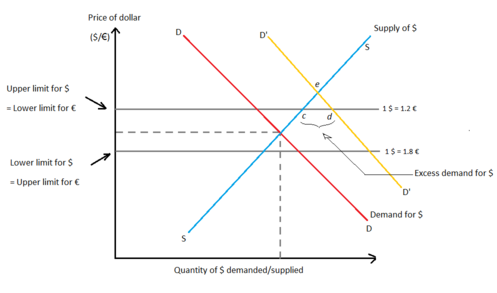

Excess Demand for US Dollars

Excess demand for US dollars describes a situation where domestic demand for foreign financial assets, services, and goods exceeds the foreign demand for financial property, services, and goods from the EU. In a case where the money demand for the US dollar rises to D’D’ from DD, it results in excess money demand to the extent at cd. For that reason, the ECB will sell cd US dollars in exchange for the euro to help maintain the limit in the band. Otherwise, equilibrium would be the result at e under the floating exchange rate regime.

Whenever the ECB trades US dollars in such a case, the official US dollar reserves gradually decline, resulting in the shrinking of the domestic money supply. The ECB ought to purchase government bonds to prevent the domestic money supply from shrinking. Hence, it is possible to meet the money supply shortfall. The apt term for this strategy is the sterilized foreign exchange market intervention. If the ECB runs out of its reserves, it can opt to devalue the euro to reduce the excess US dollar demand. Thus, they can narrow the gap between fixed rates and equilibrium.

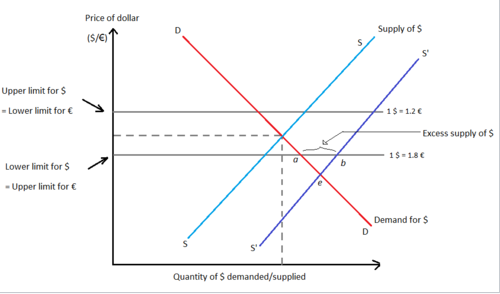

Excess Supply of the US Dollars

The excess supply of the US dollars describes the event where the foreign demand for financial assets, services, and goods from the EU somewhat exceeds the European currency demand for foreign financial property, services, and commodities. If the US dollars supply rises to S’S’ from SS, it may result in the excess supply to the ab extent. Whenever this happens, the ECB buys ab US dollars to exchange for euros to help maintain the limit in the band. In any case, the equilibrium gets attained at e under the floating exchange rate regime.

Whenever the ECB buys the US dollars in such a case, the result would be the increase in its official dollar reserves, and the domestic money supply chain might expand to result in inflation. Hence, the ECB ought to sell its government bonds to prevent inflation by causing a counter increase in the money supply. If the ECB collects excess reserves, it can revalue the euro to control the collection of the US dollar. In other words, it seeks to narrow the gap between fixed rates and equilibrium to cause the opposite of devaluation.

Another effective strategy to maintain a fixed exchange rate would be the automatic adjustment system. It describes a price specie flow plan under the gold standard that adjusts to changes or shocks and corrects any balance payments disequilibrium. Richard Cantillon introduced this mechanism in 1752, and David Hume discussed it further to refute its mercantilist doctrines and emphasize that governments could not accumulate gold by importing more than their exports. This currency mechanism has the following assumptions:

- There are no capital flows and no banks.

- Gid coins get minted at a static parity in every country

- There is a worldwide fixed supply of gold

- All transactions occur in gold

- Prices are flexible

Changes in the gold standard currency system involve gold flow between different nations resulting in price equalization that satisfy the purchasing power parity or equalization of return assets rates that meet the interest rate parity under a fixed exchange rate regime. Each country's currency supply featured either paper or gold currency under the gold standard backed by gold.

Hence, the money supply would rise in the surplus nation and fall in the deficit nation. Therefore, internal prices would increase in the surplus country and fall in the deficit country, making exports from the deficit country extra competitive than exports in the surplus country. Above all, the deficit country would encourage exports and discourage imports until they eliminate the balance of payments deficit.

Benefits of the Fixed Exchange Rate

Avoid Currency Fluctuations

Currency fluctuations can result in significant challenges in trading. For instance, a rapid appreciation in the currency would make exports to be uncompetitive for exporters. Conversely, a devaluation can raise imports costs and dimmish profit. Exchange rate uncertainty reduces the incentive for investors to export. A fixed exchange rate regime serves as a stable exchange rate option to encourage investments.

Manage Inflation

Inflationary pressure is rampant in governments where the exchange rate can devalue or increase value freely. For example, devaluation can result in inflation since it subjects investors to fewer incentive costs cut-outs, increased import prices, and demand for export increases. Besides, a rapid rise in the exchange rate can badly impact manufacturing firms by worsening their current accounts.

Disadvantages Of Fixed Exchange Rate

Macroeconomic Objective Conflicts

The monetary authority might conflict with other economic objectives to maintain the fixed exchange rate. Whenever the currency value is falling or under pressure, the best solution would be to increase the interest rates with other currencies. Hence, it will reduce inflationary pressures and increase hot money flows. Yet, it will also result in lower economic growth and lower aggregate demand, resulting in unemployment and recession.

Less Flexibility

It becomes somewhat difficult to respond to temporary fluctuations using the fixed exchange rate. For instance, the current account balance payments will encounter a deterioration whenever the oil prices rise indefinitely. The fixed exchange rate does not allow the authority to reduce or devalue a deficit.

Higher Interest Rates

The government must raise the interest rates whenever the currency falls below the exchange rate, even if it is not suitable for the economy. Besides, current account imbalances are rampant for fixed exchange rates. For instance, an overvalued exchange rate can result in a sudden current account deficit whenever there is an overvalued exchange.

Also Read: Money Flow Index

Frequently Asked Questions

1. How do you maintain a fixed exchange rate?

The central bank should intervene by selling foreign currency to purchase domestic currency to maintain the fixed exchange rate regime. Whenever the central bank interferes, it decreases the domestic currency supply and shifts the trading curve to help restore the currency value at equilibrium.

2. How does a fixed exchange rate work?

The fixed exchange rate system relies on the central bank and the government to tie the domestic currency exchange rate to a foreign currency exchange rate or the price of gold. The primary function of the fixed exchange rate would be to narrow the currency value band and maintain a stable currency exchange rate that is favorable for trade. It is a strategic approach to enable a sound and easy marketing platform between two tied countries.

3. What happens if a country has a fixed exchange rate?

The central bank or the monetary authority should sell or buy foreign currencies depending on the demand and supply to help maintain a stable and fixed exchange rate. In any case, whenever the central bank’s sales are way too brisk, the monetary base growth with decrease gradually, interest rates will rise, and credit & money quantity declines.

4. Which type of exchange rate is better?

The floating exchange rate system can be the best option for a country that believes its central bank can control and maintain a stable monetary policy. Yet, the fixed exchange rate system can be the best option for lower economy countries that lack a fiscal and prudent financial system. In other words, the best exchange rate system will depend on the country's economy and government model.

References:

1. https://corporatefinanceinstitute.com/resources/knowledge/economics/fixed-exchange-rate/

2. https://www.sciencedirect.com/topics/economics-econometrics-and-finance/fixed-exchange-rate

3. https://www.britannica.com/topic/fixed-exchange-rate

4. https://saylordotorg.github.io/text_international-economics-theory-and-policy/s27-05-which-is-better-fixed-or-float.html