Imagine a single forex trade changing how you see on the foreign exchange market. Many retail traders dive into a forex trading account with high hopes but quickly encounter challenges. The constant price changes of major currency pairs, like EUR USD or the Japanese yen, create chances and challenges. As the largest financial market globally, forex trading happens non-stop. Each currency pair reflects economic factors, market volatility, and reactions from central banks worldwide.

Every new forex trader discovers that guessing exchange rates or chasing trends on trading platforms won’t lead to success. It’s all about patience, risk management, and truly understanding the forex market’s mechanics. By mastering market rhythms and implementing proven strategies, every trade becomes a planned decision rather than a gamble, turning knowledge into steady results.

Achieving Success in the Forex Market

Recently, a well-planned forex trade showed how skill, timing, and discipline can yield strong results. An investment of $24,000 was carefully placed on a researched currency pair. Over just two weeks, this amount grew to a $190,000 profit, resulting in a 950% increase. This achievement shows the value of mastering forex trading, proving the effort was worth it to study and each strategically managed loss.

Trade Highlights:

- Capital Risked: $24,000

- Total Profit: $190,000

- Growth Rate: 950% in two weeks

- Strategy Applied: Controlled risk with structured trade management

These results show the potential of disciplined and strategic planning. Market movements matched expectations, guided by a systematic approach rather than emotion. This is the true nature of forex trading: a single well-executed trade can exceed months of effort. In an ever-volatile market, these outcomes demonstrate how preparation and consistency turn potential into achievement.

Why Forex Trading Is Worth It

Each forex trade reveals key lessons into the foreign exchange market's dynamics. Although many retail traders begin with dreams of rapid gains, they quickly encounter true market volatility. As the largest financial market, forex experiences constant fluctuations driven by global demand and news updates. Traders actively respond to economic changes and supply variations that influence currency pair movements.

Real advancement in forex trading comes from a foundation of knowledge, not from predicting trends or chasing popular currencies. By studying exchange rates and crafting strategies on reliable trading platforms, traders build discipline and control. They recognize that consistent growth outweighs the appeal of quick wins in this large area. Understanding market behavior ensures that every lesson learned adds significant value.

The Million-Dollar Aspiration in Forex Trading

Every forex trader dreams of turning a small amount of money into a lot of money. This can happen if a trader learns to be patient and follow simple rules. The forex market is open all day and all night because people around the world are trading. Traders can buy and sell money freely based on what is happening in the market.

Forex trading uses two kinds of money that are traded together. The value of the money changes all the time around the world. Sometimes prices move very fast, which can be risky but can also help traders earn money. Good traders watch the market closely and follow a clear plan instead of making fast choices. Making a lot of money in forex does not happen by luck, but by being patient, working hard, and practicing every day.

Understanding the Realities of Forex Trading

Many new traders start forex trading hoping to make money fast. But the real market does not work that way. To do well, traders must learn first and trade carefully. The forex market changes because many people react to news and money changes around the world. This makes prices move fast and change often.

Without help, new traders can feel confused when prices change fast. Good traders use safe trading tools, follow simple rules, and use plans that have worked before. Trading popular money pairs is safer because they are easier to buy and sell. Learning forex trading takes patience, careful money control, and learning every day as the market changes.

Master Forex Trading with Asia Forex Mentor

Doing well in forex trading starts with learning the basics. Many new traders begin without a clear plan and get confused when money prices change over time. Asia Forex Mentor helps traders learn step by step in an easy way. Trading is a skill that grows with patience and practice, not luck.

The program teaches important skills like watching money prices and learning about popular currencies. Students learn by using pairs like EUR USD, which many traders use every day. They learn how to buy and sell money, how to stay safe with their money, and how to think before trading. Real improvement happens when students practice often and stay calm while trading.

A mentor helps traders learn and feel less confused. With a teacher’s help, students learn how the market moves and how to trade better. Each new skill helps them understand money prices and make smart choices without letting feelings take over. Learning step by step and practicing often helps students become good traders over time.

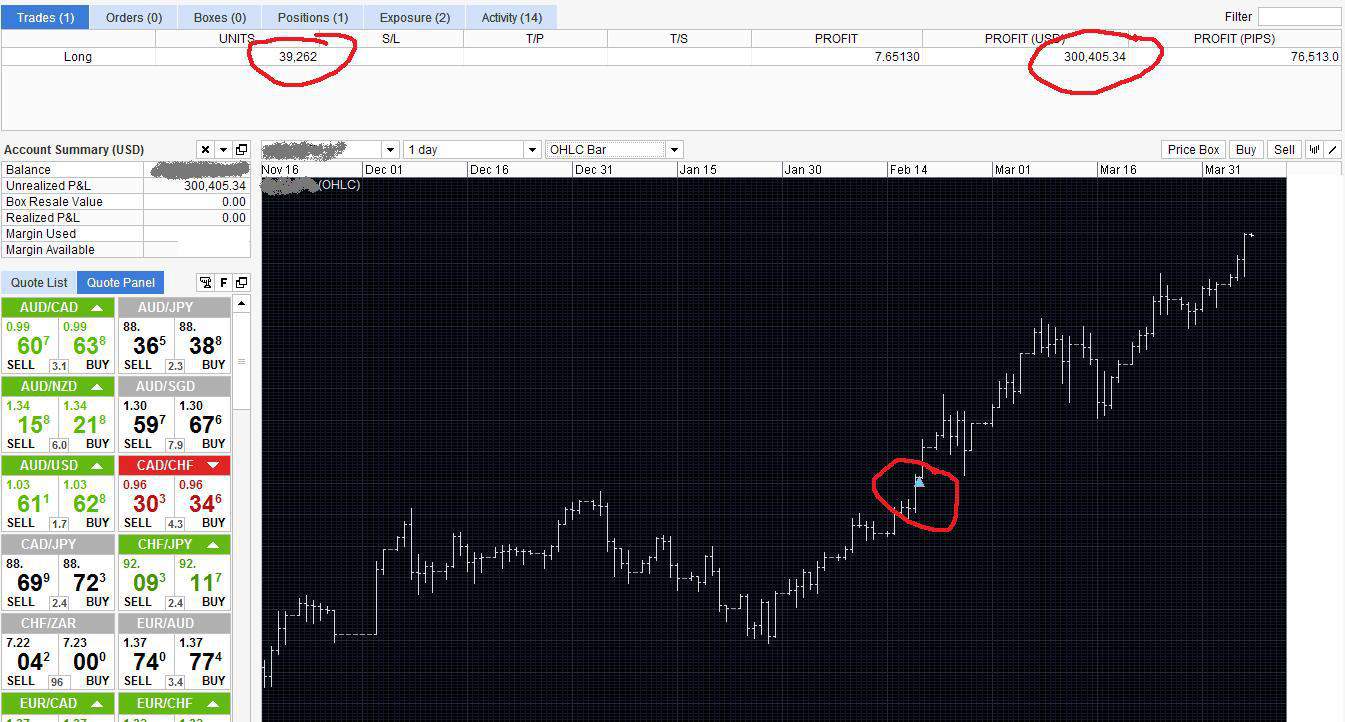

The Follow-Up: One Month Later

One month of disciplined patience and strategic execution has delivered impressive results:

Trade Performance Summary:

- Capital Risked: $24,000

- Previous Profit: $190,000

- Current Profit: $300,000

- Monthly Growth: +$110,000

This additional $110K profit in just one month highlights the power of consistent forex trading discipline.

Key Takeaways:

- Success stemmed from sticking to the strategy, avoiding impulsive reactions to short-term market shifts.

- Meticulous monitoring of each currency pair ensured clarity and confidence in decision-making.

- The position is still open, with potential for more profits being pursued.

The ambitious target of reaching one million is still in sight, and every strategic decision inches closer to that goal.

Also Read: Day Trading Courses: 5 Programs Trusted By Traders

Conclusion

Every forex trade tells a story. It is a story about waiting, choosing the right time, and trusting the plan. The forex market rewards traders who stay calm, protect their money, and follow clear rules. This market never sleeps, so there are always chances to learn and grow. Each time traders buy or sell money, they learn more about how different currencies move and work together.

Success in forex comes from caring about every trade, from when it starts to when it ends. It is not about rushing or guessing. It is about building good habits in a fast market. Every trade, whether it wins or loses, teaches something new and builds confidence. Over time, even one trade can help guide the whole journey toward freedom with money.

Frequently Asked Questions

Top Trading Platforms for Newcomers

Choosing the right platform is crucial; it should provide real-time charts, seamless execution, and intuitive tools for analyzing market trends. Beginners in the forex market should opt for platforms that offer demo accounts to practice without risking real money. Even seasoned traders prefer platforms supporting multiple major currency pairs for enhanced flexibility and comprehensive market access.

How to Start Forex Trading Safely

Embark on your forex trading journey by understanding the forex market's mechanics and mastering basic trade management. Begin with small investments to mitigate risks, and prioritize trading in one or two major currency pairs. Leverage a demo account to analyze how price movements are influenced by news and economic data. Remember, the path to becoming a successful trader involves viewing the experience as an educational journey, not just a quest for profit.

Why Market Volatility Is Crucial for Forex Trading

Market volatility plays a pivotal role in forex trading, as it dictates the speed and extent of price movements. While increased volatility can result in substantial profits, it also elevates risk levels for both newcomers and seasoned traders. Grasping how major currency pairs behave during volatile periods is essential for determining optimal entry and exit points. Navigating trades in these conditions builds expertise in strategy, discipline, and understanding the dynamic nature of the forex market.