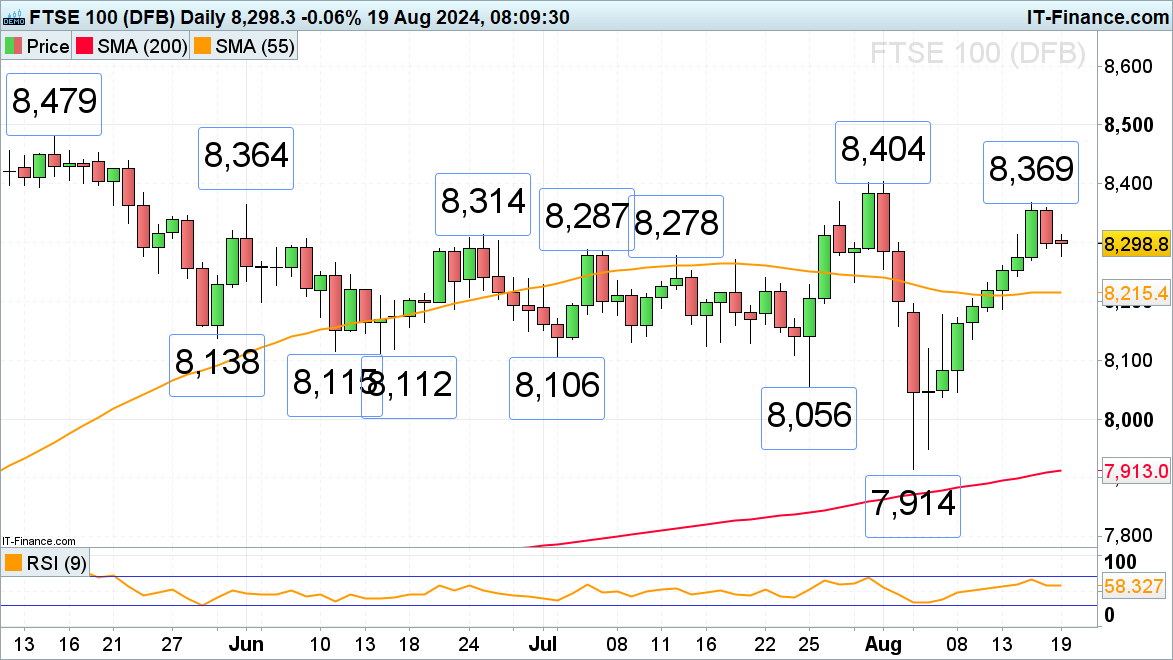

Following eight consecutive days of advances, the FTSE 100 experienced some profit-taking on Friday as traders adjusted positions amid ongoing rate cut expectations on both sides of the Atlantic. Monday morning’s trading has been quiet due to a sparse economic calendar. Resistance is identified at last week’s high of 8,369, with further resistance at the late July and early August high of 8,404.

Minor support is observed at the mid-July high of 8,278, ahead of the 55-day simple moving average (SMA) at 8,215.

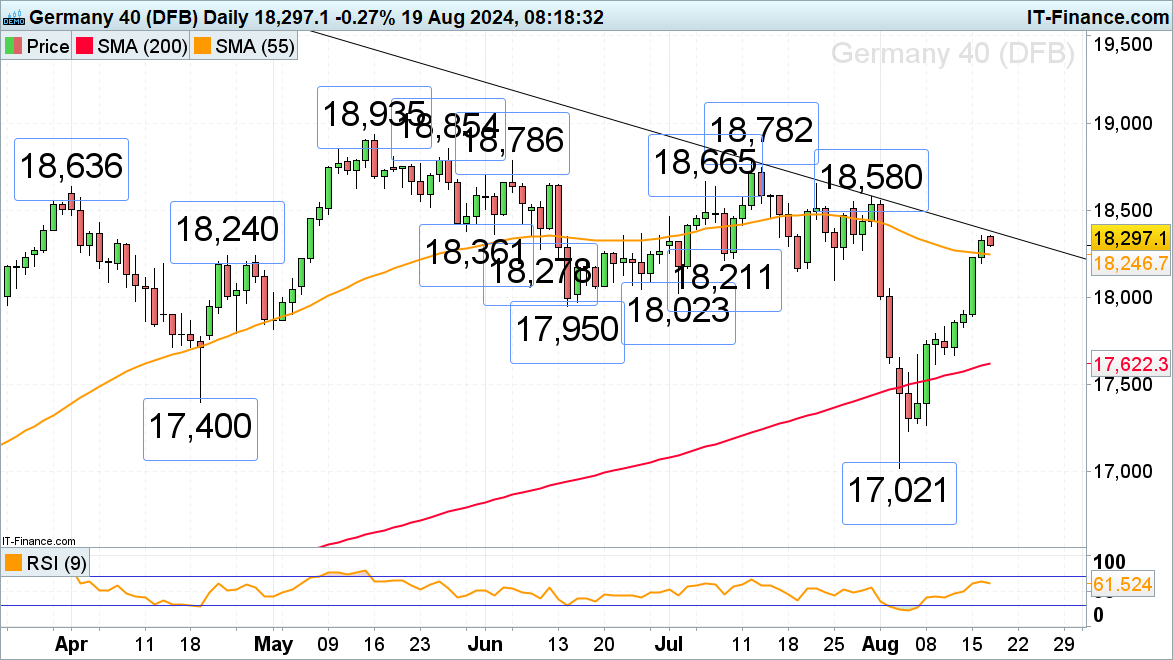

The DAX 40 has seen a robust recovery from last week's low of 17,021, bringing it close to the July-to-August resistance line at 18,372, which may limit further gains on Monday. If the index breaks through, the next target is the late July high of 18,580.

Support is noted at the 55-day SMA at 18,247, with additional support at the July 9 low of 18,211.

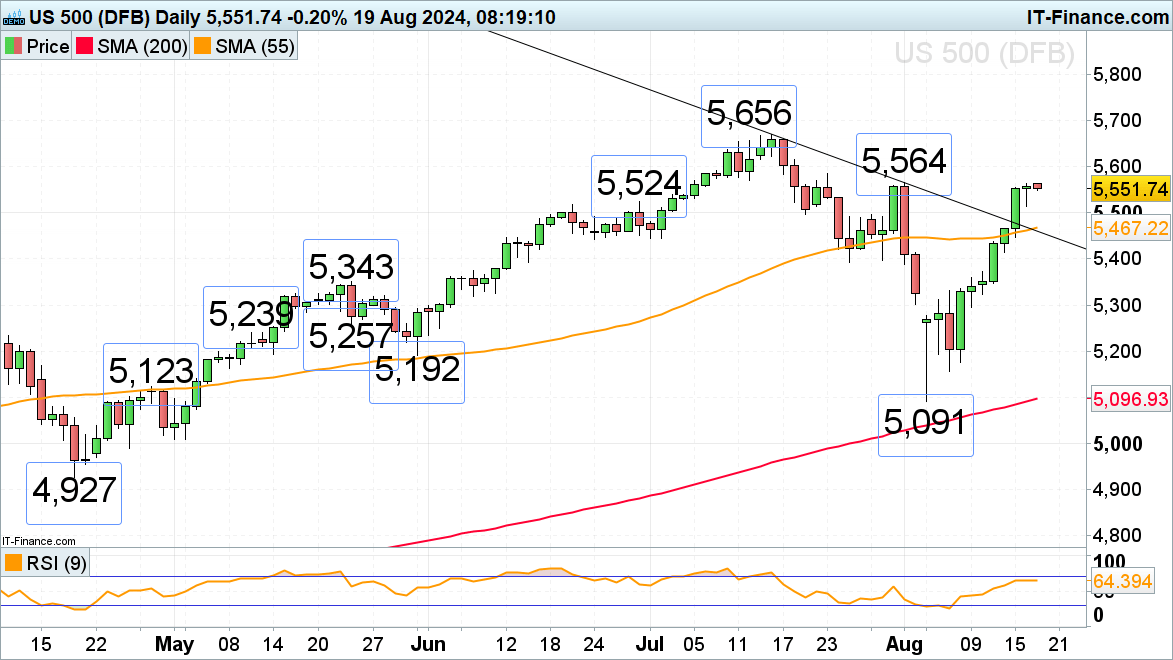

The S&P 500 has staged a sharp rally from its August 5 low of 5,091, bringing it back near the early August high of 5,564, where it may temporarily stall. If the upward momentum continues, the next resistance is at the July peak of 5,669.

The 55-day SMA, which recently crossed the July-to-August downtrend line at 5,467-to-5,462, could provide support if revisited.