The Gann Square of 9 a trading strategy that can be used to calculate future market prices and movements. The strategy has been used since the early 20th century. Its creator was a successful stock investor named William D. Gann.

Also Read: How to Trade Futures – A Beginner’s Guide

Contents

- Who is William D. Gann?

- What is the Gann Square?

- Gann Square Crosses: Cardinal Cross and Ordinal Cross

- Predicting Resistance and Support Levels Using Gann's Square of Nine Calculator

- Learning to Use the Gann Square of Nine Calculator

- Key Takeaways

- FAQs

Who is William D. Gann?

William D. Gann was a successful stock investor who earned over US$2 million in the American stock exchange using his Gann Square of Nine investing strategy. He never taught anyone his strategy, wrote a book about it, or had adherents to teach others how to use it. Currently, traders only use a few aspects of it and no one fully understands it.

Despite the lack of instructional material on the Gann Square of Nine, traders have been able to successfully use it to make profitable trades and predict market behavior. It is rumored that Gann developed the strategy while traveling overseas and implemented it when he returned to the USA. The strategy is the result of integrating his knowledge of biology, mathematics, astrology, physics, and other areas of study into an investment strategy.

According to its adherents, Gann theory works because it integrates a certain harmonic pattern found in nature into forecasting securities prices. Since all these are bound by natural law, reliable stock predictions can also be made using the applicable elements of natural law.

What is the Gann Square?

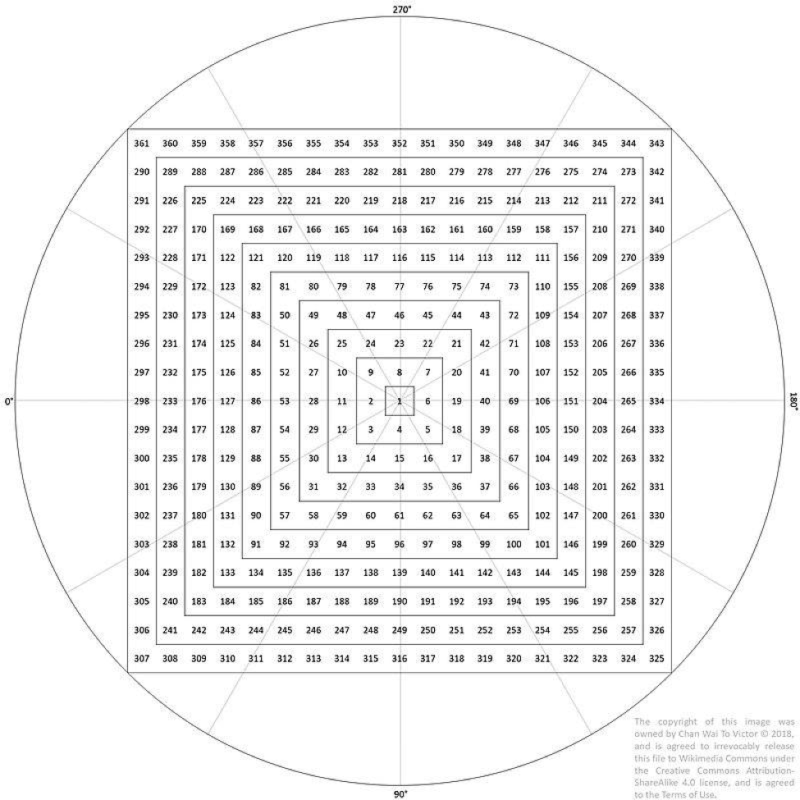

The Gann square has Nine rows and 9 columns. The market price that you want to extrapolate from is placed in the center of the square, that cell is called the base. From the base, the numbers increase by one with every additional square. The squares are assigned a numerical value by moving away from the base in a spiral. Overall, there are 81 numbers in the Gann square.

Gann Square Crosses: Cardinal Cross and Ordinal Cross

The Gann square can be used to predict the price at which there will be future resistance and support levels. These prices are located in the cells that are at 45 degree angles on the chart. Gann calculated that numbers along the 45 degree angle were the strongest and had the greatest influence over market behavior.

The values with the greatest weight, according to Gann, are located along the ordinal and cardinal cross.

Cardinal Cross

The cardinal cross angles are 90, 180, 270, and 360 degrees. The angles are more significant and of higher importance than the angles on the ordinal cross.

Ordinal Cross

The ordinal cross numbers are 45, 135, 225, and 315 degree angles. These angles, while important, are less weighty and influential than the cardinal angles.

Also Read: Death Cross: A Complete Guide

Predicting Resistance and Support Levels Using Gann's Square of Nine Calculator

The most popular way to use a Gann Square of Nine chart is to use it to predict the resistance and support level of a security. You can do this by performing the following steps with a Gann chart.

- Look at the market chart candlestick and select the lowest relevant market price on the chart.

- Put the lowest market price in the center of the Gann square and calculate the Gann square of 9 using it.

- Next, locate the current price of the security on the chart and highlight it.

- To find the resistance level, move away from the current price in a clockwise manner (with prices increasing). The price values that you are looking for will be on the cardinal and ordinal crosses (ignore the price values closest to the current market price). The values on the cardinal and ordinal crosses are the Gann square of 9 calculator forecasted resistance levels.

- To find the support levels, move away from the current market price in a counter-clockwise manner. The values on the cardinal and ordinal crosses are the Gann square of 9 calculator forecasted support levels.

If you don't want to use a Gann chart and work out or spend the time learning how to use one, you can easily calculate the next resistance level for your market price.

To find the next resistance, level perform the following steps with a calculator.

- Take the square root of the lowest relevant market price. For example, let's say the market price is US$28.

- If the square root of the number of has a digit in the tenths position that exceeds 1, add it to the number in the ones position. In our example, the square root of 28 is 5.29. So, add the 2 to the number 5 to get 7.29.

- Square the new number. In our case it will be (7.29)^2 which equals 53,14. Round the number down and you get 53. The next resistance level will occur at US$53.

- The tenths number must be added to the one position because if the tenths number is greater than 1, it means that the next resistance level value is in a different quadrant of the graph. Adding the number 2 to the ones positions moves the resistance level calculation one quadrant to the right.

Learning to Use the Gann Square of Nine Calculator

Since there are no experts, university courses, books, or other instructional materials on the Gann Square of Nine, its practitioners read the work of its adherents, work together, or figure it out themselves using Gann's work.

To use the Gann theory to trade is not easy or quick. It takes concentrated effort, lots of time, and a great deal of experimentation. Moreover, the Gann square of nine calculator is not an intraday calculator. It was never intended for intraday trading. It was intended for long-term trading (e.g., weeks, months, years). Still, there are intraday traders who use it to predict resistance and support levels during the trading day.

Also, Gann's methods cannot be used when the market opens. The traders must wait for at least an hour before doing their Gann square work.

Key Takeaways

Gann Square of 9 trading strategy has proven itself to be a reliable way to trade in the modern market. Traders who studied it and understand it say that it is 90% accurate.

For new or unsophisticated traders, Gann's theory is likely to be very difficult to understand and use. Also, traders should not use trading strategies that they do not understand and have not tested. So, if you master Gann theory, you, like Gann, may earn millions of dollars in the stock market.

FAQs

Why are people skeptical of the Gann Square of 9 trading strategy?

Many traders are skeptical of Gann's Square of Nine trading strategy because he used astrology to create it. Since astrology is not considered a real science (by scientists) they think that the theory lacks a scientific and mathematical foundation.