For new traders, buying stock and waiting for it to move up in price is the only way to make money. Yet this is not the reality for veteran investors that can make profits without putting money in the stock, and one such method is a long call option strategy.

It’s one of the most elementary option’s trading strategies. The investor purchases the call options with the expectation that the asset's price will rise appreciably over the strike price before the date of expiration for the option.

Also Read: How To Selling Call Options

Contents

- Call Options Explained

- Long Call Option

- Example of Long Call Option

- Long Call Outlook

- Long Call Setup

- The Impact of Implied Volatility on a Long Call

- Leverage

- The Influence of Time Decay on a Long Call

- Rolling a Long Call

- Unlimited Profit Potential

- Conclusion

- FAQs

Call Options Explained

As a form of financial contract, a call option allows a buyer the opportunity but not the obligation to purchase an asset at a particular price in a particular time period. The asset in question can be a bond, stock, or commodity. The buyer makes money when the asset rises in price.

For clarity's sake, the difference between a call and put option is that the latter permits the holder to sell the asset at a particular price, before or on the date of expiration.

When the market price is not going over the option's strike price within that period, the options expire worthless.

Long Call Option

The call option can be labeled as long, and the basic principle applies in this case, the buyer can but is not obligated to purchase an asset at a future date for the agreed strike price. But with a long call, traders can plan beforehand to buy the asset, at a reduced price.

One scenario is to buy a long call option before a significant event, such as a company's earnings report.

Although the profit potential from a long call option is minimal, at the same time losses get balanced by the premiums.

Meaning if a company is not showing positive earnings and is justifying expectations, the stock's price is going to decline.

But the maximum losses for the buyer will get caped by the paid premiums for the option.

Said simply, the long call is wagering that the underlying asset will rise in value before the date of expiration.

When purchasing a long call option, you expect the underlying stock price to rise and that way profits can get made from the contract by using the right to purchase the asset, and instantly sell it to pocket the profit.

This is a frequently used options trading strategy and gets classified as a bullish strategy. Investors purchase the call option when they believe the stock price is going to rise because the increase in the assets price influences the value of a call.

To be on a long call option is when you purchase calls on a particular stock. While the calls seller possesses a short position in the options.

Example of Long Call Option

Let's look at a hypothetical scenario where the underlying stock of X Computers has a price per share of $10.

When an investor purchases one call option for X Computers with a strike price of $15 expiring after two months. The investors believe the price will rise over $15 in the next month.

We can have a premium for the call option at $2 per share.

Being the option's holder, the investor can purchase 100 shares of X computers for $15 until the date of an expiration date. It's important to know that one option contract amounts to 100 shares of the asset.

Predicting a price rise up to $20 in that month. The call buyer can use his right and purchase 100 shares at $15, rather than $20. After the call option buyer gets the shares at $15, he can sell them for the going price of $20.

The buyers get a profit of $5 per share. Offsetting the $2 paid premium.

Long Call Outlook

A long call is bought when an investor is confident the underlying asset's price will rise at a minimum over the expense of the premium before or at the date of expiration. Additional out-of-the-money strike prices will be cheaper, but that comes with reduced chances of success.

The further out of the money the strike price, the more bullish will the sentiment for the prospect of the stock.

Long Call Setup

The position for a long call begins when a trader buys a call option contract. Calls get listed in an option chain and offer crucial information about the strike prices, dates of expiration, and the bid-ask price.

The fee to start trade is the premium. Investors evaluate numerous factors to estimate the worth of an option’s premium. Detail such as the strike price relative to the stock price, volatility, and expiration time.

The Impact of Implied Volatility on a Long Call

Implied volatility shows the option for price movements in the future. Larger implied volatility will produce bigger-priced options.

This is due to the perception the price will rise in the future. The price of the option declines when the implied volatility goes down. Options buyers take advantage of the rise in implied volatility before expiration.

Also Read: How To Use Pocket Options

Leverage

When contrasted with purchasing the specific asset directly, the call option buyer can gain leverage because the reduced priced calls increase in value faster for every rise in the point price of the given asset.

But the lifespan of call options is limited. When the price of the asset is not moving over the strike price before the date of expiration for the stock, the call option expires worthless.

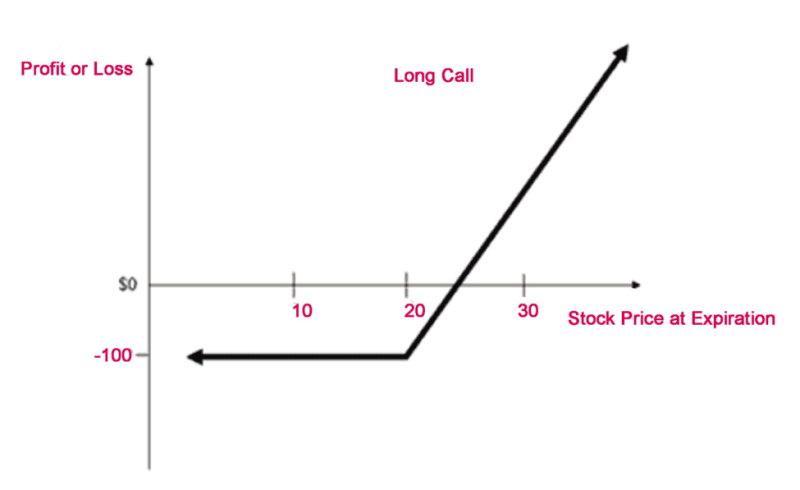

Let's check the long call payoff diagram.

The Influence of Time Decay on a Long Call

The remaining time to expiration and implied volatility produce the external value of an option, influencing the price of the premium paid. When every factor is stable, the price will be bigger for options contracts that have more time until expiration.

The reason is additional time for the asset to experience price movement. But as the time until expiration declines, the price of the option declines. Meaning time decay functions counter options buyers.

Rolling a Long Call

Long call position can get modified to prolong the time duration for a trade when the stock does not rise before expiration. The option to roll the position into the future enables the trade additional time to get profitable, but with an expanse, considering extra time means larger options prices.

If an investor decides to prolong a trade, the long call option can get rolled out by selling to close the present position and buying-to-open an option at a future date. This is going to generate a debit payment and incur extra costs to the initial position.

Unlimited Profit Potential

Considering that there is no limit on the stock price at the expiration date, this results in theoretically unlimited maximum achievable profit when using the long call option strategy.

While for the long call options, risks get limited to the price paid for the call option, and makes no difference how low the stock price gets traded on the date of expiration.

Conclusion

Call options provide a profitable strategy for modern finance. They get used to generating profits with complex positions that are not an option with standard securities.

Buyers of call options can benefit from the upside of specific shares for a tiny percentage of the price of the share.

Yet not everything is perfect, investors can face losses. A typical course that can lead to losses is selling unhedged calls that lose their value when a stock performs a drastic movement in the wrong way from the same strike price this will involve risk for a maximum loss in the money options.

The long call option strategy can get implemented when investors are bullish on a stock and expect the price to rise before the contract's date of expiration.

FAQs

What are long calls and short calls?

Buying a call or put option is a long position. Traders possess the right to purchase or sell to the investor at a specific price. On the other side selling a call or put option is a short position. In this situation, the investor sells from the long position holder of the option.

What is a long call option example?

An investor buys a long call option on an asset that is trading at $40 per share at a $45 strike price. In this case, the trader wagers that the assets price will rise over $45.

What is a long call strategy?

The long call option is a standard call option, where the investor has the right, but not the obligation, to purchase an asset at a strike price in the future. The benefit of a long call is that it permits investors to plan beforehand to buy an asset at a reduced price.

How does a long call make money?

The profit from a long call is the strike price plus the premium collected. When investors purchase an option, the premium plus the commissions paid for the option is the max they can lose This occurs the option is “out of the money” following expiration, it is worthless.