Libertex Review

With the evolution of technology, the dynamics of financial markets have changed like every other field of life. Unlike traditional trading, now trading transactions are possible online from the comfort of our homes. Traders can buy and sell any underlying asset relying on the expertise of an online broker's platform. Among the reputed online brokers, Libertex is one such renowned virtual trading platform.

Libertex is an online brokerage company used by the indication investments ltd that has not only made its mark within the traders but has also been acknowledged globally through various prestigious awards. Founded in 1997, Libertex has served millions of traders, investors, and even financial institutions and has become a reliable name in the dealing of financial instruments.

In short, we can say that Libertex is one such brokerage platform that facilitates traders and investors with all their basic trading needs Regardless of the experience and expertise, every online brokerage platform has drawbacks, which may result in a bad experience for its users. Therefore the selection of an appropriate online brokerage platform is key to successful trading.

For this reason, this review intends to inform the readers regarding the advantages and limitations of using Libertex as an online brokerage platform. The ultimate aim of this Libertex review is to provide the best possible analysis. As a result of this analysis, customers can make an informed decision before reaching out to this online trading platform.

What is Libertex?

Like many other online platforms, Libertex is one such company that offers virtual brokerage services to traders and investors worldwide. Libertex as an online brokerage firm has been serving for more than two decades and has become a trustworthy name in the financial market. The authenticity of Libertex can also be evaluated through its global reach and recognition by many international awards.

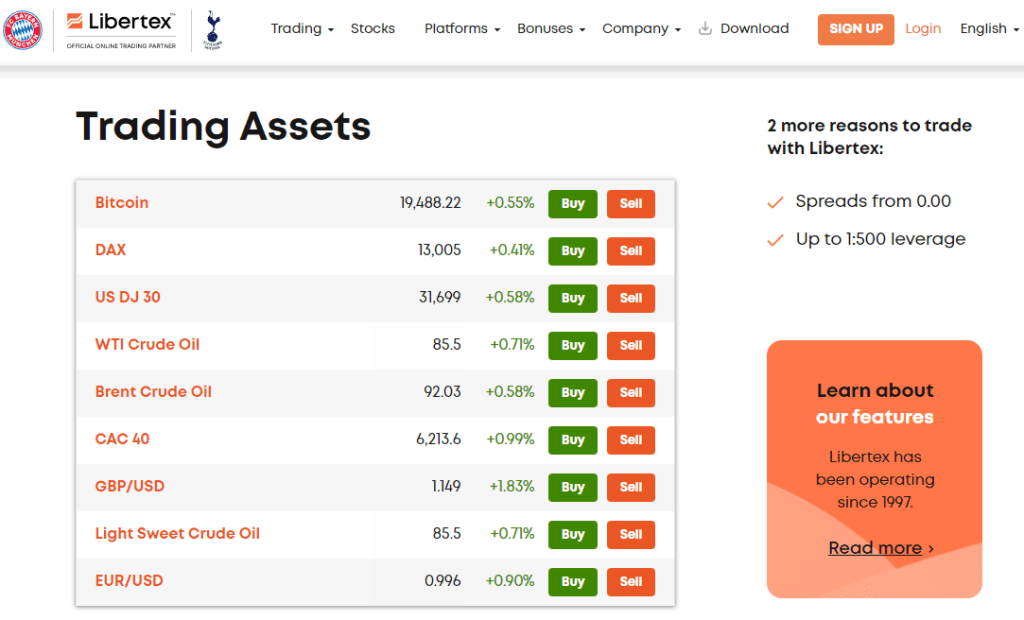

Libertex offers its trading CFDs in numerous financial instruments including stocks, commodities, securities, Forex trading, Cryptocurrencies, EFTs, and many others. Most of the trading in these underlying assets takes place for a fixed commission fee but Libertex also offers commission-free trading in stocks. In comparison to many other brokerage platforms, Libertex can be considered a cost-efficient online broker for its minimal commission fees.

The minimum deposit requirement for a Libertex account is $ 10 which is inviting however, the downside is that there are additional fees for payment withdrawals and transfers. Nonetheless, the surplus of charges is mentioned on their website up-front and there are no hidden or annual charges on Libertex retail investor accounts.

Like any other online broker, Libertex facilitates its customers with all the basic tools for their trading needs. Moreover, the latest Meta Trader 4 and Meta Trader 5 interface, which is approved and favored by many financial experts worldwide, is also available on the Libertex Platform. Similarly, most of the in-demand financial instruments are present for trading CFDs at Libertex.

Overall, any new or experienced trader can rely on Libertex for buying and selling any assets without worrying about the legitimacy of the broker. Libertex is used by indication investments and is regulated by the Cyprus Security Commission and also holds a license that validates its reliability. Simultaneously, It is also very convenient and easy to open a trading account with Libertex. All these plus points make Libertex a good choice as an online brokerage firm for trading CFDs.

With all the above-mentioned advantages, it can also not be denied that many competing platforms offer more advanced trading features as compared to Libertex. However, to use those features traders and investors also have to bear the expenses. Therefore, Libertex is the best option for those who are looking for minimal-cost brokerage services.

Advantages and Disadvantages of Trading with Libertex

Benefits of Trading with Libertex

There are many advantages of trading with Libertex. Firstly, traders and investors can trust this online broker if they want to trade in any financial instruments. Libertex has been a part of the online trading process for a long time and holds the potential to provide the best services to its clients. Hence, if one is looking for a genuine firm among dozens of online brokerage platforms, Libertex is one name that can be trusted.

Secondly, once a trader opens an account with Libertex, there are multiple tools, services, training programs, trading strategies and methods, and current market information with a user-friendly interface for the clients to start their trading journey. For this reason, Libertex is an ideal platform for newbies as well as experienced traders where all the trading requirements are met at a single platform.

Many affiliate training programs are available through Libertex to guide the new traders and the operational analytics support the matron investors as well. The Libertex training programs offer basic information and resources for inexperienced traders and also cover strategies and analytical techniques for advance level investors. All in all, Libertex is a reliable one-stop shop for all the trading needs of traders.

Another benefit of Libertex is that it starts with tight spreads of 0.0 pips and there are no charges on the spreads. Consequently, Libertex only charges a commission of 2% or less on profitable trading transactions which are not so high in comparison to other online brokers.

Moreover, Libertex offers a minimal deposit account type that has low risk and moderate yields. The minimum deposit is $100 which is affordable and cost-friendly for all kinds of traders. Such trading account types are best for long-term investment services. Similarly, the CFD account in Libertex provides leverage up to 1:50 and more considering the instrument.

Libertex Pros and Cons

PROS

- Low commission and fees

- Advanced MT4 and MT5 user-interface

- Licensed and regulated online brokerage platform

- Provision of customer support

CONS

- Additional transfer and withdrawal fees

- ECP/STP model unavailable

Analysis of the Main Features of the Forex Broker

4.0 Overall Rating |

4.0 Execution of Orders |

3.5 Investment Instruments |

4.5 Withdrawal Speed |

3.5 Customer Support |

4.0 Variety of Instruments |

4.0 Trading Platform |

Libertex Customer Reviews

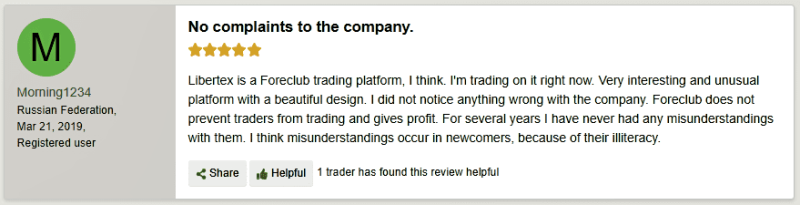

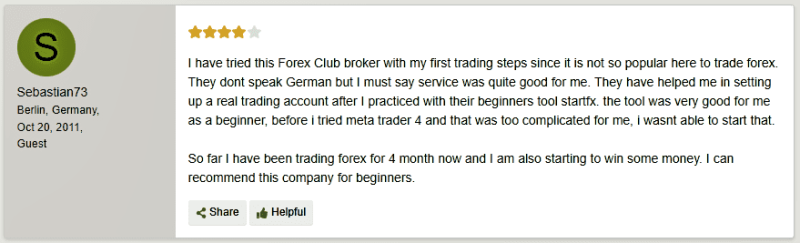

To evaluate the performance of Libertex as an online broker, we also analyzed the overall customer reviews present on various platforms. These reviews clearly suggest that users have been satisfied with the brokerage services offered by Libertex. Moreover, the design and interface of the website are also appreciated by the customers.

Many reviews also highlight how newbies and first-time users have also found the platform facilitating and they have managed to earn profits right after practicing on the demo account. There were also positive reviews regarding the tools offered on the website and many considered the tools quite handy.

In contrast, a few clients also pointed out the slow web-based interface of Libertex compared to other brokerage platforms. However, this does not affect the overall trading experience of the customers.

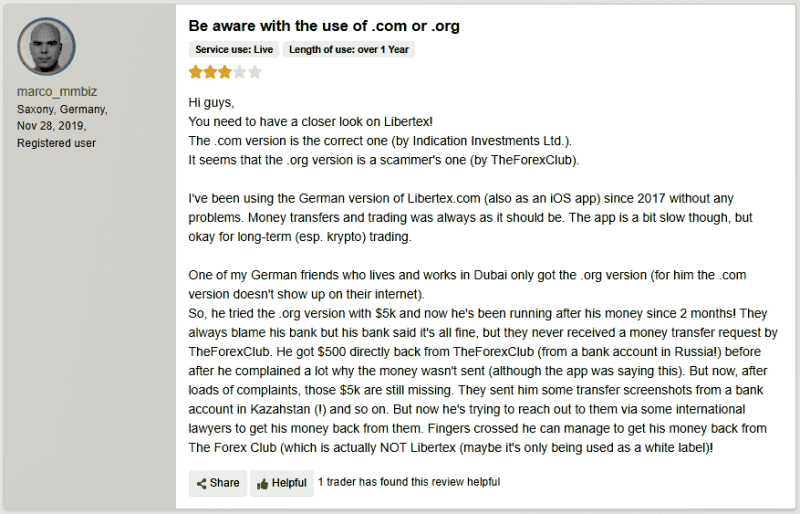

Additionally, some also talked about a fake or scam version of Libertex which is also present and apparently uses the same company name as Libertex. In this regard, traders need to be careful about differentiating between genuine and illegitimate platforms before making any investments.

Libertex Spreads, Fees, and Commissions

Every brokerage company earns through the commission they get at every spread and trading transaction. Mostly to overcome the competition and entice customers, brokerage companies offer low-commission trading. However, there are many hidden charges which are not disclosed to the clients. In such a scenario, to lower the trading cost it is very important to look for an online broker who demands low commissions and no additional fees.

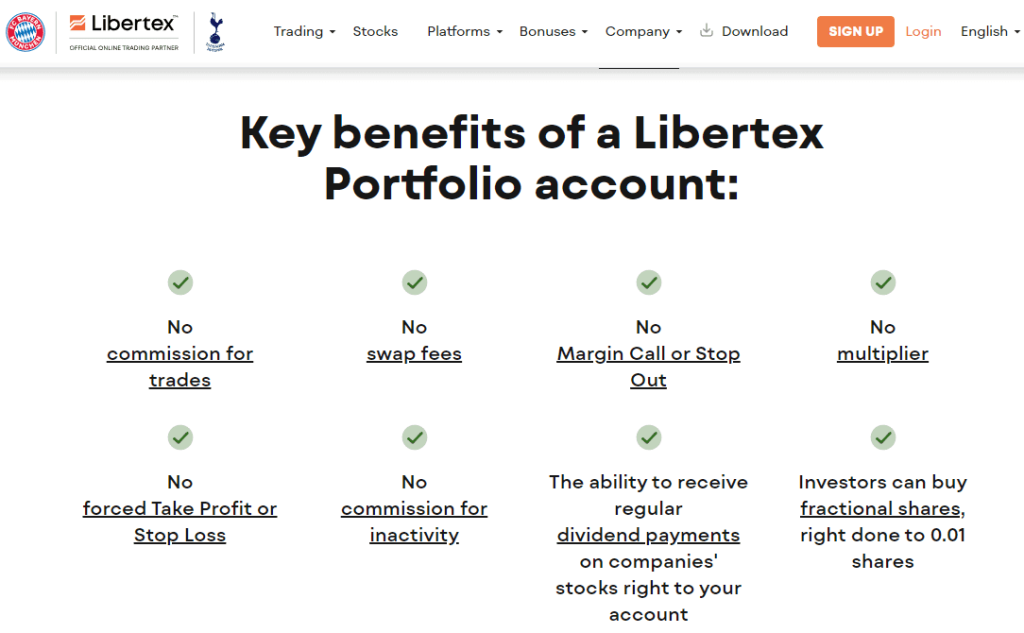

Libertex is one such platform that serves its customers on a very low commission compared to other online brokerage firms. Moreover, Libertex applies no commission on spreads but only on every trading transaction. Similarly, through the Libertex Portfolio account users can invest in stocks with a zero swap policy. Overall, Libertex covers all the basic requirements of a trader or investor account at a minimal cost.

In addition to the commissions, there are no account holding fees or any other monthly service charges on Libertex. On the downside, Libertex does charge additional transfer and withdrawal fees and there are also swap commissions on trading instruments like commodities or EFTs when they are withheld for longer than a trading day.

In terms of spreads, Libertex holds a strong position among other brokers as it offers tight spreads to its clients. The lowest spreads start from 0.1 pip, making it a great opportunity for traders to earn returns from price movements.

All in all traders and investors who are looking to open their trading accounts with Libertex should consider the additional charges however also keep in mind that they can be compensated by the low trading commissions compared to other costly brokerage platforms.

How Libertex Fees Compare to other Brokers

Account Types

Online brokerage services usually provide multiple retail investor accounts, keeping in mind the diverse needs of their clients. However, Libertex offers only two basic types of accounts for its clients. The first is the Libertex Portfolio account and the other is the Libertex CFD account. Each of these account types offers different services so that users can choose the one which suits their trading needs.

The Libertex Portfolio account is considered best for long-term investments. Investors who are willing to invest in a minimal-risk account with a moderate yield can opt for the portfolio account. This account type requires a minimum deposit of $50 and has the benefit of no swap commissions or fees on stock trading. However, this account type does not provide any leverage to its customer which can be a flaw.

The Libertex CFD account type, on the other hand, is ideal for day trading in instruments like forex, stocks, Crypto, etc. The advantage of a CFD account is that it provides leverage from 1 to 999 to the customers depending on the type of asset. However, it should also be kept in mind that high leverage involves significant risk for the investors. Moreover, users also have the chance to create a demo account before opening a CFD account to get familiar with the various features of the platform.

Regardless of the multiple features offered in these two accounts, Libertex is offering minimal account types compared to many other online brokerage platforms. Hence, the lack of options for account types can be considered a flaw when we measure the pro and cons of Libertex and evaluate it side by side with other online brokers.

How to open your account?

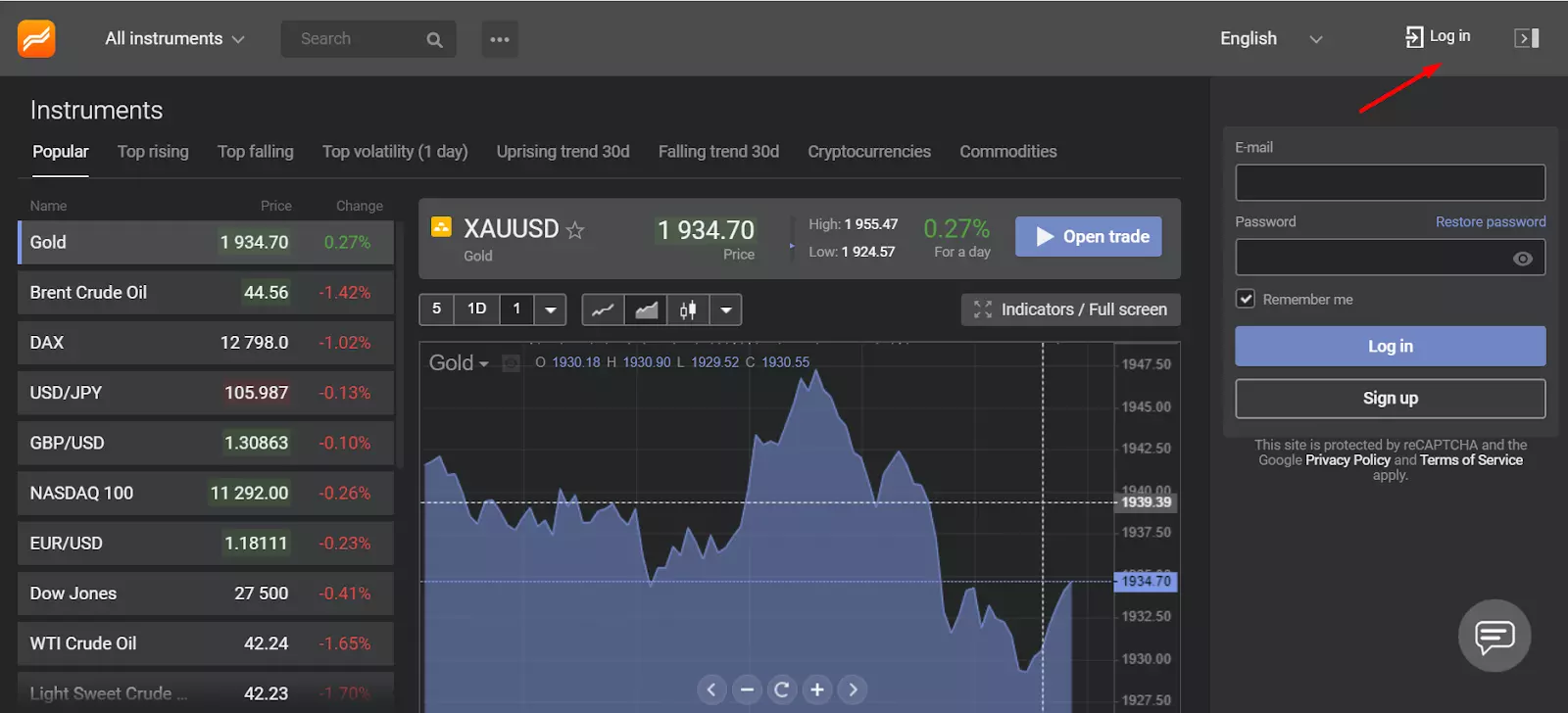

Opening a trading account with Libertex is relatively simple. As soon as the user decides which account type to choose either portfolio or CFD, an account can be created within minutes. There are only a few steps to follow to open an account on Libertex. However, the account will only be activated once the information is verified and the funds are deposited.

The first step is to go to the official Libertex website and click on the “Account Registration” tab. Next, the user will be redirected to another page which will ask for the email address and password for the account to be registered.

Once the details have been entered, click on the ” Register an account” tab. The final step in the process is that the user will get a verification code on the given email address or Phone which will be asked to enter for verification.

As soon as the account details are verified by the server, the user will get access to the Libertex dashboard. The user will be able to surf the entire Libertex website including all the live updates, news, and other tools. At this stage, if the user deposits funds in their account, they will be able to start trading.

However, in a demo account, the user will get a view of the platform through the website but will not be able to trade unless they switch to a real account after the minimum deposit requirement. The demo account mimics the real account in every way and does not have any expiration period so users can take a trial for as long as they want.

What Can You Trade on Libertex

The successful trading journey on any online trading platform needs to be started with a thorough analysis of the financial markets. Therefore, Libertex offers educational material to novice traders on its website so that traders can make an informed decision regarding the trading asset before they start trading.

Moreover, there are options for multiple tools on the Libertex platform for market and price fundamental analysis. Moreover, traders can also practice through a demo account first before the actual trading so that they can evaluate the risks and observe the results. For this reason, the option of a demo account provided on the Libertex services is very crucial.

When it comes to the real trading part, mostly all online brokerage companies offer stocks and EFTs trading on a low or zero commission basis. The reason behind this strategy is that stocks are considered to be the most popular underlying asset amongst traders and investors. As preferred stocks also come with dividend payments, traders prefer stocks over other assets.

However, Libertex provides an opportunity for its clients to trade in multiple asset classes including forex, Cryptocurrencies, futures, funds, metals, Indices, etc. Hence, one can select any one or more trading assets to start trading with a global reach.

Nevertheless, the important part is to make sure one is familiar with all the basic trading techniques, strategies, and market conditions before making any monetary investments. For this reason, the question of how to trade with Libertex is more important than what to trade.

Libertex Customer Support

When it comes to trading in financial instruments, anything can go wrong. Not only novice traders but any experienced investors may also face problems from the first step of registration till the final withdrawal of money when trading CDFs. In this scenario, it is the customer services that can retain the customers for the trading platform.

In this regard, Libertex group offers customer services through multiple mediums. From telephone, email, and live chat to postal services, the Libertex trading platform provides different methods of customer care. This Customer support is most active when the trader needs hand-holding when the retail investor accounts lose money or even in cases when there is any technical fault.

Other than the advantage of electronic and postal services, the customer support of the Libertex platform also provides multilingual communication for customers across the globe. So Customers can solve their problems and sort out their issues explicitly in their language.

On the hind side, regarding the customer service provided by Libertex group, many reviews also suggest that there were instances of delayed responses and unsatisfactory services. In such a case, the slow customer care can affect the ranking of the Libertex platform when compared to other trading platforms.

Libertex Customer Support

Libertex Contacts Table

Security for Investors

Withdrawal Options and Fees

At any point when the trader has earned considerable profits or is losing money rapidly, the trader would want to get access to their funds. This is the time when withdrawal options and fees become an essential feature of a brokerage company. How conveniently and fast services of withdrawal the broker provides and what additional withdrawal charges are levied need to be considered before investment with an online broker.

To withdraw payments from the retail investor accounts, there are multiple options available on the Libertex platform. Traders have the choice to either transfer their funds through bank transfer or can use their credit or debit card for the payment transactions. Additionally, the withdrawal payment methods in Libertex also include popular electronic wallets for immediate transfers.

As deposits of funds are free of cost on the Libertex platform, this is not the case with withdrawal payments. Libertex charges 1% withdrawal fees on basic transaction methods and not more than 2% on profit withdrawals. Moreover, in some cases, international bank transfers may also result in high withdrawal fees.

All in all, the withdrawal of funds in Libertex is a speedy and easy process with lots of options for the traders to choose from. If one is likely to opt for a regular bank transfer or electronic transaction then the withdrawal fee is minimal which can be overlooked considering the other benefits.

Libertex vs Other Brokers

The Libertex trading platform provides up-to-the-mark brokerage services to retail investors and traders who deal in trading CFDs. It suffices to say that Libertex is in the league with the best online brokerage platforms. Nevertheless, to analyze the standard and services of Libertex, it is important to compare it with other brokerage platforms and come to a definite conclusion.

#1. Libertex vs Avatrade

Avatrade is considered to be the best online trading platform for traders and investors right now. Along with many similarities, some differences signify the performance of both these platforms. The very first similarity is that both Libertex and Avatrade provide retail investor accounts for their customers on their websites. Secondly, both these companies work virtually and all trading transactions and processes are done digitally.

The difference is that Avatrade offers multiple types of accounts ranging from retail investor accounts for new investors to professional trading accounts for experienced traders. There are also other account types available for traders and institutions on their needs.

Moreover, unlike Libertex there are no withdrawal fees on the Avatrade platform, however, there are inactivity charges for the users. Avatrade also offers loss insurance to traders. In the above comparison, we can see that Avatrade has an edge over Libetex when it comes to account types and insurance policies.

#2. Libertex vs Roboforex

When we compare Libertex with Roboforex as trading platforms, it can be seen that they are both quite similar in terms of the features and services they offer. Both Libertex and Roboforex are based in Cyprus ad are regulated by the Cyprus securities and regulation commission.

Similarly, both these companies have a global reach in multiple companies and have been in the field for quite some time. Overall both Libertex and Roboforex can be weighed as equally credible online trading platforms.

However, there are some minor differences between these two firms which can be mentioned. One contrasting element is that Libertex offers trading in Cryptocurrencies which is not available at Roboforex. Consequently, traders who are interested in Crypto would have to go for Libertex. On the other hand, Roboforex has an edge over Libertex as it offers many different types of trading accounts compared to the Libertex platform which only has two types of accounts.

#3. Libertex vs Alpari

Alpari is another virtual brokerage platform that has provided services to numerous traders and investors. Based in a top Russian trade dealer a licensed company with authenticity and accountability of fund transfers and trading transactions.

When compared to Libertex, Alpari is a tough contestant offering similar trade features such as 100 plus financial instruments, a modern MT5 interface, compelling analytical tools, educational programs, etc.

In opposition to this, some loopholes make Libertex a better option than Alpari in many ways. For instance, Alpari does not cater to customers from the USA, Japan, and some other countries. Whereas Libertex has a wider global reach for traders. Another drawback is that Alpari lacks substantial customer support services, which deems crucial for many new and seasoned traders. Keeping all these differences in mind traders can choose the platform that caters to their needs.

How Libertex Trading Options Compare against other Brokers

Conclusion: Libertex Review

For any individual who wants to try their luck in the financial markets, it is crucial to look for an online brokerage company that suits their trading needs and financial outlook. These days there are numerous online firms offering brokerage services on a low zero-commission basis. These companies aim to lure traders towards their platforms by promoting various bonus deals on stocks, EFTs, and other underlying assets.

However, practically the best online broker is the one who offers not only low trading costs but also communicates all calculated expenses including their commission and every other hidden fee and charge. Other than the costs, an investment-worthy brokerage platform provides all the trading requisites including tools for technical analysis, useful trading tools, speedy and responsive customer care, a user-friendly interface, educational resources, and most importantly variety of financial instruments.

When we evaluate Libertex as a reputable brokerage platform, it is evident that it puts up the standard. With Libertex we have the assurance that the platform covers all the important features of an online broker including major trading assets, an easy-to-use interface, responsive customer support, training programs, low commission, and minimal withdrawal fees.

Moreover, a comparative analysis with other major online brokerage companies suggests that Libertex is no way behind its competitors and can be calculated as equal among the top online brokers.

Libertex is not only a platform for Novice traders but seasoned investors can also find Libertex a profitable trading partner. With access to global clients, Libertex has something for every kind of trader. About the fraudulent concerns of the traders and investors, which are quite relevant, investors can have the assurance of the authenticity and credibility of Libertex. It is a Licensed company that is regulated by the Cyprus security commission.

On the hind side, Libertex has some flaws which cannot be overlooked. When compared with the best brokerage platforms across the world, Libertex has a limited range of trading assets which sometimes is an additional benefit for the traders. Secondly, Libertex is not regulated by a centralized exchange which impacts its position in the global financial markets.

Overall, Libertex can prove to be sufficient for a variety of traders and investors around the world with their valuable services. Nevertheless, those traders who look for above-the-ordinary benefits may opt for other options.

Libertex Review FAQs

Is Libertex safe and legit?

Yes, Libertex is a safe and legit brokerage company as it is a licensed firm. It is regulated by the Cyprus Securities and Exchange Commission (CYSEC). This means that Libertex is being monitored and supervised by a security commission and any kind of defaults, frauds, mishandling, or data security breaches may result in suspension or cancellation of their license.

Moreover, the commission also ensures that the firm is providing compensation where required and that any sort of financial tempering is not involved. From this evidence, we can conclude that Libertex is safe and a legitimate brokerage platform. However, one lapse is that Libertex is not regulated by any centralized commission which would have made its case stronger.

Does Libertex offer a demo account?

Yes, Libertex offers a demo account. Libertex offers two account types. The first one is the Portfolio account, which does not consist of a demo account, while the other is the Trading CFDs account, which has a demo account. However, users can register for a demo account, and whenever satisfied with the performance, the user can switch to either a Portfolio account or a CDF account.

Unlike other platforms, Libertex does not offer a demo account with its account types. However, even when there are differences in the features of both these accounts, the user can still have a clear idea about the interface and the overall efficiency of the platform, which is the ultimate aim of a demo account.

Is Libertex available in the USA?

No Libertex does not operate in the USA nor does any traders who are USA resident can get access to the Libertex brokerage services. Moreover, Libertex is also not regulated by centralized financial markets like the New York exchange or NASDAQ.

The list of countries where Libertex does not operate can be found on its website. However, Libertex is available in many countries including Australia, Canada, and multiple Asian and south-Asian countries.