LonghornFX Review

Forex brokers are pivotal in the world of currency trading. They act as intermediaries, connecting traders to the global forex markets. Choosing the right Forex broker is crucial, as it can significantly impact your trading experience and success. Factors like reliability, trading conditions, and customer support are essential in this choice.

In the realm of Forex brokers, LonghornFX stands out. It operates as an STP (Straight-Through Processing) and ECN (Electronic Communication Network) broker, offering direct access to the Forex and CFD markets. With LonghornFX, traders have the opportunity to trade over 180 financial instruments. They benefit from leverage up to 1:500 and tight spreads, enhancing their trading potential. Furthermore, LonghornFX caters to various trading styles, including scalping and hedging, accommodating diverse trading strategies.

This review will delve into the offerings of LonghornFX. We'll explore its unique features, like trading with MetaTrader 4 (MT4) and the option to earn by copying trades of experienced market participants. Our focus is on providing a comprehensive analysis, balancing expert viewpoints with actual trader experiences. We aim to inform your decision-making process, whether LonghornFX is the right broker for your trading needs. Stay tuned for an in-depth look at account options, commission structures, and more.

What is LonghornFX?

LonghornFX is a renowned True ECN STP Broker, known for its exceptional trading conditions. This broker is designed to cater to traders at all experience levels, offering a user-friendly platform and competitive trading environment.

The platform provides access to a diverse range of 160+ assets. This includes an impressive selection of 55+ currency pairs, encompassing major, minor, and exotic pairs. It's an ideal choice for those looking to trade in the dynamic forex market.

Crypto enthusiasts find LonghornFX appealing due to its 35+ crypto pairs. These include popular options like BTC/USD and ETH/USD. This variety caters to the growing demand for cryptocurrency trading.

For stock traders, LonghornFX offers 64+ stocks, including big names like Apple, Tesla, and Goldman Sachs Group. This gives traders the opportunity to invest in leading global companies. Additionally, 11 indices such as NAS100, AUS200, and SPX500 are available, providing options for those interested in broader market trends.

Moreover, LonghornFX includes trading in metals and commodities. Traders can invest in gold, silver, platinum, as well as commodities like gas and oil. This diversification allows traders to spread their investments across different asset classes.

Benefits of Trading with LonghornFX

After trading with LonghornFX, I've noted several benefits that stand out. First, the access to a diverse range of over 160 trading instruments, including more than 55 currency pairs and 35+ crypto pairs, offers substantial opportunities for diversification. This extensive variety caters to different trading interests, from forex to cryptocurrencies, and stocks to indices.

Another key advantage is the low minimum deposit requirement of just $10, making it accessible for traders at all levels. This low entry barrier is particularly beneficial for new traders or those looking to test the waters with minimal financial commitment. Additionally, LonghornFX's use of MetaTrader 4, a platform known for its user-friendly interface and robust features, enhances the trading experience. This platform is ideal for both beginners and experienced traders, offering advanced tools and analysis options.

Furthermore, high leverage options up to 1:500 can significantly amplify potential profits. However, it's essential to remember that higher leverage also increases the risk of losses. Lastly, the tight spreads, starting as low as 0.1 pips for major currency pairs, ensure competitive trading conditions. This is particularly advantageous for frequent traders who benefit from lower transaction costs over time.

LonghornFX Regulation and Safety

As a trader who has experienced trading with LonghornFX, it's important to understand its regulatory context and safety measures. LonghornFX is owned and operated by Longhorn LLC, registered in Saint Vincent and the Grenadines. This region's financial sector falls under the oversight of the Financial Services Authority of St. Vincent and the Grenadines (SVGFSA).

It's crucial to note that LonghornFX operates without licenses, as the SVGFSA doesn't issue licenses but registers Forex brokers in their general company registry. This might be a concern for some traders who prefer trading with a fully licensed broker. However, LonghornFX implements progressive methods to protect clients' funds and personal data. Their use of cold storage for cryptocurrencies, which keeps traders' assets completely offline, is a significant security measure. Additionally, account security is enhanced with 2FA (Two-Factor Authentication), adding an extra layer of protection.

From my trading experience, it's important to know that LonghornFX's clients don't participate in any compensation funds. This means there's no financial safety net in case of the broker's insolvency. Moreover, disputes with LonghornFX are resolved internally, without third-party involvement, which could be a downside for those preferring external mediation. Lastly, LonghornFX's financial statements are not publicly available, which might affect transparency for some traders. These factors are essential to consider when choosing LonghornFX as your trading partner.

LonghornFX Pros and Cons

Pros

- High leverage up to 1:500

- Multiple accounts for each trader

- Low initial deposit requirement ($10)

- Tight spreads from 0.1 pips

- Full access to MetaTrader 4 (MT4)

- Supports automated trading

- Beneficial partnership program

Cons

- No cent accounts available

- Broker operates without a license

- Only cryptocurrency accepted for deposits and withdrawals

LonghornFX Customer Reviews

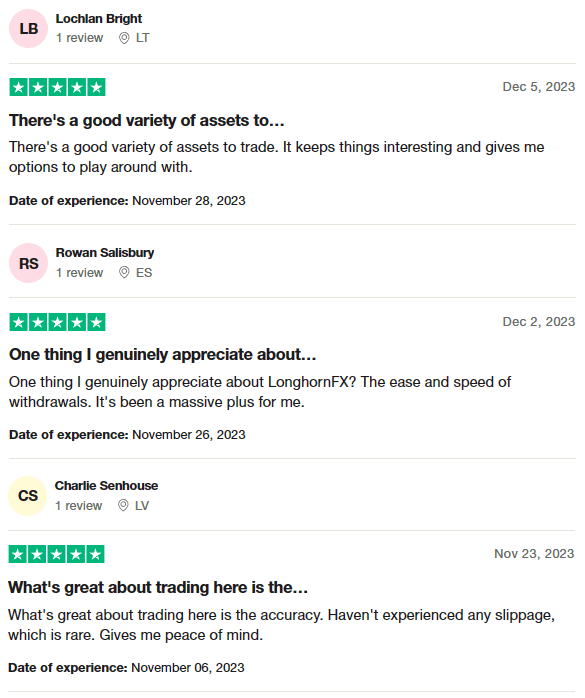

LonghornFX customers generally express satisfaction with the broker's offerings. They highlight the diverse range of trading assets available, which provides them with ample opportunities and flexibility in their trading strategies. Another significant point of appreciation is the ease and speed of withdrawals, which users find exceptionally convenient and efficient. Additionally, traders commend the accuracy of trades and the lack of slippage, contributing to a more reliable and stress-free trading experience. These positive aspects collectively contribute to the users' overall positive perception of LonghornFX.

LonghornFX Spreads, Fees, and Commissions

Trading with LonghornFX, an ECN broker, involves two main types of fees. Firstly, there's a $6 fee per lot charged for all assets and trades. This fee is a standard part of the trading costs. Secondly, LonghornFX uses floating spreads, which vary based on the trading instrument and market conditions. For instance, the minimum spread for the EUR/USD pair is notably low at 0.1 pips.

It's important to note that LonghornFX doesn't charge fees for deposits or withdrawals. This is a benefit for traders who frequently move funds in and out of their trading accounts. However, when dealing with cryptocurrency transactions, standard blockchain network and miner fees apply. This means that while LonghornFX doesn't impose additional charges, depositing and withdrawing Bitcoin will inherently incur some costs due to these external fees. This aspect is crucial to consider for those who plan to use cryptocurrencies for their trading capital.

Account Types

After testing the account types offered by LonghornFX, I can outline them as follows:

MT4 ECN Account

- The sole live account type provided by LonghornFX.

- Direct trading with liquidity providers, ensuring efficient market access.

- Tight spreads with a fee charged per lot.

- Adjustable leverage and a choice of base currency.

- Unlimited live accounts per trader, allowing for diverse trading strategies.

Swap-Free/Islamic Account

- Specifically for Muslim clients.

- No swaps, adhering to Islamic finance principles.

- Subject to an administrative fee instead of swap charges.

Demo Account

- Openable in any version of the trading platform.

- No limit on the number of demo accounts.

- Provides identical trading conditions as live accounts, perfect for practice and strategy testing.

Each account type is designed to meet different trading needs and preferences, offering flexibility and tailored options for all types of traders.

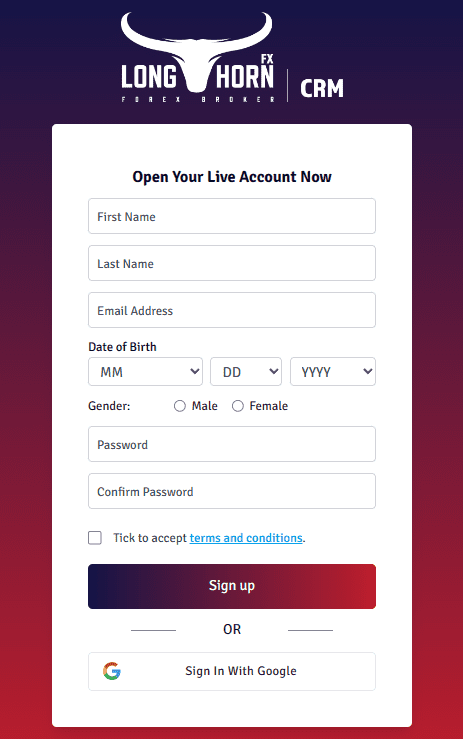

How to Open Your Account

- Go to the LonghornFX website and find the account creation form on the homepage.

- Enter your first and last names, email address, date of birth, and gender in the form.

- Make a password and type it again for confirmation.

- Send in the registration form once it's filled out.

- Look in your email for a confirmation message from LonghornFX.

- Click on the confirmation link in the email to verify your email address.

- Open your user account on the LonghornFX website.

- Log in to your account using your email address and password, and complete any additional verification required by LonghornFX.

LonghornFX Trading Platforms

Based on my experience with LonghornFX, traders exclusively use MetaTrader 4 (MT4) as their trading platform. MT4 is widely recognized for its user-friendly interface and advanced trading tools, making it suitable for both beginners and experienced traders. The platform provides access to all the necessary features for effective trading, including technical analysis tools, charting capabilities, and automated trading options. This exclusive focus on MT4 ensures that users have a streamlined and efficient trading experience.

What Can You Trade on LonghornFX

From my trading experience with LonghornFX, I found a diverse range of trading instruments. The platform offers over 55 currency pairs, which include major, minor, and exotic pairs, catering to forex traders with various interests and strategies. This variety is ideal for those looking to trade in the dynamic forex market.

In addition to currencies, LonghornFX provides over 35 crypto pairs, including popular ones like BTC/USD and ETH/USD. This extensive selection meets the growing demand among traders for cryptocurrency options. For stock traders, there are more than 64 stocks available, featuring prominent companies like Apple, Tesla, and Goldman Sachs Group, offering a broad spectrum for investment.

Indices trading is also available, with 11 options such as NAS100, AUS200, and SPX500. These indices allow traders to engage with broader market trends. Furthermore, the platform includes trading in metals like gold, silver, and platinum, and commodities such as gas and oil. This wide array of trading instruments ensures that traders on LonghornFX have access to a comprehensive and varied market.

LonghornFX Customer Support

Based on my experience, LonghornFX provides efficient customer support through various channels. One of the most convenient options is the live chat feature, which offers instant assistance. This is particularly useful for urgent queries or when immediate guidance is needed, ensuring real-time communication and swift problem resolution.

For those who prefer speaking directly with a support representative, LonghornFX's callback service is a great option. This service allows clients to schedule a call at a time that suits them, providing a more personalized support experience. Additionally, for more detailed or complex issues, or when there's a need to share documents, reaching out via email is a practical choice. This channel caters to comprehensive queries and is ideal for non-urgent matters, ensuring thorough assistance is provided.

Advantages and Disadvantages of LonghornFX Customer Support

Withdrawal Options and Fees

Withdrawing funds from LonghornFX, I found that the process is primarily through Bitcoin. Clients have two options: they can either transfer cryptocurrency to their own wallets or choose to withdraw profits to a card or bank account via Instacoins. Opting for Instacoins involves additional fees, including conversion charges from BTC to fiat currency and service fees for using the Instacoins platform.

LonghornFX is prompt in processing withdrawal requests, typically completing them on the day they are submitted. However, the actual time for the funds to be credited depends on the blockchain's speed, which can take up to 6 hours. A minimum of 6 confirmations is required for each transaction. The platform sets the minimum withdrawal amount at $10, with no upper limit, offering flexibility in fund management.

It's important to note that while LonghornFX does not charge any withdrawal fees, Bitcoin transactions are subject to a network fee. This fee is 0.0005 BTC, meaning its actual cost varies based on Bitcoin's market price at the time of the transaction. This aspect is crucial to consider for budgeting and financial planning.

LonghornFX Vs Other Brokers

#1. LonghornFX vs AvaTrade

LonghornFX and AvaTrade differ significantly in their offerings and regulatory status. AvaTrade, established in 2006, is known for its heavy regulation and a wide range of financial instruments, offering over 1,250 options. It serves a vast client base globally, except in the US, and is licensed in multiple jurisdictions. On the other hand, LonghornFX, with its focus on cryptocurrency transactions and high leverage, offers a more niche service with less regulatory oversight.

Verdict: AvaTrade is better for traders seeking a heavily regulated environment with a broader range of trading instruments. LonghornFX may appeal to those prioritizing cryptocurrency transactions and high leverage.

#2. LonghornFX vs RoboForex

RoboForex, operational since 2009 and regulated by the FSC, boasts a wide array of trading platforms and over 12,000 trading options. It caters to a diverse clientele with its advanced technology and personalized trading terms. LonghornFX, meanwhile, focuses more on cryptocurrency and forex trading, with a simpler platform approach.

Verdict: RoboForex stands out for traders seeking technological variety and a vast array of trading options. LonghornFX is more suitable for those who prefer a straightforward, crypto-centric trading experience.

#3. LonghornFX vs Exness

Exness and LonghornFX cater to different trader segments. Exness, established in 2008, offers a range of CFDs, metals, energy, and over 120 currency pairs, including cryptocurrencies. It's known for its low commissions, instant order execution, and infinite leverage for small deposits. Exness also provides a comfortable trading environment with various account types. In contrast, LonghornFX focuses on cryptocurrency and forex trading with high leverage and a more streamlined service.

Verdict: Exness is preferable for traders looking for a diverse range of trading instruments and conditions, along with a comfortable trading environment. LonghornFX is tailored for those focusing on cryptocurrency and forex markets with high leverage needs.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: LonghornFX Review

In conclusion, LonghornFX emerges as a unique choice in the Forex and CFD trading landscape, particularly for those prioritizing cryptocurrency transactions and high leverage options. The broker's offering of a wide variety of assets, including a significant number of currency and crypto pairs, along with stocks, indices, and commodities, caters to diverse trading interests and strategies. Additionally, features like tight spreads, multiple account options, and the user-friendly MetaTrader 4 platform enhance the overall trading experience.

However, potential users should be aware of some limitations. The absence of broker licensing and restriction to cryptocurrency for deposits and withdrawals might not align with every trader's preference or risk comfort. The lack of a compensation fund and limited customer support channels are other aspects that require consideration.

Also Read: TNFX Review 2024 – Expert Trader Insights

LonghornFX Review: FAQs

Can I trade with fiat currencies on LonghornFX?

No, LonghornFX only allows deposits and withdrawals in cryptocurrency, specifically Bitcoin.

Does LonghornFX offer a demo account?

Yes, LonghornFX offers a demo account which replicates live trading conditions, allowing for practice and strategy testing.

Is LonghornFX regulated?

LonghornFX is not regulated, as it operates in Saint Vincent and the Grenadines where the financial authority does not issue Forex broker licenses but only registers them.

OPEN AN ACCOUNT NOW WITH LONGHORNFX AND GET YOUR BONUS