Contents

- What is a Managed Forex Account?

- Understanding Managed Forex Accounts

- How Does Managed Forex Account Works?

- Things to Consider When Getting Forex Managed Accounts

- Types of Forex Managed Accounts

- Best Forex Brokers with Managed Accounts in Forex Trading

- Best Managed Forex Accounts in the Forex Market

- Final Thoughts

- FAQs

What is a Managed Forex Account?

This is a form of currency trading account that allows a money manager who is an expert in that field to make trades. The professional fund manager is in charge of the retail investor accounts; trades and transactions will be carried out on behalf of the client for a certain fee.

Making trading decisions, buying and selling of currencies are done by the individual in a regular trading account. But with a managed forex account, you can sit and relax as a money manager handles all business related to forex and the forex market.

In this kind of account, a higher fee and cost follow unlike a standard forex trading account; it also involves a high minimum deposit in some situations. All market logistics, equity, and bond investment accounts are managed by the money manager.

All this doesn't mean that you won't be in control of your account. You get to be in complete control of your account while your money managers access your account for trade.

Also Read: 10 BEST Forex Broker 2024 • From An Expert Trader

Understanding Managed Forex Accounts

If you're ready to accept the risks that come with trading and you want professionals to handle the selection of currencies and trading on your account, try managed forex accounts.

This mode of trading is an opportunity in the investment industry because it offers solid potential returns from leverage forex trading.

To start the managed forex account, you need to fund your forex account before the professionals can start their job. Those funds in your account will be traded by the money managers in the high leverage foreign exchange market.

When going for this type of forex trading scheme, investors have high hopes for huge gains along with the knowledge of the losses that follow.

One of the best parts of managed forex accounts is that investors get exposed to an asset class; this is different from the regular stocks and bonds we know.

There is more gain in forex trades as opposed to traditional securities that brings returns like interest payments, dividends or share growth. In forex trading, as the value of a currency rises or falls concerning each other, there will be gains.

The speculation of opportunities for a huge shift in price, the values between markets internationally, or the risk in these markets will spike the need to invest in currencies.

Forex traders, speculators, and investors as well open retail investor accounts with the hope of trading on their own. Beginners and newbies try trading but it turns out to be an extremely difficult task.

Note that some individuals succeed and make some gains with huge returns. Some of those returns turn out to be higher than the return on equities. To save the time, stress, effort, and even loss that comes with being inexperienced, use the services of a professional money manager.

The reason for a account manager is that you have more hope of getting profit because the professional in question can be trusted to come through with returns.

How Does Managed Forex Account Works?

A money manager is in charge of your managed forex trading account and that of other investors. When you open an account, your account manager trades your capital with other investors as well. They help you buy and sell currencies that would bring great returns in the long run.

The power of the money manager over the investors' funds is discretionary. The decisions and trades taken by the experienced trader or manager cannot be influenced by the investor. This is because the retail investor accounts lose money if care is not taken.

These managers in question charge a certain amount as a performance fee so they're paid when profits are gotten from the trade. Your money manager has no right to make deposits or withdrawals from your account unless you authorize it.

Using a managed forex account and expecting immediate profit is not the way to go because of the forex markets volatility. Most of the managed forex account should have a disclaimer that implies that losing money is part of the game because retail investor accounts lose money from time to time.

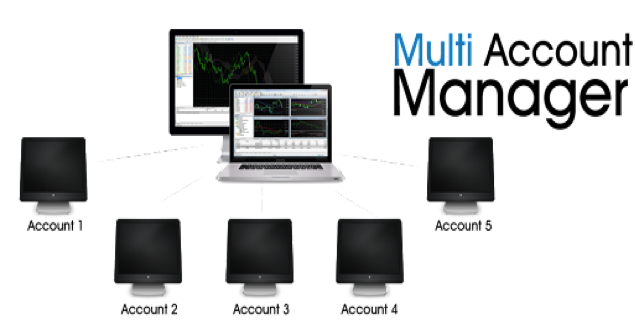

Since the fund managers have a long list of accounts to manage at the same time, they make use of a system from which they can see all accounts. These managers can access all investors' accounts through their dashboard.

On the dashboard, they can fix their allocation methods and the criteria to be used in each of the sub-accounts under their control. The risks and profit earnings will be managed through this medium as well.

As time goes by you can suggest some strategies and trading signals you want your fund manager to consider on your account. Managed forex accounts save you psychological and emotional issues that come with losing and gaining trades.

Forex brokers differ and vary according to their characteristics; so be sure to consider all factors before making a decision on which to use.

Things to Consider When Getting Forex Managed Accounts

When it comes to choosing a managed account, there are a few things to consider in the forex market. Some expert traders create accounts and give them to other traders to mirror or copy them.

But in the case of a broker, they display several accounts for investors to choose from. These investors now make their choice based on the account that matches their requirements and specifications.

Now that you know so much about managed accounts and how they work, what should you consider? How do you make a decision on the managed account or fund manager that would be in control of your account? Check the short factors below:

Fees

This is a vital factor to consider when choosing a managed account. Performance fees are very important and they vary according to the broker. These fees are charged to the investors, and they depend on the minimum balance in the account.

Fund Performance

On this part, investors need to check out the status of the track record of the professional manager before choosing them. Look out for a lot of things possible including consistency and profitability.

Trading Activity

You need to get used to how your manager trades and what his method of trading looks like. The frequency of their trades is also very important, this way you know what to expect. The status of your forex account manager is also important as it tells you if they're intraday or scalper traders. It could even tell you if they trade less frequently than stated.

Maximum Drawdown

Things would not always be good as there are times when trades will go wrong and times when they will flourish.

However, it is good to pick a manager that has a record of low maximum drawdown. The low level tells investors about the worse state the fund manager has been before recovering the account.

Minimum Deposit and Volatility

This informs investors about the minimum amount they are required to deposit before the account is managed. It plays a vital role in the decision of investors so this should be accessed with caution.

The volatility range could also affect the decisions of investors as they need to be sure of a certain level of returns from each trade taken.

In all, it is advised that investors choose a manager that has minimal maximum drawdown, low fees, and reliable performance.

Also Read: Finding Forex Trainers Online Guide

Types of Forex Managed Accounts

The managed forex account consists of four major types, and all will be well explained in this section of our article.

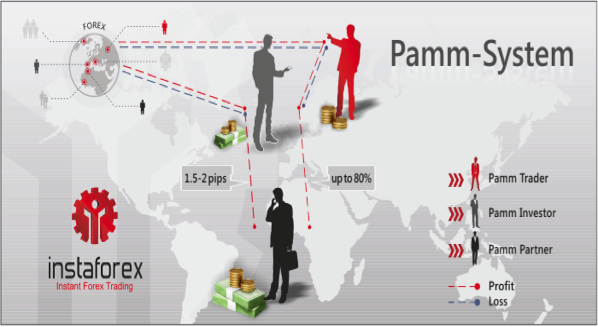

PAMM Accounts (Percent Allocation Management Module)

PAMM accounts are said to be very common concerning managed forex accounts. Investors' earnings, as well as losses, are distributed equally among different sub-accounts. The money invested by the investor does not count in this sense.

So, all accounts managed by the manager share the same percentage of profit and loss as well. The transparency that exists within this account is commendable because investors can see every step the account manager takes.

LAMM (Lot Allocation Management Module)

The account manager in charge of accounts under this module has the power to apply diverse leverage on all sub-accounts. This is however dependent on the needs of the clients and the managers as well.

A reasonable degree of flexibility is provided to the investors under this account. The flexibility is to curb the risks and manage them through LAMM accounts.

MAM (Multi-Account Manager)

This is a mixture of LAMM and PAMM accounts. The flexibility that comes with this type of account is the same as a LAMM account. The administration of accounts under MAM is done with the mind of mirroring PAMM accounts.

RAMM (Risk Asset Management Model)

With RAMM, investors will find the amazing features in PAMM present. These features are quite improved, hence, risk management that might arise from the account manager and investor can be curbed.

Those who use a RAMM account trade independently regardless of the absence of the fund manager. After that, they can now decide on the part of their balance that should be allocated for management.

Investors should look out for the difference that exists between these accounts before deciding on one.

Best Forex Brokers with Managed Accounts in Forex Trading

FXPro

This is one of the best-managed forex accounts brokers. FXPro is well known among investors in the industry. A MAM account is made accessible to investors and managers. Since MAM is a mixture of LAMM and PAMM accounts, it is a great choice for account managers.

Fund managers can set up their trading commission, thanks to the flexibility provided. The account managers can also apply additional markups and performance fees based on the investors in the business.

Also, based on trading volumes with rebates, account managers will be rewarded. All the flexibility is to the benefit of managers and investors.

FXPro offers a good variety of range allocation methods that gives many options to managers. The range includes percentage, equity percentage, lot, proportional equity/balance allocation, or equal risk. All these are popular choices to the brokers, they are all-round and very open. EAs can also be used on accounts like this.

IC Markets

As a well-known broker in the forex market, IC Markets has a strong force for traders and investors. With regards to managed accounts, the ECN broker offers MAM and PAMM accounts for the best experience.

Using this broker, you get access to the two types of accounts, and also the ability to manage allocation parameters in the real sense of it.

The accounts here are flexible and the sub-accounts will benefit from the flexibility. The sub-accounts in question will get 1 micro lot like the minimum trade size; the minimum trade size is also 0.01 standard lots.

The speed of execution is great with IC Markets as only the best prices are accepted. The spread is very competitive as it starts from a RAW spread at 0 pips.

Note that all trading done with the IC Market broker goes through the MT4 platform. Traders are also allowed to make use of EAs through the platform.

Roboforex

This is another broker that has improved over the years to become popular. Roboforex offers RAMM accounts to managers and their services are commendable.

Investors and traders that seek some level of independence can turn to the RAMM service as it is an excellent choice. Independence is for fixing risk parameters on the accounts been managed.

As with some brokers, Roboforex carries out its trading through an MT4 trading platform. Copy-trading services are also provided within the account service of RAMM. These features on the broker are very unique and some traders find them attractive.

Further, if investors or traders decide to change their equity maybe through deposit or withdrawal, relevant parameters will be adjusted automatically by the broker. This is to match the new amount chosen. All these provide a swift and easy process while using the broker.

Dukascopy

If you want a managed FX managed account, Dukascopy is the next best option. They are a well-known broker who also provides a variety of banking services. You have the option of choosing between two types of PAMM accounts.

The LP PAMM accou0nt gives you the option of handing over your funds to the broker, who will control and profit from them. Here, $1,000 is the minimum deposit. You can also leave your money with a money manager through the Standard PAMM account.

A third option is an account that includes MAM, PAMM, and LAMM functions and allows you to oversee an indefinite account with a minimum trade size of 1 micro lot in sub-accounts.

Dukascopy is a popular choice among traders and managers because of these advantages, as well as the flexibility and the possibility that you could check out a demo account beforehand.

Best Managed Forex Accounts in the Forex Market

AvaTrade

The MAM account through AvaTrade should be evaluated by money managers that want to trade for their clients. The money manager who wants to trade block trades for client sub-accounts can use the MT4 MAM terminal, which provides excellent account service and functionality.

Account managers can use EAs (Expert Advisors) to trade, create sub-groups for different strategies, and choose from a variety of commission schemes. There is a lot of liquidity, reliable execution, and competitive spreads.

Benefits of using AvaTrade include having multiple types of accounts like LAM, balance, PAMM; a reliable manager, and reasonable regulation.

eToro

When it comes to the finest FX managed account, eToro is one of the brightest lights. eToro is a fantastic trading platform with one of the largest user bases, and the Copy Trader feature is one of the most valuable features of trading with eToro.

Copy trading is a type of investment portfolio in which a trader follows and copies another trader's holdings into their own.

Because of the scale of the eToro user base, there is a large number of traders to copy at no cost to the investor.

eToro is one of the best in the business, with detailed statistics and detailed information on the traders' track histories. In Europe, the CySEC (Cyprus) and the FCA (Financial Conduct Authority) govern eToro (UK).

With the CopyPortfolio feature, eToro's copy trading service takes a step forward. Leading Broker Holdings are made up of the platform's most successful and long-term traders.

Market Portfolios come in a multitude of forms of investment as well. The investment committee of eToro evaluates and manages each Copy Portfolio's progress.

Vantage FX

To offer a managed account, certain brokers collaborate with a third party. This can facilitate a more complex service, which is exactly what the Vantage FX PAMM Account does.

On the MT4 and MT5 platforms, the Vantage FX PAMM Account offers a customizable performance pricing model with the ability to deposit and withdraw funds whenever.

The managed account's PAMM structure eliminates any rounding concerns that may arise from lot allocation while also allowing for the use of the equity allocation mechanism.

Other managed accounts include Infinox, Forex92, Key to Market, FP Markets, FXPrimus, and so on.

Final Thoughts

Managed forex accounts could be ideal for you if you want to engage in the forex market and make money but don't want to trade on your own.

Remember that, in addition to much larger minimum deposit amounts, you could be charged anywhere from 15% to 40% (or more) of your winnings. Depending on the account's circumstances, you may additionally be charged brokerage and other manager fees.

If you don't have enough risk capital to trade in a managed account or prefer to trade your own money, you might be better off trading in a conventional forex trading account, especially if you already have a viable trading plan.

Aside from privacy, trading in a conventional forex account provides you with far more flexibility and lower expenses than trading in a managed forex account.

FAQs

What is a managed forex account?

A managed forex account is a form of exchange trading account in which an experienced fund manager, for a charge, makes trades and transactions on behalf of a client.

A forex managed account is a good option for individual investors who aren't experts in foreign currencies but want exposure to this asset class.

How do I protect my forex account?

To protect your forex account, you need to pay attention to the regulation outlined by the broker. Do not register with a broker without a good reputation. Your password should be strong and protected from people.

Make sure to use a firewall while trading to prevent intruders. Avoid all public networks if possible. Lastly, maintain virus spyware, ransomware, or malware.

Can someone manage my forex account?

Yes, someone can manage your forex account. The management of a person's account led to the advent of managed forex accounts.

Here, a professional will be in charge of your managed accounts. Bear in mind that this expert would not manage your account alone as other investors can contract him for the same purpose.

The expert account manager manages your account and trades your funds for a fixed rate or a share of the profits made. These managers work with brokers to advertise their services to clients and independently handle trades.

How do I start a forex-managed fund?

Before you can start your forex-managed fund, there are a series of exams to pass. The series 3 and 34 exams have to be taken and passed. You then have to join the National Futures Association (NFA) as a CTA.

Follow up on all the requirements stipulated before you can move on to the next level. Make sure to register before providing spot forex account management services.