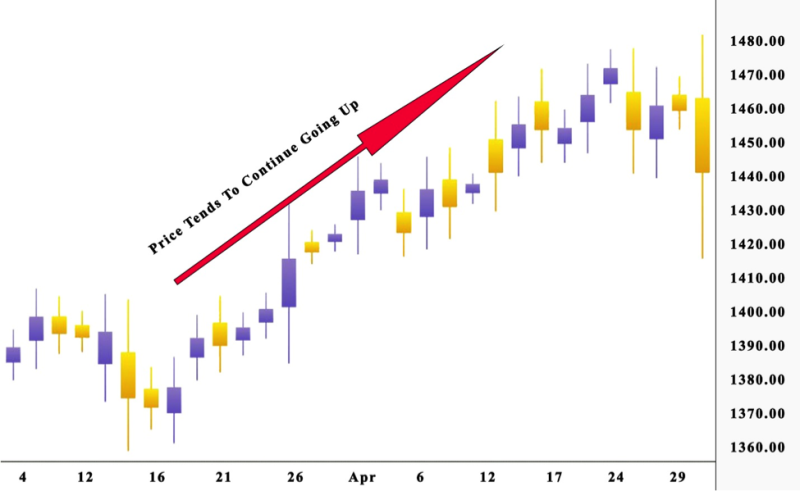

Momentum is a driving force behind price trends, keeping an asset on an upward trajectory in the market.

Sometimes momentum is not perceived as an investment strategy. But more like an instinctive reaction to information provided by market volatility.

Traders like the concept of buying a winning stock and selling losers, yet it's contradictory if you take into account the old mantra buy low sell high. Most brokers work with the adage “the trend is your friend”.

That is the concept behind momentum trading, following the direction of the trend. After encouraging news about the company that issues a given stock is made public, that asset starts climbing the market charts. Brokers will flock to buy it, expecting it to rise even more in the future.

This is why some refuse to accept momentum trading as a strategy, for them, it’s a reactional move to market circumstances and not something you plan for and implement.

Yet once you start to use momentum as a guide in your trades, you have to know when to exit the position, you have started in turn that gives is some elements of a strategy.

Also read: A Complete Guide To Your Trading Plan

Contents

- Can You Profit from Momentum Trading?

- The Inventor of Momentum Trading

- Momentum Day Trading Strategy

- Momentum Traders Use Momentum Indicator

- Momentum Trading Strategies

- The Best Time of Day to Trade

- Risks of Momentum Trading

- Momentum Day Trading Chart Patterns

- Conclusion

- FAQs

Can You Profit from Momentum Trading?

It's standard for a stock to rise for several days, after positive news about earning in a previous quarter, or a short squeeze that can be present a few days.

Traders believe that trends tend to build on themselves, and that makes investors confident in riding a wave that in theory will grow for some time. When the prediction comes true, profits can be made.

Most brokers scan for positive earnings reports that indicate it’s the right time to start momentum trading.

It’s good to start buying at the beginning of the trend when the price is still relatively lower, remember the objective is to buy low and then sell high further down the line, making a profit for the difference.

The Inventor of Momentum Trading

Richard Driehaus was not the first momentum trader, still, he was the broker that transformed the practice into a strategy that he used to manage his funds. Many of the techniques he used are the fundamentals of what is now known as momentum investing.

His guiding principle was that profits are earned by “buying high and selling higher” rather than purchasing underpriced assets and hoping for the market to re-evaluate them.

Driehaus sell the losers and allowed wining stock an opportunity to ride the trend and reinvest the money from the losers in other assets that are starting to rise.

Momentum Day Trading Strategy

A momentum strategy is the bread and butter of day trading. Traders are aware that to make a profit, they have to use technical indicators to locate assets that are responsible for market trends.

The fact is that every day some stock will move, the job of traders is to find out ahead of time which stock is starting to rise and for how long.

What is required for a momentum day trading strategy? Traders need a stock that is moving, assets that are going sideways are not the desired target for investing.

Most investors use stock scanners to identify stock on the move, and an unofficial rule is to focus on extreme cases because they are rare and not a product of false signal that can start a stock on its way up just to come back crashing down a few days letter.

Momentum stocks share a few elements that can be used to identify a good prospect for momentum trading.

Strong daily charts indicate the stock is over the moving averages and resistance. The high relative volume is at a minimum twice over the average.

A fundamental catalyst such as earnings reports, an announcement from government institutions, or breaking news.

These factors are not necessary for momentum sometimes a stock starts to rise without them, this is called a technical breakout.

Also read: Money Management Trading

Momentum Traders Use Momentum Indicator

Momentum strategies are most useful for volatile markets , where there is a constant stream of traders. Few key factors help determine if the momentum of a stock is starting to develop.

Volume

Volume is the quantity of a given stock that is traded in a certain time frame. Volume does not indicate the transactions, but the number of assets traded. If eight buyers acquire one stock each, it looks the same as if one trader buys eight of the assets.

Volume is crucial for momentum traders, having to enter and exit positions fast, which depends on a constant flow of buyers and sellers in the markets.

If a market is full of traders active on both sides, it is a liquid market where you can exchange an asset for cash much easier. But if a market has a deficit of buyers and sellers, then it is illiquid.

Volatility

Volatility is a momentum trader’s key parameter it measures the degree of change in the price of a stock. When a market is highly volatile, it indicates large price swings, and a market with low volatility is relatively stable.

Momentum traders search for volatile markets, to benefit from short-term rises and fall in an asset’s value. It is crucial to have an adequate risk management strategy to safeguard trades from unplanned market events. The best way to accomplish these is with stops and limits.

Time frame

Momentum trading strategies are based on short-term market movements, but the time spent on trade can depend on how long the trend maintains its strength.

This can make it appropriate for brokers who use longer-term styles such as position trading, as well as those who prefer short-term styles, such as day trading and scalping.

Momentum Trading Strategies

Whether you are concentrating on development or value stocks, decisions are made with fundamental analysis. Few attractive momentum trading strategies and signals are used by investors attempting to profit from the trends.

- Day traders searching for momentum stocks usually implement unique criteria to locate opportunities by focusing on small companies, unusually high volatility, and high volume. Chart patterns are also used with technical analysis to get a feel for the momentum.

- Popular opinion in momentum trading is that an asset that reaches a new high is probably going to climb even higher. One option for locating momentum stocks is to filter assets trading within 5% of their highs.

- In earnings season, try to identify stocks that shock with a rise can generate momentum trading suggestions. Observing he news media channels can result in information that can help find momentum trading tactics.

The Best Time of Day to Trade

The momentum trading strategies are most fruitful during work hours, but mornings are usually the best time to trade, especially the opening hour of the market.

Recommendations are to focus on the time frame from 9:30 am to 11:30 am. Still, you should not relax for the rest of the day, news can break at any time and influence the market and amount of volume that is traded.

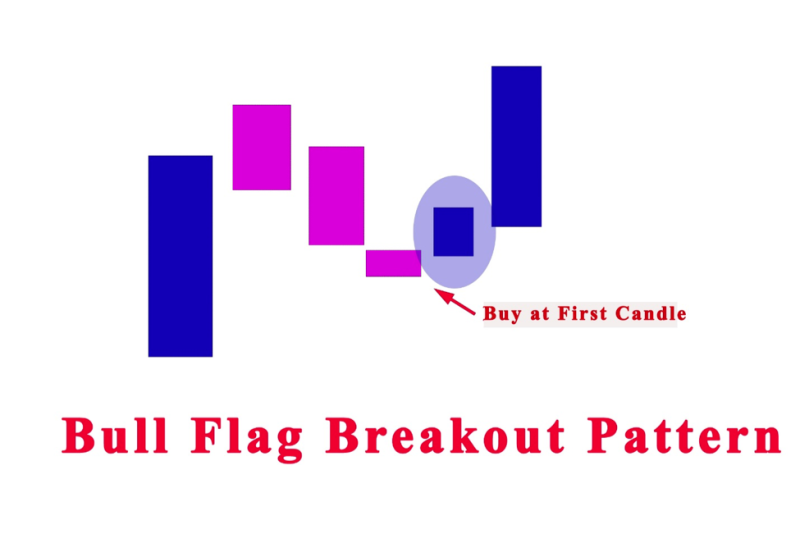

Stock that appeared boring at the start of the day can be a great option to trade on the first pullback.

The initial pullback will typically take the form of a bull flag.

Risks of Momentum Trading

When using momentum, you are expecting a given trend to stay on its course. The problem with the idea is that no guarantees are offered that the trend will continue to move in the same direction.

Trends reverse constantly, momentum has an expiration date, the problem is to figure out when the momentum will lose steam and the price will decline in value.

The perfect momentum trade is purchasing asset on the rise and selling it at its peak. In theory, it's easy to say that, but in practice, it’s hard to spot the right moment. Investment timing is the crucial factor and the difference amid triumph and disaster.

When a stock rises seconds decide the outcome. Stocks can start an upward trend that is consistent for months but joining the trend after it has made its progress is not a good strategy, you catch the train at the station not when it’s on its way.

Momentum trading is perilous, the main issue is that the operation can be implanted in both directions. Brokers that acquired the asset can turn around and start selling it, starting a wave where other desperate sellers attempt to get rid of the stock, effectively lowering prices, moving the trend downward.

It is a delicate way to work in the stock market. Momentum trading can be profitable, but it can also cause significant losses.

Momentum Day Trading Chart Patterns

Trades depend on chart interpretation to get a feel of the market. When day trading few methods are useful like the bull flag pattern something investors spot every day and offer low-risk entries in strong stocks.

Trading platforms and stock scanners enable fast identification of perspective stock for momentum trading. With these software tools, you can spot the relative volume in the market.

But scanners alone do not locate patterns on charts, traders must use their skills.

With the bull flag pattern, the start is the initial candle to perform a fresh high subsequently the breakout.

Usually, volume rises at the occasion the initial candle creates a new high. That is the result of legions of investors initiating their purchasing orders.

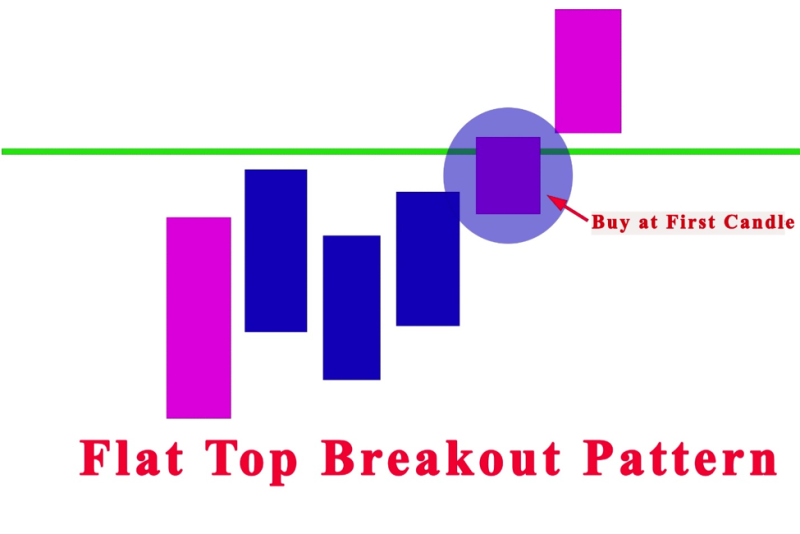

The flat-top breakout pattern is analogous to the bull flag bar the pullback has a flat top in the area of strong resistance. This pattern emerges because traders at a distinct price level will crave investors to purchase all the stocks since prices can be continuing higher.

The pattern results in a large breakout if short sellers see this resistance level emerging, they palace a stop order over it.

When traders remove the resistance, the buy stop orders will then be activated resulting in the asset the stock to quickly climb the chart up and will receive profits.

Conclusion

Momentum strategies are not for beginners, but if implemented correctly the profits can be high. It takes focus to trade with these types of momentum indicators because brokers must be ready to end a position at the first signal of a change in direction and the funds must be redirected into a new trade that is show potential.

The downside of momentum trading is the fees that make this strategy impractical for many investors, but these can change with cheaper brokers that are more influential in the careers of short-term active traders.

Buying high and selling higher is momentum traders' goal, but it’s not a risk-free strategy it's a fair share of challenges.

FAQs

What Is a Momentum Trading Strategy?

The momentum trading strategy involves traders buying a stock that is rising and selling it when they reach its peak.

What Is Momentum of a Stock?

Momentum is the velocity of price changes in stock. Momentum shows the rate of change in price movement over a period to help traders regulate the potential of a trend.

What Time Frame Is Momentum Trading?

Short time frames are prioritized in momentum trading prioritizes.

Why Is Momentum Important in Trading?

Trading depends on predicting the course of the market and momentum signals that stock is going to continue in a given direction for the foreseeable future.