Oil prices surged following reports of disruptions at Libya's key oilfields, a critical revenue source for the internationally recognized government in Tripoli. The oilfields, located in the eastern region of the country, are reportedly under the influence of Libyan military leader Khalifa Haftar, an opponent of the Tripoli government. While Libyan Prime Minister Abdulhamid al-Dbeibah's government has not yet confirmed any disruptions, the mere possibility has already impacted the market, pushing oil prices higher.

Further adding to supply concerns is the ongoing tension in the Middle East, where Israel and the Iran-backed group Hezbollah have exchanged missile fire. Although a top U.S. general noted on Monday that the risk of a broader conflict has lessened, the potential for an Iranian strike on Israel keeps markets on edge, contributing to the sharp rise in oil prices.

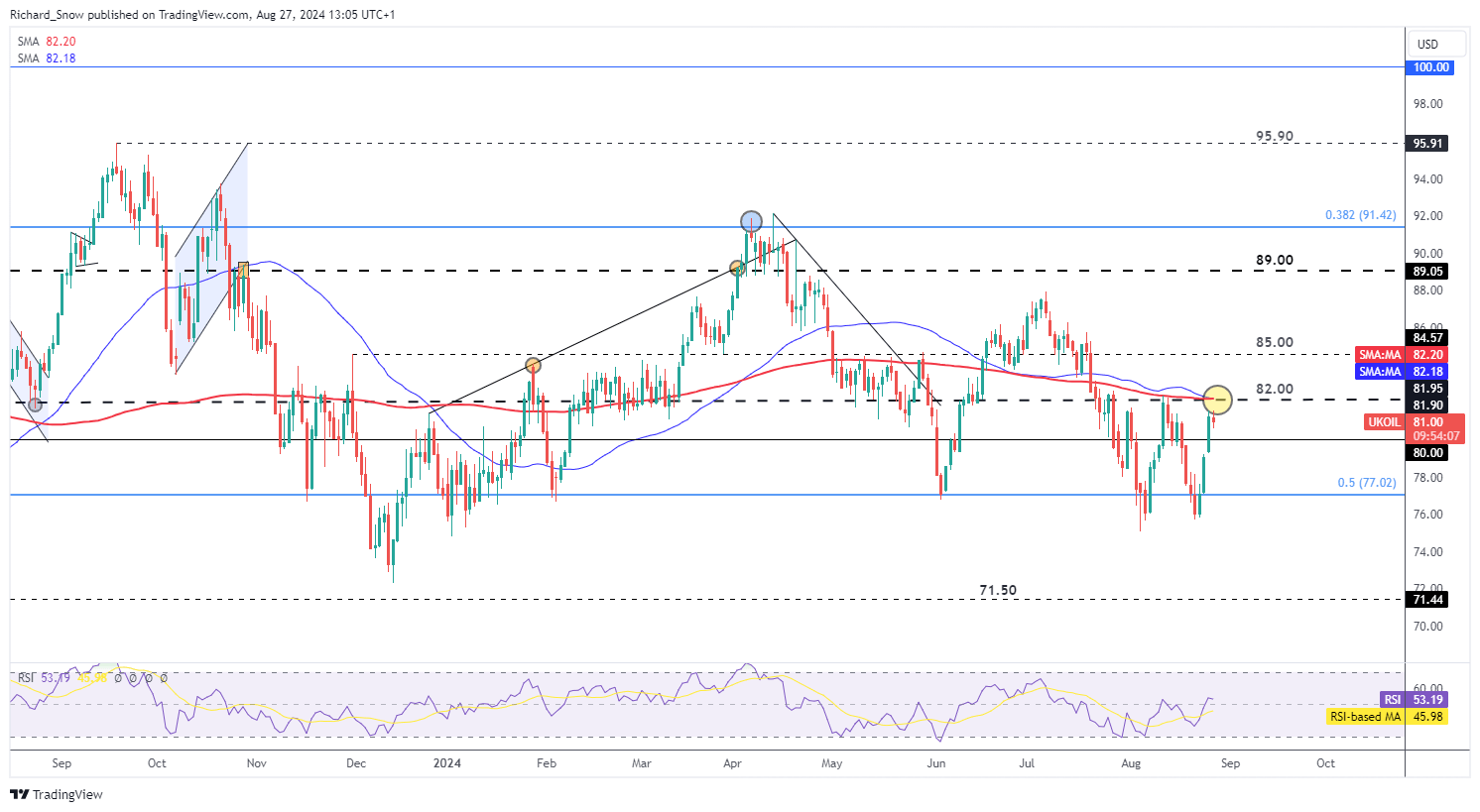

Oil Prices Approaching Crucial Technical Resistance

Oil bulls have capitalized on the recent upward movement, with prices rising from $75.70 per barrel to $81.56. The supply uncertainties in Libya and the Middle East tensions provided a significant boost to oil prices.

However, today's trading suggests a possible slowdown in this upward momentum, as prices have struggled to break through the $82 mark, just shy of the earlier swing high of $82.35 this month. Despite this, oil remains in a broader downtrend due to constrained global economic prospects and downgraded estimates for oil demand growth.

The $82.00 level remains critical for a continued bullish trend, especially as it aligns with the 50-day and 200-day simple moving averages, creating a strong area of confluence resistance. Should bulls manage to maintain the upward trajectory, $85 would become the next resistance target. On the downside, support is seen at $77.00, with the RSI indicator showing neutral ground, neither overbought nor oversold.

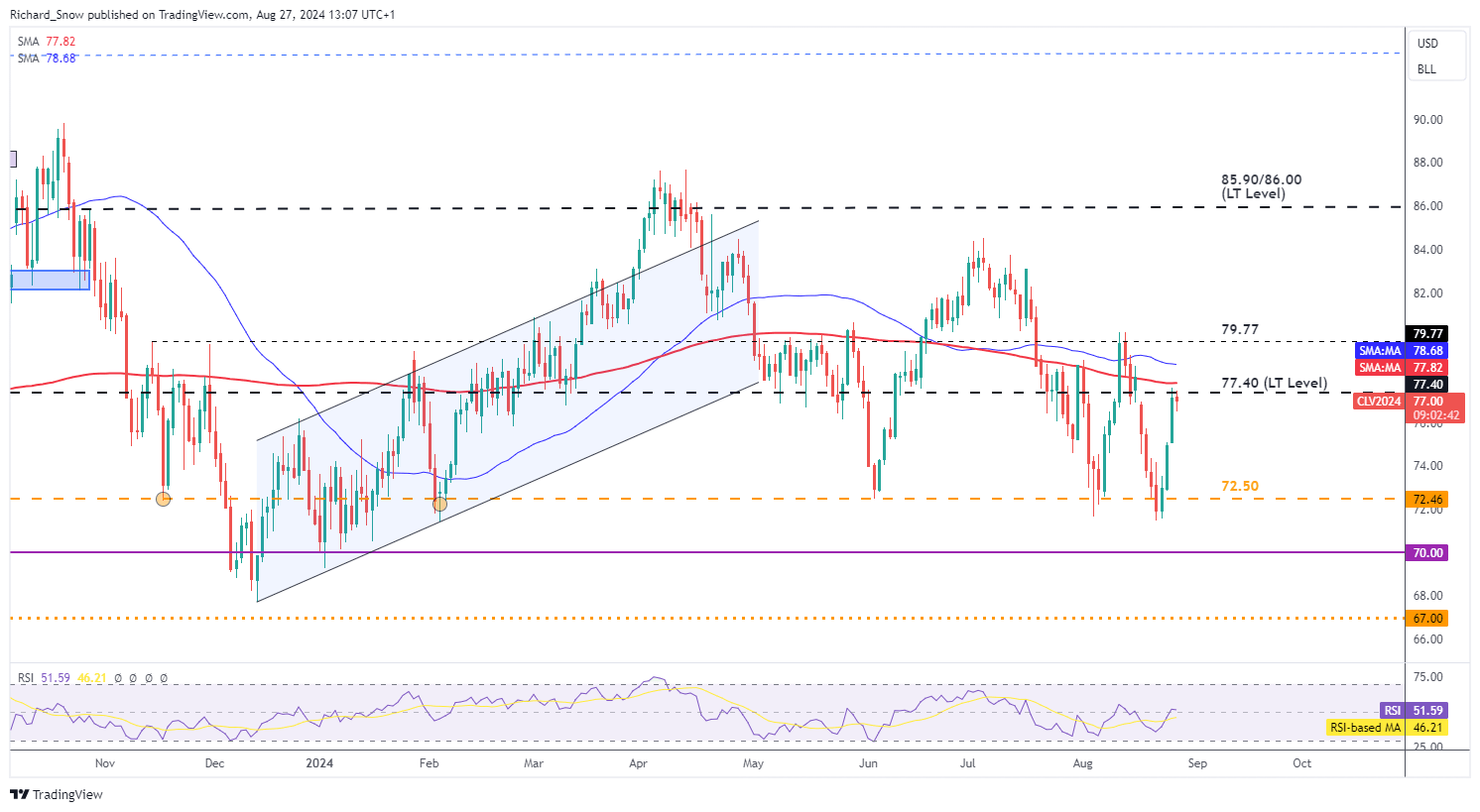

WTI Crude Nears Long-Term Resistance at $77.40

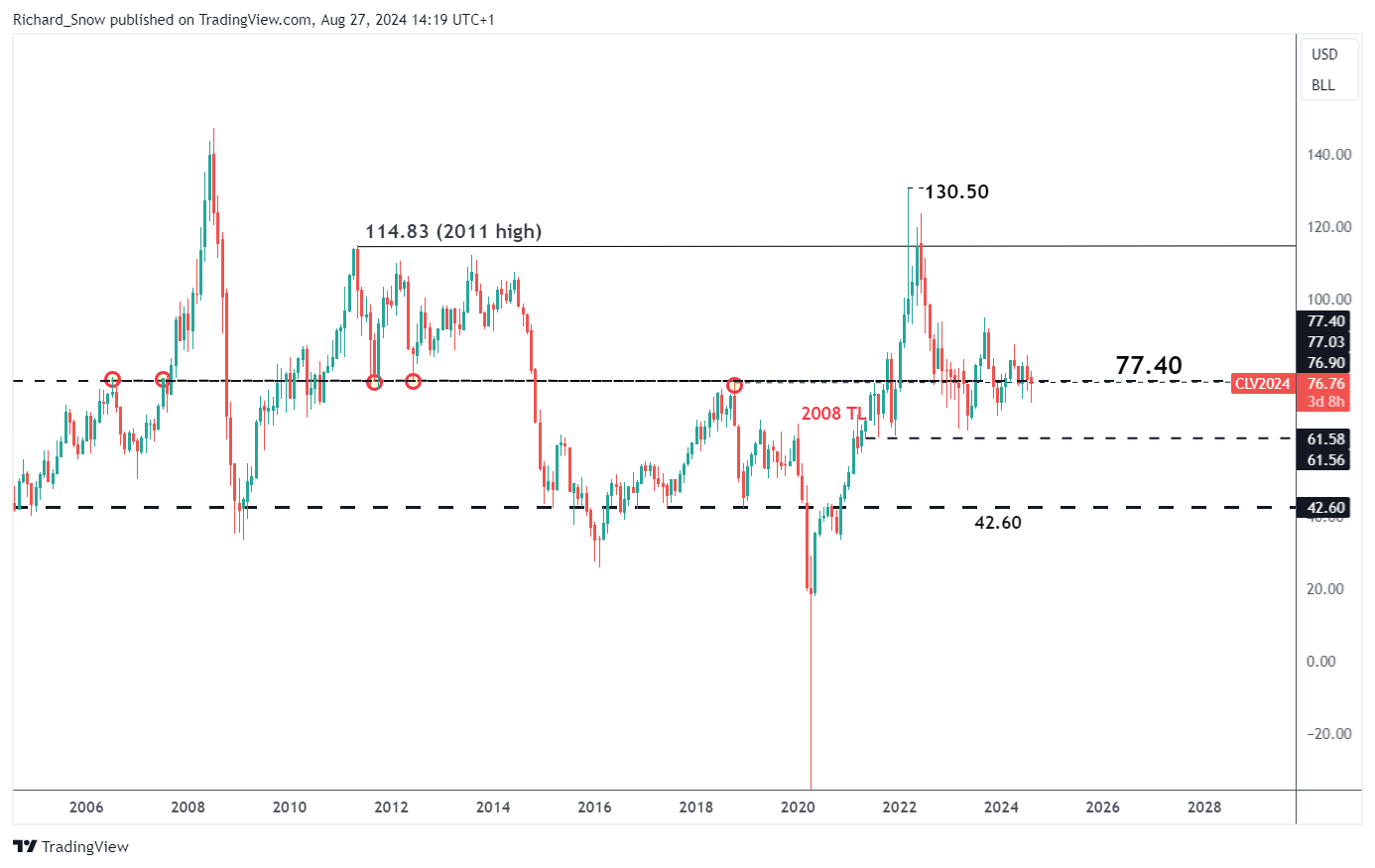

WTI crude oil has followed a similar pattern to Brent, rising over the past three trading sessions but showing signs of slowing today. Key resistance is found at the significant long-term level of $77.40, a level that has acted as major support in 2011 and 2013, and as a pivotal point in 2018.

The immediate resistance remains at $77.40, with additional resistance around the November and December 2023 highs near $79.77, which have also challenged bulls recently. Support is located at $72.50.