Outside bars are a technical analysis trading strategy. It is easy to learn, and profitable too. Moreover, it relies on traditional chart analysis that has proven to be a reliable predictor of market patterns over time.

The trading technique is based on using traditional technical analysis to spot a sign of trend reversal in Forex trading and take advantage of it.

The signs are easy to identify, and can be used in combination with other chart analysis techniques to confirm the interpretation of the signals. They vary in strength, so investors can decide the level of risk that they want to assume when trading.

Before we discuss the trading technique, we must first review support and resistance candlesticks in market charts. If you cannot identify market entry and exit points unless you know what support and resistance candlesticks are and can interpret the chart's content.

Also Read: Spinning Top Candlestick: A Complete Guide

Contents

- What are support and resistance candlesticks?

- Increase Successful Trading Using Support and Resistance

- What are pips?

- What is an outside bar?

- Outside Bar Trading Strategy

- Tips for Trading Outside Bars

- Summary

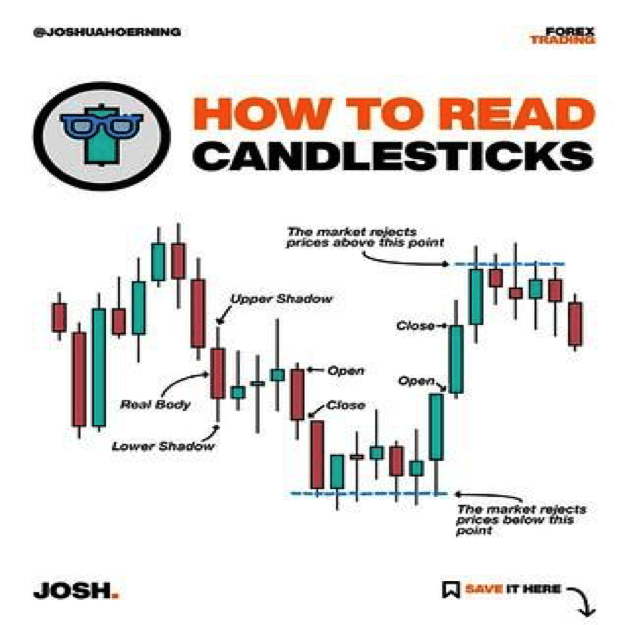

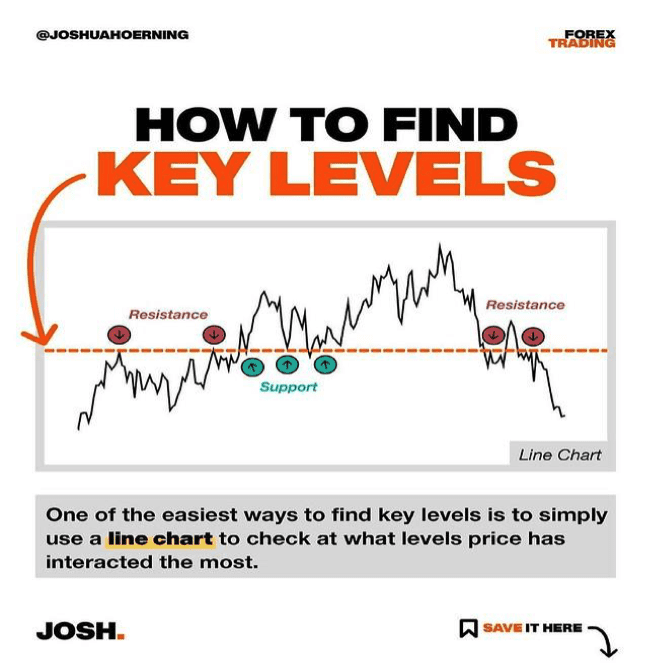

What are support and resistance candlesticks?

Support

Support candlesticks are always below the current price level. Essentially, they are any low swing on the chart. The bigger the low swing the greater the strength of the support. Strong supports are generally associated with potential for the market trend to reverse itself.

Resistance

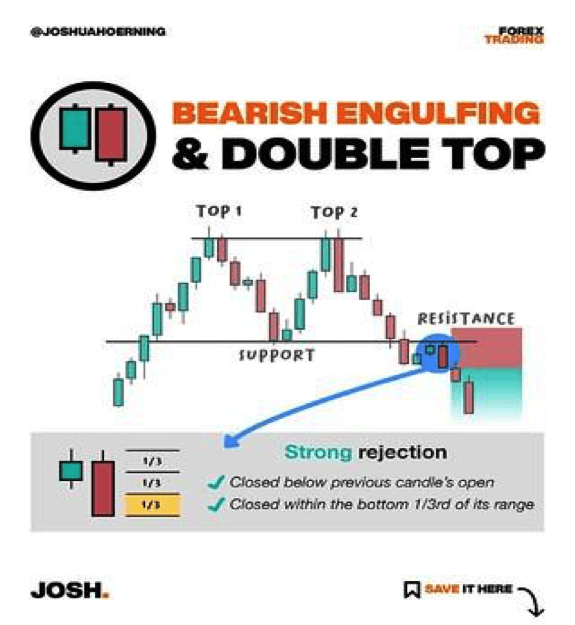

Resistance candlesticks are always above the current price level any high swings on a chart are considered resistance. The bigger the high swing, the stronger the resistance.

Source:

Zones Not Clearly Defined Points

Support and resistance candlesticks represent a zone. They are not clearly defined points on a chart. When a candlestick is in a support or resistance zone it signals an opportunity to make a profitable trade.

Increase Successful Trading Using Support and Resistance

To increase your chances of correctly interpreting support and resistance signals, wait for the trading session to close and observe the closing price.

If the closing price is still in the support/resistance zone, your prediction is more likely to be correct. You want to wait until the end of the trading season. Sometimes during the trading day, the price may break through the support/resistance zone, and then returns to the support/resistance zone at the close of the trading session.

What are pips?

Pips are the percentage points or points that represent the change in value between two currency pairings. Each pip is equal to US$0.0001.

For example, if an EUR/USD pairing moves from 1.1039 to 1.1042, there has been a change of 3 pips which translates into US$0.0003.

Pips are important in outside bar trading, because you must decide when you want to exit a trading position. If you are a conservative investor you may exit a trading position after a change of 2 – 5 pips.

However, if you have a high-risk tolerance, you may be willing to hold your trading position until there has been a change of 60 – 100 pips.

Also Read: 50 Pips a Day Forex Strategy

What is an outside bar?

It is a trading technique that uses 2 bars (a.k.a. 2 candlesticks) patterns that signal a reversal in the direction of the market.

The outside bar has shadows that engulf the bars before it. It extends higher than the next highest bar and lower than the next lowest low. Thus, since the outside bar covers the highest high and lowest low. It overshadows or engulfs the bars that precede it.

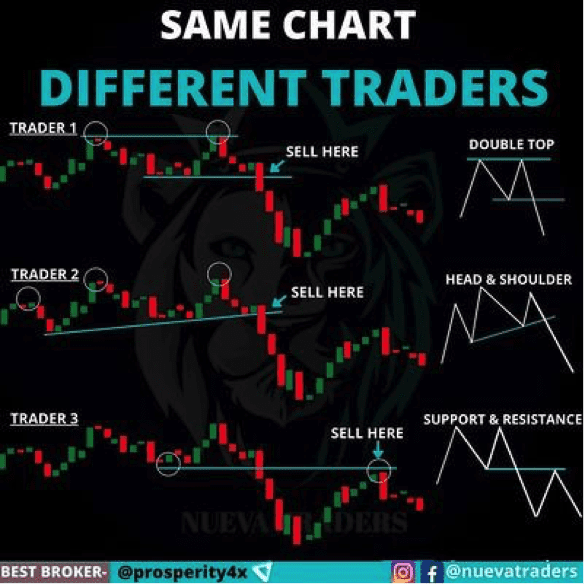

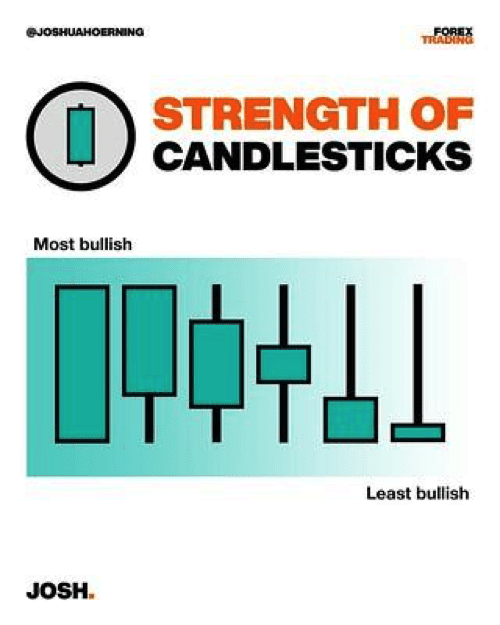

Depending on the chart pattern where the outside bar is found, it may be classified as bullish or bearish. Bullish signals tell you to buy because the price is going to rise. Bearish trends tell you to sell because the price level is going to fall.

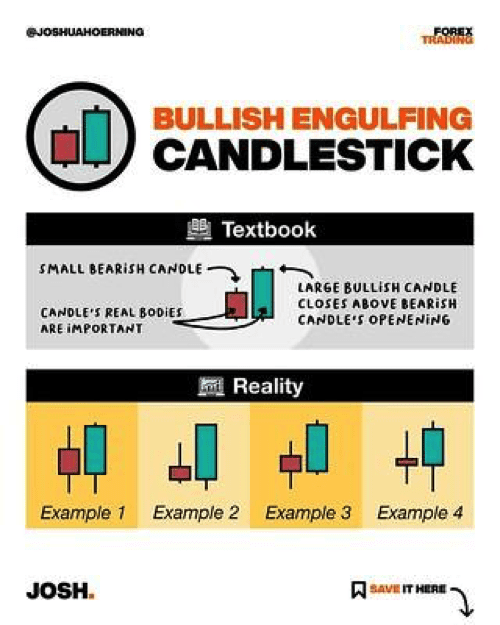

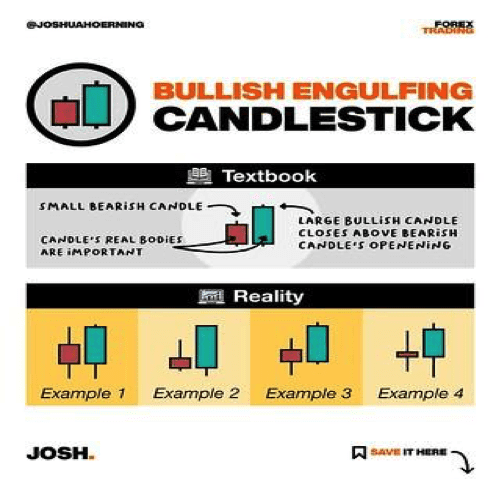

Bullish Outside Bars

Bullish outside bars are bars that are higher than the closest high bar. These bars are also referred to as resistance candlesticks. They signal that the asset price is going to rise.

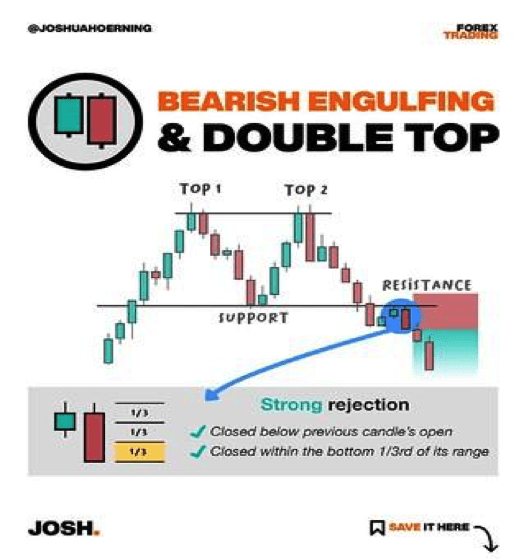

Bearish Outside Bars

Bearish outside bars are bars that are lower than the closest low bar. These bars are also referred to as support candlesticks. They signal that the asset price is going to fall.

Outside Bar Trading Strategy

The following technique can be used to lock in a profit when you are using the outside bar trading strategy. Note, the recommended strategy is a conservative one.

You can execute the outside bar trading strategy by doing the following:

- Place a buy-stop order for a bullish outside bar that is 2 -5 pips above the highest bar. In the case of a bearish outside bar, place a sell-stop order that 2-5 pips below the lowest low bar.

- Next, for a bullish outside bar, put in a stop-loss order that is 2-5 pips below the nearest low price. Ideally, you want to sell before the price drops.

For the bearish bar, put in a buy-stop order that is 2-5 points above the closest high bar. Ideally, you want to buy when the asset price is at its lowest, and before it begins to rise.

- To get your target profit, do the following:

- If a buy order, target the previous high swing. For a sell order target the previous low points.

- If your goal is to earn a 300% profit, you can risk 50 pips and take your profit when the market hits 150 pips.

- Manage your trades using a trailing stop behind a low if it is a buy order and above the high if it’s a sell order.

If you do this you will be stopped out when the bar hits the previous candlesticks low value (for a buy order). In the case of a sell order, you will get stopped out when the bar hits the high of the previous bar.

Tips for Trading Outside Bars

If you have decided to use outside bar in your Forex trades, consider the following:

- It almost always signals a reversal pattern.

a. Bearish trends are found when there is an upswing move.

b. Bullish trends are found when there is a downswing move.

- When trading, trade in the direction of the long-term trend.

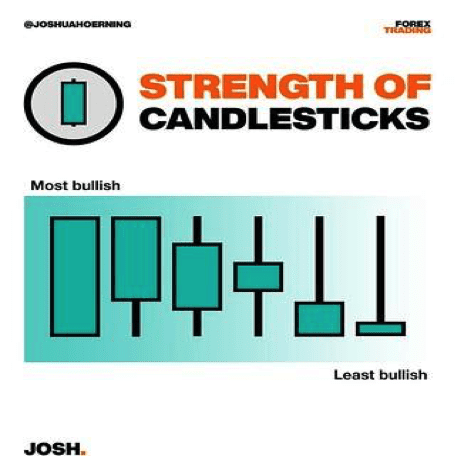

- Strong outside bar signals mean that the market trend is more likely to reverse itself. The signal is strong under the following conditions:

a. The bullish bar closes in the top 25% of the price range, the signal is strong.

- Strong outside bar signals mean that the market trend is more likely to reverse itself. The outside bar signal is strong under the following conditions:

a. When bullish bars close in the top 25% of the price range, the signal is strong.

b. When it is close to the bottom 25% of the price range, the signal is strong.

- Weak signals have candlesticks that close near the middle of the price range. They tend to indicate a one-bar trading range.

Summary

Outside bar is a great trading strategy for inexperienced and experienced Forex traders. Its effectiveness can be boosted by pairing it with other more robust market trading and interpreting strategies and techniques.

You can create various trading strategy pairings. After you have created ones that are reliable and profitable, you can search for the outside bar patterns that signal good market conditions.

Its best points are that it’s easy to identify, interpret, execute, and has proven to be a reliable and profitable trading strategy over time.

Moreover, since it can be used by traders of all experience levels and provides a range of trading possibilities for those who favor it and want to engage in more complex and/or challenging trading using it.

For training on how to execute outside bar trading, you can complete website courses. You should choose a course created by a business that specializes in Forex and has content specifically designed for traders at your experience and knowledge level.