Quadruple witching is the third Friday at the end of each quarter when stock options, stock index options, stock index futures, and single stock futures simultaneously expire. This happens four times a year, in March, June, September, and December.

It's an important day in the market. On each quadruple witching day, there is increased trading volume, securities' volatility, order flow, and trading activity. The increased trading volume is due to traders opening and closing contracts to cover their positions.

Moreover, with the increased trading volume, there is an increase in temporary price inefficiencies in the market. These inefficiencies can be exploited by arbitrageurs for quick profits. The arbitrageurs look for assets at low prices and then sell them at higher prices. The trades take seconds, and when done using large lot sizes, the small differences in prices can produce a lot of profit.

Also Read: What Is Covered Put Strategy: Comprehensive Guide

Contents

- Options and Futures Expiration Dates

- 4 Kinds of Derivatives Behind Quad Witching

- Is it a Quad Witching or a Triple Witching?

- Is the Quad Witching Bullish or Bearish?

- Day Traders Beware of the Witching Days

- Beginners Trade with Caution

Options and Futures Expiration Dates

Options contracts expire at the end of every month. However, futures contracts expire at the end of every quarter. When the expiration dates of the two financial instruments occur on the same day, it produces periods of high market activity that disrupt the normal trading and provide short-term lucrative trading opportunities for savvy traders who can quickly identify market opportunities and execute profitable trades.

Let's look at the financial instruments that create the quad witching effect.

4 Kinds of Derivatives Behind Quad Witching

What is a derivative?

A derivative is a financial contract entered into by a buyer and seller that has a set price, known rights and obligations, and an expiration date. It is a contract supported by an asset that is traded on the stock market. The underlying asset determines the value of the derivative. Note, ownership of a derivative contract does not give the owner interest in the company issuing the security, voting rights, or the right to any dividends issued by the company.

What is an options contract?

An options contract gives the buyer, also known as an owner or holder, of the contract the right to exercise the contract but not the obligation to do so. In these contracts, the seller, also known as the writer, is required to deliver the underlying asset if the buyer exercises the contract. Before the options contract expires, a buyer can exercise the rights conferred by it, sell it, or do nothing.

There are two types of options, calls and puts.

Call Option

Call options give the buyer the right, but not the obligation, to buy the underlying asset by a set date for a set price.

Put Options

Put options give the buyer the right, but not the obligation, to sell the underlying asset by a set date for a set price.

Do Nothing

If the buyer does nothing, the buyer loses the money paid for the contract, the premium. Nothing else happens.

Sell It

If the market has turned against the buyer or the buyer is no longer interested in the contract, the buyer can sell the contract to someone else. When the contract is sold, the initial buyer sells the contract rights to someone else and is removed from the contract – it is effectively closed for the initial buyer.

Close It

If the market moves against the buyer and the buyer wants to get out of the contract immediately or the buyer wants to exercise the contract, the buyer can close it. To close the contract, the buyer can exercise the contract's rights, buy/sell the underlying asset, and close the contract before or on its expiration date.

What is a futures contract?

A futures contract, entered into by a buyer and seller, gives the buyer the right and obligation to buy the specified asset at the contract price on a specific date. The contract price must be paid regardless of the market price of the asset on the specified date of contact completion. As for the seller, the seller must deliver the specified asset to the buyer on the set date and at the price listed in the contract.

Stock Index Options

Stock markets index options can be bought or sold for a set period of time. The indexes are based on a big basket of stocks. The large number of stocks gives the investor exposure to the market and the advantage of a diversified portfolio.

The stock indexes (e.g., S&P 500, Russell 3000, FTSE 100) contain many kinds of stocks or are limited to a particular industry. The value of the index is based on the value of the collection of underlying stocks. So, the value of the index changes based on the performance of the stocks in its collection.

The value of the indexes is determined at the end of each trading day. Generally, traders close these contracts before the end of the trading day. If closed before the end of the trading day, the index closing price is subtracted from the exercise price. If the exercise price is higher, it's a profit for the buyer and a loss for the seller. On the other hand, if the exercise price is lower than the closing price, it's a loss for the buyer and a profit for the seller.

At the end of the contract, the buyer will be in the money, out of the money, or at the money. In-the-money means the buyer made a profit. Out-of-the-money means the buyer suffered a loss. Finally, at-the-money means that the buyer broke even, no gain and no loss.

Stock Index Futures

Stock index futures, also referred to as equity index futures and index futures, are futures contracts based on a stock index (e.g., S&P 500, Russell 3000, FTSE 100). These are contracts to buy or sell the underlying assets for a specific price on a specific date. The underlying assets are tied to a stock index that determines their market value.

Index futures are not delivered to the buyer on the expiry date. They are settled in cash on a daily basis. Traders must pay/collect the differences in value every day.

Index futures are used to speculate on the future performance of an index, as a hedge against potential investment losses in the future, and as a form of spread trading. They are also used by traders as an indicator of the market sentiment.

Also Read: How to Trade Futures – A Beginner’s Guide

Stock Options

These options contracts give the buyer the right, but not the obligation, to purchase a specific stock on a set date in the future. The seller is required to provide the stock to the buyer on the set future date at the agreed-upon contract price.

Options contracts do not represent ownership of the security or ownership of an interest in the company that issued the security. Options buyers do not have any shareholder rights or privileges.

Stock options are cheaper than buying the stock itself. They can be purchased at a discount price. Moreover, the premium paid for them goes toward paying for the underlying asset if the buyer decides to purchase it.

Single Stock Futures (SSFs)

SSFs are contracts between a buyer, the long side, and a seller, the short side, of a contract. The buyer promises to pay the seller for 100 shares of a specific stock at a pre-set price on a set future date. The seller must deliver the stock to the buyer on the set future date at the contract price.

SSFs became available in the USA in 2002 and were banned in 2020. They are still traded in India, Spain, the United Kingdom, and South Africa.

These futures never quite took off with investors. They are unattractive because they have low trading activity, trading volume, and liquidity.

Like other options and futures, they are used for speculation or to hedge against potential future losses from existing investments.

Is it a Quad Witching or a Triple Witching?

The terms quad witching and triple witching are often used interchangeably in the USA. A triple witching occurs when three futures and options expire simultaneously on the third Friday at the end of the financial quarter. Quad witchings haven't existed since 2020 when SSFs were banned in the USA. Therefore, many traders don't distinguish between quad and triple witchings anymore.

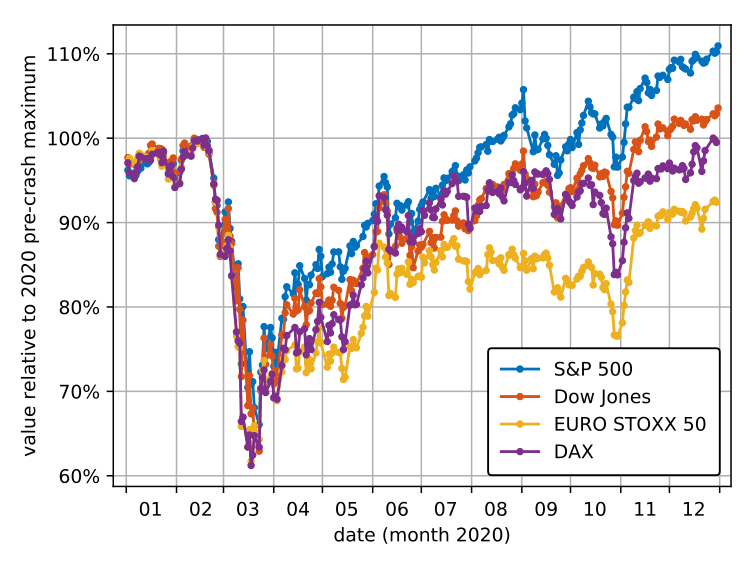

Is the Quad Witching Bullish or Bearish?

There have been some studies that looked at whether quad witching days are bullish or bearish. There is no clear trend that these trading days are bullish or bearish. Yes, there is a lot of trading activity and securities' prices tend to rise, but the upward price trend is temporary and often the result of increased trading volume, especially at the end of the trading session on each quad witching day.

The rise in trading volume is primarily due to the large amount of trading done by institutional investors. The large trading orders are placed by banks, central banks, brokerages, pension funds, hedge funds, and other well capitalized market players.

Day Traders Beware of the Witching Days

A derivative trader who participates in day trading may want to avoid the market on these trading days. The securities' prices are likely to be volatile and the trends chaotic due to the increased market activity in the trading sessions leading up to a quad witching, and the trading session on the day of the quad witching.

Beginners Trade with Caution

An inexperienced derivatives trader should focus on options trading. Options contracts give traders more flexibility and choices than futures contracts. Futures contracts are an all or none deal. The buyer makes a profit or loses all the money invested in the future. Futures contracts work well for people who can predict the performance of the market well. However, inexperienced derivative traders are likely to lose their capital because they cannot read the market well and are unlikely to speculate well on the future performance of a stock or index.

Quad witching days occur in March, June, September, and December. Day traders are advised to not trade on those days, or at least not get stressed out by the market activity. Moreover, even during the days leading up to quad witching the market may be kind of chaotic as everyone tries to close their positions in the money and at a profit.