In 2024, the world of crypto continues to evolve with the rise of Real World Asset (RWA) tokens—tokens backed by physical assets like real estate, commodities, or traditional finance products. This isn't just speculation anymore; RWAs offer tangible value tied to real-world assets, creating exciting new investment opportunities for savvy investors. In fact, the RWA market is expected to grow by over $16 billion this year alone!

But where should you start? If you’re looking for solid investment options, you’re in the right place. In this guide, we’ll break down the 5 best RWA tokens to consider in 2024. Whether you're new to crypto or a seasoned pro, these picks offer a blend of security and potential for growth. Let’s dive into the future of tokenized assets!

What is Real World Assets Tokenization

Real world asset tokenization is a transformative process in the financial sector, marking the conversion of assets on-chain into digital tokens through blockchain technology. This innovative approach encompasses a wide array of assets, from traditional financial assets like stocks and bonds to traditionally illiquid assets such as real estate and art. By leveraging the power of blockchain, this method is revolutionizing how assets are managed, traded, and perceived, fundamentally altering the financial landscape.

The tokenization of real-world assets unlocks unprecedented opportunities in the investment realm. It democratizes access to high-value investments, previously the domain of a select few, by enabling fractional ownership and enhanced liquidity. This shift not only broadens the spectrum for potential investors but also injects a new level of efficiency and transparency into the market. The result is a more inclusive, dynamic, and resilient financial ecosystem, poised to evolve with technological advancements.

5 Best Real World Assets (RWAs) Tokens to Invest in 2024

#1. Chainlink (LINK)

Chainlink is crucial for bringing real-world data to blockchain systems, especially in sectors like real estate and art. Its technology, known as oracles, ensures that information from the physical world is accurately reflected on the blockchain. This reliability is essential for tokenizing valuable assets and making them accessible on decentralized platforms. As the demand for these types of assets increases, Chainlink will continue to be a key player in ensuring everything runs smoothly between data and blockchain technology.

With the growing integration of traditional finance and blockchain, Chainlink’s importance keeps rising. By ensuring secure and accurate data transmission, it has cemented its place as a fundamental infrastructure in the RWA sector. Investors are betting on Chainlink because it plays a significant role in making decentralized applications work properly, making it a must-watch for 2024.

#2. Maker (MKR)

Maker is well-known for its stablecoin, DAI, which is backed by real-world assets like real estate. This means property owners can use their real estate to secure loans, providing liquidity without having to sell their properties. For investors, Maker offers a stable and trusted platform in a space that can sometimes feel unpredictable.

What sets Maker apart is its dual focus on stability and growth. The project has been around for a while, proving its resilience in the volatile crypto world. As real estate-backed tokens become more popular, Maker’s system offers both reliability and opportunity for those looking to invest in RWAs in 2024.

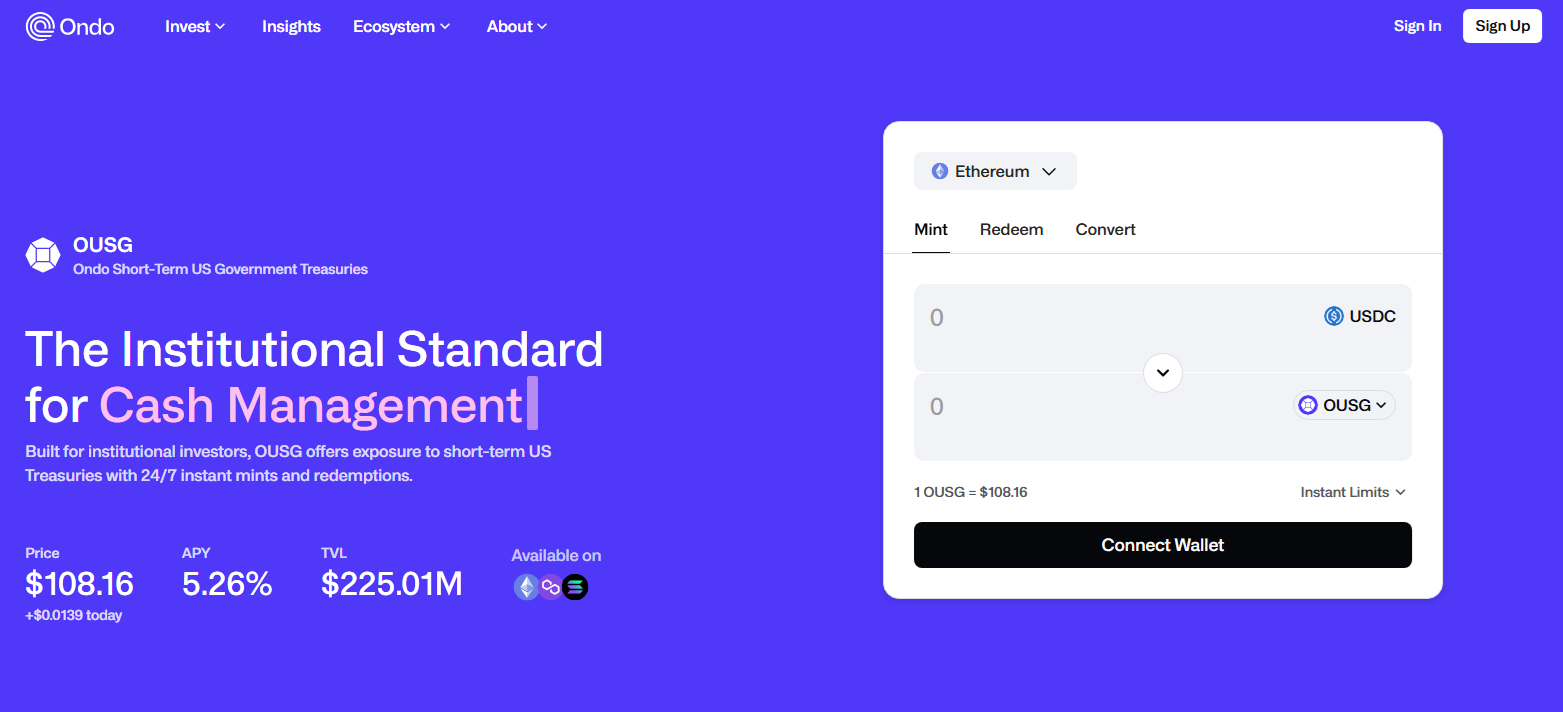

#3. Ondo Finance (ONDO)

Ondo Finance is changing the game by making high-grade investment products like mortgage-backed securities available through tokenization. This means regular investors can now get in on financial products that were once only for large institutions. By putting these assets on the blockchain, Ondo makes it easier and more affordable for people to access them.

For investors, Ondo opens up new opportunities to tap into traditional assets without the usual barriers. The project has seen solid growth and is expected to perform well in 2024 as more people look for accessible ways to invest in RWAs, especially in real estate.

#4. Centrifuge (CFG)

Centrifuge focuses on helping businesses tokenize their assets like invoices or real estate, which helps them borrow money more easily. This creates a way for investors to earn stable returns by investing in these tokenized assets, backed by real-world collateral. It’s a win-win for both businesses and investors, as it opens up new financing opportunities and lowers costs.

For those interested in stable, predictable investments, Centrifuge offers a solid platform. By merging real-world assets with decentralized finance (DeFi), it provides a unique way to earn from RWAs while minimizing the risks often associated with other crypto investments.

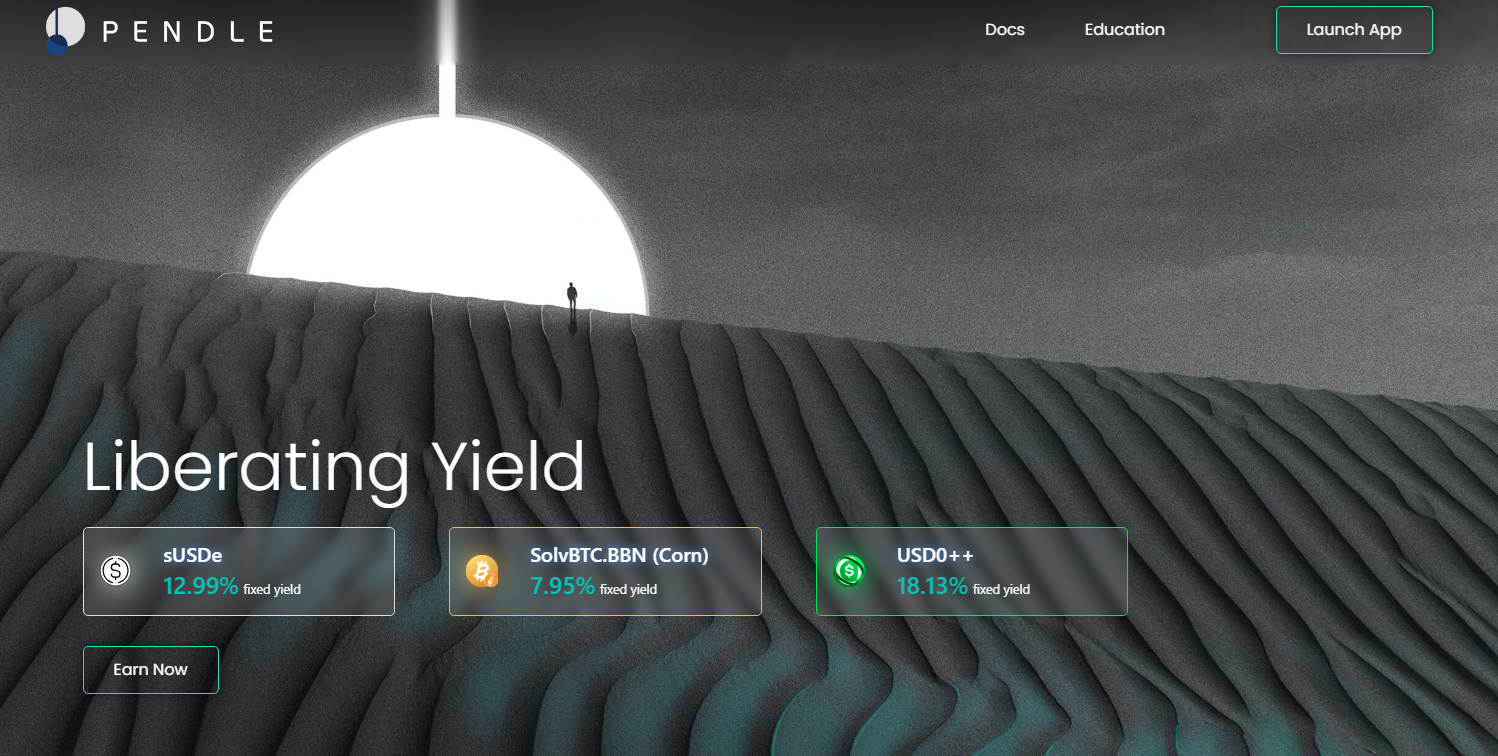

#5. Pendle (PENDLE)

Pendle takes a different approach by allowing investors to trade future yields of assets. This means you can buy into the expected returns of an asset, even if the asset itself won’t provide value until later. Recently, Pendle has expanded to include RWA tokens, giving investors even more flexibility and options to optimize their earnings.

Pendle’s unique model is attractive for those looking to get creative with their investments. By splitting the yield from the asset itself, it offers greater control over investment strategies, making it one of the more exciting RWA projects to keep an eye on in 2024.

Benefits of Tokenizing Real-World Assets

One of the standout benefits of asset tokenization is the facilitation of fractional ownership. This feature enables individuals and small businesses to own portions of high-value assets, which were historically exclusive to wealthy investors or large financial entities. Fractional ownership breaks down financial barriers, making it feasible for a broader demographic to invest in premium assets like real estate, fine art, or even rare collectibles. This democratization of investment opportunities marks a significant shift towards inclusivity in the financial world.

Through fractional ownership, tokenization is effectively leveling the investment playing field. Small-scale investors and businesses now have the opportunity to diversify their portfolios by accessing markets that were once the stronghold of large financial institutions and asset managers. This not only empowers smaller entities with more investment choices but also injects fresh capital into these markets, enhancing overall market vitality. The ripple effect of this change is profound, as it encourages economic growth and financial participation across a wider section of society.

Challenges and Considerations in Tokenization

The path to successfully tokenizing real-world assets is fraught with challenges that need meticulous attention. Key among these is the imperative for rigorous due diligence and reliable asset ownership verification. Ensuring the authenticity and legality of assets before tokenization is critical to maintain trust and stability in the market. Additionally, aligning this innovative process with the existing financial system regulations poses a complex task. These regulatory compliance issues are vital for the integration of tokenized assets into mainstream financial markets, ensuring they operate within legal and ethical boundaries.

The use of smart contracts in tokenization brings a layer of enhanced transparency and precision in the execution of transactions, known as atomic settlement. While these contracts automate and secure the transaction process, they also necessitate the development of comprehensive legal frameworks to govern their use. The legal aspect becomes especially crucial in addressing disputes, ownership rights, and contract enforceability. Thus, while smart contracts are a boon for the efficiency and transparency of tokenized assets, they also underscore the need for robust legal infrastructure to support this burgeoning domain.

Conclusion

In conclusion, the tokenization of real-world assets marks a significant milestone in the evolution of the financial sector. By blending traditional assets with blockchain technology, it paves the way for more inclusive, efficient, and transparent financial practices. As this technology matures, it is expected to become a widely accepted part of the global financial ecosystem, providing a diverse range of opportunities for investors and reshaping the financial inclusivity landscape.

Also Read: Wrapped Bitcoin: All You Must Know

FAQs

What is Real-World Asset Tokenization?

Real-world asset tokenization is the process of converting rights to an asset into a digital token on a blockchain. This innovative approach allows for assets, including both traditional and illiquid ones, to be digitally represented, making them easier to trade and invest in.

How Does Fractional Ownership Work in Tokenization?

Fractional ownership in tokenization means dividing an asset into smaller, more affordable shares represented by tokens. This allows individuals and small businesses to invest in high-value assets like real estate or art, which were previously out of reach due to high investment thresholds.

What are the Main Challenges in Tokenizing Assets?

The main challenges in tokenizing assets include ensuring thorough due diligence, verifying asset ownership, and complying with existing financial regulations. Additionally, integrating smart contracts for transaction management requires robust legal frameworks to address issues like dispute resolution and contract enforceability.